Know Your Customer (KYC) refers to the process financial institutions and other regulated entities follow to verify the identity of their customers, assess their risk profile, and monitor their transactions. This process helps ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. KYC is crucial for preventing financial crime, such as money laundering, terrorist financing, and tax evasion.It enables financial institutions to understand their customers better, manage risks effectively, and maintain a sound financial system. Furthermore, KYC compliance is essential for avoiding regulatory penalties and reputational damage. The Financial Action Task Force (FATF), an intergovernmental body, sets the global standards for combating money laundering and terrorist financing. These standards include KYC requirements that financial institutions must follow. National regulators then enforce these standards and issue specific guidelines for compliance in their respective jurisdictions. Personal identification documents include government-issued identification, such as passports, driver's licenses, and national identity cards. These documents are used to verify the customer's identity, including their name, date of birth, nationality, and photograph. Corporate identification documents include articles of incorporation, business registration certificates, and tax identification numbers. These documents are used to establish the legal existence and ownership structure of a corporate customer. Financial institutions must understand the purpose and nature of the business relationship with their customers. This includes determining the types of products and services the customer is interested in, the expected transaction volume, and the reasons for establishing the relationship. Financial institutions must verify the source of funds used by customers for transactions. This helps ensure that the funds are legitimate and not derived from illicit activities, such as money laundering or terrorist financing. Politically exposed persons (PEPs) are individuals who hold prominent public positions, either domestically or internationally, and may be at a higher risk for corruption. Financial institutions must conduct EDD for PEPs, including obtaining senior management approval and scrutinizing their transactions more closely. Financial institutions must apply EDD measures to customers from high-risk jurisdictions, as identified by the FATF or national regulators. These customers may pose a higher risk of money laundering or terrorist financing due to weak regulatory environments or high levels of criminal activity in their home countries. Customers exhibiting unusual transaction patterns or activities that are inconsistent with their risk profile may require EDD. This includes investigating the reasons for such transactions and, if necessary, filing suspicious activity reports (SARs) with the relevant authorities. During the account opening process, financial institutions must collect KYC information from their customers. This includes obtaining personal or corporate identification documents, as well as information about the customer's business activities, anticipated transaction volumes, and source of funds. Financial institutions must verify the customer's identity using reliable, independent sources. This may involve checking the customer's identification documents against government databases or using third-party verification services. Transaction monitoring involves scrutinizing customer transactions to detect unusual patterns or activities that may indicate money laundering, terrorist financing, or other financial crimes. Financial institutions must have systems in place to identify and flag such transactions for further investigation. Financial institutions must conduct periodic reviews of their customers' KYC information to ensure its accuracy and completeness. These reviews should be conducted at regular intervals, with the frequency determined by the customer's risk profile. Financial institutions must retain KYC documentation and transaction records for a specified period, typically five to ten years, depending on jurisdictional requirements. This ensures that the necessary information is available for regulatory inspections and law enforcement investigations. Financial institutions are required to report suspicious activities or transactions to the relevant authorities, such as Financial Intelligence Units (FIUs). These reports, known as Suspicious Activity Reports (SARs), help authorities detect and investigate financial crimes. Digital identity verification solutions enable financial institutions to verify customer identities using advanced technologies, such as biometrics, facial recognition, and document authentication. These solutions can streamline the KYC process, improve customer experience, and reduce the risk of identity fraud. Artificial intelligence (AI) and machine learning (ML) can enhance the efficiency and effectiveness of KYC processes by automating data analysis, risk assessment, and transaction monitoring. These technologies can identify patterns and anomalies that may indicate financial crime, enabling financial institutions to focus their resources on high-risk customers and activities. Blockchain technology has the potential to revolutionize KYC by providing a secure, decentralized platform for storing and sharing customer information. This can reduce duplication of efforts, enhance data security, and improve the overall efficiency of the KYC process. While technology offers significant benefits for KYC, it also presents challenges, such as data privacy concerns, regulatory compliance, and the need for collaboration between different stakeholders. Financial institutions must strike a balance between leveraging technology to improve KYC processes and addressing these challenges. Financial institutions face various challenges in maintaining effective KYC programs, such as evolving regulatory requirements, resource constraints, and the growing complexity of global financial networks. To address these challenges, institutions must invest in technology, employee training, and robust compliance processes. Non-compliance with KYC regulations can result in severe penalties and sanctions, including fines, restrictions on business activities, and damage to an institution's reputation. Financial institutions must take KYC compliance seriously to avoid these consequences and protect their customers and the broader financial system. A risk-based approach to KYC enables financial institutions to allocate resources effectively by focusing on higher-risk customers and activities. This approach ensures that institutions can manage their compliance obligations efficiently while maintaining a strong focus on mitigating financial crime risks. KYC plays a vital role in combating financial crime, protecting the integrity of the global financial system, and ensuring compliance with AML and CTF regulations. Financial institutions must prioritize their KYC efforts to mitigate the risk of financial crimes and maintain the trust of their customers, regulators, and society at large. As financial crime threats and regulatory requirements continue to evolve, financial institutions must continually improve and adapt their KYC practices. This includes investing in technology, employee training, and robust compliance processes, as well as collaborating with regulators and industry peers to share best practices and insights. Consumers and businesses should seek banking services from financial institutions that demonstrate a strong commitment to KYC compliance and the fight against financial crime. By doing so, they can help ensure the safety and stability of their own financial activities and contribute to a more secure and transparent global financial system.What Is Know Your Customer (KYC)?

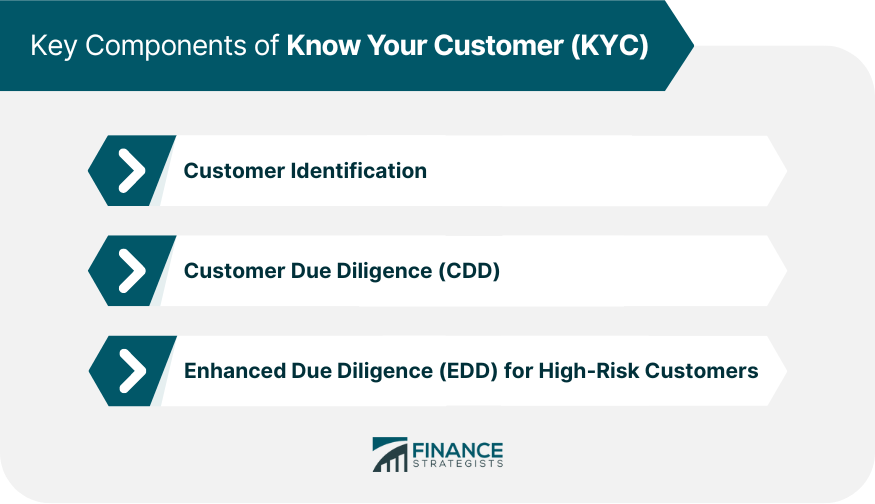

Key Components of KYC

Customer Identification

Personal Identification Documents

Corporate Identification Documents

Customer Due Diligence (CDD)

Purpose and Nature of the Business Relationship

Source of Funds

Enhanced Due Diligence (EDD) for High-Risk Customers

Politically Exposed Persons (PEPs)

Customers from High-Risk Jurisdictions

Customers with Unusual Transaction Patterns

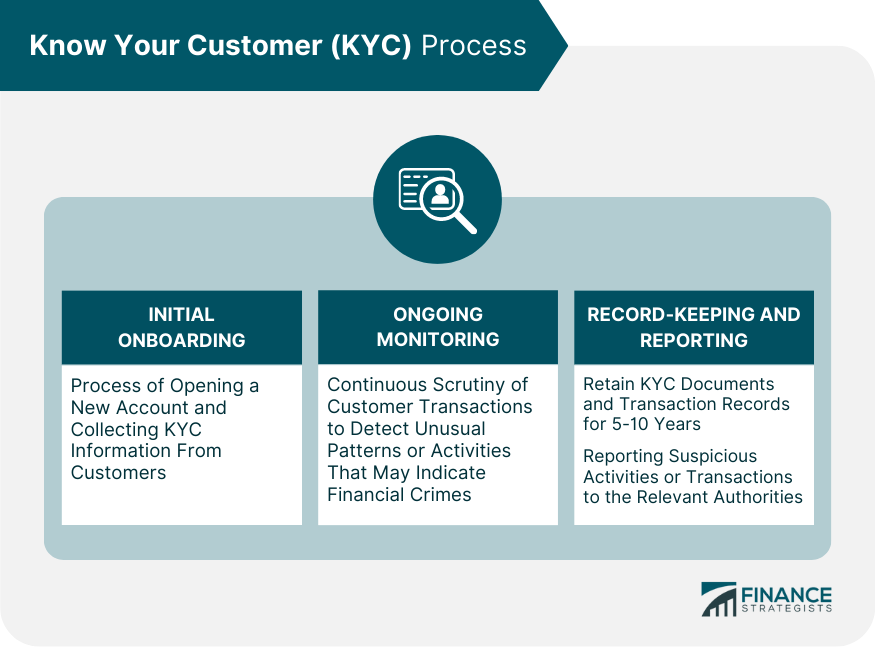

KYC Process and Procedures

Initial Onboarding

Account Opening

Customer Verification

Ongoing Monitoring

Transaction Monitoring

Periodic Reviews

Record-Keeping and Reporting

Documentation Retention

Reporting Suspicious Activity

Technology and KYC

Digital Identity Verification

Artificial Intelligence and Machine Learning in KYC

Blockchain-Based KYC Solutions

Challenges and Opportunities in Leveraging Technology for KYC

Compliance Challenges and Penalties for KYC

Challenges in Maintaining Effective KYC Programs

Penalties and Sanctions for Non-Compliance

Importance of a Risk-Based Approach to KYC

Final Thoughts

Know Your Customer (KYC) FAQs

Know Your Customer (KYC) is the process financial institutions follow to verify their customers' identities, assess risk profiles, and monitor transactions. KYC is crucial for preventing financial crime, such as money laundering and terrorist financing, and ensuring compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

The key components of a KYC process include customer identification, customer due diligence (CDD), and enhanced due diligence (EDD) for high-risk customers. Customer identification involves verifying personal or corporate identification documents, while CDD and EDD involve assessing the risk profiles of customers and applying appropriate measures based on their risk levels.

Financial institutions implement KYC procedures through initial onboarding, ongoing monitoring, and record-keeping and reporting. During onboarding, they collect and verify customer information. Ongoing monitoring involves scrutinizing customer transactions and conducting periodic reviews of customer information. Record-keeping and reporting involve retaining documentation and reporting suspicious activities to relevant authorities.

Technology is transforming KYC processes by enabling digital identity verification, the use of artificial intelligence (AI) and machine learning (ML) for data analysis and risk assessment, and the implementation of blockchain-based KYC solutions. These technological advancements can streamline KYC processes, improve accuracy and efficiency, and enhance the overall effectiveness of AML and CTF efforts.

Compliance challenges with KYC regulations include evolving regulatory requirements, resource constraints, and the growing complexity of global financial networks. Non-compliance can result in severe penalties, such as fines, restrictions on business activities, and reputational damage. Financial institutions must invest in technology, employee training, and robust compliance processes to maintain effective KYC programs and mitigate risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.