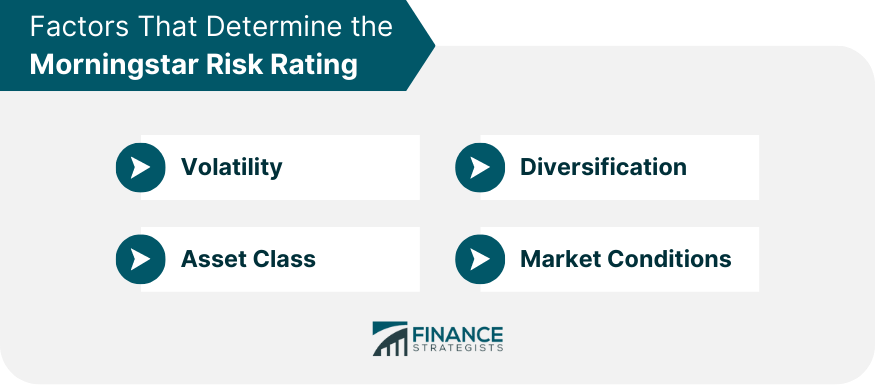

Morningstar, Inc. is an American publicly traded company that provides independent investment research, data, and rating services to individual investors, financial advisors, asset managers, and retirement plan providers. The Morningstar rating system is available in two forms: Star System - This system uses a one to five-star rating, with a five-star rating being the best. Medal System - This system awards Gold, Silver, and Bronze medals to funds. Medals are awarded based on how a fund has performed in the past five years compared with all other funds in its category. The star system is the most common form of the Morningstar rating. The ratings are based on an analyst's assessment of a fund's past risk and return performance relative to its peers. The rating is designed to reflect the risk-adjusted return of a fund. It attempts to identify funds that have provided the highest level of consistent returns given their level of risk, or are most likely to provide strong risk-adjusted returns in the future. The Morningstar rating system uses a proprietary algorithm to calculate ratings for more than 7,000 funds in the US. In this case, 30-day returns from the past three years are compared to those for other stock funds in their categories. Morningstar analysts calculate a risk-adjusted return by assigning a weight to both volatility and the amount of money that investors have actually lost in a fund, known as downside deviation. After taking these into account, analysts compare a fund's returns against a peer group of similar funds. The star rating is then assigned based on how the fund performed relative to the average fund in its category. Several factors can affect an investment's Morningstar Risk Rating, including: Volatility - Investments with higher historical volatility tend to have a higher Morningstar Risk Rating. Asset Class - Different asset classes, such as stocks, bonds, and commodities, have different levels of risk. Diversification - Investments that are well-diversified tend to have a lower risk level than investments that are concentrated in a single asset class or sector. Market Conditions - Market conditions can affect an investment's risk level, as well as the overall risk level of the investment market. Morningstar rates funds on a one-to five star scale. Five stars is the best rating that can be assigned to a fund, denoting that the fund has outperformed 90% of funds in its category on both an absolute and risk adjusted basis over time. One star is the lowest rating that can be assigned to a fund, which means it has underperformed 80% of funds in its category on an absolute and risk adjusted basis. Morningstar calculates performance at different time periods depending upon the type of investment: 1 year, 3 years, 5 years and 10 years. For equity investments (stocks), Morningstar rates from one-year to 10-years. As for fixed income investments, Morningstar rates from 3-years to 10-years. The difference between the best and worst rating is also significant: funds with 5 stars receive a top ranking and outperformed their peers by 1.5% on an annualized basis over the past decade as of February 2011. Whereas funds with one star received a bottom ranking and underperformed their peers by 2.5% on an annualized basis over the past decade as of February 2011. Morningstar ratings can be used when making two types of investment decisions: buying individual stocks and picking mutual funds. When buying an individual stock, Morningstar's star rating can help you determine a fund's riskiness. A five-star rating is the best indication that a stock is less risky than its peers, while a one-star rating is the worst. For mutual funds, Morningstar's star ratings can help when choosing between similar alternatives in terms of risk and return. When all else fails, go with the fund that has five stars. While this might not always yield great returns, it probably means that it has performed better than its peers over time. On the other hand, a fund with one star is riskier than its peers on average; avoid it if there are better alternatives in the same category. Assume that an investor is interested in investing in a large-cap growth fund. In order to narrow down the choices, the investor could use Morningstar's ratings to find the best-rated funds in that category. Morningstar rates the large-cap growth category from one to five stars, with a five-star rating indicating that the fund has outperformed 90% of funds in its category on both an absolute and risk adjusted basis over time. The investor could then further research the five-star rated funds to find the one that best suits his or her individual needs. The Morningstar Risk Rating is commonly used for mutual funds. Morningstar assigns a Morningstar Risk Rating to each mutual fund based on its historical volatility and other factors. Mutual funds with higher Morningstar Risk Ratings may be riskier but may also offer the potential for higher returns. The Morningstar Risk Rating is also used for ETFs, which are similar to mutual funds but trade on stock exchanges like individual stocks. Morningstar assigns a Morningstar Risk Rating to each ETF based on its historical volatility and other factors. The Morningstar Risk Rating is less commonly used for individual stocks, as the risk level of a single stock can be more difficult to evaluate than the risk level of a mutual fund or ETF. However, the Morningstar Risk Rating can still be used as one of several factors to consider when evaluating an individual stock. Morningstar Risk Rating provides investors with a standardized way to evaluate the potential risks associated with different investments. By comparing the Morningstar Risk Ratings of different investments, investors can better understand the risks and potential returns of each investment. Morningstar Risk Rating also provides a standardized way to compare different investments, regardless of their asset class or type. This can be particularly helpful for investors who are considering investing in different types of assets, such as stocks, bonds, or commodities. By providing a clear and standardized measure of investment risk, Morningstar Risk Rating can help investors to make informed investment decisions. Using Morningstar Risk Rating in conjunction with other investment research and analysis, investors can make more informed decisions about which investments to include in their portfolio. Morningstar Risk Rating is based on an investment's historical volatility and may not accurately reflect its current or future risk level. Factors such as changes in the investment's management, market conditions, or economic trends may cause the investment's risk level to change, even if its historical volatility remains the same. Morningstar Risk Rating is based on historical performance and may not account for all potential risks associated with an investment. For example, Morningstar Risk Rating may not account for the risk of fraud or other types of risks that are not related to market volatility. There are several other measures of investment risk that investors may use in addition to Morningstar Risk Rating. These include: 1. Beta - Beta measures an investment's sensitivity to market movements. A beta of 1 indicates that the investment moves in line with the overall market, while a beta greater than 1 indicates that the investment is more volatile than the market, and a beta less than 1 indicates that the investment is less volatile than the market. 2. Value at Risk (VaR) - VaR is a statistical measure that estimates the maximum loss an investment may experience within a given period of time, based on a specific level of confidence. 3. Sharpe Ratio - The Sharpe Ratio measures an investment's return relative to its risk level, based on its standard deviation. The Morningstar rating system is one of the most popular ways to measure a mutual fund's performance, but it is not without its flaws. Critics argue that the star rating system is too subjective and that it does not take into account all of the risks associated with investing. Morningstar ratings are also backward-looking and do not necessarily predict how a fund will perform in the future. Nevertheless, Morningstar ratings are one of the best ways to compare different mutual funds and to get a sense of a fund's overall riskiness. Morningstar's star ratings are assigned based on the fund's performance relative to its peers over time. These ratings should not be seen as a guarantee of future returns, but rather as an indicator of how well the fund has performed compared to other mutual funds that invest in similar stocks or bonds. When making an investment decision, it is always important to do your own research and to consult with a financial advisor.Morningstar Rating System Definition

How Does the Morningstar Rating System Work?

Factors That Determine Morningstar Risk Ratings

Interpreting Morningstar Ratings

How to Use Morningstar Ratings

Example of Morningstar Ratings

Morningstar Risk Rating for Specific Investments

Morningstar Risk Rating for Mutual Funds

Morningstar Risk Rating for Exchange-Traded Funds (ETFs)

Morningstar Risk Rating for Individual Stocks

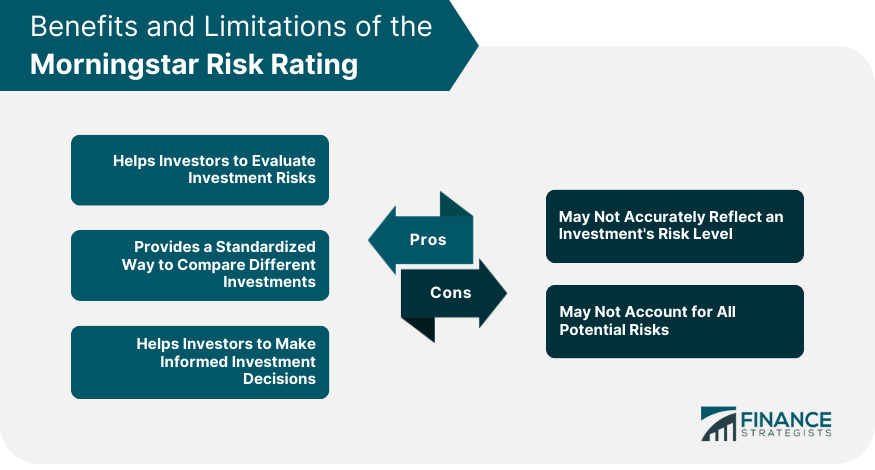

Benefits of the Morningstar Risk Rating

Helps Investors to Evaluate Investment Risks

Provides a Standardized Way to Compare Different Investments

Helps Investors to Make Informed Investment Decisions

Limitations of the Morningstar Risk Rating

May Not Accurately Reflect an Investment's Risk Level

May Not Account for All Potential Risks

Morningstar Risk Rating vs Other Risk Measures

How Reliable Are Morningstar Ratings?

The Bottom Line

Morningstar Rating System FAQs

The Morningstar Risk Rating is a measure of a mutual fund's volatility, or the risk of its returns, relative to similar funds. It is represented by a scale of one to five stars, with one being the least risky and five being the most risky.

The Morningstar Risk Rating is based on a statistical measure called standard deviation, which is a way of measuring how much an investment's returns vary from its average return. Morningstar calculates the standard deviation of a mutual fund's monthly returns over a three-year period and then assigns the fund a risk rating based on its standard deviation compared to the standard deviation of other funds in the same category.

The Morningstar Risk Rating provides investors with a quick and easy way to evaluate the risk level of a mutual fund compared to similar funds. It can help investors to make informed decisions about which funds to invest in based on their own risk tolerance and investment goals.

The Morningstar Risk Rating is based solely on past performance and does not take into account factors such as changes in management, market conditions, or future events that could affect a fund's risk level. It also does not take into account the potential impact of fees and expenses on a fund's returns.

Yes, the Morningstar Risk Rating can change over time as a fund's risk level changes. Morningstar updates the ratings on a monthly basis and also reassesses the ratings on a quarterly basis to ensure that they remain relevant.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.