An offshore mutual fund is a type of investment fund that is registered and operated outside of the investor's home country. These funds are established in jurisdictions that offer favorable tax laws and regulations, making them attractive to investors seeking to reduce their tax liability and diversify their portfolio globally. Offshore mutual funds may be managed by domestic or international investment management firms and may invest in a range of assets, including stocks, bonds, commodities, and real estate. These funds may also specialize in specific sectors, such as technology or healthcare, or geographic regions, such as emerging markets. 1. Equity Funds: These funds primarily invest in the shares of companies listed on stock exchanges across the globe. They offer long-term capital appreciation and may generate dividends for investors. 2. Fixed-Income Funds: These funds invest in debt instruments such as government and corporate bonds, aiming to provide a stable income stream with lower volatility compared to equity funds. 3. Money Market Funds: These funds invest in short-term, high-quality debt instruments and offer lower risk and lower returns than other types of offshore mutual funds. They are an ideal choice for conservative investors seeking capital preservation. 4. Balanced Funds: Also known as hybrid funds, balanced funds invest in a mix of equities, fixed-income securities, and cash, aiming to provide a balance between capital appreciation and income generation. 5. Index Funds: These funds replicate the performance of a specific market index by investing in the same securities as the index, offering a cost-effective and passive approach to investing. 6. Specialty Funds: Specialty funds focus on specific sectors, industries, or themes, such as technology, healthcare, or emerging markets. They offer targeted exposure to areas with high growth potential but can carry higher risks due to their concentrated nature. 1. Unit Trusts: A unit trust is a pooled investment vehicle where investors' funds are combined and managed by a professional fund manager. The trust issues units to investors, representing their share in the trust's assets. 2. Open-Ended Investment Companies (OEICs): An OEIC is a type of investment fund incorporated as a company, allowing investors to buy and sell shares directly from the fund. OEICs offer more flexibility in terms of investment strategies compared to unit trusts. 3. Société d'Investissement à Capital Variable (SICAVs): A SICAV is an open-ended investment company based in European countries, particularly Luxembourg and Switzerland. Similar to OEICs, SICAVs issue shares to investors and offer a range of investment strategies. 4. Limited Partnerships: Limited partnerships are a legal structure where investors act as limited partners, contributing capital but not participating in the management of the fund. The general partner manages the fund and assumes unlimited liability for its debts and obligations. 1. Popular Offshore Financial Centers: Some of the most popular offshore financial centers for mutual funds include the Cayman Islands, Bermuda, Luxembourg, and Ireland. These jurisdictions offer favorable tax regimes, well-established legal systems, and robust regulatory frameworks. 2. Regulatory Environment: The regulatory environment in offshore financial centers is designed to maintain high standards of investor protection while offering flexibility to fund managers. Regulations typically include licensing requirements, periodic reporting, and the appointment of independent auditors and custodians. 1. Lower Tax Rates: Offshore mutual funds are often domiciled in jurisdictions with low or zero tax rates on investment income and capital gains, reducing the overall tax burden for investors. 2. Tax Deferral: In some cases, investors can defer taxation on their investment gains until they repatriate the funds to their home country, allowing for tax-efficient reinvestment and compounding of returns. 3. No Capital Gains Tax: Many offshore jurisdictions do not impose capital gains tax on investments held within mutual funds, providing a significant tax advantage for investors seeking long-term capital appreciation. Investing in offshore mutual funds allows investors to diversify their portfolios across different countries, sectors, and asset classes. This diversification can help reduce the overall risk of the portfolio and potentially enhance returns by gaining exposure to high-growth markets or undervalued assets. Offshore mutual funds provide investors with access to global investment opportunities that may not be available through domestic investment options. These funds can invest in a broad range of assets, including international equities, bonds, and alternative investments, offering potential for higher returns and unique investment strategies. By investing in offshore mutual funds denominated in different currencies, investors can diversify their currency exposure and potentially benefit from currency appreciation or reduce the impact of adverse currency fluctuations on their portfolios. Offshore jurisdictions often provide a higher degree of confidentiality and privacy for investors, due to strict banking secrecy laws and limited information sharing agreements with other countries. This can be an important consideration for high-net-worth individuals seeking to protect their assets and maintain privacy. Offshore mutual funds may be subject to different regulatory regimes than domestic funds, and this can create regulatory risks for investors. For example, some offshore jurisdictions may have less stringent investor protection measures or may not enforce regulations as rigorously as more developed financial centers. Investing in offshore mutual funds can expose investors to political risks, such as changes in government policies or political instability in the fund's domicile or the countries where the fund invests. These risks can potentially impact the fund's performance and the safety of investors' assets. Investing in offshore mutual funds denominated in foreign currencies exposes investors to currency risk, as fluctuations in exchange rates can impact the value of their investments. This risk can be mitigated through currency hedging strategies or by investing in funds that hold assets in multiple currencies. Offshore mutual funds may face operational risks related to the management of the fund, including errors in valuation, trading, or settlement of securities. These risks can be exacerbated if the fund operates in multiple jurisdictions or invests in less liquid or more complex assets. Liquidity risk is when some offshore mutual funds may invest in less liquid or more volatile assets, which can make it more difficult for the fund to meet redemption requests in a timely manner. This can potentially result in a suspension of redemptions or a forced sale of assets at unfavorable prices. Investors in offshore mutual funds may have limited access to investor protection schemes, such as compensation funds or deposit insurance, which are available in some domestic markets. This can increase the risk of loss in the event of a fund's insolvency or fraud. Before investing in an offshore mutual fund, investors should carefully consider their investment objectives, risk tolerance, and time horizon. This will help ensure that the selected fund aligns with their overall financial goals and risk appetite. Investors should research the fund manager's experience, qualifications, and track record in managing similar funds. A reputable fund manager with a proven track record can help instill confidence in the fund's ability to achieve its investment objectives. Evaluating the historical performance of an offshore mutual fund can provide insights into its risk-return profile and potential to achieve the desired investment outcomes. Investors should compare the fund's performance against relevant benchmarks and peer funds to assess its relative performance and consistency over time. Investors should carefully examine the fees and expenses associated with investing in offshore mutual funds, including management fees, administration fees, and transaction costs. High fees can significantly impact the net returns of the fund, particularly over the long term. Understanding the tax implications of investing in offshore mutual funds is crucial for investors to ensure they are making tax-efficient investment decisions. Investors should consider consulting with a tax professional to understand the specific tax consequences of their offshore investments. Investors can invest directly in offshore mutual funds by opening an account with the fund management company and purchasing shares or units of the fund. Online investment platforms allow investors to access a wide range of offshore mutual funds through a single account. These platforms typically provide research tools, investment analysis, and portfolio management features to help investors make informed investment decisions. Investors can also invest in offshore mutual funds through brokerage firms that offer access to international markets and investment products. These firms may provide research, advice, and trading support to help investors navigate the complexities of offshore investing. Working with a financial advisor who has experience in offshore investments can be valuable for investors seeking guidance on selecting and managing their offshore mutual fund investments. Financial advisors can provide personalized advice based on the investor's specific goals, risk tolerance, and tax situation. Offshore mutual funds are subject to KYC and AML regulations to prevent financial crimes and ensure the integrity of the financial system. Investors will typically be required to provide proof of identity, address, and source of funds when opening an account with an offshore mutual fund. US investors in offshore mutual funds must be aware of the FATCA regulations, which require US citizens and tax residents to report their foreign financial assets, including mutual fund investments, to the Internal Revenue Service (IRS). The CRS is a global standard for the automatic exchange of financial account information between countries to combat tax evasion. Investors in offshore mutual funds should be aware of the reporting requirements under CRS and ensure they comply with their home country's tax regulations. Investing in offshore mutual funds offers several benefits, including tax advantages, portfolio diversification, access to global markets, currency diversification, and enhanced privacy. However, these benefits come with certain risks and challenges, such as regulatory risk, political risk, currency risk, operational risk, liquidity risk, and limited investor protection. Before investing in offshore mutual funds, investors should carefully consider their investment objectives, risk tolerance, and the specific characteristics of the fund. They should also conduct thorough due diligence on the fund manager, legal structure, domicile, and regulatory environment. Seeking professional advice from a financial advisor or tax professional can be invaluable in navigating the complexities of offshore investing and ensuring a successful investment experience.What Is an Offshore Mutual Fund?

Structure of Offshore Mutual Funds

Types of Offshore Mutual Funds

Legal Structures

Domicile and Jurisdiction

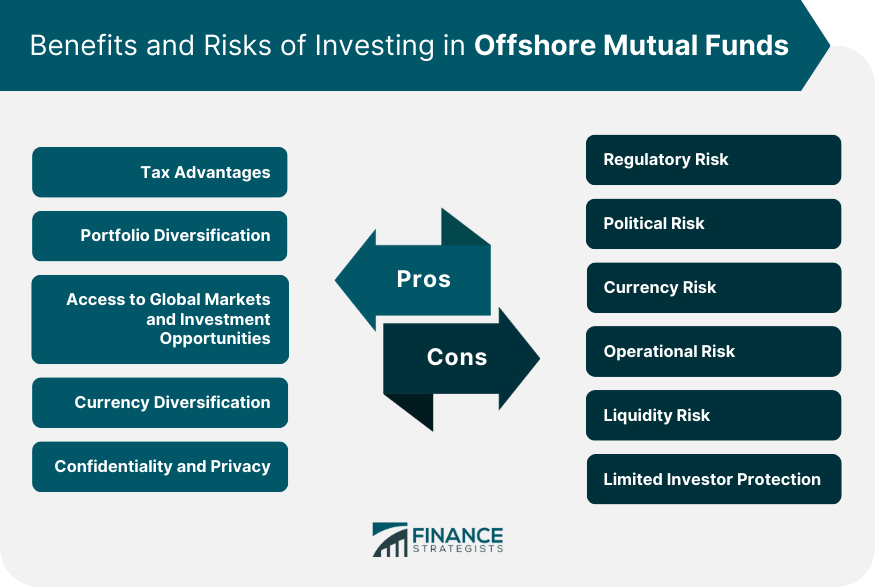

Benefits of Investing in Offshore Mutual Funds

Tax Advantages

Portfolio Diversification

Access to Global Markets and Investment Opportunities

Currency Diversification

Confidentiality and Privacy

Risks and Challenges of Offshore Mutual Funds

Regulatory Risk

Political Risk

Currency Risk

Operational Risk

Liquidity Risk

Limited Investor Protection

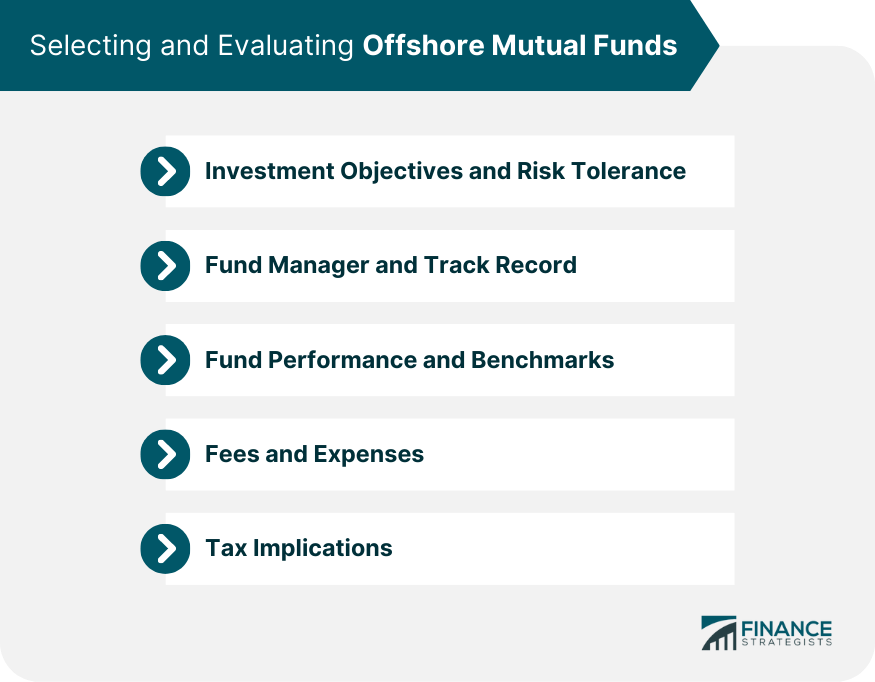

Selecting and Evaluating Offshore Mutual Funds

Investment Objectives and Risk Tolerance

Fund Manager and Track Record

Fund Performance and Benchmarks

Fees and Expenses

Tax Implications

How to Invest in Offshore Mutual Funds

Direct Investment

Investment Platforms

Brokerage Firms

Financial Advisors

Regulatory and Compliance Considerations for Offshore Mutual Funds

Know Your Customer (KYC) and Anti-money Laundering (AML) Regulations

Foreign Account Tax Compliance Act (FATCA)

Common Reporting Standard (CRS)

Conclusion

Offshore Mutual Fund FAQs

An offshore mutual fund is a type of investment fund that is based outside the investor's home country, often in a tax haven or low-tax jurisdiction.

Investing in an offshore mutual fund can provide several benefits, such as lower taxes, diversification, and access to international markets and investment opportunities that may not be available in the investor's home country.

Offshore mutual funds are typically regulated by the financial regulatory authorities in the country where they are based. Investors should research the regulatory requirements and reputation of the fund manager and service providers before investing.

No, offshore mutual funds are available to any investor who meets the minimum investment requirements set by the fund manager. However, some offshore mutual funds may have higher minimum investment requirements than funds based in the investor's home country.

Offshore mutual funds can be risky, as with any investment. However, investing in an offshore mutual fund does not necessarily mean it is riskier than investing in a domestic mutual fund. Investors should carefully evaluate the risks and potential returns before investing in any mutual fund.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.