A lien is a legal claim a person or organization has on someone else's property as security for a debt. Putting a lien on someone's property gives you the right to take possession of it if the debt is not paid. Liens offer security, enabling individuals or groups to seize property as a legal means to collect debts and recoup their losses. Once a lien is enforced, the lender may sell the property and deduct the amount owed from the funds generated by the sale. Liens frequently appear in the public record, alerting other parties, including potential creditors, to existing debts. For this reason, liens often discourage property owners from selling or borrowing their assets. Liens can be granted by a property owner as a part of the conditions of obtaining a loan, or they can be imposed by someone making a claim against the owner. For instance, the local government may file a lien when a property owner does not pay real estate taxes. For a creditor, property that has not been liquidated has no value. Thus, they often use their lien to force a sale of the affected assets. Once sold, creditors keep the amount equivalent to the lien’s value and return the excess funds to the borrower. If the borrower decides to sell off the property prematurely, when the loan has not yet been paid in full, they are required to pay the loan balance first before they can keep the proceeds of the sale. This condition addresses the conflict of interest created by a lien since the owner is incentivized not to sell the property. For example, let us say you took out a bank loan of $100,000 to purchase a home valued at $200,000. As collateral, a lien may be placed on your home equivalent to the total value of the loan. If you decide to sell your home for $250,000 without paying off your loan, the bank must first receive its $100,000 loan balance. Then, you get to keep the remaining $150,000. If you default on your payments, the bank might file a lawsuit and obtain a judgment enforcing the lien. Once this happens, the bank has a right to $100,000 of your home’s value. The bank could then force you to sell your home immediately or seize it so that it can sell on its own. From the proceeds of the sale, the bank would retain $100,000 while you would keep any remaining amount. There are three primary types of liens: statutory, consensual, and judgment liens. Statutory liens are not the product of lawsuits. Instead, they result from state or federal laws and do not require consent from the borrower. These types of liens are automatically enforceable when specific circumstances cited in the law occur. Below are some common subtypes of statutory liens: When a property owner does not pay their real estate taxes, special liens called tax liens are placed against the asset. If tax liens are not paid for an extended period of time, the government may order a property sale to collect overdue taxes, interest, and penalties. The IRS could file a Notice of Federal Tax Lien to notify creditors that the government has a legal right to the property. A mechanic's lien can be placed on your property if you employ someone to work on your property but fail to pay them according to the terms of your contract. For example, these liens may be filed by suppliers of materials to a project site. A home-buying lien refers to a legal claim against a home purchased with borrowed money. You have a lien on your home if you have a mortgage. Mortgage loans are secured by liens placed on properties by lenders. If you ever fall behind on your payments, the bank that backed your loan will have a legal claim to your property due to this claim. Consensual liens are ones that a person freely accepts, typically due to a loan. Below are some common subtypes of consensual liens: When a debt is secured by a purchase-money security lien, the creditor gives the debtor credit to buy a specific asset which also serves as security for the debt. A car loan or a home mortgage are typical examples of this lien. Non-purchase-money security liens use the debtor's existing property as security for a loan. A second mortgage on a home is a common example of this lien. Judgment liens are the product of lawsuits and are granted by court proceedings. For example, if you are being sued for damages, which your insurance cannot cover, a judge may place a lien on your property to secure payment for the claimant. Liens have some benefits that protect the interest of creditors or lenders. Liabilities backed by a lien have a reduced risk of default because the creditor has a claim on some of the debtor's assets. If debtors default, creditors can seize the property and sell it to recoup its losses. When someone uses their personal property to secure a loan, the loan agreement contains a lien against that asset. It serves as a means of ensuring payment. The lender is confident that he will still be able to get his money back even if you do not pay back the loan. Courts can use liens to ensure that people pay their debts or damages resulting from lawsuits. If the losing party fails to pay, enforcement mechanisms such as the seizure of property or garnishment may be set into motion. In most cases, anyone owed money has the right to place a lien on the debtor's property to collect the debt. Contractors who do not get paid for their work are the ones who utilize liens most frequently. However, anyone who wins a court ruling that someone owes them money is qualified to file one. Liens, which can be filed against many entities and assets, such as corporations, houses, and automobiles, are utilized across all industries to collect debts. If you are owed money and have tried to reach out to the other party without success, filing a lien may be the next step. Filing a lien is a severe legal move and should only be done as a last resort. Before filing a lien, it is recommended that you try to set up a payment plan or work with a debt collection agency. If you do decide to proceed in filing a lien, follow these steps: The debtor may need to be informed that a lien will be filed if the obligation continues to go unpaid, depending on your state's rules. The clerk of courts can typically provide you with the form that must be filed in some states to give notice. The notice period may be shorter in other states. For example, in some states, before filing a mechanic's lien, a preliminary notice must be given within ten days of beginning work or up to 120 days from the last day. You should speak with a professional lien lawyer to help you through the lien filing procedure if you are uncertain whether you need to file a notice or how many days you must notify the debtor due to the differences in state legislation. If you choose to file a lien, you must follow the deadline imposed by each state. This timeline can range from 60 days to a year, giving creditors enough time to exhaust other means of collection first. You should conduct some research before filing a lien on the property. You will need to perform a title search to confirm the rightful owner and obtain a legal description of the property from the deed. It is vital to remember that this procedure can cost several hundred dollars. If there are already other liens on the property, they will take precedence over your claim, which may prohibit you from collecting the owed amount. Once you have finished the required research, it is time to prepare the lien document. The following details are typically included in a brief one-page lien document: Many states have simple forms to complete, but some also request filing affidavits or other supporting documentation along with the lien. Consult with an expert attorney first to be sure you have all the paperwork you need to file a lien in your state and that your lien document is comprehensive. Depending on your state, you must file the lien with the clerk of court or the property recorder's office. A lien on a piece of property must be filed in the county where the property is situated. The average filing fee in most jurisdictions is between $25 to $50. The debtor will be served with a copy of the lien after it is filed to inform them that the creditors have legal rights to the property. The debtor has a right to know that the creditor may take action to collect the debt, including foreclosing on the property. You may speak to a lien lawyer to find out more about who should be served with a copy of the lien and how to do so. If the obligation is not paid after the lien is issued, you can enforce the lien by bringing a foreclosure action against the property owner. The property will have to be sold, and the money raised will be used to pay off the debt. The amount of time you have to file a foreclosure case varies, but most states give you a year. Your lien expires and loses value if you do not file a lawsuit before the enforcement period is finished. The process of filing a foreclosure lawsuit can be complicated and time-consuming. It is advised that you speak with a lawyer to ensure all deadlines are met, the lawsuit is correctly filed, and you are given the money you are owed. Getting a lien off your property might take a long time and be challenging. However, there are a few options you may take: If you pay the debt that the lien is for, the creditor must file a satisfaction of lien with the court. This document proves that the debt has been paid, and the lien is no longer valid. If you believe that the lien was filed wrongfully or is otherwise invalid, you can go to court and ask a judge to have the lien removed. However, you may be required to present proof that the lien was obtained through coercion, fraud, bad faith, or other illegal means. Sometimes, the lender may be willing to work with you to remove the lien. For instance, they may agree to release the lien if you sell the property or refinance your mortgage. You can also try to negotiate a repayment plan that would allow you to pay off the debt over time. You can declare bankruptcy to get the lien released. This option may occasionally only be enforceable for a certain period of time and is only open to particular liens, such as judicial liens. The duration of a lien's validity and the time a creditor has to file a lawsuit after the debtor defaults are subject to state laws. The lien might be removed and regarded as unenforceable once this amount of time has passed. A lien allows creditors to collect from debtors by using their assets as collateral. Liens are most commonly filed against homes or cars. A lienholder may take possession of the property if the debtor does not pay the debt. Filing a lien is a legal process that requires the creditor to notify the debtor and file the lien with the property recorder's office or the clerk of court. The creditor can enforce the lien through a foreclosure lawsuit if the debtor does not pay the debt. A debtor may choose between several ways to get rid of a lien, including paying the debt in full, negotiating with the lender, or declaring bankruptcy.What Is a Lien?

How Do Liens Work?

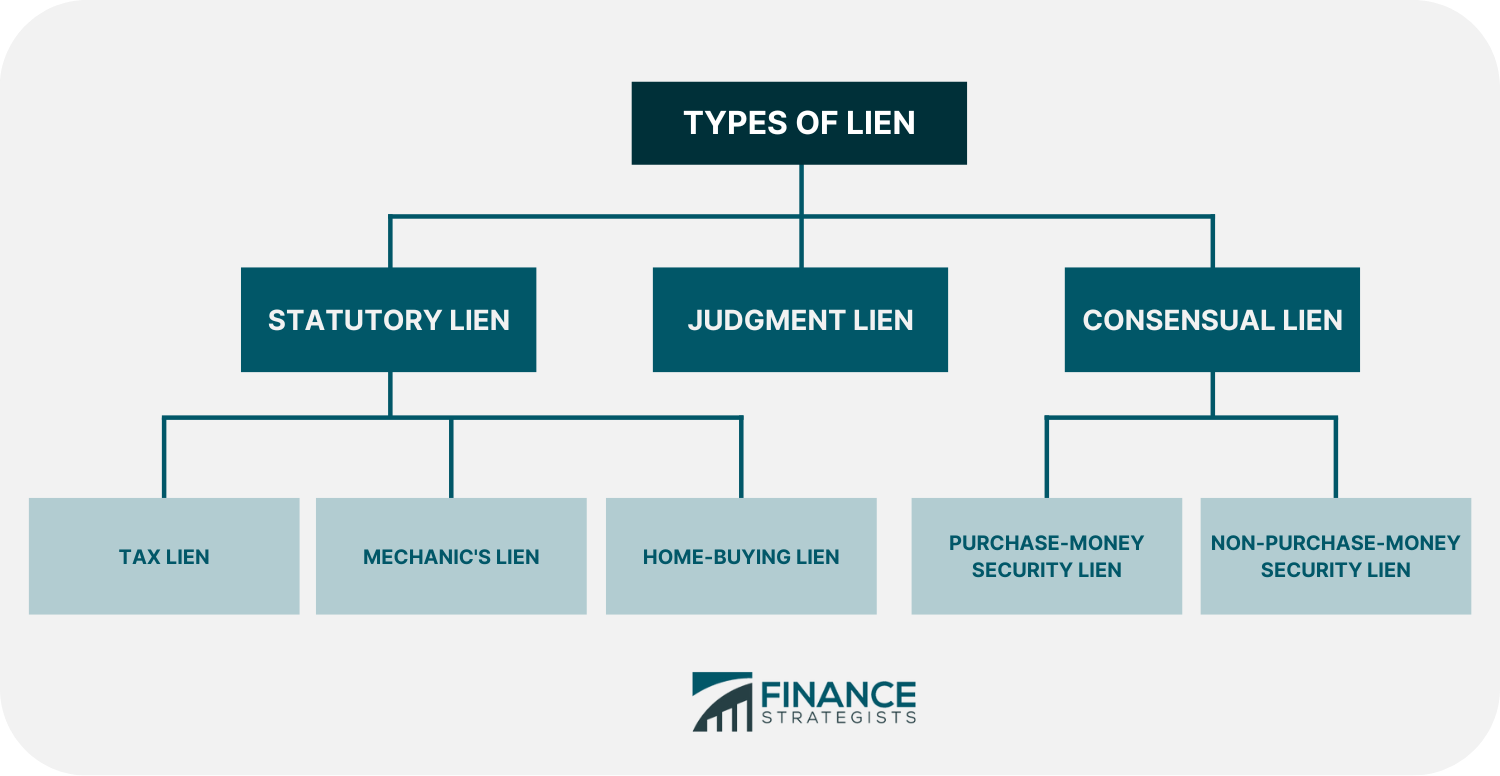

Types of Liens

Statutory

Consensual

Judgment

Importance of Liens

Shield Against Default Risk

Loan Security

Enforcement of Judgments

How to File Liens

Step 1: File a Preliminary Notice

Step 2: Review and Adhere to Deadlines

Step 3: Conduct a Title Search

Step 4: Draft a Lien

Step 5: File the Lien

Step 6: Notify All Parties

Step 7: Enforcement of the Lien

Getting Rid of Liens

Pay the Debt in Full

Acquire a Court Order to Remove the Lien

Negotiate With the Lender

File for Bankruptcy

Wait for the Statute of Limitations to Expire

The Bottom Line

Lien FAQs

Statutory and judgment liens affect your credit score and make it more difficult for you to get financing in the future. However, repaid consensual liens have no adverse effects on your credit.

A levy takes the property to pay off the tax debt, whereas a lien is a formal claim made against your property to satisfy the tax debt.

Liens are legal claims made on an asset, such as real estate or a car. Most frequently, a lien is utilized as collateral for debt repayment.

Liens are legal instruments used to safeguard the interests of creditors and other parties owed money by property owners.

A mortgage or home-buying lien is the most common type, giving the bank financing the money an initial claim to the property. The property is used as collateral for the future repayment of the loan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.