Under U.S. bankruptcy law, individuals can file for Chapter 7 bankruptcy every eight years from the date of the discharge of their previous Chapter 7 bankruptcy. This type of bankruptcy, also known as "liquidation bankruptcy," allows debtors to wipe out most of their unsecured debts, providing them with a fresh financial start. However, frequent filings can lead to severe implications, including a substantial impact on one's credit score, lasting for ten years. Therefore, it's important to consider alternative debt management strategies before opting for multiple Chapter 7 bankruptcy filings. The purpose of Chapter 7 bankruptcy is to give debtors a fresh financial start. It's an essential component of the financial system, designed to help individuals or businesses facing insurmountable debt levels. Eliminating unsecured debts, such as credit card bills, medical expenses, and personal loans, allows debtors to regain financial stability and gradually rebuild their credit. To file for Chapter 7 bankruptcy, the debtor must pass the "means test." This test compares the debtor's income to the median income of their state. If the debtor's income is below the median, they are typically eligible to file under Chapter 7. The process of filing for Chapter 7 bankruptcy begins with the debtor (or their attorney) filing a petition with the bankruptcy court serving the area where the debtor lives. The petition includes detailed information about the debtor's assets, liabilities, income, expenses, and a summary of their financial affairs. After filing, a bankruptcy trustee is assigned to the case. The trustee's role is to review the debtor's petition, liquidate non-exempt assets, and distribute the proceeds to the creditors. Once the process is complete, the debtor receives a discharge of debts. The discharge effectively eliminates the debtor's obligation to pay the discharged debts, giving them a fresh financial start. Under U.S. Bankruptcy law, there are limitations on how frequently a person can file for Chapter 7 bankruptcy. A debtor must wait eight years from the date of a previous Chapter 7 discharge before they can file again. Despite these restrictions, certain circumstances might influence the frequency of filing. For instance, significant unforeseen expenses, such as medical bills, can lead to repeated financial distress. Filing for Chapter 7 bankruptcy triggers an "automatic stay," which stops most collection efforts by creditors. This stay provides temporary relief from harassing phone calls, lawsuits, wage garnishments, and other collection actions. Another benefit is the ability to discharge new debts that have been incurred since the previous bankruptcy filing. It offers another chance to eliminate unsecured debts and regain financial stability. Filing for Chapter 7 bankruptcy will significantly impact the debtor's credit score, and a record of the bankruptcy will remain on their credit report for ten years. Multiple filings may compound this impact and make it more challenging to rebuild credit. As previously mentioned, there are strict time restrictions on repeat Chapter 7 filings. If these are not adhered to, the debtor may not receive a discharge of their debts. Repeated bankruptcy filings can also lead to emotional distress and a sense of financial instability. It can make future financial planning challenging and add stress to personal relationships. Debt consolidation combines multiple debts into a single payment with a potentially lower interest rate. This option can make it easier to manage debts and avoid the need for repeated bankruptcy filings. Credit counseling services offer guidance on managing money and debts, budgeting, and other basics of personal finance. This assistance can help individuals avoid future financial pitfalls that might lead to bankruptcy. Chapter 13 bankruptcy, unlike Chapter 7, involves a repayment plan where the debtor repays their debts over three to five years. This type of bankruptcy can be an effective alternative for those with regular income who can afford to make monthly payments. In some cases, creditors might be willing to negotiate repayment terms. This option can include reducing the total amount of debt, lowering interest rates, or extending the repayment period. A bankruptcy lawyer can provide advice tailored to the debtor's unique circumstances. The lawyer can help assess the debtor's financial situation, advise on the best course of action, and guide them through the bankruptcy process. The law explicitly states the frequency with which a debtor can file for Chapter 7 bankruptcy. Understanding these legal restrictions is essential to avoid filing too soon and risking non-discharge of debts. Given the potential pitfalls of frequent Chapter 7 bankruptcy filings, it's important to determine the best financial strategy for the future. This strategy could involve adopting new financial management techniques, seeking professional financial counseling, or exploring alternatives to bankruptcy. Chapter 7 bankruptcy, a legal mechanism designed for debtors to obtain a fresh financial start, can be filed every eight years following the discharge of a previous Chapter 7 filing. While it provides relief from creditors and discharges unsecured debts, it significantly impacts one's credit score and has strict eligibility requirements. The frequency of filing is influenced by personal financial circumstances, but multiple filings can lead to stress and financial instability. Therefore, exploring alternatives like debt consolidation, credit counseling, Chapter 13 bankruptcy, or negotiating with creditors is advisable. Expert legal advice can help in understanding the law's position on the frequency of filings and devising an effective financial strategy, emphasizing avoiding recurrent bankruptcy filings. With careful planning and informed decisions, individuals can navigate financial difficulties and regain their financial footing.How Often Can Chapter 7 Bankruptcy Be Filed?

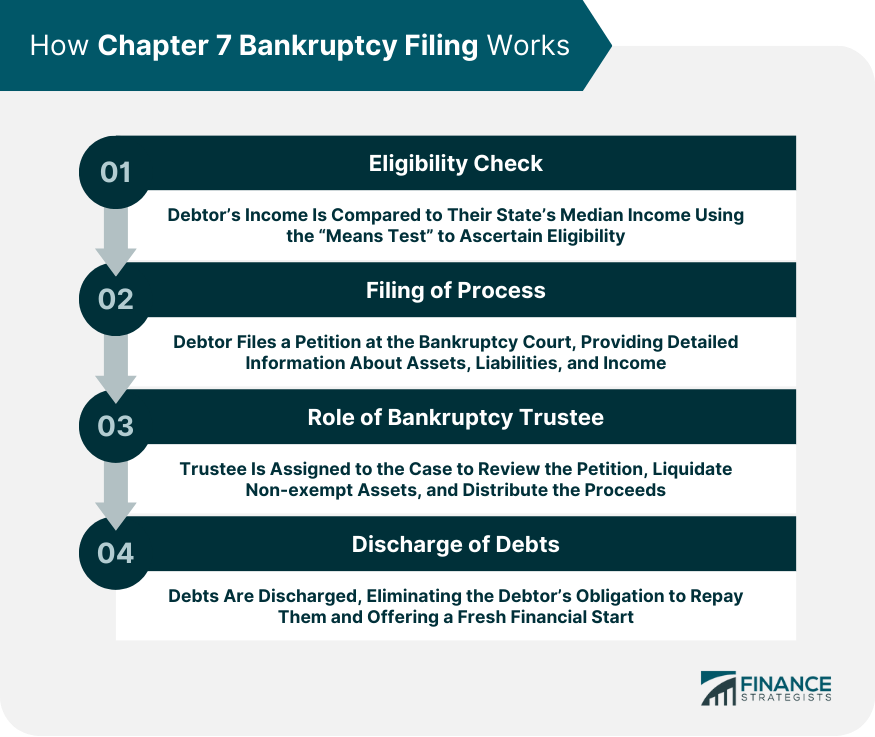

How Chapter 7 Bankruptcy Filing Works

Eligibility Requirements

Filing Process

Role of the Bankruptcy Trustee

Discharge of Debts

Frequency of Filing Chapter 7 Bankruptcy

Legal Guidelines and Limitations

Circumstances That Might Influence Frequency

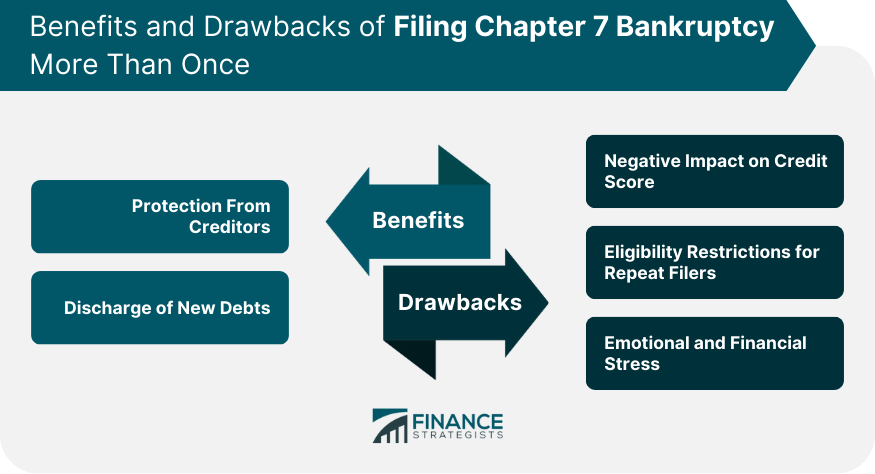

Benefits of Filing Chapter 7 Bankruptcy More Than Once

Protection From Creditors

Discharge of New Debts

Drawbacks of Filing Chapter 7 Bankruptcy More Than Once

Negative Impact on Credit Score

Eligibility Restrictions for Repeat Filers

Emotional and Financial Stress

Alternatives to Multiple Chapter 7 Bankruptcy Filings

Debt Consolidation

Credit Counseling

Chapter 13 Bankruptcy

Negotiation With Creditors

Legal Advice on the Frequency of Filing Chapter 7 Bankruptcy

Conclusion

How Often Can Chapter 7 Bankruptcy Be Filed? FAQs

Under U.S. law, you can file for Chapter 7 bankruptcy again after eight years from the date of the discharge of your previous Chapter 7 bankruptcy.

Filing for Chapter 7 bankruptcy can significantly impact your credit score, and multiple filings may compound this effect. A record of the bankruptcy will remain on your credit report for ten years.

Yes, alternatives to multiple Chapter 7 bankruptcy filings include debt consolidation, credit counseling, Chapter 13 bankruptcy, and negotiation with creditors.

The primary benefits of filing Chapter 7 bankruptcy multiple times are the protection from creditors through an "automatic stay" and the discharge of new unsecured debts incurred since the previous bankruptcy filing.

The law is explicit about the frequency with which a debtor can file for Chapter 7 bankruptcy. A debtor must wait eight years from the date of a previous Chapter 7 discharge before they can file again.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.