Market indices are statistical measures that represent the performance of a group of stocks, allowing investors to gauge the overall movement and health of a specific market or industry. They provide a snapshot of the collective performance of the underlying stocks, usually through a numerical value or percentage change. Market indices serve as reference points and enable investors to compare the performance of their portfolios to the broader market. By monitoring market indices, investors can gain insights into the overall direction and sentiment of the market. Market indices hold immense importance in the world of investing for several reasons. Firstly, they provide a way to assess the performance of a specific market or industry, allowing investors to make informed decisions based on trends and patterns. Additionally, market indices serve as benchmarks against which investment managers and mutual funds evaluate their own performance. By comparing their returns to the performance of relevant market indices, investors can determine whether their investments are outperforming or underperforming the broader market. Furthermore, market indices act as indicators of market sentiment and can help investors identify potential risks and opportunities within a given market or industry. There are various types of market indices that cater to different methodologies and objectives. Understanding these types can enhance investors' understanding of the composition and calculation methods used in different indices. A price-weighted index calculates the average price of the constituent stocks, giving more weight to higher-priced stocks. In this type of index, stocks with higher prices have a greater impact on the index value. The Dow Jones Industrial Average (DJIA) is a prominent example of a price-weighted index. However, it's important to note that price-weighted indices can be biased towards higher-priced stocks, regardless of their market capitalization. A market capitalization-weighted index, also known as a market-cap-weighted index, considers the market value of the constituent stocks. Stocks with higher market capitalizations have a higher weight in the index, reflecting their significance in the overall market. The S&P 500 is a well-known market capitalization-weighted index that tracks the performance of 500 large-cap stocks listed in the United States. In contrast to the previous two types, an equal weighted index assigns equal importance to each constituent stock, irrespective of its price or market capitalization. This approach provides a more balanced representation of the overall market. An example of an equal weighted index is the Wilshire 5000, which includes all actively traded stocks in the U.S. market. Several market indices serve as benchmarks for investors, providing a snapshot of the overall performance of a specific market or industry. The S&P 500 is one of the most widely recognized market indices globally, comprising 500 large-cap U.S. companies across different sectors. It serves as a barometer for the U.S. economy and is often considered a benchmark for investors looking to invest in U.S. equities. Being a market capitalization-weighted index, the S&P 500's performance is heavily influenced by the largest constituents. As such, it is an excellent indicator of the performance of large-cap stocks in the U.S. The Dow Jones Industrial Average, or DJIA, is one of the oldest and most iconic market indices globally, tracking the performance of 30 blue-chip U.S. companies across different sectors. The DJIA is a price-weighted index, giving greater weight to higher-priced stocks. Historically, it has been considered a gauge of the performance of industrial companies in the U.S., but its composition has since evolved to include technology, healthcare, and financials, among others. The NASDAQ Composite is a market capitalization-weighted index that tracks the performance of over 3,000 stocks listed on the NASDAQ exchange. It comprises several technology companies, including Apple, Amazon, Facebook, and Google, making it an excellent gauge for the performance of the technology sector. The NASDAQ Composite is often considered a benchmark for investors seeking exposure to technology stocks. Market indices serve several crucial purposes in the world of investing, aiding investors in various ways. Market indices help investors track the performance of a specific market or industry, making it easier to make informed investment decisions. By providing a reference point, investors can identify trends, patterns, and risks and opportunities in the market, helping them make more informed investment decisions. Market indices provide a benchmark for investors to compare the performance of their portfolios or investment managers against the broader market. By comparing the returns of their investments to the relevant market indices, investors can determine whether their portfolios are underperforming or outperforming the market, helping them make necessary adjustments. Market indices can serve as economic indicators, providing insight into the overall health of the economy. Rising market indices usually indicate a growing economy, while falling market indices may indicate an economic downturn. Market indices may not provide a complete picture of the overall market or industry they represent, as they only include a limited number of stocks. This lack of representation can lead to biases and inaccuracies in the performance of the market or industry. Market indices may also be subject to inherent biases, such as favoring larger companies or specific industries. These biases can impact the accuracy of the index's performance as a barometer for the broader market. Market indices can be manipulated by market participants, such as institutional investors or market makers, who may buy or sell stocks to influence the performance of the index. This manipulation can lead to inaccuracies in the index's performance and impact the ability of investors to make informed decisions. Market indices serve as crucial tools for investors, providing a way to track the performance of specific markets or industries. By understanding the different types of market indices, their key features, and their uses, investors can make more informed investment decisions. While market indices have limitations and criticisms, they remain a valuable benchmark for investors to evaluate their portfolios and gauge the overall direction and sentiment of the market. Market indices are essential tools for investors, providing an overview of the performance of specific markets or industries. The types of market indices available and their calculation methodologies enable investors to identify trends, patterns, and opportunities in the market. Market indices serve as benchmarks against which investors can evaluate the performance of their portfolios and make necessary adjustments. While market indices have limitations and criticisms, they continue to play a crucial role in the investment landscape. Investors must understand the potential biases and limitations of market indices to make informed decisions. By selecting the most relevant and suitable market index, investors can evaluate their investment performance more accurately.Definition of Market Indices

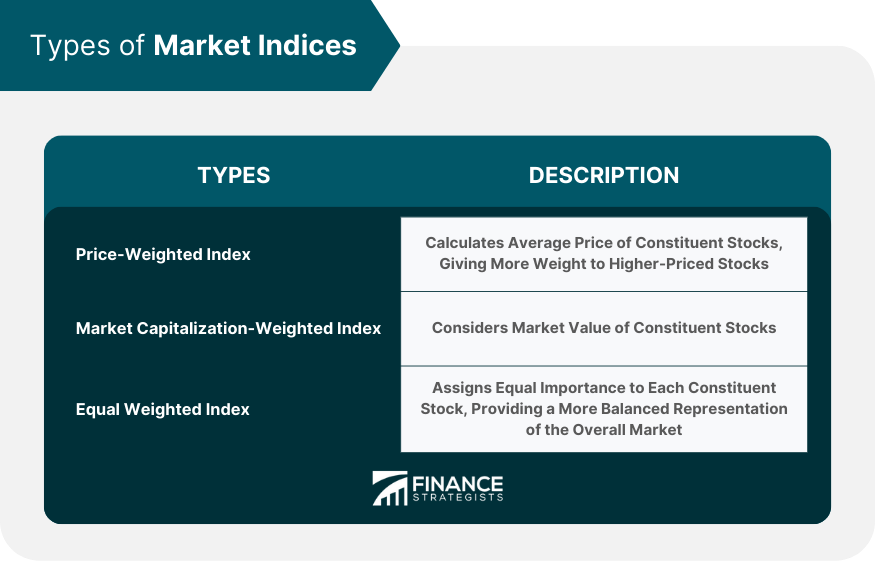

Types of Market Indices

Price-Weighted Index

Market Capitalization-Weighted Index

Equal Weighted Index

Key Market Indices

S&P 500

Dow Jones Industrial Average

NASDAQ Composite

Uses of Market Indices

Investment Decisions

Performance Evaluation

Economic Indicators

Criticisms of Market Indices

Limited Representation

Inherent Biases

Market Manipulation

Conclusion

Market Indices FAQs

Market indices are statistical measures that track the performance of a group of stocks or bonds, providing insight into the broader market's performance.

Price-weighted indices give greater weight to higher-priced stocks, while market capitalization-weighted indices give more weight to larger companies based on their market value.

Some key market indices include the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

Market indices are calculated using various formulas, such as the price-weighted index formula, market capitalization-weighted formula, or the equal-weighted formula, which all weigh stocks differently.

Market indices are used for investment decisions, performance evaluation, and as economic indicators for tracking the overall health of the economy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.