The expense of initiating a Chapter 7 bankruptcy in 2023 fluctuates depending on the court and the nature of the case. Effective December 1, 2020, the fundamental filing fee for Chapter 7 bankruptcy stands at $78. Still, some courts might impose additional charges, including a mandatory credit counseling course fee. Besides, attorney fees can significantly augment the bankruptcy cost. On average, hiring an attorney for a Chapter 7 bankruptcy costs around $1,500. Nonetheless, this figure can range from $1000 to $2,500 or even higher, contingent on your case's intricacy and your attorney's expertise. Court fees are a fixed cost in any Chapter 7 bankruptcy case. These fees are mandated by the court and are typically non-negotiable. The court fee for filing Chapter 7 bankruptcy is $78, but there can be additional fees for amendments to schedules or reopening cases. Attorney fees can vary dramatically based on the complexity of the case and the region in which you're filing. An attorney with extensive experience in complex bankruptcy cases may charge more than a less experienced attorney. However, a higher fee might be worthwhile for the higher level of expertise and potential for a more favorable outcome. The miscellaneous costs encompass several expenses, including fees for credit counseling, debtor education courses, and credit report charges. Furthermore, there could also be potential fees for a bankruptcy trustee, particularly if your case involves considerable non-exempt property. The cost of a bankruptcy case can vary depending on its complexity. If the debtor has multiple types of debt, numerous creditors, or a large amount of non-exempt property, this can complicate the case and increase the cost. The cost of living in your area can also affect the cost of bankruptcy. Higher-cost areas often mean higher attorney fees. Furthermore, some courts have higher filing fees than others. Experienced attorneys often charge higher fees than those with less experience. However, hiring an experienced bankruptcy attorney may result in a more favorable outcome and could potentially save money in the long run. Understanding the potential costs of filing for bankruptcy can provide a clearer picture of your financial situation. It allows you to weigh the cost of bankruptcy against the potential benefits. Knowing the potential cost can aid in financial planning. It allows you to allocate resources efficiently and helps in setting realistic expectations. Understanding the cost of bankruptcy helps set realistic expectations about the process. Bankruptcy is not a quick fix, and understanding the costs can help prepare you for the journey. The costs of bankruptcy, especially attorney fees, must often be paid upfront. For many people struggling with debt, this can pose a significant challenge. The cost of bankruptcy can vary widely from case to case. This variability can make it difficult to accurately predict the total cost. There can be additional costs that are not immediately apparent when filing for bankruptcy. For example, the cost of credit counseling, debtor education courses, and possible trustee fees can add to the total cost. Choosing the right attorney is crucial in minimizing the cost of bankruptcy. While it may be tempting to choose the attorney with the lowest fees, it's also important to consider their experience and expertise. Proper planning and organization can also reduce the cost of bankruptcy. Gathering all necessary documents and information before starting the process can help avoid costly errors or delays. Some courts offer fee waivers or installment plans for people who cannot afford the filing fee. Additionally, some attorneys offer payment plans to help clients manage their fees. While it's important to consider the financial costs of bankruptcy, it's equally important to consider the emotional and psychological impact. Bankruptcy can be a stressful and emotionally draining process. The financial ramifications of bankruptcy don't end once your debts are discharged. It can impact your credit score and ability to obtain credit for many years to come. A comprehensive understanding of Chapter 7 bankruptcy costs is crucial. The process entails three primary expenses - court fees, attorney fees, and miscellaneous costs, with the basic court fee set at $78. Attorney fees vary largely, with an average cost of around $1,500, influenced by case complexity and regional costs of living. Numerous factors can affect these costs, including the complexity of the case, geographical location, and the attorney's expertise. Recognizing these costs enables financial transparency, strategic planning, and setting of realistic expectations. Yet, challenges such as high upfront costs and potential hidden costs persist. Minimizing bankruptcy costs can be achieved through careful attorney selection, efficient planning, and exploring waivers or repayment plans. Overview of Chapter 7 Bankruptcy Cost

Calculation of Chapter 7 Bankruptcy Cost

Court Fees

Attorney Fees

Miscellaneous Costs

Factors That May Have an Impact on Chapter 7 Bankruptcy Cost

Complexity of the Case

Geographic Location and Its Influence

Attorney's Expertise and Experience

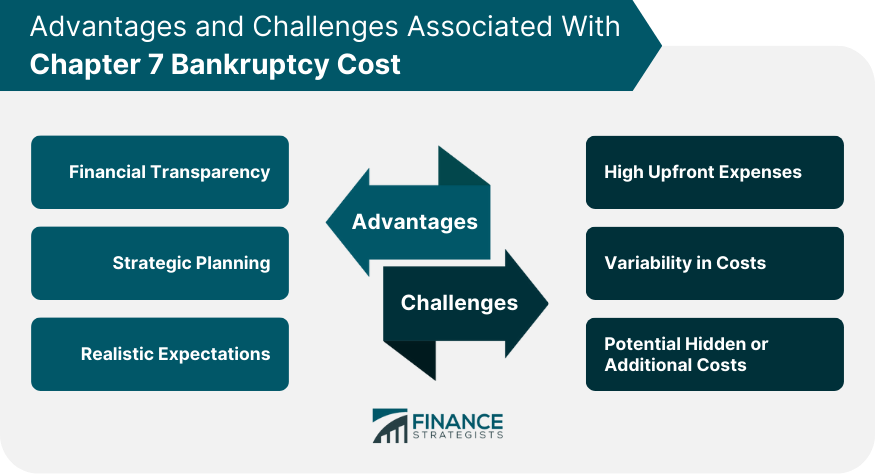

Advantages of Understanding Chapter 7 Bankruptcy Cost

Financial Transparency

Strategic Planning

Realistic Expectations

Challenges Associated With Chapter 7 Bankruptcy Cost

High Upfront Expenses

Variability in Costs

Potential Hidden or Additional Costs

Strategies to Minimize Chapter 7 Bankruptcy Cost

Careful Selection of an Attorney

Efficient Financial Planning and Organization

Exploration of Potential Waivers and Repayment Plans

Assessment of the Comprehensive Impact of Chapter 7 Bankruptcy

Balancing the Financial Cost Against Emotional Cost

Understanding Long-Term Financial Ramifications

Conclusion

Chapter 7 Bankruptcy Cost FAQs

The cost of filing for Chapter 7 bankruptcy includes court fees of $335, attorney fees, and miscellaneous costs. The total cost varies depending on factors such as case complexity, geographic location, and attorney expertise.

Yes, there are strategies to minimize the cost of Chapter 7 bankruptcy. These include selecting the right attorney, efficient financial planning and organization, and exploring potential fee waivers or repayment plans offered by the court.

While Chapter 7 bankruptcy generally has lower upfront costs, determining which option is more cost-effective depends on individual circumstances. Chapter 13 bankruptcy, despite higher initial fees, allows for a repayment plan over several years, which may be more manageable for some individuals.

Yes, besides court and attorney fees, there can be miscellaneous costs such as credit counseling and debtor education course fees, credit report fees, and potential trustee fees. These additional costs should be considered when estimating the total expense of Chapter 7 bankruptcy.

Chapter 7 bankruptcy can impact your credit score and ability to obtain credit for several years. It's essential to understand the long-term consequences and consider the comprehensive impact, including the financial and emotional aspects, before filing for bankruptcy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.