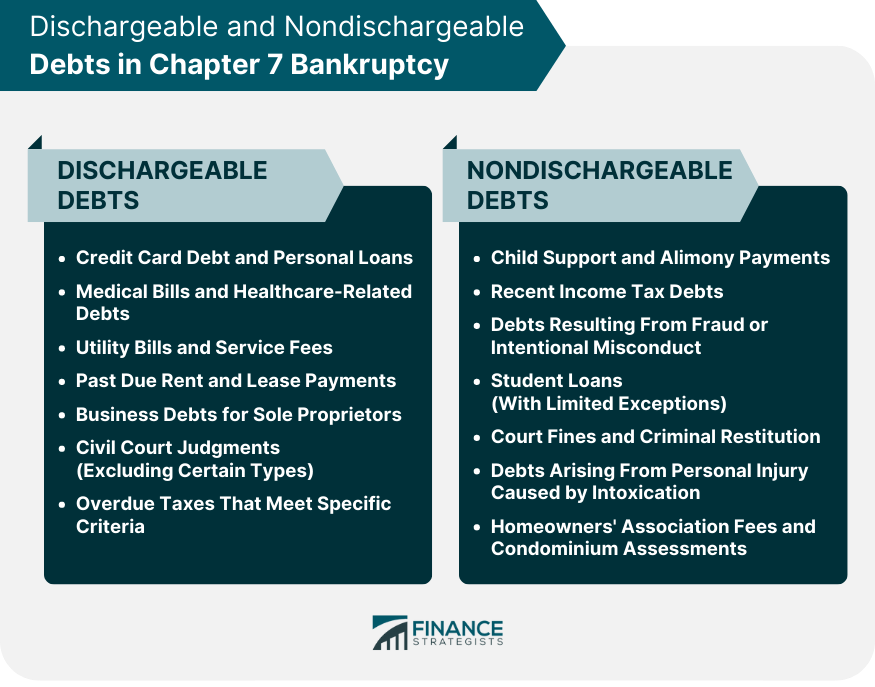

The phrase "debt discharge" represents a pivotal point in a bankruptcy proceeding. It's the much-anticipated moment when an individual, who has declared bankruptcy, is finally released from the obligation to repay certain debts. It refers to the elimination of a debtor's legal responsibility to pay specific types of debts. This provision is an integral component of bankruptcy law, offering a fresh start to individuals who find themselves in overwhelming financial situations. A discharge in bankruptcy means that you will be off the hook for paying the covered debts. Not all debts can be discharged under chapter 7, but many of the most common forms of debt can. Credit card debt and medical bills are dischargeable, for example. The vast majority of debts can be discharged under chapter 7 bankruptcy, including credit card debt, medical debt, and past-due utility bills. Particularly under chapter 7, debtors who have filed for bankruptcy honestly and in good faith can get the majority of their debt erased. Bankruptcy under Chapter 7 is often known as a liquidation bankruptcy. It allows for the discharge of certain types of debts. The following are some categories of debts typically discharged in a Chapter 7 bankruptcy. Credit card debt and personal loans are among the most common types of debts discharged in Chapter 7 bankruptcy. This provision is applicable to both secured and unsecured credit card debts and personal loans. Once these debts are discharged, the debtor is no longer legally obligated to make repayments, offering significant financial relief. Medical emergencies can result in enormous healthcare-related debts that a debtor might not be able to pay off. In Chapter 7 bankruptcy, medical bills, along with other health-related debts, can be discharged. This opportunity allows individuals to move past the financial strain caused by unforeseen health crises. Utility bills and service fees, such as those for electricity, gas, water, and trash removal, can be discharged in a Chapter 7 bankruptcy proceeding. This provision is especially helpful for debtors who have accumulated substantial amounts of unpaid utility bills. Unpaid rent and lease payments are other types of debts that may be discharged under Chapter 7. This alleviates the financial burden for individuals who are unable to meet their housing obligations due to dire financial circumstances. Sole proprietors can find relief from certain business-related debts in Chapter 7 bankruptcy. Such discharge can pave the way for entrepreneurs to rebuild their financial footing without the burden of past business debt. Chapter 7 bankruptcy permits the discharge of some civil court judgments. However, this excludes those related to fraud, willful injury, and certain other misconducts. Although most tax debts are not dischargeable, Chapter 7 allows for the discharge of certain overdue taxes. These include income taxes that are at least three years old, provided certain conditions are met. Some debts that cannot be discharged in chapter 7 bankruptcy are student loans, spousal alimony, child support, debts owed to the government as fines, and debts incurred from intoxicated driving. Besides these, any debts that the court deems fraudulent or in bad faith are unlikely to be discharged. Creditors may object to certain debts being discharged, but the court has the final say. As previously stated, child support and alimony payments are nondischargeable. This rule maintains the welfare of the children and former spouses dependent on these payments. Income taxes for the years immediately preceding the bankruptcy filing are nondischargeable. Debtors are required to pay these taxes even after a Chapter 7 bankruptcy discharge. If a debtor has incurred debts due to fraudulent activity or deliberate misconduct, such debts are nondischargeable. This provision ensures individuals face the financial repercussions of their actions. Student loans are typically nondischargeable, except in rare circumstances of proven undue hardship. The standard for demonstrating undue hardship is high and the exception is rarely granted. Court-imposed fines, penalties, and criminal restitution orders cannot be discharged in bankruptcy. This ensures that financial punishments resulting from criminal activity remain intact. As with the exceptions to dischargeable debts, any debts related to personal injury or death caused by the debtor's intoxication are nondischargeable. Any fees or assessments owed to a homeowners' association or condominium board are not dischargeable in Chapter 7 bankruptcy. These debts must be paid even after a bankruptcy discharge. Your chapter 7 bankruptcy will discharge your debts around 60 days after the 341(a) meeting of creditors. Typically, this means that the court will discharge your debts about four months after you first file. Barring any bad faith claims on your paperwork, chapter 7 cases tend to move quickly. Chapter 7 bankruptcy provides individuals with a fresh start by discharging certain types of debts. This process eliminates the legal obligation to repay specific debts, offering significant financial relief. Common dischargeable debts include credit card debt, personal loans, medical bills, utility bills, past-due rent, and certain business debts for sole proprietors. However, not all debts can be discharged in Chapter 7. Nondischargeable debts include child support, alimony payments, recent income tax debts, debts resulting from fraud or intentional misconduct, student loans (with limited exceptions), court fines, and criminal restitution. It's important to note that the timing of the discharge varies, but it typically occurs approximately four months after filing, following the 341(a) meeting of creditors. Seeking professional advice is crucial in navigating the bankruptcy process and understanding which debts can be discharged.What Is a Debt Discharge?

What Is a Discharged Bankruptcy Chapter 7?

Dischargeable Debts in Chapter 7 Bankruptcy

Credit Card Debt and Personal Loans

Medical Bills and Healthcare-Related Debts

Utility Bills and Service Fees

Past Due Rent and Lease Payments

Business Debts for Sole Proprietors

Civil Court Judgments (Excluding Certain Types)

Overdue Taxes That Meet Specific Criteria

What Cannot Be Discharged in Chapter 7 Bankruptcy?

Child Support and Alimony Payments

Recent Income Tax Debts

Debts Resulting From Fraud or Intentional Misconduct

Student Loans (With Limited Exceptions)

Court Fines and Criminal Restitution

Debts Arising From Personal Injury Caused by Intoxication

Homeowners' Association Fees and Condominium Assessments

When Will My Chapter 7 Bankruptcy Be Discharged?

Conclusion

What Debts Are Discharged in Chapter 7 Bankruptcy? FAQs

In a Chapter 7 bankruptcy, individuals may have their unsecured debt, such as credit card and medical bills, discharged and no longer be liable to repay them. Other types of dischargeable debt include most personal loans and certain taxes that meet certain criteria.

Secured debts, such as mortgage or car loan payments, are not automatically discharged in Chapter 7 bankruptcies and the debtor may still be responsible for repaying them depending on individual circumstances.

Generally, student loans are not dischargeable in Chapter 7 bankruptcy unless the debtor can prove that repayment of the loans would cause undue hardship.

Certain types of taxes may be eligible for discharge if certain criteria are met, such as if the taxes are more than three years old and not related to fraud or failure to file a return.

A Chapter 7 bankruptcy generally stays on your credit report for up to 10 years from the date it is filed. However, this period may vary depending on individual circumstances and other factors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.