Bankruptcy is a legally declared inability or impairment of an individual's or organization's ability to pay its creditors. Bankruptcy allows a person or business that owes more money than it's able to pay to either work out a plan to repay the money over time or completely eliminate most of the bills. In a marriage, financial challenges often arise. One such predicament is bankruptcy. Though the decision to file for bankruptcy may seem individualistic, its implications often extend beyond personal boundaries, significantly affecting spouses. It's essential to comprehend the spousal effects of bankruptcy, whether considering it as a solution to insurmountable debt or dealing with its aftermath as a spouse. When one spouse files for bankruptcy, it does not automatically include the other. A debtor can file individually (pertaining only to their debts) or jointly (addressing the couple's combined debts). If a spouse files individually, only their separate debt and share of the joint debt is included. However, creditors can still pursue the non-filing spouse for their share of joint debts. In contrast, a joint filing includes all debts of both spouses, offering a complete financial reset for the couple but with more profound implications for their credit scores. Filing bankruptcy, whether individually or jointly, has a significant impact on credit scores. If a bankruptcy filing is individual, it's reflected on that spouse's credit report and can lower their score by up to 200 points. However, the non-filing spouse's credit report remains untouched unless they share joint debts. Joint bankruptcy filings will appear on both spouses' credit reports, leading to a similar drop in credit scores. Bankruptcy can also have serious consequences for property and assets, especially those held jointly. In individual bankruptcy, joint assets might be part of the bankruptcy estate, subject to seizure by the bankruptcy trustee to repay creditors. The specific consequences largely depend on state laws and the type of bankruptcy filed. Upon filing for bankruptcy, an "automatic stay" goes into effect, prohibiting most creditors from continuing collection activities. While this stay can provide immediate relief from creditor harassment, its protections may not extend fully to the non-filing spouse, especially in the context of individual bankruptcy and joint debts. Creditors may still pursue the non-filing spouse for joint debts, leading to financial stress. A bankruptcy filing can affect credit opportunities for years. Lenders view bankruptcy negatively, leading to higher interest rates and stricter qualification requirements for future credit. If only one spouse filed, the couple might still secure some credit using the non-filing spouse's unaffected credit score. But joint bankruptcy significantly narrows future credit opportunities until the bankruptcy notation is removed from credit reports. A bankruptcy filing stays on the filer's credit report for a considerable period. Chapter 7 bankruptcy remains for ten years, while Chapter 13 stays for seven. During this time, it can affect both the filing spouse's and the non-filing spouse's ability to obtain new credit, buy a home, or even find a job. Bankruptcy can also affect spouses' future financial planning. Filing bankruptcy can make it challenging to secure loans for major purchases like cars or homes, contributing to higher interest rates and more restrictive loan terms. It can also disrupt retirement planning, as it may be necessary to use retirement savings to pay debts. Consequently, spouses might need to postpone retirement or alter their lifestyle expectations. Chapter 7 bankruptcy, often called "liquidation bankruptcy," wipes out most of the filer's unsecured debts, such as credit card bills and medical expenses. However, this comes at the cost of the debtor's non-exempt property, which is sold to repay creditors. If a spouse files for Chapter 7, non-filing spouses might find their shared property at risk. Also, the discharged debts only apply to the filing spouse, leaving non-filing spouses responsible for their individual and shared debts. Chapter 13 bankruptcy allows debtors to keep their property and pay their debts over time, typically three to five years. While it does protect more property than Chapter 7, it demands a stable income for the repayment plan. If one spouse files for Chapter 13, non-filing spouses may still be held responsible for joint debts if they're not fully repaid in the bankruptcy plan. In community property states, debts incurred during the marriage belong to the community property - effectively, both spouses. When one spouse files for bankruptcy in these states, all community property (including the non-filing spouse's portion) becomes part of the bankruptcy estate, which can be used to repay creditors. However, the filing does discharge both spouses' liability for community debts. On the other hand, in equitable distribution states, debts are typically assigned to the spouse who incurred them. In these states, individual bankruptcy filings involve only the filing spouse's property and debts. Still, the non-filing spouse may be held responsible for joint debts. Bankruptcy often necessitates a significant financial lifestyle change. Budgeting becomes more critical than ever, emphasizing living within means, reducing expenses, and avoiding new debt. It's also crucial to establish an emergency fund to handle unexpected expenses without resorting to credit. After bankruptcy, rebuilding credit should be a priority. Regularly reviewing credit reports for errors, ensuring bills are paid on time, and gradually taking on credit that can be repaid responsibly are all steps in the right direction. Bankruptcy, whether filed individually or jointly, has immediate and long-term effects that significantly impact both spouses' financial situation and credit standing. The type of bankruptcy, coupled with state laws, also adds layers of complexity to the bankruptcy's impacts. It is crucial to navigate these complexities effectively and adopt strategies for future financial planning and credit rebuilding. Given the gravity of this decision, it is highly recommended that couples seek professional guidance. A financial advisor can offer invaluable insights into the intricacies of bankruptcy and its repercussions on marital finances. They can also provide personalized advice on coping strategies post-bankruptcy, helping spouses rebuild their financial future and manage debts responsibly. Navigating bankruptcy is no easy task, but with the right advice and commitment to a financially disciplined lifestyle, it is possible to weather the storm and set the stage for a secure financial future.Overview of Bankruptcy

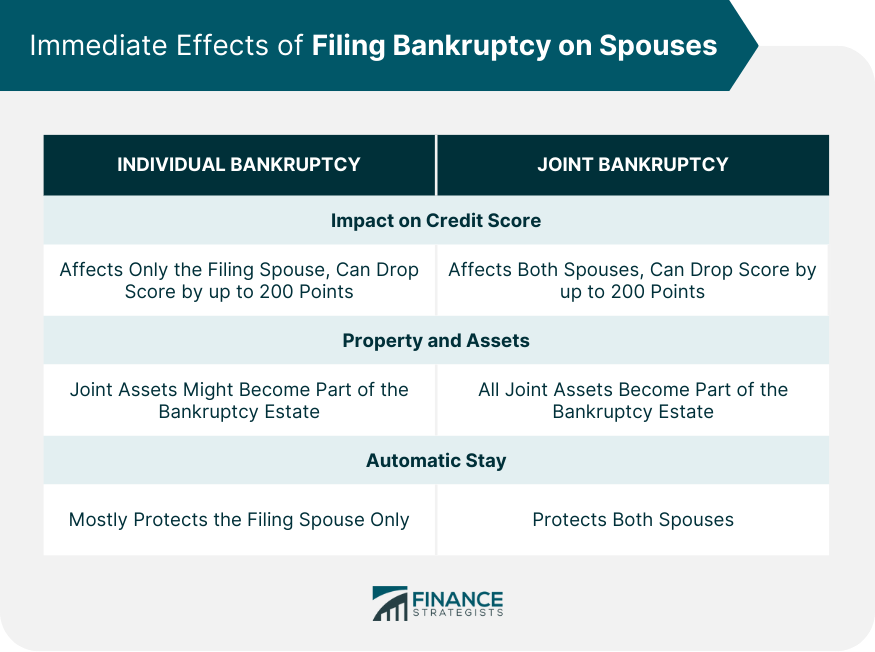

Immediate Effects of Filing Bankruptcy on Spouses

Individual vs Joint Bankruptcy

Impact on Credit Score

Consequences to Property and Assets

Automatic Stay

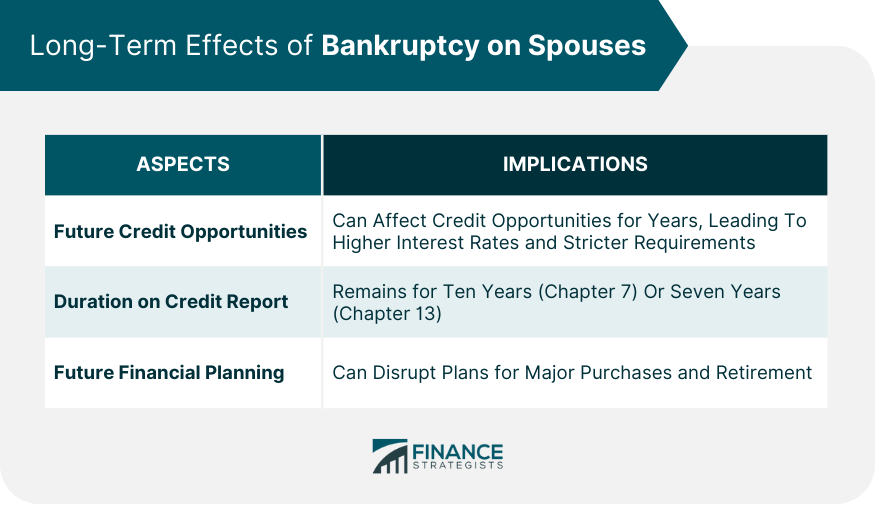

Long-Term Effects of Bankruptcy on Spouses

Future Credit Opportunities

Duration on Credit Report

Future Financial Planning

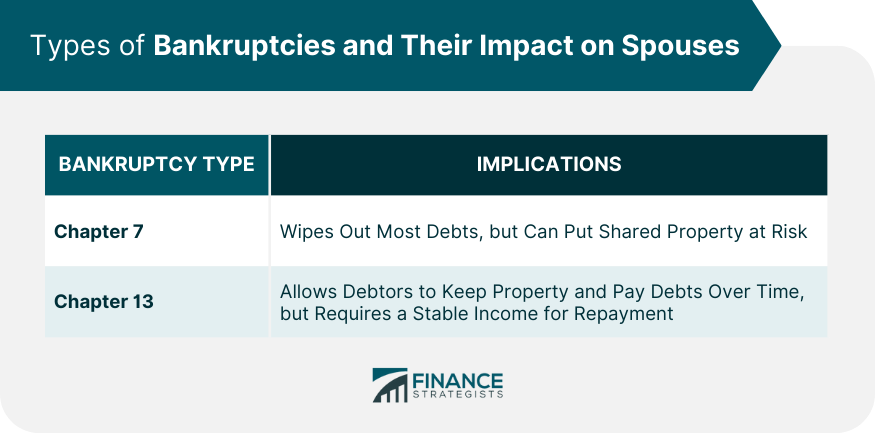

Types of Bankruptcies and Their Impact on Spouses

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

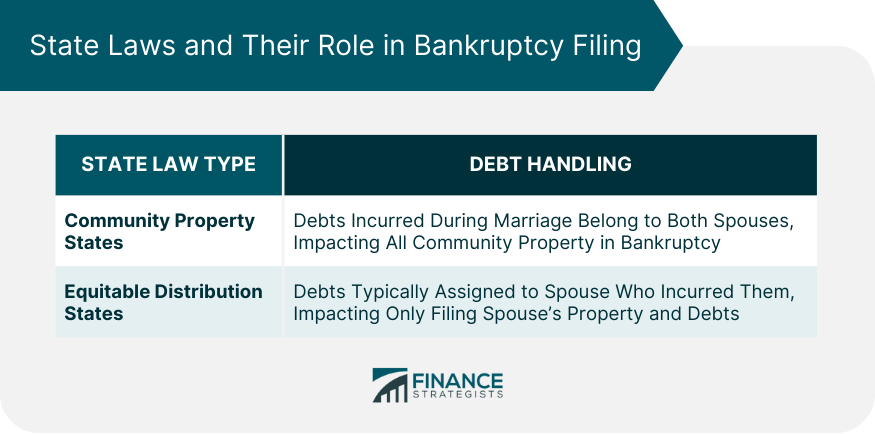

State Laws and Their Role in Bankruptcy Filing

Community Property States

Equitable Distribution States

Coping Strategies for Spouses Affected by Bankruptcy

Post-bankruptcy Financial Planning

Rebuilding Credit

The Bottom Line

Impact of Bankruptcy on Spouses FAQs

Filing bankruptcy can significantly lower the filing spouse's credit score. If debts are joint, the non-filing spouse's score may also be impacted.

Joint assets can become part of the bankruptcy estate in an individual filing and may be used to repay creditors, depending on the bankruptcy type and state laws.

Long-term effects include potential difficulties in securing credit, higher interest rates, and the need for significant adjustments in future financial planning.

In Chapter 7, the non-filing spouse may find shared property at risk, and they remain responsible for their individual and joint debts.

Key strategies include stringent budgeting, establishing an emergency fund, and taking steps to rebuild credit over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.