While the straight answer to this question is 'yes,' it's important to understand that this only provides temporary relief. Filing for bankruptcy can temporarily stop an eviction through a process known as an "automatic stay." However, this is not a permanent solution, and the conditions under which it may not prevent eviction will be discussed later in this article. It's essential to comprehend the role bankruptcy plays in eviction cases and the specific conditions under which eviction can proceed despite a bankruptcy filing. It's crucial to consult with a legal professional to navigate the complexities of bankruptcy and eviction laws in order to fully understand your rights and options. The automatic stay is an injunction that immediately stops most actions by creditors, collection agencies, or government entities against a debtor the moment a bankruptcy petition is filed. This includes eviction actions, at least temporarily. But as with most laws, there are exceptions and limitations to this automatic stay. In the context of eviction, a landlord may still proceed in certain situations. There are different types of bankruptcy, and each can affect an eviction process differently. Chapter 7 bankruptcy, often referred to as 'liquidation bankruptcy,' provides a quick discharge of qualifying debts. However, it offers limited protection against eviction, especially if the landlord already has a judgment for possession. On the contrary, Chapter 13 bankruptcy, also known as 'reorganization bankruptcy,' provides mechanisms that could potentially help a debtor stave off eviction. While the automatic stay provides immediate but temporary relief from eviction, it's not an all-encompassing protection. For instance, if the landlord has a judgment of possession against the tenant before the bankruptcy filing, the automatic stay won't stop the eviction. Further, if the eviction is due to "endangerment" of the property or "illegal use of controlled substances" on the property, the automatic stay won't apply. These specific cases reveal the nuances of the automatic stay's application in bankruptcy law. Passed in 2005, the BAPCPA made several significant changes to bankruptcy law, some of which relate to eviction proceedings. The Act added exceptions to the automatic stay provisions of bankruptcy for eviction actions. As a tenant or landlord, understanding these changes is critical to comprehending the current legal landscape. This Act was designed to prevent abuse of the bankruptcy system. As it pertains to eviction, the BAPCPA allows a landlord to proceed with eviction for endangerment of property or illegal drug use on the property, regardless of a bankruptcy filing. Thus, understanding the BAPCPA is critical for tenants seeking to use bankruptcy as a tool to stop eviction. The 2005 amendment introduced new rules, allowing a landlord to proceed with eviction if they already have a judgment for possession before the bankruptcy filing. In these circumstances, the automatic stay doesn't halt the eviction. However, the tenant might be able to buy some time by filing a certification of cure with the bankruptcy court, provided they can pay off the arrearage in full, and the landlord hasn't sold the property yet. Navigating these rules can be complex, emphasizing the importance of legal guidance in such matters. While bankruptcy can provide temporary relief from eviction, it's a serious step with long-term financial implications. It's always worthwhile to explore alternatives. Here we discuss a few options that may be available to tenants facing the threat of eviction. Often, landlords prefer to avoid the legal process and costs associated with eviction. Open communication about financial hardship might lead to a payment plan or another type of resolution. It's essential to keep the lines of communication open and to approach these conversations with honesty and a willingness to find a mutually agreeable solution. Many organizations provide free or low-cost legal assistance to tenants facing eviction. These services can help you understand your rights and potentially negotiate a solution with your landlord. While legal aid can't always prevent eviction, they can sometimes provide valuable assistance that could make a meaningful difference in the outcome of an eviction proceeding. Many federal, state, and local programs provide financial assistance to renters. The aid may include help with paying rent or even legal services. These programs can sometimes provide the needed assistance to stave off eviction, making it essential for tenants to explore all available options. Given the complexity of bankruptcy law and the significant impacts of bankruptcy filing, it's crucial to consult with an experienced bankruptcy attorney if you're considering this option. A consultation can provide invaluable advice tailored to your specific situation, taking into account your financial circumstances, the specific reasons for eviction, and any applicable state-specific laws. An attorney can help you navigate the complex interplay between bankruptcy and eviction laws, advising on whether bankruptcy could help in your specific situation and explaining the potential consequences of filing. This professional guidance can help you avoid common pitfalls and make an informed decision about whether bankruptcy is the right path for you. In a consultation, you can expect the attorney to ask detailed questions about your financial situation, including your income, expenses, debts, and assets. They'll use this information to provide tailored advice. Filing for bankruptcy can temporarily halt an eviction through an automatic stay, but it is not a permanent solution. Understanding the limitations and exceptions of the bankruptcy stay is crucial, as certain situations may allow eviction to proceed despite a bankruptcy filing. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) introduced exceptions to the automatic stay for eviction actions, emphasizing the need to comprehend these changes. It is important to recognize that state-specific laws can impact the interaction between bankruptcy and eviction, adding complexity to the process. Exploring alternatives to bankruptcy, such as negotiating with the landlord, seeking legal aid services, or utilizing government assistance programs, is recommended before considering bankruptcy. Ultimately, consulting with a bankruptcy attorney is essential to fully understand your rights and options, navigate the complexities of bankruptcy and eviction laws, and make an informed decision tailored to your specific situation. Can Bankruptcy Halt an Eviction?

Understanding the Bankruptcy Stay

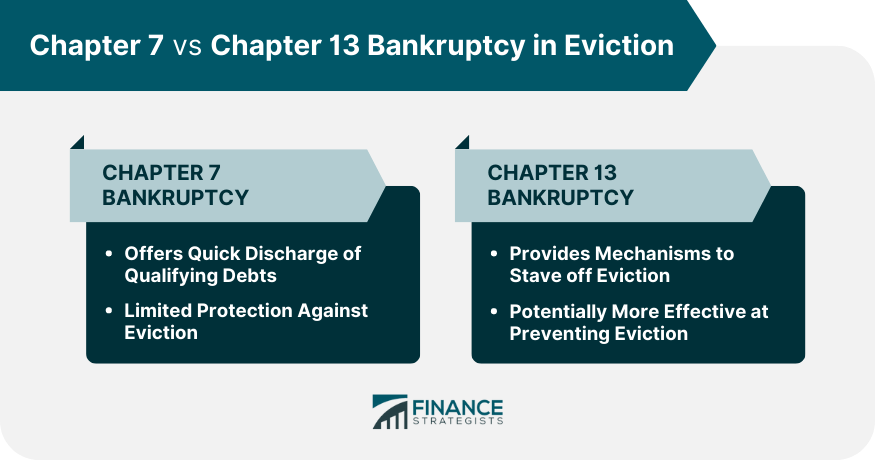

Chapter 7 vs Chapter 13 Bankruptcy in Eviction

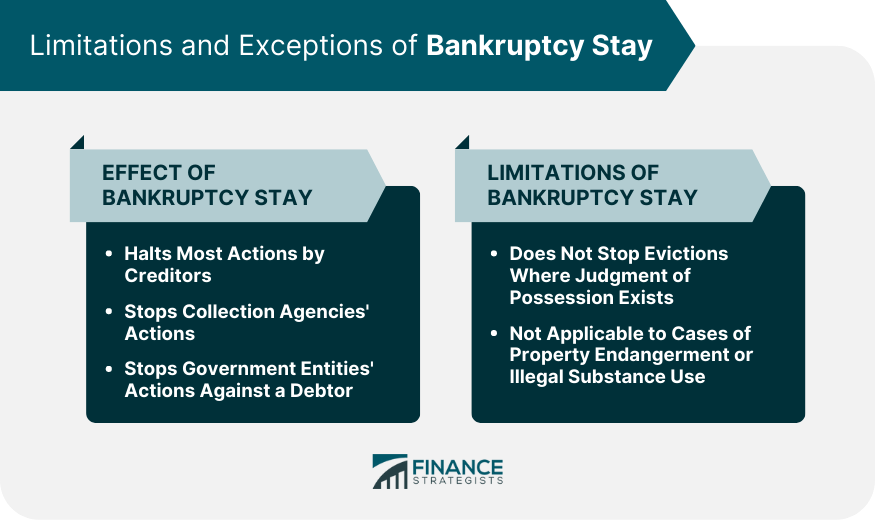

Limitations and Exceptions of Bankruptcy Stay

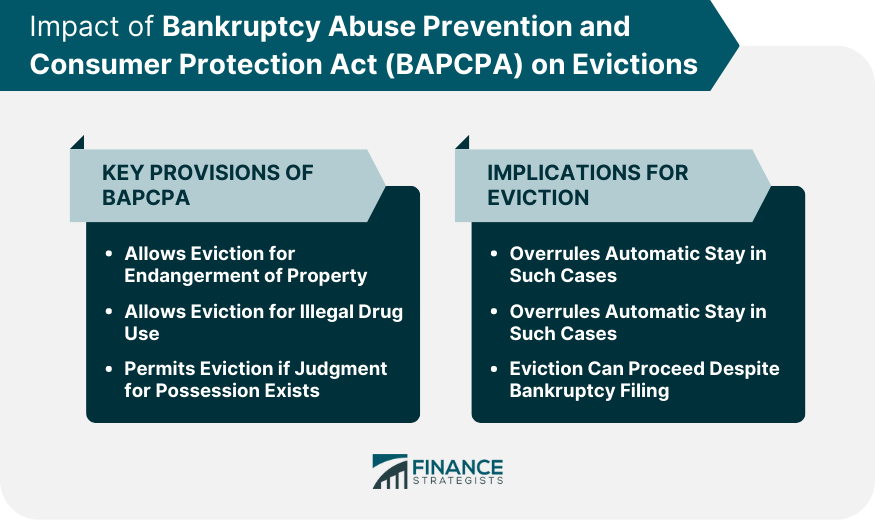

Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) and Its Impact on Evictions

Understanding BAPCPA

Implications of the 2005 Amendment

Alternatives to Bankruptcy When Facing Eviction

Negotiating With Your Landlord

Seeking Legal Aid Services

Government Assistance Programs

Consult With a Bankruptcy Attorney

Importance of Professional Advice

Expectations in a Consultation

Bottom Line

Does Filing for Bankruptcy Stop an Eviction? FAQs

Yes, filing for bankruptcy can temporarily stop an eviction through an "automatic stay," but there are certain exceptions and limitations.

The BAPCPA allows a landlord to proceed with eviction for endangerment of property or illegal drug use on the property, despite a bankruptcy filing.

No, if the landlord has a judgment for possession before the bankruptcy filing, the automatic stay won't stop the eviction.

Alternatives to bankruptcy when facing eviction include negotiating with the landlord, seeking legal aid services, and exploring government assistance programs.

Consulting with a bankruptcy attorney is crucial due to the complexity of bankruptcy laws. An attorney can provide advice tailored to your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.