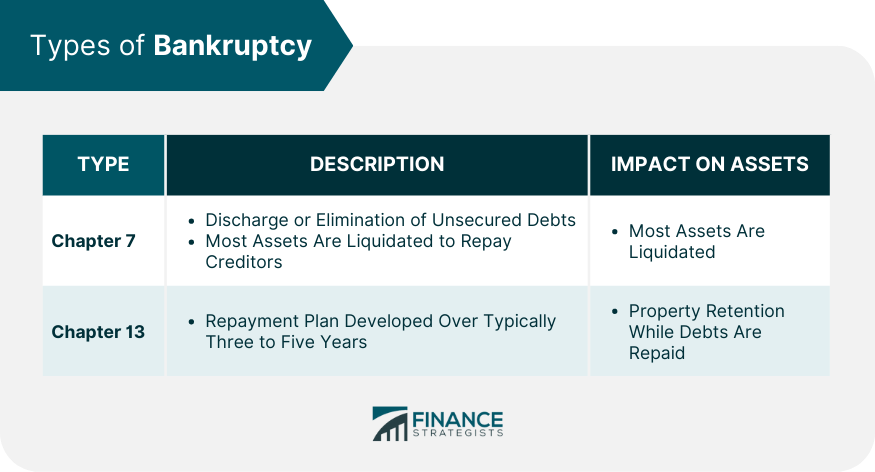

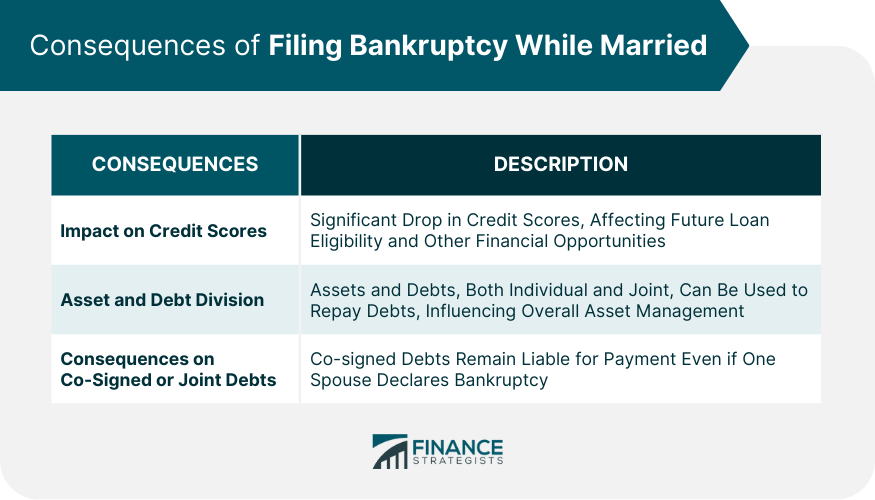

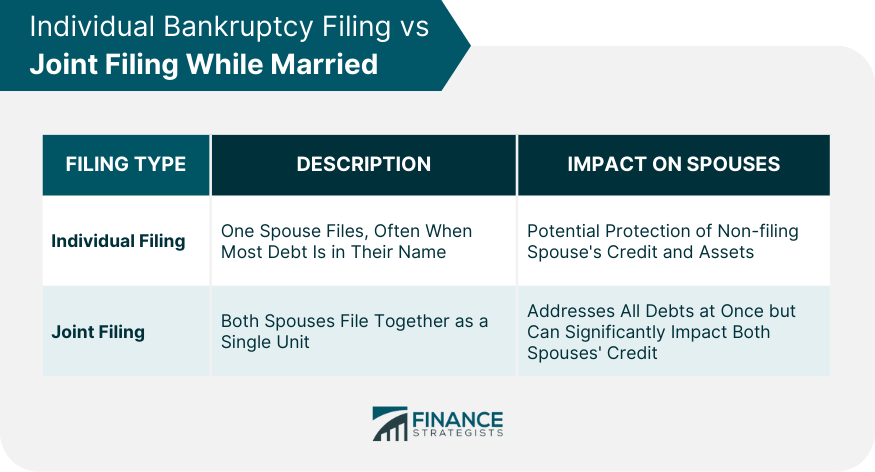

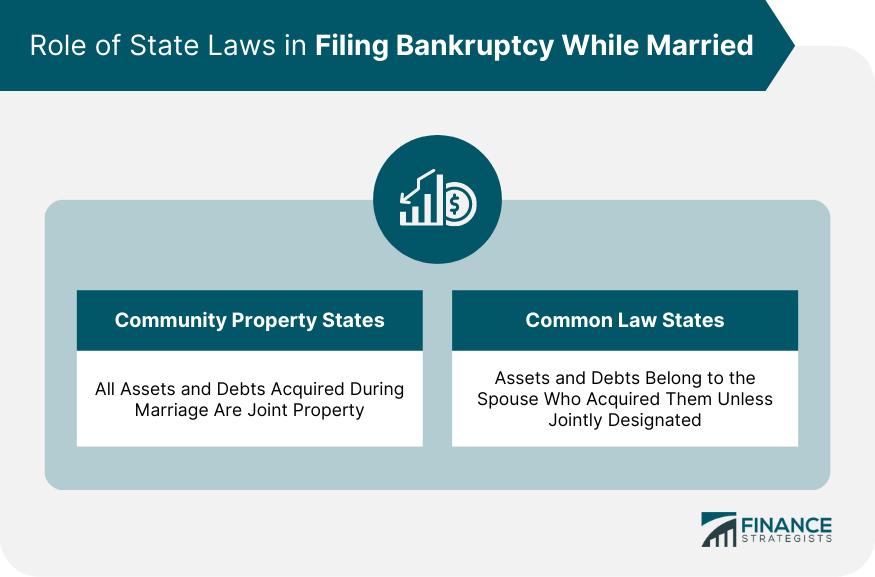

Filing bankruptcy while married is a crucial financial decision with long-term impacts. When a married couple files for bankruptcy, they can choose between Chapter 7, where most of their assets are liquidated to pay off debts, or Chapter 13, where they keep their property but commit to a repayment plan over several years. This decision can significantly affect both spouses' credit scores and how their assets and debts are managed. The process is further complicated by state laws, particularly whether you live in a community property or a common law state. After bankruptcy, the road to financial recovery involves careful budgeting, credit management, and possibly financial counseling. Always consult with a financial advisor or bankruptcy attorney to fully understand the implications and make an informed decision. Chapter 7, also known as liquidation bankruptcy, is a legal process that enables debtors to discharge or eliminate their unsecured debts, such as credit card debts or medical bills. When a married couple files for Chapter 7 bankruptcy, most, if not all, of their assets, are liquidated or sold to repay their creditors. The trustee oversees this process, ensuring that it adheres to the applicable bankruptcy laws and regulations. On the other hand, Chapter 13, often referred to as wage earner's bankruptcy, allows debtors to develop a plan to repay all or part of their debts over time, typically three to five years. The advantage of Chapter 13 bankruptcy for married couples is that they can retain their property while reorganizing and repaying their debts. When a married couple files for bankruptcy, both spouses' credit scores are likely to drop significantly. This credit score impact can make it challenging to secure future loans, housing, or even employment. It's worth noting that a bankruptcy can stay on the credit report for up to ten years, depending on the type of bankruptcy filed. Filing bankruptcy affects the way assets and debts are divided between the spouses. Both shared, and individual assets can be used to repay debts, depending on the specifics of the bankruptcy case and local laws. Regarding debts, both joint and individual debts are taken into account in bankruptcy proceedings. Bankruptcy also affects co-signed or joint debts. If one spouse has co-signed a loan with the other, the creditor can seek payment from the co-signing spouse if the other declares bankruptcy. Understanding these implications is crucial before filing for bankruptcy. A spouse may choose to file for bankruptcy individually if most of the debt is in their name alone. This option can protect the non-filing spouse from the negative impacts of bankruptcy, such as a credit score drop and potential asset liquidation. However, in some states, this isn't entirely possible due to community property laws, which we'll discuss later. Joint filing, on the other hand, involves both spouses filing for bankruptcy together as a single unit. The key benefit here is that it allows for all debts, whether individual or joint, to be addressed in one go. However, it can have a more significant negative impact on both spouses' credit scores. State laws play a significant role in filing bankruptcy while married. In community property states, all assets and debts acquired during marriage are considered joint property. Therefore, even if only one spouse files for bankruptcy, all community property is part of the bankruptcy estate and can be used to pay off debts. Examples of community property states include California, Arizona, and Texas. In contrast, in common law states, assets and debts belong to the spouse who acquired them unless they're specifically designated as joint property or debt. Therefore, individual bankruptcy filing is often more straightforward in common-law states. The implications of these laws can be profound. In community property states, filing individually does not protect the non-filing spouse's assets from being included in the bankruptcy estate. On the other hand, common law states only the assets of the spouse filing for bankruptcy are at risk. Navigating financial struggles can be challenging, especially when considering bankruptcy while married. Bankruptcy offers the opportunity to start afresh financially, but the process can be intricate and intimidating. Here are the essential steps to follow when considering this significant decision. The first step in filing for bankruptcy is gathering all your financial information. This includes a comprehensive list of your debts, assets, income, and expenses. Be thorough and accurate in documenting this information, as it will be the basis of your bankruptcy filing. Before you can file for bankruptcy, you need to complete credit counseling from a government-approved agency. This counseling will provide you with an understanding of your financial situation and potential alternatives to bankruptcy. Make sure to get a certificate of completion as proof; you'll need this when filing for bankruptcy. Next, you'll need to complete the required bankruptcy forms. These forms detail your financial situation, including your debts, assets, income, and expenses. Consider working with a bankruptcy attorney during this step to ensure everything is filled out correctly. Once the forms are ready, pay the bankruptcy filing fee and submit your paperwork to the court. After your bankruptcy case is filed, an automatic stay will be implemented, preventing your creditors from making direct contact with you or staking a claim on your property. A trustee will be assigned to your case, and a creditors' meeting will be scheduled. During this meeting, you'll be asked questions about your bankruptcy forms and financial situation. It's crucial to attend this meeting and answer all questions honestly. Following the creditors' meeting, you will need to fulfill any post-filing requirements. If you've filed for Chapter 7 bankruptcy, this may include liquidating your assets. For Chapter 13, you'll need to begin your agreed-upon repayment plan. You'll also need to complete a debtor education course. Once all requirements have been met, your remaining eligible debts will be discharged. This marks the completion of your bankruptcy process. After filing for bankruptcy, you'll likely experience both short and long-term effects. In the short term, you might find relief from financial stress and harassment from creditors. In the long term, however, your credit score will be impacted, and you may find it challenging to secure credit, housing, or employment. Rebuilding credit after bankruptcy is essential. You can start by making timely payments on any remaining debts or new credit you acquire. Over time, your credit score will slowly improve. Lastly, consider seeking financial counseling to help avoid future financial difficulties. Financial planning can include creating a realistic budget, establishing an emergency fund, and managing credit wisely. Filing bankruptcy while married involves critical considerations, notably the type of bankruptcy (Chapter 7 or 13) and the way it impacts credit scores, assets, and debts. Whether to file individually or jointly is another significant decision, and state laws greatly influence this, particularly whether the couple resides in a community property state or a common law state. Protecting a non-filing spouse's assets requires careful planning but also legal and ethical compliance. The process of filing includes several steps, from gathering financial records to meeting with creditors. Following bankruptcy, rebuilding credit and thoughtful financial planning is crucial for a more secure financial future. Each situation is unique, and the counsel of a bankruptcy attorney can be invaluable in understanding and navigating the complexities of filing bankruptcy while married.Filing Bankruptcy While Married Overview

Types of Bankruptcy

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

Consequences of Filing Bankruptcy While Married

Impact on Credit Scores

Asset and Debt Division

Co-signed or Joint Debts

Individual Bankruptcy Filing vs Joint Filing While Married

Individual Bankruptcy Filing

Joint Bankruptcy Filing

Role of State Laws in Filing Bankruptcy While Married

Community Property States vs Common Law States

Impact of State Laws

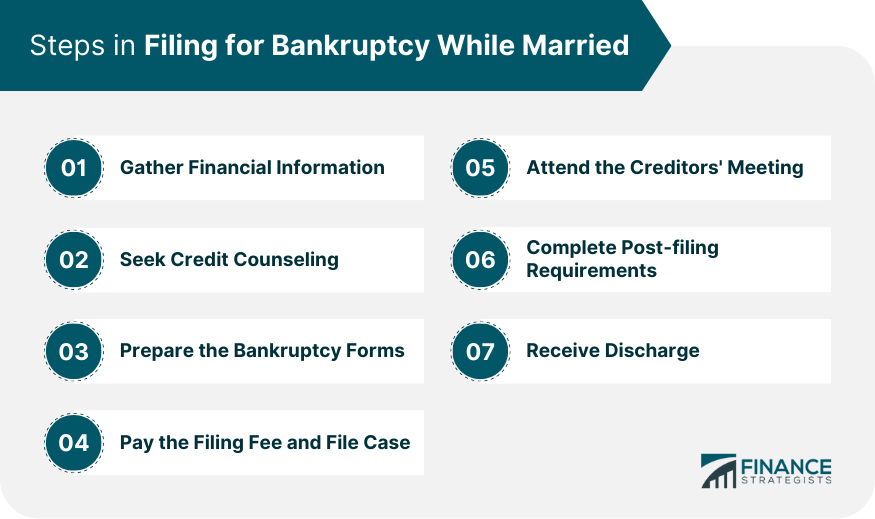

Steps in Filing for Bankruptcy While Married

Gather Financial Information

Seek Credit Counseling

Prepare the Bankruptcy Forms

Pay the Filing Fee and File Case

Attend the Creditors' Meeting

Complete Post-filing Requirements

Receive Discharge

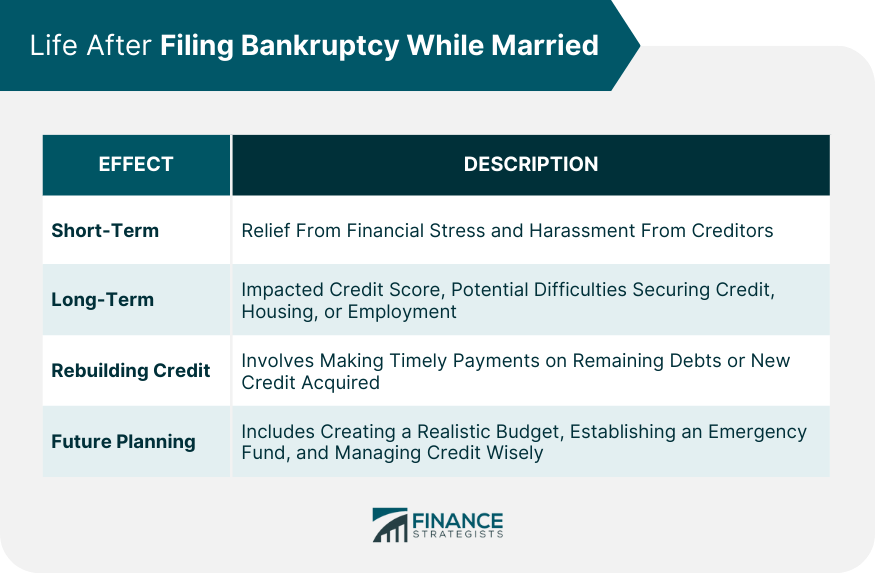

Life After Filing Bankruptcy While Married

Short and Long-Term Effects of Bankruptcy

Rebuilding Credit

Future Planning

Conclusion

Filing Bankruptcy While Married FAQs

Chapter 7 bankruptcy, often called liquidation bankruptcy, typically involves the selling of the couple's assets to pay off their debts. In contrast, Chapter 13 bankruptcy allows the couple to keep their property but requires them to repay their debts over a period of three to five years based on a court-approved repayment plan.

Filing for bankruptcy while married can significantly impact both spouses' credit scores, especially if you file jointly. Bankruptcy can remain on your credit report for up to 10 years, depending on the type of bankruptcy filed, making it harder to secure loans or credit in the future.

In some cases, one spouse can file for bankruptcy without significantly affecting the other. However, this largely depends on whether the couple lives in a community property state or a common law state and if the debts are held jointly or individually. It's also important to note that creditors can still go after joint assets or joint debts, even if only one spouse files for bankruptcy.

State laws play a crucial role in bankruptcy proceedings. In community property states, all assets and debts acquired during the marriage are considered joint, impacting the bankruptcy process even if only one spouse files. On the other hand, in common law states, only assets and debts, specifically under one spouse's name, are affected, potentially simplifying the process when one spouse files for bankruptcy.

Rebuilding financial life after bankruptcy involves managing finances carefully, including creating a realistic budget, establishing an emergency fund, and making timely payments on remaining or new debts to improve your credit score. Financial counseling could also be beneficial to guide you in making better financial decisions in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.