The Foreign Account Tax Compliance Act (FATCA) is a United States federal law enacted in 2010 to combat tax evasion by US taxpayers using foreign financial accounts. This comprehensive legislation has significantly impacted the international financial landscape by imposing reporting requirements on foreign financial institutions, non-financial foreign entities, and US taxpayers with foreign assets. This article will provide an in-depth understanding of FATCA, its purpose, reporting requirements, and the consequences of non-compliance. Under FATCA, FFIs are required to identify and report information on US account holders to the Internal Revenue Service (IRS). FFIs must conduct due diligence procedures to ascertain the citizenship or tax residency status of their account holders. This process may involve reviewing account holder documentation, electronic records, and any other relevant information. FFIs must report specific account information for US account holders to the IRS annually. This information includes the account holder's name, address, taxpayer identification number (TIN), account number, account balance or value, and gross receipts and withdrawals from the account. FFIs that fail to comply with FATCA reporting requirements may face a 30% withholding tax on certain US-source income. This includes interest, dividends, and other fixed or determinable annual or periodic income. Additionally, non-compliant FFIs may be subject to a withholding tax on gross proceeds from the sale or disposition of property that could produce US-source interest or dividends. NFFEs are required to identify and report information on their substantial US owners (generally those with more than a 10% ownership interest) to withholding agents. This information includes the substantial US owner's name, address, and TIN. NFFEs must provide the required ownership information to withholding agents on a Form W-8BEN-E or another appropriate form. This information is used by the withholding agent to determine if any withholding is necessary under FATCA regulations. US taxpayers with specified foreign financial assets exceeding certain thresholds must report these assets to the IRS on Form 8938, which is filed with their annual income tax return. Specified foreign financial assets include financial accounts maintained at foreign financial institutions, as well as other foreign financial assets held for investment purposes, such as stocks, bonds, and interests in foreign entities. The reporting thresholds for Form 8938 vary depending on the taxpayer's filing status and residency. For example, unmarried taxpayers living in the United States must file Form 8938 if the total value of their specified foreign financial assets exceeds $50,000 on the last day of the tax year or $75,000 at any time during the tax year. Different thresholds apply to taxpayers who are married, living abroad, or filing jointly. A Model 1 Intergovernmental Agreement (IGA) is an agreement between the United States and a foreign jurisdiction that establishes a framework for the automatic exchange of FATCA-related information. Under a Model 1 IGA, FFIs report the required information to their local tax authorities, which then exchange the information with the IRS. This model offers certain benefits to FFIs, such as reduced reporting burdens and exemption from the FATCA withholding tax for compliant institutions. A Model 2 Intergovernmental Agreement (IGA) is an agreement between the United States and a foreign jurisdiction that requires FFIs to report FATCA-related information directly to the IRS. Under a Model 2 IGA, FFIs must enter into individual agreements with the IRS and are subject to IRS oversight and audit. This model provides for the exchange of information on request rather than automatic exchange. FATCA compliance strategies are crucial for both foreign financial institutions (FFIs) and US taxpayers with foreign assets. For FFIs, implementing FATCA-compliant policies and procedures is the first step towards compliance. These policies should include procedures for identifying US account holders and reporting their account information to the IRS. FFIs must also conduct due diligence on their account holders to ensure compliance with FATCA regulations. Furthermore, FFIs must register with the IRS and obtain a Global Intermediary Identification Number (GIIN). This unique identifier allows the IRS to track and verify the compliance of the FFI with FATCA requirements. For US taxpayers, disclosing foreign financial assets on tax returns is necessary for FATCA compliance. Taxpayers must file the Form 8938, Statement of Specified Foreign Financial Assets, if they meet the reporting thresholds. Seeking professional tax advice can help taxpayers navigate the complex reporting requirements and avoid potential penalties. In some cases, US taxpayers may need to participate in the Offshore Voluntary Disclosure Program (OVDP) to come into compliance with FATCA regulations. The OVDP allows taxpayers to disclose previously unreported foreign assets and income in exchange for reduced penalties and protection from criminal prosecution. US taxpayers who fail to comply with FATCA reporting requirements may face significant penalties, including a $10,000 failure-to-file penalty and an additional penalty of up to $50,000 for continued failure to file after IRS notification. Furthermore, underpayments of tax attributable to undisclosed foreign financial assets may be subject to an accuracy-related penalty equal to 40% of the underpayment. FFIs and NFFEs that fail to comply with FATCA reporting requirements may face a 30% withholding tax on US-source income, as well as potential penalties under local laws in jurisdictions with IGAs in place. These penalties may include fines, loss of licenses, or other sanctions. The Foreign Account Tax Compliance Act (FATCA) has had a far-reaching impact on the global financial landscape, affecting not only financial institutions but also US taxpayers and non-financial foreign entities. By implementing strict reporting requirements and disclosure rules, FATCA aims to combat tax evasion and ensure transparency in cross-border financial transactions. For individuals and institutions alike, understanding and complying with FATCA's complex requirements are essential to avoid substantial financial penalties and potential reputational damage. Given the ongoing evolution of FATCA and its associated regulations, staying informed and engaged with the latest developments in this area of tax law is crucial. It is also important to seek professional guidance, such as from a tax attorney or certified public accountant, when navigating the intricacies of FATCA compliance. In addition to its direct impact on compliance, FATCA has broader implications for the international financial system. The law has prompted increased collaboration between countries and fostered a new era of global tax transparency. As more countries adopt similar measures to combat tax evasion and promote information sharing, the need for a thorough understanding of these regulations will become even more critical for individuals and institutions operating across borders. In conclusion, FATCA has undoubtedly changed the global financial landscape and will continue to shape the future of international tax compliance. By staying informed, proactive, and adaptable, both individuals and organizations can successfully navigate the challenges presented by FATCA, ensuring compliance and minimizing potential negative consequences. Ultimately, the goal is to foster a more transparent and equitable international financial system, benefiting taxpayers and countries alike.What Is the Foreign Account Tax Compliance Act (FATCA)?

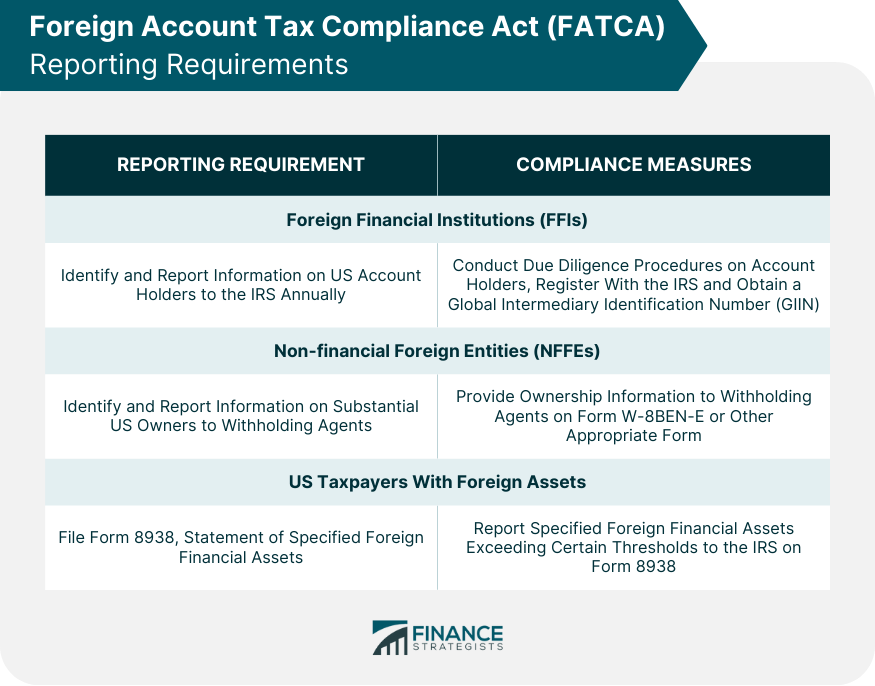

FATCA Reporting Requirements

Foreign Financial Institutions (FFIs)

Identifying US Account Holders

Reporting Account Information to the IRS

Withholding Requirements for Non-compliant Accounts

Non-financial Foreign Entities (NFFEs)

Identifying Substantial US Owners

Reporting Ownership Information to Withholding Agents

US Taxpayers With Foreign Assets

Filing Form 8938, Statement of Specified Foreign Financial Assets

Reporting Thresholds and Exceptions

Intergovernmental Agreements (IGAs)

Model 1 IGA

Model 2 IGA

FATCA Compliance Strategies

For Foreign Financial Institutions

For US Tax Payers

Penalties for Non-compliance

Individual Taxpayer Penalties

Institutional Penalties

Conclusion

Foreign Account Tax Compliance Act (FATCA) FAQs

FATCA stands for the Foreign Account Tax Compliance Act, which is a US law designed to prevent tax evasion by US taxpayers with foreign financial assets.

FATCA affects US taxpayers who hold foreign financial accounts and foreign financial institutions (FFIs) that hold these accounts on behalf of US taxpayers.

FFIs are required to identify and report information on their US account holders to the IRS, or face a 30% withholding tax on their US-sourced income.

Yes, if you are a US taxpayer and hold foreign financial accounts with an aggregate value of $10,000 or more at any time during the year, you must report these accounts on your tax return and may need to file additional reporting forms.

Penalties for non-compliance with FATCA can be severe, including hefty fines and criminal charges. It is important to comply with FATCA requirements to avoid potential legal and financial consequences.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.