A bankruptcy discharge date is a pivotal milestone in the bankruptcy process, marking the point when an individual, having filed for bankruptcy, is legally absolved from repaying most of the debts included in the bankruptcy case. This date is determined by the bankruptcy court after a thorough review of the case, ensuring all conditions and necessary steps, such as credit counseling and debtor education, have been met. The discharge date offers significant relief by eliminating the burden of many pre-bankruptcy debts, paving the way for a fresh financial start. However, it's crucial to remember that not all debts, like student loans and certain taxes, are discharged. The bankruptcy discharge date, while reducing the burden of past debts, serves as the beginning of the journey toward financial recovery and rebuilding one's credit score. From filing for bankruptcy to reaching the discharge date, individuals go through a series of steps, including credit counseling, debtor education, the 341 meeting (meeting of creditors), and more. The discharge date arrives after the completion of all these steps, typically a few months after filing the case. The bankruptcy court plays a crucial role in determining the discharge date. The court reviews the case, ensures all conditions are met, and then issues a discharge order relieving the filer of their debts. The order also prohibits creditors from making any attempt to collect discharged debts. Post-discharge, financial management becomes crucial. Sticking to a budget, making timely bill payments, and avoiding unnecessary debt can help regain financial stability. Bankruptcy remains on the credit report for up to 10 years, impacting the credit score and lending decisions. However, its impact diminishes over time with responsible financial behavior. The most direct benefit of reaching a bankruptcy discharge date is the relief from debts. Most unsecured debts like credit card debts, medical bills, and personal loans get discharged, freeing the filer from the obligation to repay them. The discharge date signifies a new beginning - a fresh start. With the bulk of previous debts wiped out, individuals can focus on financial recovery and plan for a more secure financial future. Not all debts get discharged in bankruptcy. Student loans, child support, alimony, certain taxes, and debts obtained through fraud typically survive bankruptcy and must be paid off even after the discharge date. Bankruptcy, including the discharge, leaves a negative mark on one's credit report, which can lower credit scores and hamper future borrowing attempts. Lenders may see a bankruptcy filer as a higher risk, resulting in higher interest rates or denial of credit. Adopting responsible financial habits like saving, budgeting, and responsible use of credit can help improve credit scores and financial health over time. Post-bankruptcy, financial counseling, or education can be beneficial. It can provide guidance on managing finances and avoiding future financial distress. In conclusion, while the bankruptcy discharge date brings considerable relief from debt, it also comes with its own set of challenges. Understanding these challenges and planning for the aftermath can make the road to financial recovery smoother. Despite the initial difficulties, with responsible financial habits and appropriate guidance, individuals can successfully navigate their way toward a secure financial future. Following a bankruptcy discharge, rebuilding credit becomes a primary focus. Several strategies can be helpful in this process, including obtaining a secured credit card, taking out a credit-builder loan, or becoming an authorized user of a trusted person's credit card. Timely payments on these credit lines can contribute positively to credit history and help increase credit scores. Bankruptcy can provide an opportunity to reevaluate spending and saving habits. Creating a realistic budget that accounts for income, living expenses, and savings can guide financial decision-making. Establishing an emergency fund is also crucial to avoid future financial distress. Various tools can assist in post-bankruptcy financial management. For example, credit monitoring services can help track credit score progress, and budgeting apps can assist in adhering to a spending plan. After a bankruptcy discharge, setting long-term financial goals can guide recovery efforts. These goals may include saving for retirement, buying a home, or funding education. Despite the initial impact of bankruptcy, these objectives can still be achieved with careful planning and diligent financial practice. A bankruptcy discharge date, determined by the court after a thorough review, marks a turning point in the debt relief journey, absolving individuals from most pre-bankruptcy debts. This significant relief offers a fresh start, permitting a focus on financial recovery and future security. However, challenges persist, as not all debts are discharged, and credit scores may be adversely impacted. After discharge, disciplined financial management, including budgeting, timely payments, and debt avoidance, is critical. Despite bankruptcy's negative impact on credit reports, this diminishes over time with responsible behavior. Recovery strategies include adopting sensible financial habits, seeking financial counseling, and utilizing financial tools. Setting long-term goals aids in charting a course toward financial security. Despite bankruptcy's initial impact, with thoughtful planning and diligent practice, the road to recovery is navigable, and a secure financial future is achievable.What is a Bankruptcy Discharge Date?

How a Bankruptcy Discharge Date Works

Process Leading to the Discharge Date

Role of the Bankruptcy Court

Aftermath of the Bankruptcy Discharge Date

Financial Management Post-discharge

Long-Term Effects on Credit Reports

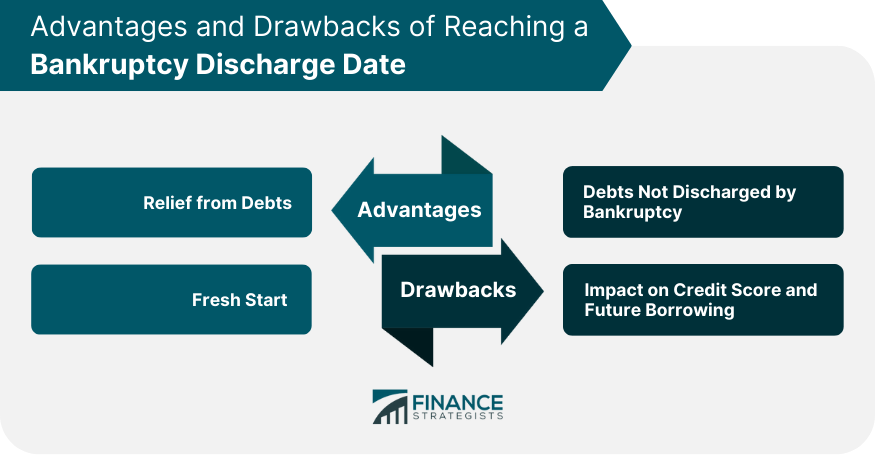

Advantages Related a Bankruptcy Discharge Date

Relief From Debts

Fresh Start

Drawbacks Related to Bankruptcy Discharge Date

Debts Not Discharged by Bankruptcy

Impact on Credit Score and Future Borrowing

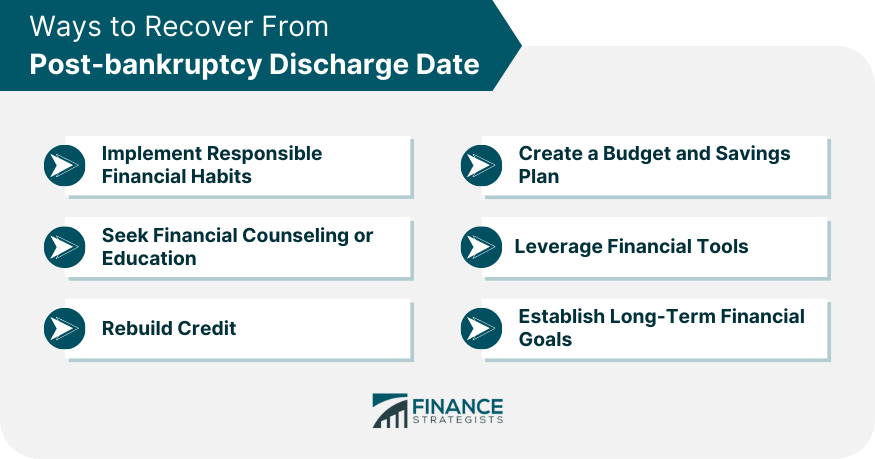

Ways to Recover From Post-bankruptcy Discharge Date

Implement Responsible Financial Habits

Seek Financial Counseling or Education

Rebuild Credit

Create a Budget and Savings Plan

Leverage Financial Tools

Establish Long-Term Financial Goals

Conclusion

Bankruptcy Discharge Date FAQs

The bankruptcy discharge date is the point in time when an individual, who has filed for bankruptcy, is legally relieved from the obligation to repay certain debts included in the bankruptcy case.

The bankruptcy discharge date is important as it marks the end of the bankruptcy process and provides a fresh start for the individual. It relieves them from the burden of pre-bankruptcy debts, allowing them to focus on rebuilding their financial health.

After the bankruptcy discharge date, the debtor is freed from the obligation to pay off most of their unsecured debts. However, they need to pay off non-dischargeable debts like student loans, child support, and certain taxes. They also need to focus on rebuilding their credit score and adopting responsible financial habits.

The bankruptcy discharge date leaves a negative mark on your credit report, which can lower your credit score and affect future borrowing attempts. However, its impact lessens over time with responsible financial behavior.

After the bankruptcy discharge date, you can recover by implementing responsible financial habits such as saving, budgeting, and responsible use of credit. Seeking financial counseling, rebuilding your credit, creating a realistic budget, establishing an emergency fund, and setting long-term financial goals are some of the ways to improve your financial health post-bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.