An eviction is a legal action taken by a landlord or property owner in order to remove an individual from their rental residence. In some cases, a tenant may face eviction proceedings if they fail to pay rent or breach the terms of their lease agreement. It is essential for tenants to understand their rights and obligations under the law to protect themselves from wrongful evictions or unfair treatment by a landlord. The stages of an eviction process will vary depending on the jurisdiction, but typically involve: A notice informing the tenant of the lease violation A demand for payment of back rent (if applicable) A court hearing where both parties can present evidence and be heard Issuance of a judgment ordering either party to do something (e.g., require the tenant to move out by a certain date) A sheriff’s execution of the judgment through physical removal of the tenant Eviction proceedings can be a frightening prospect for those who are unable to meet their rental or lease obligations. Fortunately, filing for bankruptcy may provide eviction relief in certain situations. Depending on the bankruptcy type and other financial circumstances, individuals may have options available to them that allow them to stay in their current residence, despite an eviction order having been issued. Also known as “liquidation” or “straight bankruptcy,” Chapter 7 is the most common form of filing for individuals. It allows for certain possessions to be kept while other types of debt (such as medical bills or credit card balances) are erased. This form of bankruptcy is ideal for those attempting to erase debts quickly, as it typically takes less than six months from start to finish. In some cases, it can also stay (or delay) an eviction court proceeding if filed during this process. Chapter 13 bankruptcies involve a repayment plan over three to five years with creditors being paid off in an orderly manner. This type of filing suits those who have a regular income and need some time to pay back accumulated debt without losing property or facing liquidation proceedings. The repayment plans established through this process can also put a hold on eviction proceedings until all debts have been settled according to the settlement plan agreed upon between creditors and debtor(s). It is important to understand the process and requirements involved before attempting to use this option as a way to avoid or delay an eviction order. In order to qualify for bankruptcy protection, individuals must meet certain criteria and file the appropriate paperwork in court. This includes providing detailed financial information and listing all creditors, assets, and liabilities in order to accurately represent their current financial situation. Depending on the type of filing (Chapter 7 or Chapter 13), different qualifications may apply. For example, those applying under Chapter 13 must prove a regular income stream sufficient enough for payments according to their repayment plan. Individuals filing for bankruptcy protection are required by law to provide a pre-bankruptcy notice informing landlords of their intention prior to filing with the court system. This gives landlords time and opportunity to take any necessary legal action in response if desired. Failure to provide this notice can result in the dismissal of the case or refusal of repayment plans by creditors at later stages of the process. Filing for bankruptcy can have a major effect on eviction proceedings and rental agreements. It is essential to understand the potential outcomes before proceeding with the filing process in order to ensure the best outcome for both parties involved. For those facing eviction, filing for bankruptcy may be able to temporarily stop or delay proceedings. This allows individuals time to get back on their feet financially before having to leave their current residence. In some cases, this may even provide permanent relief if enough assets are liquidated or debt payments are established as part of the bankruptcy settlement. Depending on the type of bankruptcy filed, lasting effects may remain even after eviction proceedings have been completed. The primary example of this is Chapter 13 filings. Those approved by creditors under such circumstances must follow a repayment plan over three to five years. If any payments are missed during this period, creditors can rescind any reprieve given previously, allowing landlords to terminate rental agreements if desired. Filing for bankruptcy as a way to stop or delay eviction proceedings may seem like the right solution, but there are some important considerations that need to be made before taking any action. Bankruptcy filings can be expensive and require legal representation in most cases. This can make the process especially difficult for those already struggling financially, as the costs associated with filing may not provide any additional relief from existing debts. Before starting any step of the bankruptcy process, it is essential to understand all costs involved and whether or not funds are available for these payments. Another consideration with filing for bankruptcy is the potential impact on credit scores. Bankruptcy filings remain on an individual’s credit report for 7-10 years and can significantly reduce credit scores during this period depending on the type of filing. This may also affect the ability to obtain (and maintain) future loans such as car leases or mortgages due to the overall lower score. Bankruptcies can be a helpful tool for individuals facing eviction, providing temporary or permanent relief depending on the type of filing and circumstances. However, it is crucial to consider all potential outcomes before taking any action; this includes not only costs but also long-term impacts affecting credit scores. Knowing how bankruptcy filings can affect existing evictions and rental agreements is essential in order to make the best decision for both parties involved.What Is an Eviction?

Types of Bankruptcies That May Clear Evictions

Chapter 7 Bankruptcy

Chapter 13 Bankruptcy

The Process of Filing for Bankruptcy to Stop Eviction Proceedings

Qualifying for Bankruptcy Protection

Pre-bankruptcy Notice Requirement

Impact of Bankruptcy on Eviction Proceedings and Rental Agreements

Filing and Evictions

Lasting Effects on Rental Agreements

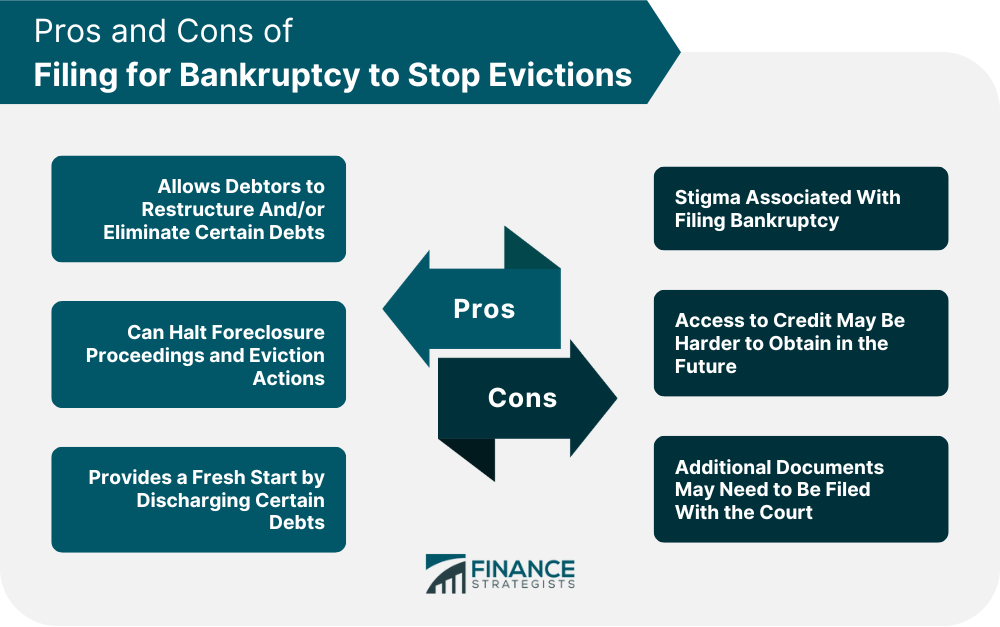

Additional Considerations When Filing for Bankruptcy to Stop Eviction Proceedings

Costs

Credit Scores

The Bottom Line

Do Bankruptcies Clear Evictions? FAQs

Yes, it is possible for bankruptcy to clear an eviction from your record. In most cases, this requires filing for bankruptcy and then pursuing an adversary proceeding in which you must prove that the eviction should be discharged or resolved through the bankruptcy process. It can be a time-consuming and expensive process, but if successful, the eviction can be cleared from your record.

It varies depending on the case's complexity, but it generally takes several months or longer for an eviction to be cleared after filing for bankruptcy through an adversarial proceeding.

Having an eviction cleared from your record can improve your credit score, allowing you to access better loan terms and potentially reduce interest rates on future loans. It can also make it easier to rent a new apartment or home since potential landlords may not see the negative mark on your credit report.

The primary drawback is that it can be costly to file for bankruptcy and tedious to go through the process of filing an adversary proceeding. Additionally, even if you are successful in clearing the eviction from your credit report, other people may still find out about it if they do their own research into public records.

You must first file a petition with the court and attend a creditors’ meeting where creditors will have the opportunity to object or ask questions about why you believe certain debts should be discharged or resolved through bankruptcy. If you choose to pursue an adversary proceeding, this must be filed separately — usually within 30 days of filing — and requires additional paperwork and hearings in order to be resolved by a judge ruling in your favor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.