A bankruptcy letter, also known as a bankruptcy notice or filing letter, is a formal document declaring an individual's or company's bankruptcy. It serves to officially notify creditors, the bankruptcy court, and other relevant parties about the debtor's financial insolvency. This letter is usually drafted by the debtor or their legal representative and includes key information such as the type of bankruptcy filed (e.g., Chapter 7 or 13 in the U.S.), the case number, court location, and filing date. Its main function is to trigger legal protections for the debtor, like an automatic stay which temporarily stops most collection actions by creditors. Given the complex nature of bankruptcy and its substantial legal implications, it's advisable for those considering bankruptcy to seek professional legal advice. The bankruptcy letter is primarily for creditors. When an individual or business files for bankruptcy, they're required to list all creditors, including the amount and nature of their debts, in their bankruptcy petition. This letter provides those creditors with formal notice of the bankruptcy filing. A bankruptcy letter should be clear and concise and provide all the necessary information. It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors. Writing a bankruptcy letter requires careful consideration and preparation. It's not simply a matter of informing creditors about the bankruptcy filing; it's also about managing relationships and setting the stage for the future. Before drafting a bankruptcy letter, it's crucial to gather all the necessary information, including the details of the bankruptcy filing and a comprehensive list of all creditors and their contact information. Understanding the nature of each debt will also help tailor the letter to each creditor. 1. Start by including the debtor's name and contact information at the top of the letter. 2. Add the date. 3. Address the letter to the creditor. 4. In the letter's body, state that the debtor has filed for bankruptcy. 5. Provide key details about the bankruptcy filing, such as the type of bankruptcy, the court where it was filed, the date of filing, and the case number. 6. Include information about the bankruptcy trustee and details about the meeting of creditors. 7. In the closing paragraphs, provide guidance to the creditor about their next steps. 8. Express appreciation for the creditor's understanding of the situation. 9. Sign the letter. 10. Enclose any necessary documentation, such as copies of the bankruptcy filing or court notices. After drafting the letter, review it carefully for accuracy and completeness. Ensure all information is correctly stated and the letter addresses all the necessary points. Once satisfied, the debtor or their attorney can send the letter to all listed creditors. A well-structured bankruptcy letter is crucial to the successful management of the bankruptcy process. Below are examples of a personal bankruptcy letter and a business bankruptcy letter. A personal bankruptcy letter typically begins by stating the individual's intent to file for bankruptcy. It then goes on to provide essential details about the bankruptcy filing. A business bankruptcy letter is quite similar, but it should also mention the steps the business is taking to either liquidate or restructure, depending on the type of bankruptcy filed. These letters serve as templates and can be adapted based on individual circumstances. They both include crucial details about the bankruptcy filing and guide creditors on what to do next. It's also noteworthy that both letters maintain a professional and respectful tone, which is essential when dealing with such sensitive matters. Receiving a bankruptcy letter can be alarming, whether you're a creditor, an employee, or another stakeholder. However, understanding the next steps can alleviate some of the concerns. Creditors who receive a bankruptcy letter should first confirm the details of the bankruptcy filing. They should then stop all collection efforts, as an "automatic stay" comes into effect when a debtor files for bankruptcy. Creditors should also file a proof of claim if they wish to receive any distribution from the bankruptcy estate. Employees and other stakeholders should also confirm the details of the bankruptcy filing. If the company is continuing operations, employees should continue to perform their duties unless otherwise instructed. If the company is liquidating, employees may need to seek new employment. The legal implications of receiving a bankruptcy letter are significant. Creditors, employees, and other stakeholders should consult with a legal professional to understand their rights and responsibilities under the Bankruptcy Code. Navigating a bankruptcy case can be complex. Seeking professional help can ensure that all necessary procedures are correctly followed. Bankruptcy law is intricate and varies by jurisdiction. Therefore, it's crucial to seek legal advice when drafting a bankruptcy letter or responding to one. A lawyer can help ensure that the letter includes all necessary information and complies with all legal requirements. Numerous resources and services can assist with bankruptcy proceedings. These include legal aid services, bankruptcy clinics, and pro bono legal services. The American Bar Association and the National Association of Consumer Bankruptcy Attorneys are also useful resources. Bankruptcy letters provide necessary notice of a bankruptcy filing to all relevant parties, such as creditors and employees. These letters outline key details about the bankruptcy case, including type, case number, court, and trustee information. Crafting such letters requires careful preparation, including a comprehensive understanding of one's financial situation, legal implications, and meticulous attention to the information provided. When responding to these letters, it's vital to verify the details and understand your legal rights and responsibilities. Given the complexities involved, it's strongly advised to seek help from a financial advisor or legal professional to navigate this process. This can mitigate potential legal risks, ensure accurate communication of facts, and help maintain relationships where possible, especially in a challenging time such as bankruptcy.What Is the Bankruptcy Letter?

Basics of a Bankruptcy Letter

Who the Letter Is For

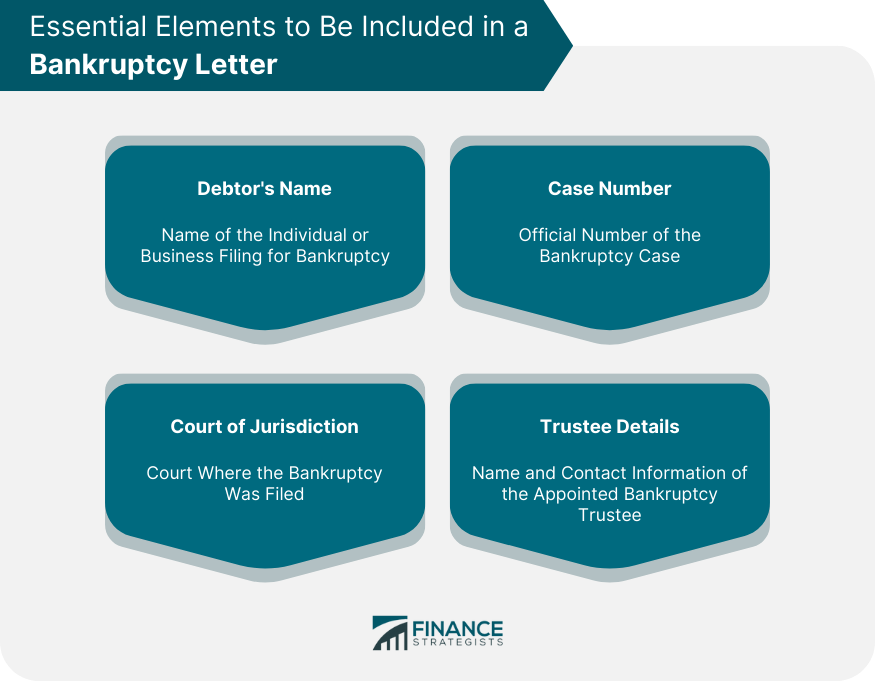

Key Elements to Include in the Letter

Process of Writing a Bankruptcy Letter

Initial Considerations and Preparations

Steps in Writing the Letter

Review and Finalization Process

Bankruptcy Letter: Practical Examples

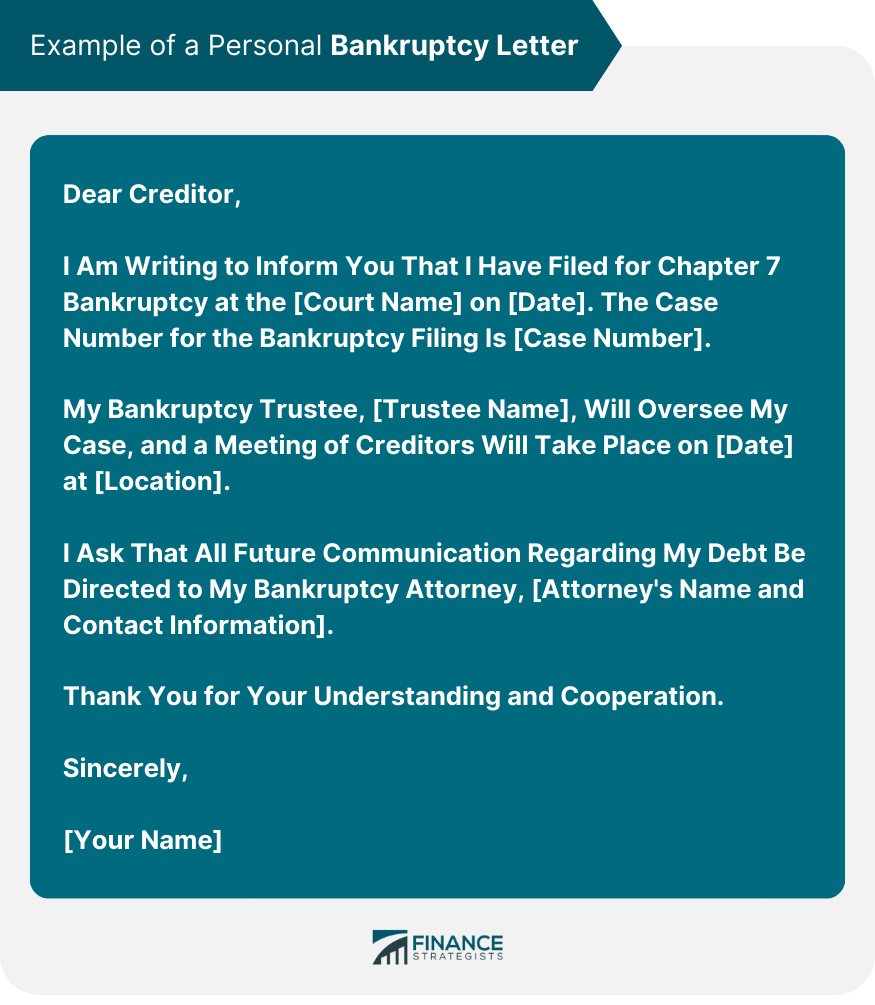

Example of a Personal Bankruptcy Letter

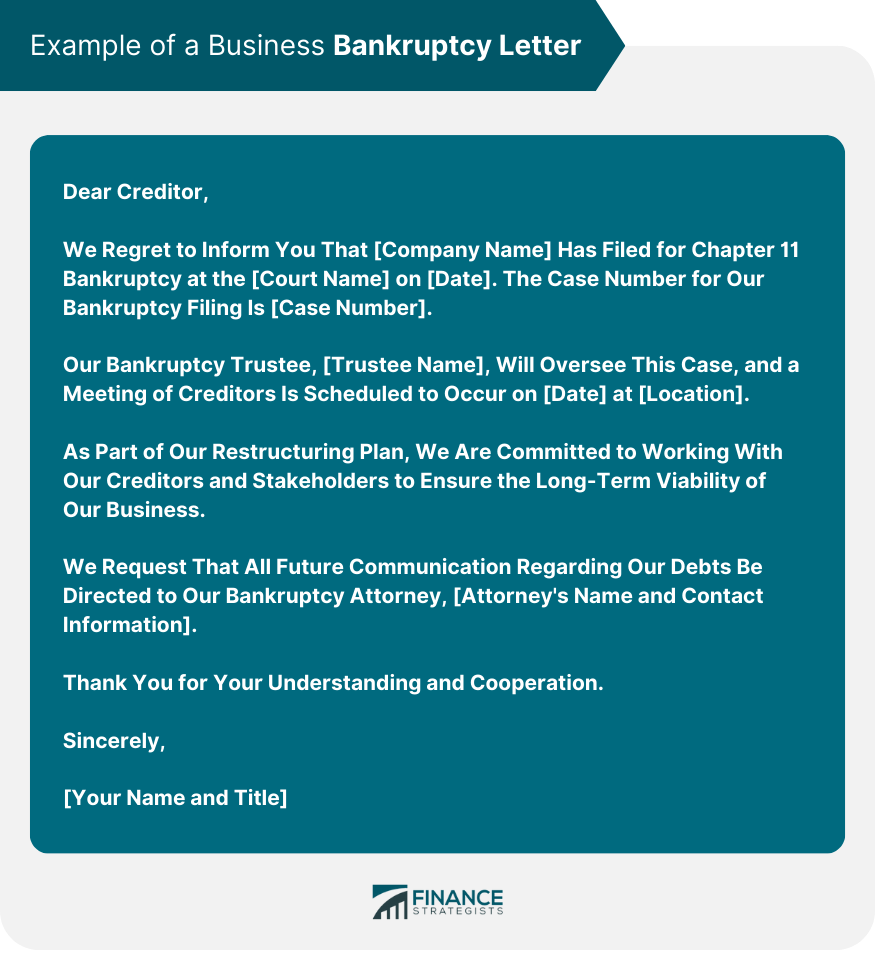

Example of a Business Bankruptcy Letter

How to Respond to a Bankruptcy Letter

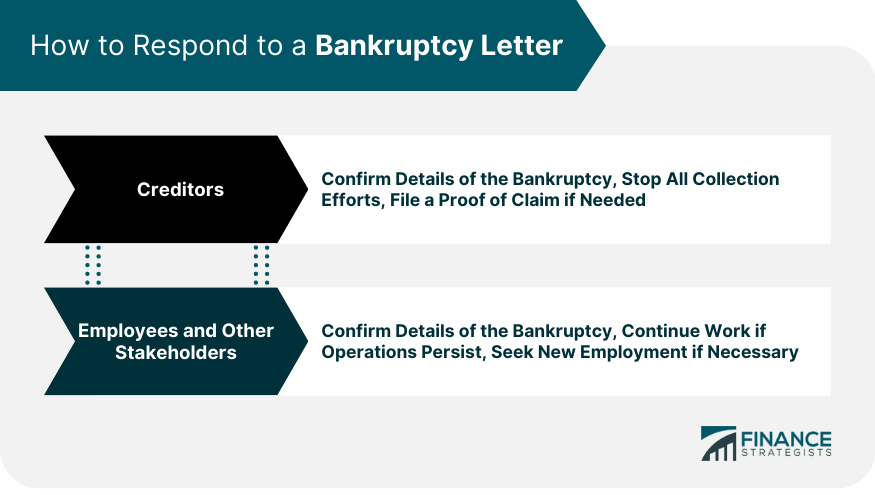

Steps for Creditors

Steps for Employees and Other Stakeholders

Legal Implications

Professional Help and Resources for Bankruptcy Letter

Importance of Seeking Legal Advice

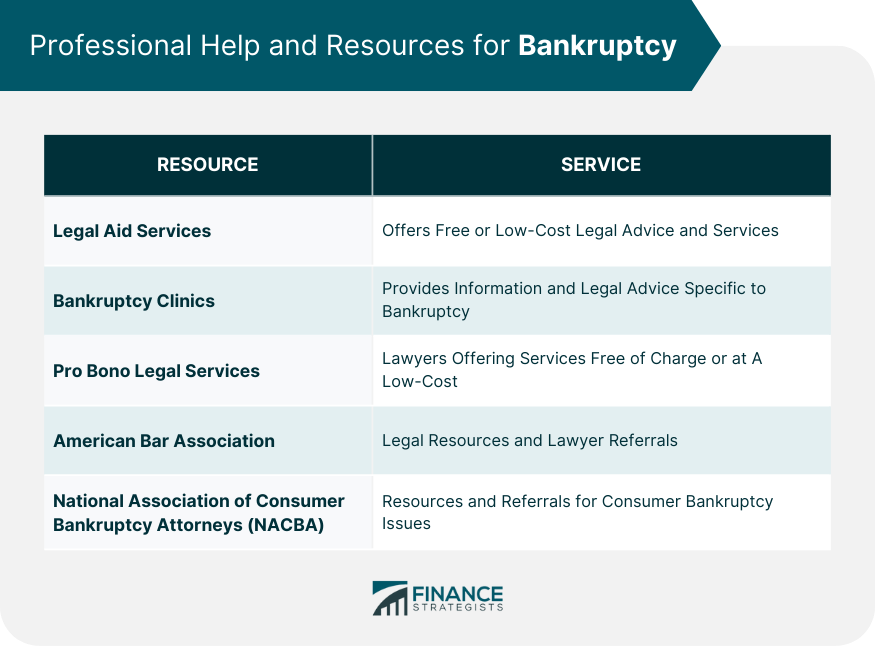

Recommended Resources and Services

Final Thoughts

Bankruptcy Letter FAQs

A bankruptcy letter is a document that provides notice to creditors and other relevant parties about a bankruptcy filing.

The basics of a bankruptcy letter include details about the bankruptcy filing, such as the type of bankruptcy, the court where it was filed, the case number, and information about the bankruptcy trustee.

Writing a bankruptcy letter involves gathering all necessary information, drafting the letter with all pertinent details, and reviewing it for accuracy before sending it to all listed creditors.

One should confirm the details of the bankruptcy filing, understand their legal rights and responsibilities, and may need to file a proof of claim to receive any distribution from the bankruptcy estate.

Given the complexities and legal implications of bankruptcy, seeking professional help ensures that all necessary procedures are correctly followed and can aid in navigating through this process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.