Consolidation, in the realm of finance, carries a dual meaning. In one sense, within the context of technical analysis, it refers to a state where an asset's price fluctuates within a specific trading range for a certain period. Here, the asset price neither significantly moves up (bullish) nor down (bearish), representing a form of market equilibrium or indecisiveness. On the other hand, consolidation in the field of financial accounting signifies the aggregation of financial statements of a parent company and its subsidiaries. This method creates a comprehensive financial overview of the combined entities, portraying them as a single economic unit. The concept of consolidation is fundamental in finance, both in terms of investment decision-making and in understanding an organization's overall financial health. Technical consolidation helps traders predict potential breakout points and make more informed investment decisions. It plays a crucial role in identifying the best moments to buy or sell securities. By recognizing a consolidation phase, traders can estimate the level of risk involved and possible return on their investments. On the other hand, consolidated financial statements offer a clear picture of a corporate group's total assets, liabilities, revenues, and expenses. They provide a transparent, unified perspective on the group's financial status, enabling investors, creditors, and other stakeholders to make informed decisions. In technical analysis, consolidation is like a "pause" in the market after a significant price movement. It is often depicted as a period where the price actions on a chart form a pattern bounded by identifiable resistance (upper limit) and support (lower limit) levels. Consolidation periods can occur in any timeframe, ranging from minutes to years, depending on the investor's perspective. The length and pattern of the consolidation period often depend on the market's psychology and can influence future price movements. Support and resistance levels are essential elements in understanding consolidation. The support level is the price level where the asset finds significant buying interest that could potentially halt further price decline. Conversely, the resistance level is where the asset meets considerable selling interest, which may stop the price from moving higher. During a consolidation phase, the asset's price oscillates between these defined support and resistance levels. This "sideways" movement typically continues until a significant volume of trades either pushes the price upwards, breaking the resistance level (bullish breakout), or downwards, breaching the support level (bearish breakout). Market consolidation represents a tug of war between buyers and sellers, reflecting a state of trader indecisiveness. It can be viewed as a cooling-off period where market participants are unsure about the asset's future direction. Such indecisiveness often arises from various factors, such as pending economic announcements, uncertainty about company earnings, geopolitical developments, or simply a period of market adjustment after a significant price move. Regardless of the reason, this indecisiveness, reflected through consolidation, is a crucial element to consider when analyzing markets. A consolidation pattern breaks when the price of the asset moves above the resistance level or below the support level with a significant increase in volume. This break often results from a shift in market sentiment, driven by factors such as: 1. An unexpected news event impacting the asset or its sector. 2. A significant change in the economic indicators. 3. A sudden large-scale buying or selling of the asset. Materially important news can have a significant impact on the price of an asset. Such news might relate to changes in a company's financials, new product announcements, changes in management, mergers or acquisitions, or macroeconomic factors. For instance, a positive earnings surprise could push the asset's price above the consolidation pattern's resistance level. Conversely, an unfavorable news event, such as a regulatory penalty, could drive the price below the support level. Therefore, news plays a critical role in breaking consolidation patterns. Limit orders, which are used by traders to buy or sell an asset at a specific price, can also impact consolidation. If a substantial number of limit orders are triggered around the support or resistance levels, it can push the asset price beyond the consolidation pattern. For instance, a flurry of buy limit orders could potentially propel the price above the resistance level, creating a bullish breakout. Similarly, a wave of sell limit orders might drive the price below the support level, leading to a bearish breakout. Hence, the role of limit orders in breaking a consolidation pattern cannot be overlooked. In financial accounting, consolidation refers to the process of combining financial statements from several entities into one. When a company owns a significant stake (usually more than 50%) in another entity, it is required to consolidate its financials, painting a comprehensive picture of the entire group's economic performance. Consolidated financial statements are the combined financial statements of a parent company and its subsidiaries. They provide an aggregated view of the financial situation of the entire corporate group. These statements include the balance sheet, income statement, and cash flow statement. They are critical for presenting a clear and comprehensive view of the financial position and performance of a group of companies, eliminating intercompany transactions and balances. Consolidated statements allow analysts, investors, and stakeholders to evaluate the financial health of a group of companies as if they were a single entity. This consolidated view is beneficial for understanding the group's overall financial position, profitability, and cash flows. Investors and analysts often prefer to review consolidated financial statements since they reflect the total resources, obligations, and operations of the parent and its subsidiaries. This comprehensive perspective aids in making more informed financial and investment decisions. Financial consolidation is a vital aspect of financial management for businesses with multiple entities. It combines the financial statements of all subsidiaries into one consolidated statement, providing a comprehensive view of the entire group's financial health. The following steps outline this process in detail: This is the first step in financial consolidation. It involves identifying all the subsidiaries and associated entities that need to be incorporated into the consolidated financial statement. Generally, a parent company consolidates the financials of those entities in which it owns more than 50% equity stake. In some cases, it may include entities over which the company has significant control or influence, even if it doesn't hold a majority stake. After identifying the entities for consolidation, the next step is to eliminate intercompany transactions and balances. These are the transactions that occur between the parent company and its subsidiaries or between the subsidiaries themselves. These transactions and balances must be eliminated to avoid double counting and overstating revenues, expenses, assets, and liabilities in the consolidated statements. For example, if a parent company sells goods to a subsidiary, this is an internal transaction and should not be counted as revenue in the consolidated financial statement. The third step is to aggregate similar items from all entities' financial statements. This includes the combination of items of assets, liabilities, equity, income, and expenses. The result will show the total assets, liabilities, equity, income, and expenses of the entire group, giving a clear and comprehensive view of the overall financial health. After combining all similar items, the next step is to attribute the net profit or loss and other comprehensive income to the parent and the non-controlling interest. Non-controlling interest refers to the ownership stake in a subsidiary not held by the parent company. This step ensures that the profitability of each entity is accurately represented in the consolidated financial statement. The final step in the process is the preparation of the consolidated financial statements. This involves summarizing all the information gathered in the previous steps into a set of financial statements that present an accurate picture of the group's financial position and performance. These statements typically include a consolidated balance sheet, income statement, statement of cash flows, and a statement of changes in equity. Consolidating the financial statements of all the subsidiaries provides a holistic view of the group's performance. It allows for an overview of revenue, profit, and cash flow at the group level. This macro-level perspective can help executives identify trends, opportunities, and areas for improvement that may not be apparent when examining individual subsidiaries. With a comprehensive view of the financial health, the top management can make informed decisions about future investments, acquisitions, resource allocation, and other strategic moves. It becomes easier to map out the direction of the organization based on firm financial footing. Financial consolidation ensures compliance with accounting standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), which require consolidated financial statements for companies with multiple business entities. Regulatory bodies such as the Securities and Exchange Commission (SEC) also require consolidated statements to maintain transparency and accountability. Consolidated financial statements offer a clear picture of the corporation’s overall performance. They offer shareholders and potential investors valuable insights into the financial status of the organization, thereby influencing their investment decisions. Financial consolidation can be a complex process, especially for multinational corporations with multiple subsidiaries across various industries and countries. It involves harmonizing different accounting systems, currencies, and fiscal periods. The process can be time-consuming and requires careful management to ensure accuracy. While financial consolidation provides a big-picture perspective, it can sometimes obscure the performance of individual subsidiaries. Poorly performing subsidiaries may be masked by the successful ones, and this can lead to delays in addressing problems at the subsidiary level. Intercompany transactions such as loans, services, or goods supplied between the parent company and its subsidiaries or among subsidiaries can complicate the consolidation process. These transactions need to be identified and eliminated to avoid double-counting of revenues, expenses, and profits. Given the complexity of the consolidation process, there is a risk of errors that could lead to inaccurate financial reporting. These inaccuracies could result in non-compliance with regulatory requirements, potentially leading to fines, penalties, and damage to the company's reputation. Consolidation is a multifaceted term in finance, referring to a state of market indecisiveness in technical analysis and the merging of financial statements in accounting. In technical analysis, it depicts a period where an asset's price moves within a defined range, signifying market equilibrium. A break in this pattern can lead to a significant price movement, signaling a new trend. In financial accounting, consolidation refers to the combination of financial statements of a parent company and its subsidiaries, presenting them as one economic entity. It provides a comprehensive perspective of a group's financial health, facilitating better investment decisions and strategic planning. However, financial consolidation also comes with its share of risks, such as obscuring individual company performance and the potential for errors during the complex consolidation process. Therefore, understanding the nuances of consolidation is crucial for investors and businesses alike. To ensure you're leveraging consolidation effectively for your financial decisions, consider seeking professional wealth management services. These experts can help you navigate the complexities of financial consolidation and provide guidance tailored to your specific needs.What Is Consolidation?

Significance of Consolidation in Finance

Understanding Consolidation in Technical Analysis

Concept of Consolidation

Role of Support and Resistance

Impact of Trader Indecisiveness

Breaks in Consolidation Patterns

Reasons Behind Breaking of a Consolidation Pattern

Effect of Materially Important News

Impact of Succession of Limit Orders

Consolidation in Financial Accounting

Concept of Consolidation in Financial Accounting

Consolidated Financial Statements: Definition and Importance

Evaluating Parent and Subsidiary Companies Through Consolidated Statements

Steps in Financial Consolidation

Step 1: Identifying the Entities That Need to Be Consolidated

Step 2: Eliminating Intercompany Transactions and Balances

Step 3: Combining Like Items of Assets, Liabilities, Equity, Income, and Expenses

Step 4: Attributing Profit or Loss and Other Comprehensive Income to the Parent and Non-controlling Interest

Step 5: Preparing Consolidated Financial Statements

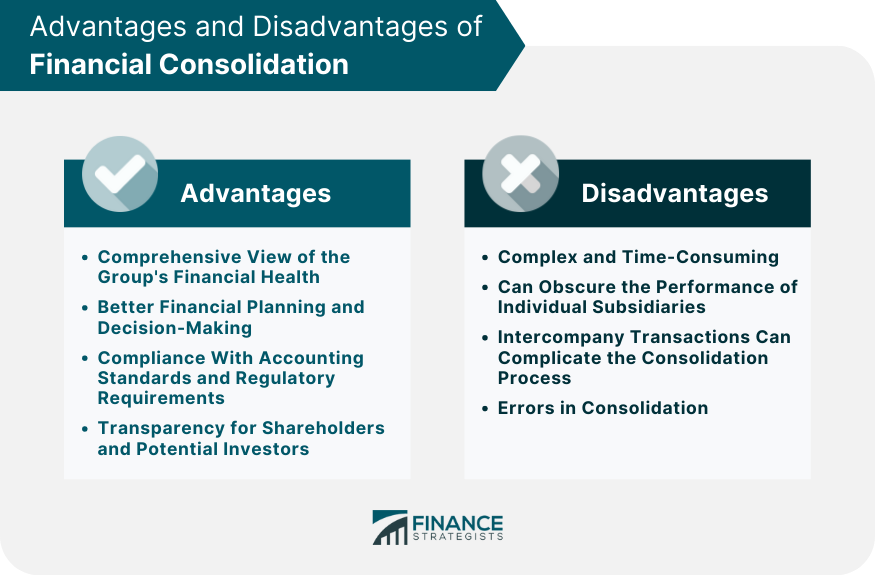

Advantages of Financial Consolidation

Provides a Comprehensive View of the Group's Financial Health

Facilitates Better Financial Planning and Decision-Making

Ensures Compliance With Accounting Standards and Regulatory Requirements

Enhances Transparency for Shareholders and Potential Investors

Disadvantages of Financial Consolidation

Complexity and Time-Consuming Process

Obscuring the Performance of Individual Subsidiaries

Complications With Intercompany Transactions

Risks of Errors Leading To Non-compliance

Final Thoughts

Consolidation FAQs

In finance, consolidation refers to a situation where an asset's price fluctuates within a specific trading range, demonstrating market indecisiveness. In financial accounting, consolidation is the combination of a parent company's financial statements and those of its subsidiaries.

In technical analysis, consolidation is a period where the asset's price moves within defined support and resistance levels. This phase indicates a state of market equilibrium or indecisiveness, which ends when the price moves above or below these levels, resulting in a break in the consolidation pattern.

Financial consolidation provides a holistic view of a corporate group's financial health, facilitates better decision-making, and ensures regulatory compliance. However, it can be a complex and time-consuming process, potentially obscuring individual company performance and leading to inaccuracies if not handled correctly.

Consolidated financial statements provide a comprehensive view of a group of companies' financial position, including total assets, liabilities, revenues, and expenses. They enable stakeholders to make more informed financial decisions by providing a clear and unified perspective on the group's financial status.

The financial consolidation process involves several steps, including identifying the entities to be consolidated, eliminating intercompany transactions and balances, combining like items of assets, liabilities, income, and expenses, attributing profit or loss and other comprehensive income to the parent and non-controlling interest, and preparing the consolidated financial statements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.