Chapter 13 bankruptcy, often referred to as a wage earner's plan, empowers individuals with regular income to develop a strategy to repay all or part of their debts. It is a legal process that allows individuals with regular income to create a repayment plan to address their debts. In this form of bankruptcy, debtors propose a repayment plan to make installments to creditors over a specified period, usually three to five years. Chapter 13 bankruptcy works by allowing debtors to make a debt restructuring plan to pay back their creditors. This option is usually taken by those with a steady enough income to afford to undertake a repayment plan. Chapter 13 bankruptcy works by giving debtors who can feasibly afford to repay their creditors an opportunity to renegotiate the terms of their debt before having their assets seized. One of the primary qualifications for filing Chapter 13 bankruptcy is having a consistent source of income. The court must be convinced of the debtor's ability to meet the obligations outlined in the repayment plan. This income can come from various sources, including wages, self-employment income, social security, pension funds, and even support from family members. As per the bankruptcy code, there are specific limits on the amount of secured and unsecured debt a debtor can have. These limits are adjusted every few years to account for inflation. It's essential to be aware of these limits because exceeding them can disqualify a debtor from filing Chapter 13. If a debtor has received a discharge in a previous Chapter 7 bankruptcy within the past four years, or a Chapter 13 bankruptcy within the past two years, they are not eligible to receive a discharge under Chapter 13. It's important to understand these waiting periods as they can impact the debtor's bankruptcy strategy. This includes submitting detailed financial information, such as lists of assets and liabilities, income and expenses, and a statement of financial affairs. After the petition is filed, an automatic stay goes into effect, which stops most collection actions against the debtor. Once the petition is filed, the debtor must submit a repayment plan. This plan outlines how the debtor proposes to repay their debts over time. The plan must provide for fixed payments to the bankruptcy trustee, who then distributes these payments to creditors. The debtor must begin making payments within 30 days after filing the bankruptcy case, even if the court has not yet approved the plan. Following the submission of the repayment plan, the bankruptcy court holds a confirmation hearing to determine if the plan is feasible and meets the standards set by the bankruptcy code. During this hearing, creditors have the opportunity to object to the plan. If the court confirms the plan, the debtor and creditors are bound by its terms. The debtor must then execute the repayment plan, making regular payments to the bankruptcy trustee. Throughout this time, the debtor must make all required payments and may not incur new debts without the bankruptcy court's approval. Upon successful completion of all payments under the repayment plan, the debtor receives a discharge of the debts provided for in the plan. This discharge releases the debtor from all debts provided for by the plan, with a few exceptions. The discharge signifies the successful completion of the Chapter 13 bankruptcy process. This plan enables debtors to consolidate their debts into a single monthly payment, making debts more manageable. Additionally, the plan allows debtors to repay their debts over an extended period, usually three to five years. Unlike Chapter 7 bankruptcy, which involves liquidation of assets, Chapter 13 allows debtors to keep their property, including their home and car. This can be a significant advantage for debtors who have substantial equity in their property or who wish to avoid foreclosure or repossession. Upon successful completion of the repayment plan, many types of debts are discharged in Chapter 13 bankruptcy. This means that the debtor is legally released from the responsibility of paying these debts. This discharge can provide a fresh financial start for many individuals. Chapter 13 bankruptcy is a lengthy and complex process. It involves creating a detailed repayment plan and making regular payments over several years. Additionally, the process requires detailed financial disclosures and numerous interactions with the bankruptcy court, which can be time-consuming and stressful. Under Chapter 13, debtors must adhere to a strict budget, closely monitored by the bankruptcy court. The repayment plan typically requires the debtor to live on a fixed income for a significant period, which can be challenging for some individuals. Filing for Chapter 13 bankruptcy has a negative impact on the debtor's credit score. A bankruptcy filing can stay on a credit report for up to seven years, which can make it difficult to obtain credit in the future. This includes understanding the type and amount of debt they have, their ability to repay these debts, and whether these debts are dischargeable in bankruptcy. Because Chapter 13 requires the debtor to make regular payments over several years, having a stable income source is essential. Individuals should consider their employment stability and future income prospects when deciding whether to file for Chapter 13. While Chapter 13 allows individuals to keep their property, it's important to understand the potential risks and benefits. This may involve considering the equity in the property, the likelihood of foreclosure or repossession, and the overall financial implications of retaining versus surrendering property. To file Chapter 13 bankruptcy, you will need to petition the bankruptcy court serving the area in which you live. The best first step is to contact an accredited bankruptcy lawyer to figure out your case. It's advisable to seek guidance from an accredited bankruptcy lawyer who can assist you in navigating the complex process. They will evaluate your financial situation, help you prepare the necessary documents, and ensure compliance with legal requirements. With their expertise, you can increase your chances of a successful Chapter 13 bankruptcy filing and maximize the benefits it offers. Chapter 13 bankruptcy provides a structured method for individuals with regular income to repay their debts over time, while keeping their property. The process involves the creation and execution of a repayment plan, under the supervision of the bankruptcy court. Upon successful completion of the repayment plan, many types of debts are discharged. While Chapter 13 bankruptcy offers many advantages, such as a structured repayment plan and protection of assets, it also has significant drawbacks, including a lengthy process, strict budgeting requirements, and a negative impact on credit score. Therefore, individuals should carefully consider their financial situation, income stability, and property implications before deciding to file for Chapter 13 bankruptcy. It's always wise to seek advice from a knowledgeable bankruptcy attorney or financial advisor to understand all potential outcomes and make an informed decision.What Is Chapter 13 Bankruptcy?

How Does Chapter 13 Bankruptcy Work?

Eligibility Criteria for Chapter 13 Bankruptcy

Regular Income Requirement

Debt Limitations

Prior Bankruptcy Filing

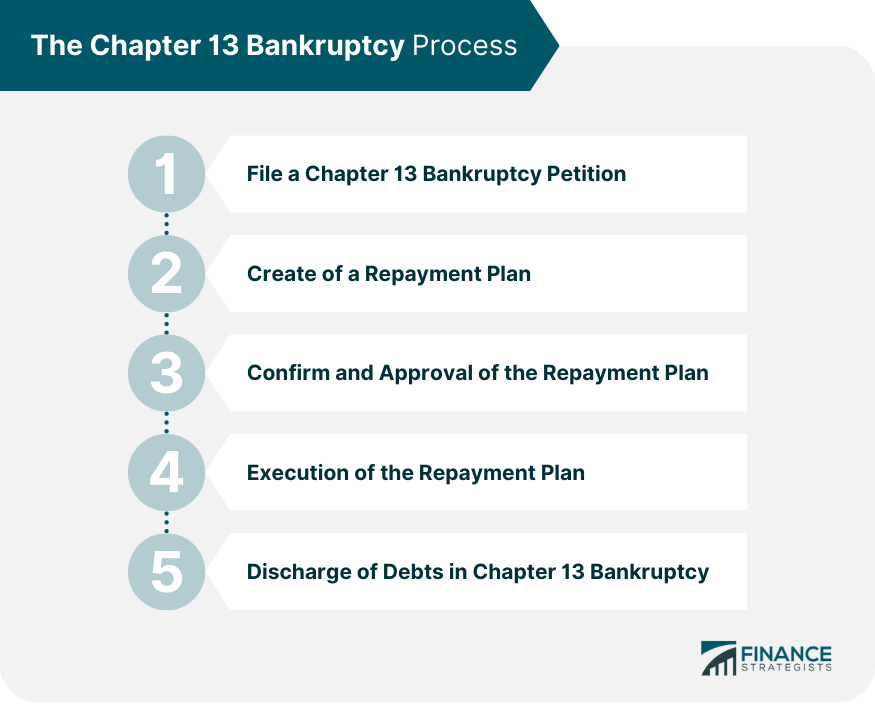

The Chapter 13 Bankruptcy Process

Filing a Chapter 13 Bankruptcy Petition

Creation of a Repayment Plan

Confirmation and Approval of the Repayment Plan

Execution of the Repayment Plan

Discharge of Debts in Chapter 13 Bankruptcy

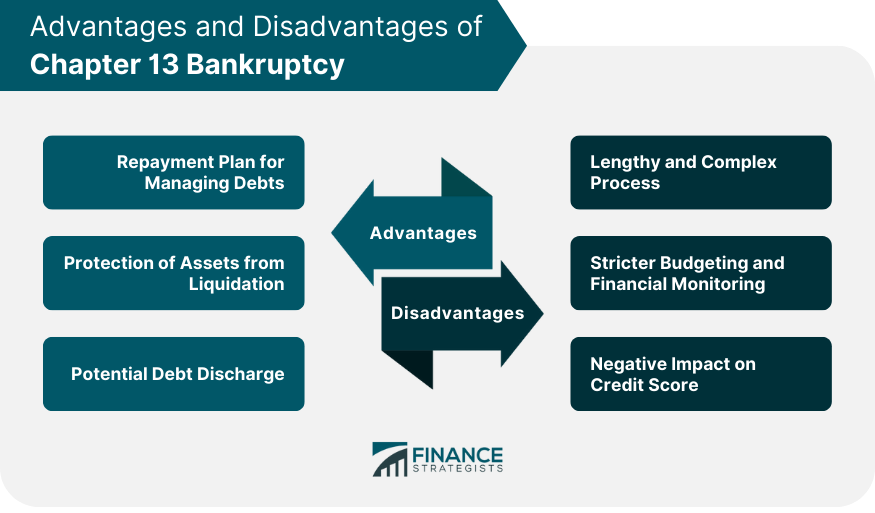

Advantages and Disadvantages of Chapter 13 Bankruptcy

Repayment Plan for Managing Debts

Protection of Assets from Liquidation

Potential Debt Discharge

Disadvantages of Chapter 13 Bankruptcy

Lengthy and Complex Process

Stricter Budgeting and Financial Monitoring

Negative Impact on Credit Score

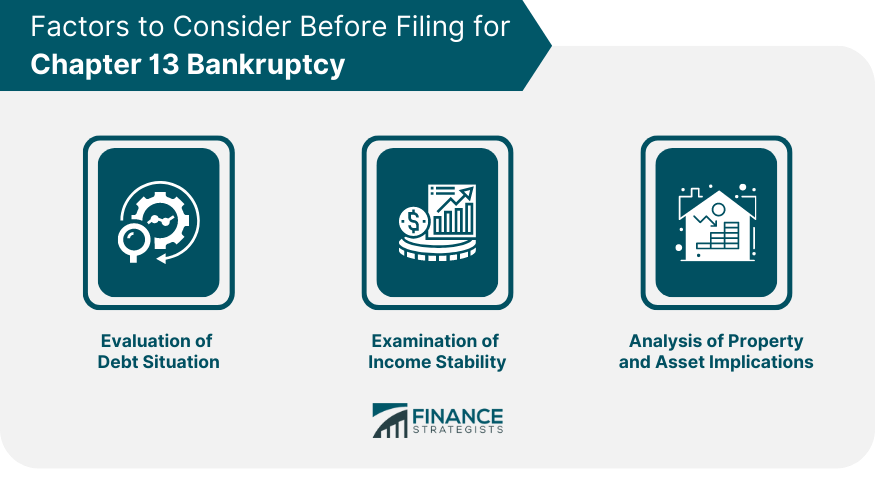

Factors to Consider Before Filing for Chapter 13 Bankruptcy

Evaluation of Debt Situation

Examination of Income Stability

Analysis of Property and Asset Implications

How to File Bankruptcy Chapter 13

Conclusion

What Is Chapter 13 Bankruptcy FAQs

Chapter 13 Bankruptcy is a type of debt reorganization that allows individuals to repay their debts over a period of 3-5 years, supervised by a bankruptcy court.

After filing for Chapter 13 Bankruptcy, the debtor must submit a repayment plan proposing how they will pay back creditors over time and the bankruptcy court will approve or deny it. Once approved, payments are made directly to a trustee who distributes them to creditors according to the terms of the plan.

Yes. Chapter 13 Bankruptcy filers must have a steady income to support their repayment plan and meet certain debt limits in order to qualify.

Yes, some types of debts are not eligible for discharge under Chapter 13 Bankruptcy, such as student loan debt, most taxes, and certain punitive damages.

Upon filing for Chapter 13 Bankruptcy, you will receive an automatic stay from creditors which prevents them from pursuing collection actions against you while the case is active. Additionally, your unsecured creditors may agree to accept a reduced amount of repayment, and you may be able to retain assets such as your home or car.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.