Getting a mortgage loan after bankruptcy is possible, but it involves navigating certain obstacles and waiting periods. The key to success is rebuilding your credit, exhibiting financial stability, and patiently waiting for eligibility. The waiting period varies from 2 to 4 years, depending on the type of bankruptcy filed and the loan type sought. For instance, after a Chapter 7 bankruptcy, the waiting period for an FHA or VA loan is 2 years. During this period, focus on improving your credit score, maintaining a consistent income, and reducing your debt-to-income ratio. Remember, lenders want to see that you've learned from your financial mistakes and are unlikely to default on a loan again. Ultimately, securing a mortgage loan post-bankruptcy requires showing lenders you've learned from past financial missteps and are less likely to default. The process of obtaining a mortgage loan after bankruptcy can be complex, but with strategic planning and perseverance, it is achievable. Below is a breakdown of the key steps involved: The first step in securing a mortgage after bankruptcy is rebuilding your credit score. Timely payments of bills, keeping credit card balances low, and avoiding new debts contribute to credit repair. Regularly monitoring your credit reports helps track progress and correct any inaccuracies. There are specific waiting periods to qualify for different types of mortgage loans after bankruptcy. For example, for an FHA loan, you must wait two years after the discharge date of a Chapter 7 bankruptcy. Understanding these periods helps in strategic planning, and Familiarize yourself with these periods for proper planning. Start with getting prequalified for a mortgage to gauge your borrowing capacity. A consistent income and a sizable down payment increase approval chances. It's crucial to demonstrate evidence of financial stability and timely payment capability. It's crucial to present convincing evidence of your financial stability and ability to make timely payments. Bankruptcy can seem like a financial dead-end, but it can be a stepping stone towards a fresh start, especially in terms of homeownership. Navigating the mortgage loan process post-bankruptcy comes with unique advantages: Obtaining a mortgage loan after bankruptcy allows a fresh start in homeownership, contributing to a sense of stability and long-term investment. While challenging, successful acquisition of a mortgage loan can lead to better money management skills, potentially allowing the negotiation of favorable loan terms in the future. While these drawbacks may seem daunting, remember that they're not insurmountable. With the right planning, you can successfully navigate the mortgage application process post-bankruptcy. The key challenge is convincing lenders of your improved financial habits. Lenders may require extensive documentation to demonstrate financial stability and the ability to meet monthly mortgage payments. Post-bankruptcy, you may face higher interest rates and down payments due to perceived risk by the lender. These terms can make homeownership costlier. Loan denial is a real risk for individuals with a bankruptcy history. Lenders might consider you a high-risk borrower, resulting in loan application rejection. Getting a mortgage loan after bankruptcy is feasible, but it demands a strategic approach to convince lenders you're not a high-risk borrower. Here are key strategies to ensure a successful mortgage loan application post-bankruptcy: Lenders looks favorably upon borrowers with stable employment. Consistent income from a reliable job reassures lenders of your ability to repay the loan. Continual management and improvement of your credit score are vital. It demonstrates to lenders that you have developed responsible financial habits post-bankruptcy. Reducing your debt-to-income ratio and boosting savings can make you a more appealing candidate to lenders. These practices indicate financial discipline and ensure you're better equipped to handle potential financial hiccups. Securing a mortgage loan after bankruptcy is not an impossible task, but it does require diligent financial management. A cornerstone of this journey is credit restoration and maintaining financial stability. Understanding waiting periods, depending on the type of bankruptcy and loan, is critical. The process may be challenging with the potential for high-interest rates, larger down payments, and loan rejection. However, consistent income, improved credit scores, and decreased debt-to-income ratios can significantly improve your chances of loan approval. The experience can lead to enhanced financial skills and ultimately a fresh start in homeownership. Therefore, despite the difficulties, the process can result in significant personal and financial growth. The assistance of a knowledgeable mortgage broker or financial advisor can be invaluable in this journey toward financial recovery and homeownership post-bankruptcy.Getting a Mortgage Loan After Bankruptcy: Overview

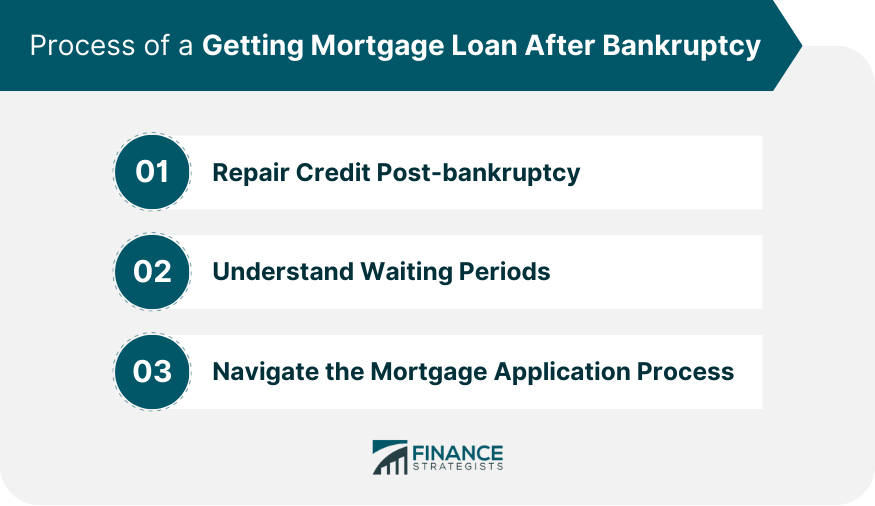

Process of a Getting Mortgage Loan After Bankruptcy

Repair Credit Post-bankruptcy

Understand Waiting Periods

Navigate the Mortgage Application Process

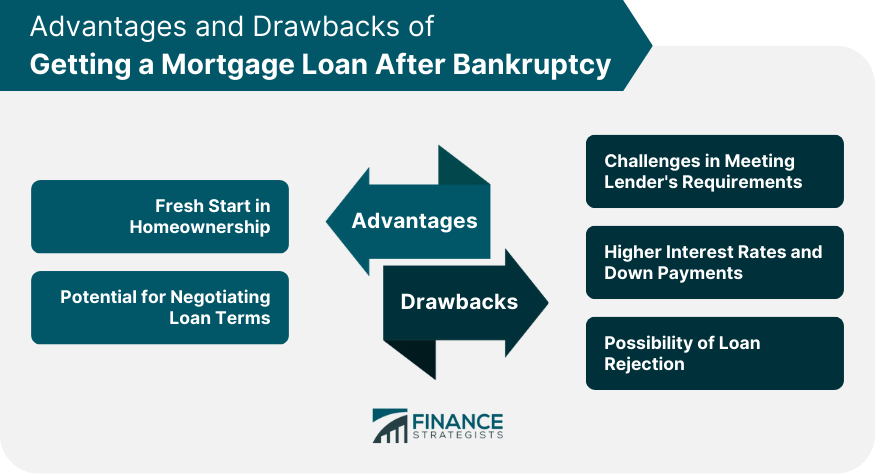

Advantages of Getting a Mortgage Loan after Bankruptcy

Fresh Start in Homeownership

Potential for Negotiating Loan Terms

Drawbacks in Obtaining a Mortgage Loan After Bankruptcy

Challenges in Meeting Lender's Requirements

Higher Interest Rates and Down Payments

Possibility of Loan Rejection

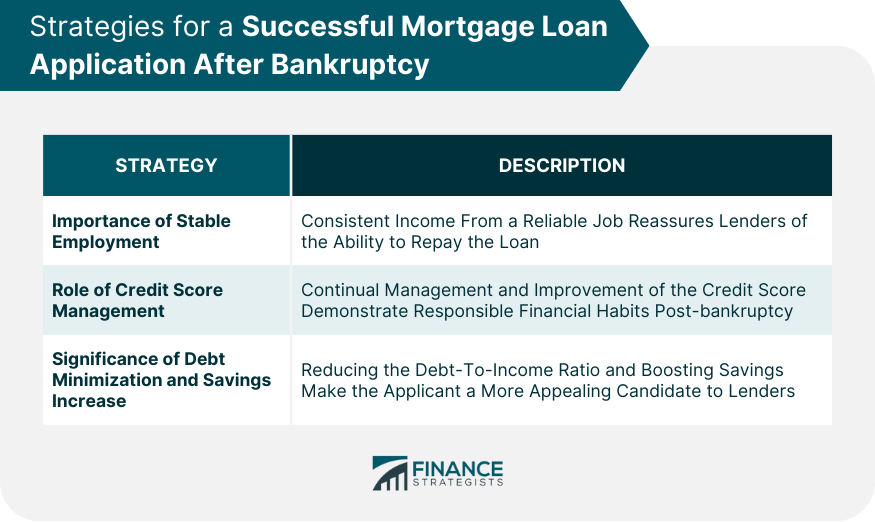

Strategies for a Successful Mortgage Loan Application After Bankruptcy

Importance of Stable Employment

Role of Credit Score Management

Significance of Debt Minimization and Savings Increase

Conclusion

Getting a Mortgage Loan After Bankruptcy FAQs

The process involves repairing your credit post-bankruptcy, understanding the waiting periods to qualify for different types of mortgage loans, and carefully navigating the mortgage application process.

The advantages include a fresh start in homeownership and the potential for negotiating better loan terms in the future due to improved money management skills.

Drawbacks can include facing higher interest rates and down payments, challenges in meeting the lender's requirements, and a higher possibility of loan rejection.

Yes, maintaining stable employment, continual management and improvement of your credit score, and reducing your debt-to-income ratio while boosting savings can make you a more appealing candidate to lenders.

The waiting period varies depending on the type of bankruptcy filed and the type of loan you're seeking. For an FHA loan, for example, you must wait two years after the discharge date of a Chapter 7 bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.