The Chapter 7 Bankruptcy Means Test is a tool used by the U.S. court system to determine if an individual filing for bankruptcy qualifies for Chapter 7 bankruptcy, which involves the liquidation of assets to repay debts. This test calculates whether the debtor has sufficient disposable income to repay some portion of their unsecured debts. The Means Test serves a crucial purpose in the bankruptcy system, ensuring that the process is fair and not prone to abuse. It distinguishes individuals who genuinely cannot pay their debts due to financial hardship from those who have sufficient disposable income to pay off a portion of their debts. By doing so, it maintains the integrity of the bankruptcy system and the concept of a "fresh start." The Means Test begins by comparing an individual's average monthly income over the six months before bankruptcy with their state's median income. If the individual's income is less than or equal to the state median, they pass the Means Test and may file for Chapter 7 bankruptcy. If the debtor's income surpasses the state's median, additional calculations are necessary. Income from all sources is considered, except tax refunds and Social Security benefits. Next, specific monthly expenses are subtracted from the debtor's monthly income, resulting in disposable income. Median income levels vary by state and household size. Every state has different income brackets that are updated periodically. If the debtor's household income is above the median, the Means Test's second part comes into play, potentially limiting the debtor's eligibility for Chapter 7 bankruptcy. This step involves deducting certain monthly expenses from the debtor's "current monthly income" (the average income over the six months before filing for bankruptcy), producing disposable income. If there is enough disposable income to repay a portion of the unsecured debts, the debtor may not qualify for Chapter 7 bankruptcy. The Means Test establishes a standard measurement of who should be allowed to erase their debt completely under Chapter 7. This helps ensure that only those who truly can't afford to repay their debts are allowed to discharge them. The Means Test prevents abuse by limiting access to Chapter 7 to those genuinely unable to repay their debts. It identifies people who might be trying to defraud the system and directs them toward Chapter 13 bankruptcy, which involves a debt repayment plan. Those who pass the Means Test can file for Chapter 7 bankruptcy and may be able to keep exempt property, like a home or a car, if they are up-to-date on the payments. Once Chapter 7 bankruptcy is granted, certain unsecured debts like credit card debt, medical bills, and personal loans can be discharged, providing the debtor with a "fresh start." The Means Test can be quite complicated, requiring a detailed analysis of the debtor's financial condition. Many find it challenging to understand and navigate without professional help. Certain debtors, especially those with higher incomes or more complicated financial situations, may find it hard to qualify for Chapter 7 bankruptcy due to the Means Test. The Means Test is not perfect and might not accurately represent a debtor's financial situation. It uses the debtor's past six months' income, which might not reflect their current ability to pay. Though this is not a direct result of the Means Test, it's important to mention that filing for bankruptcy has long-term implications on one's credit report, making it harder to obtain credit in the future. A debtor should start by gathering all necessary documents, including proof of income, copies of bills, and a list of living expenses. Detailed financial documentation is crucial in calculating monthly income and expenses accurately. Because of the Means Test's complexity, it's often beneficial to consult with a bankruptcy attorney who can help navigate the process and ensure that all forms are completed accurately. If it appears that the debtor might not pass the Means Test, they might want to consider making financial adjustments, such as reducing non-essential expenses or increasing income, if possible. Many individuals wrongly assume that having an income above the state median automatically disqualifies them from Chapter 7 bankruptcy. However, the Means Test considers more than just income; it also looks at allowed expenses and unsecured debt. There is often confusion about what constitutes 'income' in the Means Test. It includes almost all sources of incoming funds, not just wages from a job. It's a common misconception that all debts are discharged under Chapter 7 bankruptcy. Some debts, such as student loans, most tax debts, and alimony, typically cannot be discharged. Importance of Accurate Record Keeping: Accurate and thorough record keeping can greatly help in calculating monthly income and expenses. Awareness of State-Specific Guidelines: Different states have different median income levels and living expense standards. Debtors should familiarize themselves with these specific figures. Recognizing When to Consider Alternatives to Chapter 7 Bankruptcy: If passing the Means Test seems unlikely, it may be time to consider alternatives, such as Chapter 13 bankruptcy or negotiating directly with creditors. The Chapter 7 Bankruptcy Means Test is a crucial tool in determining whether an individual qualifies for Chapter 7 bankruptcy. It plays a key role in ensuring fairness in the bankruptcy filing process, preventing potential misuse of the system. However, navigating the Means Test can be complex and requires a thorough understanding of one's financial situation. Remember, it's not just about income; the test also considers expenses and unsecured debt. Additionally, not all debts can be discharged under Chapter 7. Accurate record-keeping, awareness of state-specific guidelines, and seeking professional advice can greatly assist in this process. If Chapter 7 bankruptcy isn't a viable option, other alternatives, such as Chapter 13 bankruptcy, should be considered. Ultimately, the Means Test is integral in maintaining the integrity of the bankruptcy system and assisting those genuinely in need of a fresh financial start.Overview of the Chapter 7 Bankruptcy Means Test

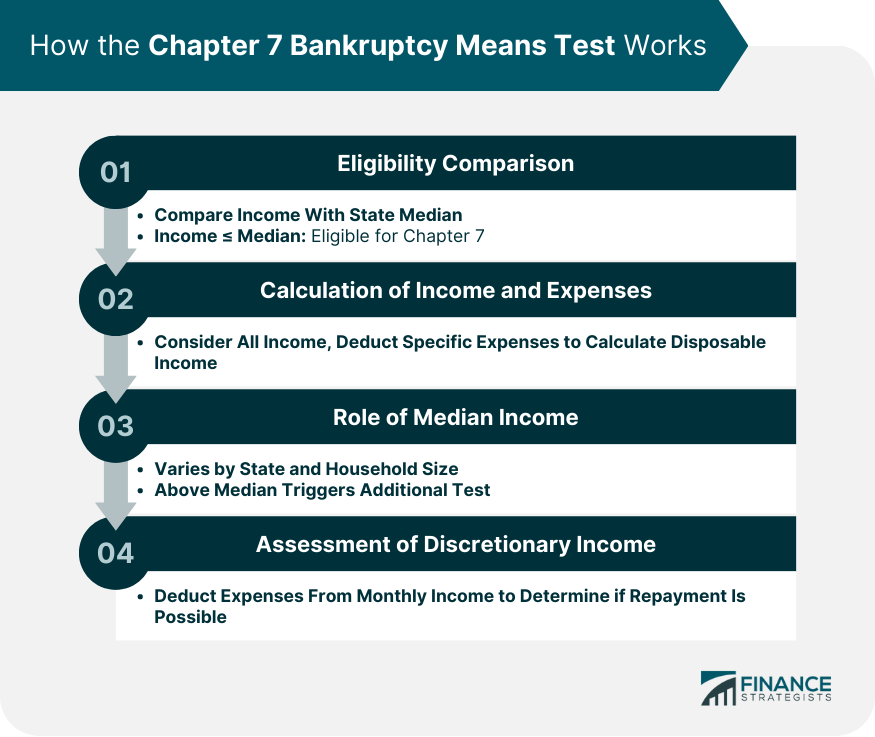

How the Chapter 7 Bankruptcy Means Test Works

Eligibility for Chapter 7 Bankruptcy

Calculation of Monthly Income and Expenses

Role of the Median Income

Assessment of Discretionary Income

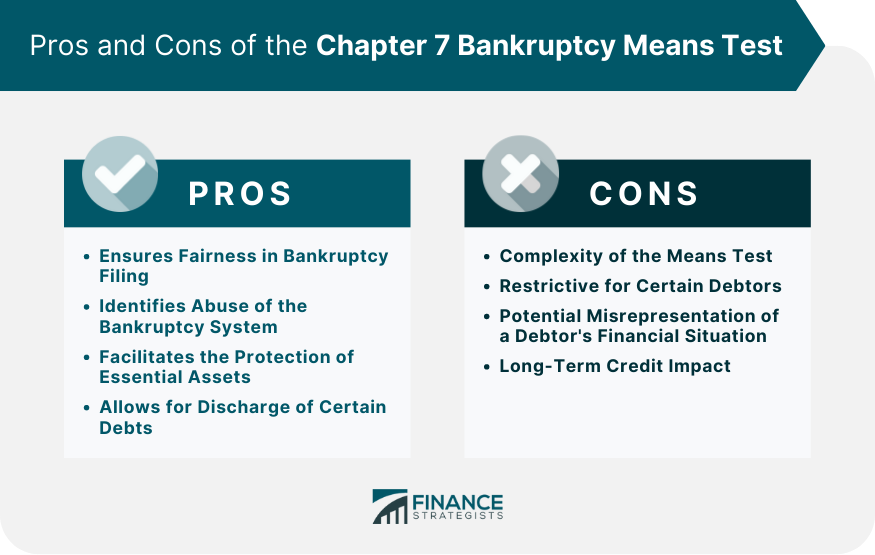

Pros of the Chapter 7 Bankruptcy Means Test

Ensures Fairness in Bankruptcy Filing

Identifies Potential Abuse of Bankruptcy System

Facilitates the Protection of Essential Assets

Allows for Discharge of Certain Debts

Cons of the Chapter 7 Bankruptcy Means Test

Complexity of the Means Test

Restrictive for Certain Debtors

Potential Misrepresentation of a Debtor's Financial Situation

Long-Term Credit Impact

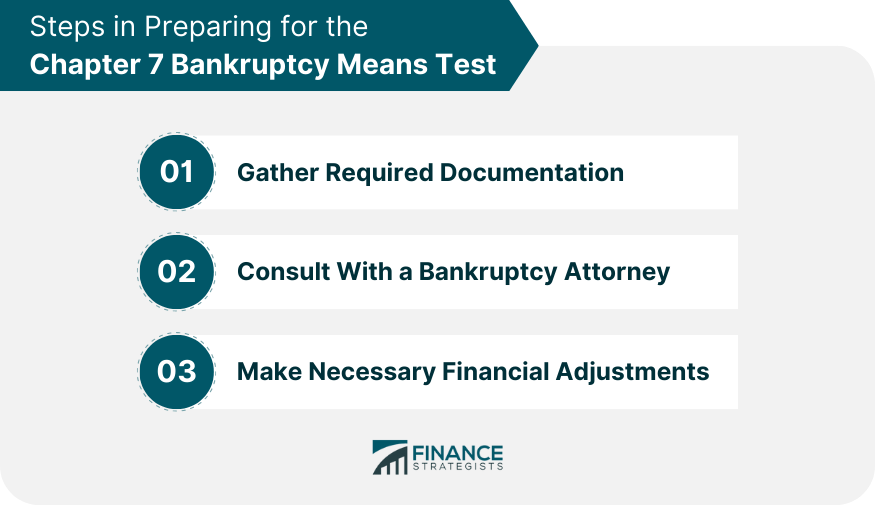

Preparing for the Chapter 7 Bankruptcy Means Test

Gather Required Documentation

Consult With a Bankruptcy Attorney

Make Necessary Financial Adjustments

Common Misconceptions About the Chapter 7 Bankruptcy Means Test

Assumption of Automatic Eligibility or Disqualification

Misunderstanding the Concept of 'Income'

Belief That All Debts Will Be Discharged

Navigation of the Chapter 7 Bankruptcy Means Test: Practical Tips

Bottom Line

Chapter 7 Bankruptcy Means Test FAQs

The Chapter 7 Bankruptcy Means Test is a calculation used to determine whether an individual's income is low enough for them to file for Chapter 7 bankruptcy. It ensures that individuals who can afford to repay their debts do not misuse the bankruptcy system.

Anyone filing for Chapter 7 bankruptcy is required to take the Means Test. However, certain exceptions exist, such as disabled veterans who incurred their debt primarily during active duty or homeland defense activity.

If you fail the Means Test, it suggests that you have enough disposable income to repay some of your debts, and hence, you may not be allowed to file for Chapter 7 bankruptcy. However, you may be eligible to file for Chapter 13 bankruptcy, which involves creating a repayment plan to pay back your debts.

Not all debts can be discharged under Chapter 7 bankruptcy. Certain types of debts, such as alimony, child support, most student loans, some tax debts, and debts for personal injury caused by driving under the influence of alcohol or drugs, typically cannot be discharged.

The Means Test considers almost all sources of income, including wages, salary, tips, bonuses, overtime, commissions, income from the operation of a business, rental income, interest, dividends, pensions, retirement plans, and unemployment compensation, among others. However, certain forms of income, such as Social Security benefits, are not included.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.