Yes, an individual can file for bankruptcy if they find themselves unable to pay back their debts. Bankruptcy is a legal procedure that provides a debtor with the opportunity to either eliminate their debts or work out a payment plan with creditors under the protection of the bankruptcy court. The most common types are Chapter 7, which involves liquidating non-exempt assets to repay debts, and Chapter 13, where debts are reorganized into a manageable payment plan. However, it's important to note that bankruptcy should be a last resort due to its long-term impact on your credit score. It's also crucial to explore alternatives and consult with a financial advisor or bankruptcy attorney to understand the full implications of filing for bankruptcy. The bankruptcy trustee plays a critical role in managing the bankruptcy process. Their responsibilities include reviewing the bankruptcy petition, verifying the debtor's assets and debts, and selling non-exempt assets to pay creditors. Individuals commonly file under Chapter 7 or Chapter 13. Chapter 7 involves liquidating non-exempt assets to repay creditors, while Chapter 13 establishes a repayment plan, allowing the debtor to keep their assets. Filing for bankruptcy involves submitting a petition, schedules detailing your financial affairs, and a statement of financial affairs to the court. After filing, an automatic stay goes into effect, halting all collection efforts. The trustee will then administer the case, and ultimately, the court will discharge eligible debts. Filing for bankruptcy initiates an automatic stay, immediately stopping most creditors from further collection actions like harassing phone calls, wage garnishments, or lawsuits. Bankruptcy can lead to the discharge of many debts, including credit card debt, personal loans, and medical bills. Alternatively, under Chapter 13, you can reorganize your debts into a more manageable payment plan. An automatic stay also stops most foreclosure proceedings, repossessions, and evictions, temporarily protecting your assets while you work through the bankruptcy process. Bankruptcy can significantly impact your credit score. A Chapter 7 bankruptcy will stay on your credit report for ten years, while Chapter 13 remains for seven. In Chapter 7, you may lose non-exempt assets, such as a second home or car, to liquidation. Chapter 13 avoids this but requires a repayment plan, which can be financially demanding. After filing for bankruptcy, you're subject to waiting periods before you can file again. This limits your options if you encounter financial difficulties in the future. A financial advisor can provide guidance on which bankruptcy chapter is most suitable based on your financial situation, objectives, and type of debt. Financial advisors also offer assistance in creating a budget, rebuilding credit, and implementing a sound financial strategy post-bankruptcy. They can suggest strategies to rebuild credit, like taking out a secured credit card or installment loan, always paying on time, and keeping your credit utilization low. Debt consolidation involves combining all your debts into one loan with a lower interest rate, while debt management plans involve negotiating lower interest rates and payments with your creditors. You can negotiate directly with creditors to reduce your debt, change the terms, or arrange a settlement. Credit counseling agencies offer resources and tools to help manage your debts and create a budget. This could be a useful step before deciding to file for bankruptcy. Interpret the Bankruptcy Code: The Bankruptcy Code is complex, and understanding it requires legal expertise. Hiring a bankruptcy attorney can help ensure you make informed decisions. Understand Legal Obligations and Responsibilities: Filing for bankruptcy also entails legal obligations, like honesty in your paperwork, attendance at a creditors' meeting, and completion of a financial management course. Potential Legal Consequences of Bankruptcy Fraud: Bankruptcy fraud, including concealing assets, filing false forms, or using false identities, carries severe penalties, including imprisonment, fines, or both. Before deciding to file, it's imperative to thoroughly assess your financial situation. This includes taking a close look at your current income, outstanding debts, and monthly expenses. You need to evaluate your ability to repay debts over time without severely impacting your quality of life. In addition, consider the value of your non-exempt assets, as these might be sold off under Chapter 7 bankruptcy to pay back your creditors. Will the loss of these assets outweigh the benefits of filing for bankruptcy? It's important to weigh all these factors before proceeding. Consultation with professionals like financial advisors or bankruptcy attorneys is highly recommended. They can provide insights into the implications of filing for bankruptcy and its impact on your financial future. These experts can guide you through the complexity of bankruptcy laws, help you understand your legal obligations and rights, and assist in exploring other possible debt-relief options. Bankruptcy is a viable option for individuals unable to repay their debts, allowing for the possibility of debt elimination or the creation of a more manageable payment plan. While it provides immediate relief from creditors and the potential to discharge or reorganize debts, it can have severe consequences, such as negatively impacting your credit score, potential loss of assets, and restrictions on future bankruptcy filings. It's crucial to comprehend the complexity of bankruptcy laws, the roles of various players like trustees, financial advisors, and bankruptcy attorneys, and the alternatives available. Before making this significant decision, a comprehensive evaluation of one's financial situation and consulting with professionals is vital. Despite the challenges, with the right guidance and post-bankruptcy financial management, it's possible to navigate this process and rebuild one's financial life.Can an Individual File for Bankruptcy?

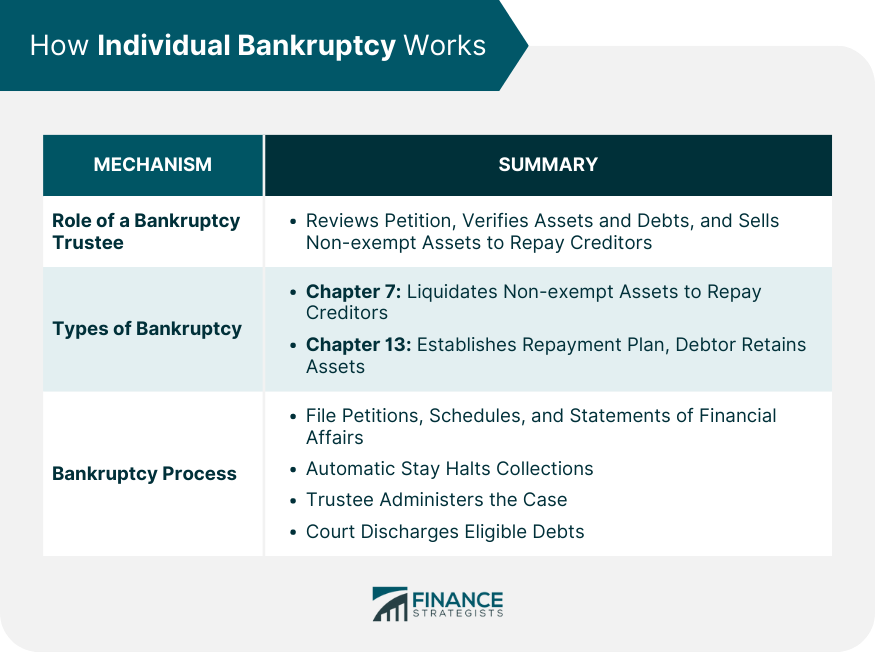

How Individual Bankruptcy Works

Role of a Bankruptcy Trustee

Different Types of Bankruptcy: Chapter 7 and Chapter 13

Bankruptcy Process: From Filing to Discharge

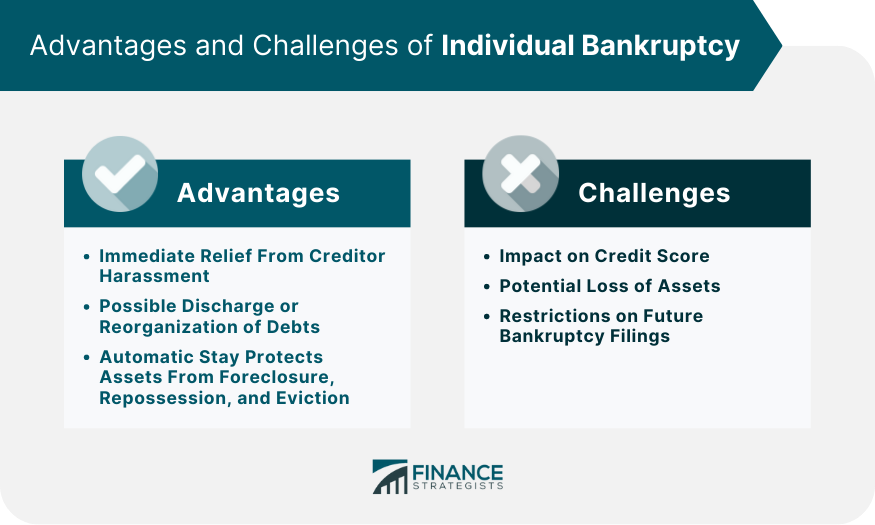

Advantages of Filing for Individual Bankruptcy

Immediate Relief From Creditor Harassment

Possible Discharge or Reorganization of Debts

Automatic Stay: Protect Assets

Limitations and Challenges of Individual Bankruptcy

Impact on Credit Score

Potential Loss of Assets

Restrictions on Future Bankruptcy Filings

Role of a Financial Advisor in the Bankruptcy Process

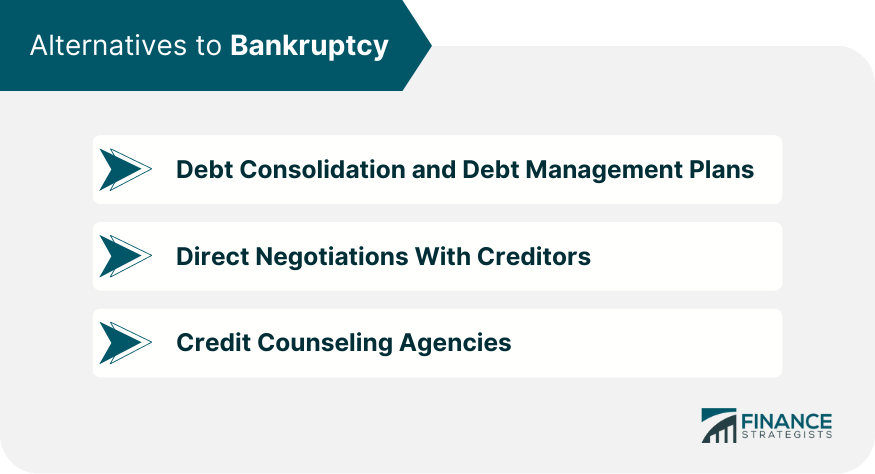

Consider Alternatives to Bankruptcy

Debt Consolidation and Debt Management Plans

Direct Negotiations With Creditors

Credit Counseling Agencies

Navigate the Legal Landscape of Individual Bankruptcy

Make the Decision: Should an Individual File for Bankruptcy?

Evaluate Financial Situation

Seek Professional Financial and Legal Advice

Conclusion

Can an Individual File for Bankruptcy? FAQs

Individual bankruptcy is a legal procedure that allows a person unable to pay their debts to eliminate or reorganize these debts under the protection of the bankruptcy court.

Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the selling of a debtor's non-exempt assets to repay creditors. Chapter 13 bankruptcy, on the other hand, allows the debtor to keep their assets and pay off their debts over time based on a court-approved repayment plan.

Filing for bankruptcy can offer immediate relief from creditor harassment, the discharge or reorganization of debts, and temporary protection of your assets thanks to the automatic stay which halts collection efforts.

Bankruptcy can have a significant negative impact on your credit score. A Chapter 7 bankruptcy will remain on your credit report for ten years, while a Chapter 13 bankruptcy stays for seven years.

Yes, there are several alternatives to bankruptcy, including debt consolidation, direct negotiations with creditors, and seeking assistance from a credit counseling agency to better manage your debts and budget.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.