Management fees are charges levied by companies or professionals for managing assets or overseeing projects. They compensate the managers for their expertise, time, and effort in providing services to clients or investors. The main purpose of management fees is to fairly compensate managers for their services. These fees ensure that managers are incentivized to provide high-quality services and effectively manage the assets or projects under their purview. There are various types of management fees, depending on the specific industry or area of expertise. This section will discuss investment management fees, property management fees, and project management fees. Investment management fees are charged by investment managers for managing assets like mutual funds, exchange-traded funds (ETFs), and hedge funds. These fees cover the cost of investment research, portfolio management, and other related services. Property management fees are levied by property managers for managing residential or commercial properties. These fees compensate managers for services such as tenant screening, rent collection, property maintenance, and lease administration. Project management fees are charged by project managers for overseeing and coordinating various tasks related to a specific project. These fees cover the cost of planning, executing, monitoring, and closing projects to ensure their successful completion. Several factors can influence management fees, including the scope of services provided, experience and reputation of the manager, market conditions and competition, and the regulatory environment. The range of services offered by a manager can impact the fee charged. More comprehensive services may result in higher fees, while fewer or more specialized services may lead to lower fees. Managers with more experience and a solid reputation in their field can often charge higher fees, as they are perceived to provide better service and deliver superior results. The level of competition and prevailing market conditions can also affect management fees. In a competitive market, managers may lower their fees to attract clients, while a less competitive market may allow for higher fees. There are several methods used to calculate management fees, including percentage-based fees, flat fees, tiered fee structures, and performance-based fees. Percentage-based fees are calculated as a percentage of the assets under management (AUM) or revenue generated by the investment or project. This method aligns the manager's compensation with the performance of the assets or project. Flat fees are predetermined amounts charged regardless of the size or performance of the assets or project. This method provides simplicity and predictability for clients and managers alike. Tiered fee structures involve charging different fee rates based on predefined thresholds, such as AUM or revenue. This method offers a balance between incentivizing performance and providing predictable fees. Management fees can have significant implications for return on investment (ROI), budgeting and financial planning, and assessing the value of management services. High management fees can reduce the overall return on investment, as a larger portion of the profits or gains is allocated to the manager. Investors should carefully consider the fees when evaluating investment opportunities. Management fees are an essential factor to consider when budgeting and planning for financial resources. Accurate projections of these fees are necessary for making informed decisions and ensuring the efficient allocation of funds. Evaluating the value of management services is crucial for determining whether the fees charged are reasonable and justified. Clients and investors should consider the quality of services, performance, and overall results when assessing the value of management fees. Negotiating management fees is an essential skill for clients and investors. This section will discuss best practices such as conducting research and benchmarking, evaluating service offerings, requesting fee reductions and discounts, and exploring alternative fee structures. Thorough research and benchmarking are critical in understanding the standard fees in the market. Comparing fees charged by various managers can help clients and investors negotiate better terms. It's essential to carefully evaluate the services offered by a manager to determine if the fees charged are justified. Clients and investors should assess the quality and scope of services in comparison to the fees being charged. Clients and investors can request fee reductions or discounts to obtain more favorable terms. Managers may be open to negotiation if they believe it will help secure a long-term, mutually beneficial relationship. Management fees are charges levied by professionals for managing various types of assets, properties, and projects. Investment management fees cover research, portfolio management, and related expenses for mutual funds, ETFs, and hedge funds. Property management fees compensate managers for services such as tenant screening, rent collection, maintenance, and lease administration. Project management fees cover planning, execution, monitoring, and closing various project tasks. Factors that influence management fees include the level of service, expertise, competition, and the size of the portfolio or project. To ensure that you are paying fair fees for management services, it is recommended to shop around, negotiate fees where possible, and evaluate the level of service provided. In general, the best practices for managing fees include reviewing fee structures regularly, considering alternative fee models, and assessing the value of services provided relative to the fees charged. By being informed and proactive in managing management fees, individuals and businesses can optimize their returns and ensure a positive outcome for all parties involved.What Are Management Fees?

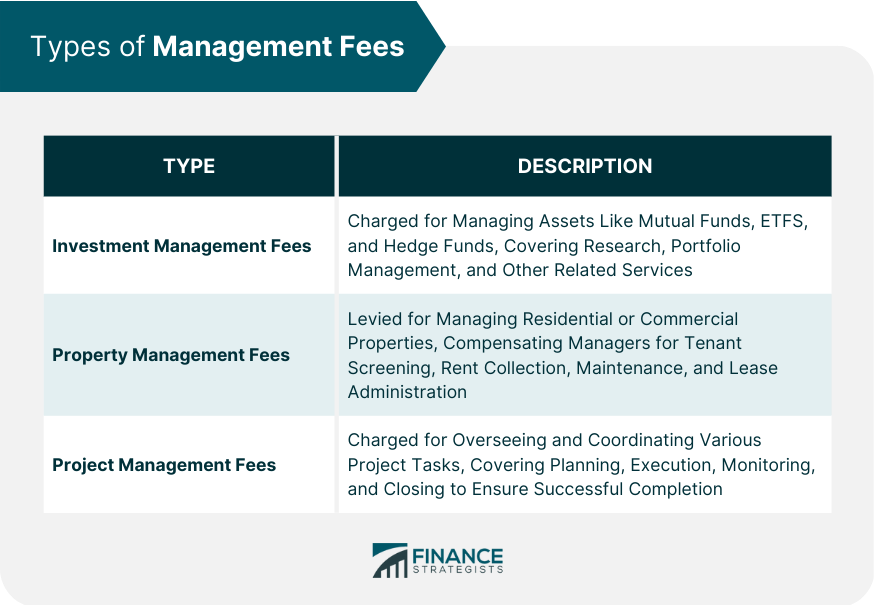

Types of Management Fees

Investment Management Fees

Property Management Fees

Project Management Fees

Factors Influencing Management Fees

Scope of Services Provided

Experience and Reputation of the Manager

Market Conditions and Competition

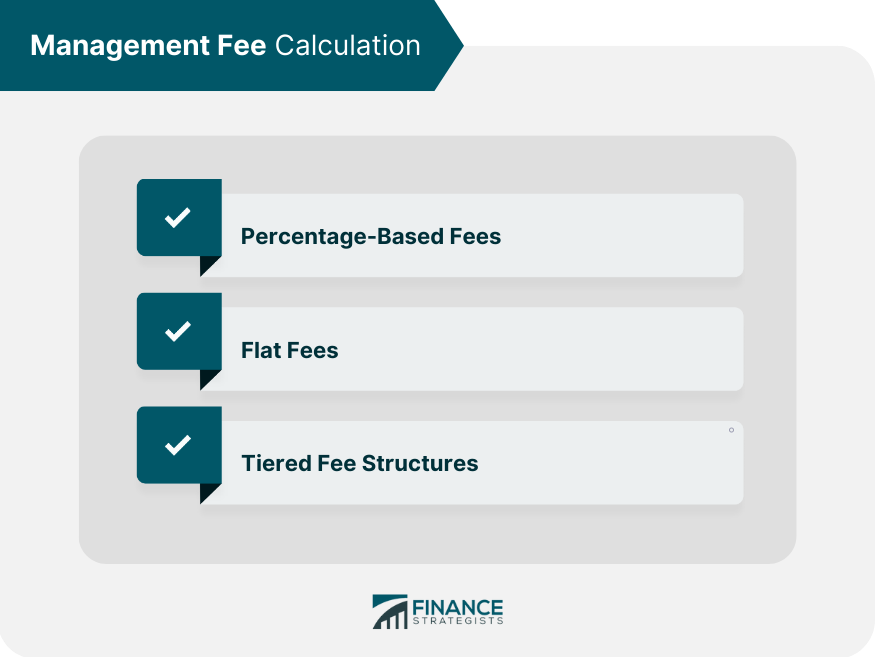

How to Calculate Management Fees

Percentage-Based Fees

Flat Fees

Tiered Fee Structures

Implications of Management Fees

Impact on Return on Investment (ROI)

Budgeting and Financial Planning

Assessing the Value of Management Services

Best Practices for Negotiating Management Fees

Conducting Research and Benchmarking

Evaluating Service Offerings

Requesting Fee Reductions and Discounts

Final Thoughts

Management Fees FAQs

A management fee is a fee charged by a financial advisor or investment manager for managing a client's assets or investments.

Management fees are typically calculated as a percentage of assets under management, ranging from 0.25% to 2% or more, depending on the type of investment and the advisor's fee structure.

Management fees are common for a variety of investments, including mutual funds, exchange-traded funds (ETFs), and separately managed accounts.

Yes, management fees can be negotiable. Some financial advisors or investment managers may be willing to lower their fees, especially for clients with larger portfolios.

Yes, management fees for investments held in taxable accounts can be tax-deductible, subject to certain limitations and restrictions. It's recommended to consult with a tax professional for specific advice on your situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.