Tape reading is a method to analyze stock trades that were printed on a ticker tape. Today, this term is symbolic and pertains to the modernized version of this technique, which includes scrutinizing electronic data of stock trades. Tape reading involves the analysis of price and volume information of a security, in real-time, with an aim to predict its future movement. As one of the cornerstones of day trading, tape reading requires traders to observe and interpret a variety of data points. These data points include the trading volume at various price levels, the size of orders coming through, the speed at which these orders are executed, and the direction in which the prices move as a result. A trader who can effectively read the tape is armed with valuable insights into the short-term market sentiment. Unlike other forms of analysis that rely on historical data or theoretical models, tape reading gives you a live view of what other market participants are doing. Traders analyze these two factors to understand the liquidity and volatility of a security. An increase in trading volume often indicates strong investor interest, which could lead to significant price changes. Similarly, the movement of prices can provide insights into the market's direction. For instance, a sudden spike in volume with minimal price movement may indicate a strong resistance or support level. Conversely, if volume and price are moving in the same direction, it may signify a strong trend. Understanding these nuances through tape reading can provide traders with opportunities to enter or exit trades advantageously. While the interpretation can be subjective, skilled tape readers have honed their ability to discern patterns and trends from the raw data. They study the size of orders, the time they're executed, and how the market reacts to these transactions. A large order executed at market price, for instance, may signal a buyer or seller with significant influence who could potentially move the market. Similarly, repeated small orders at a particular price level may indicate the presence of a large hidden order. By deciphering these signals, a tape reader can position their trades to capitalize on the projected market movements. Order flow, another key aspect of tape reading, refers to the rate at which orders are submitted, executed, or canceled. This can reveal important information about market dynamics and sentiment. For instance, a rapid sequence of buy orders could indicate bullish sentiment, suggesting an upward trend. Understanding market sentiment can help traders gauge the general feeling or attitude of investors towards a particular security. If market sentiment is bullish, it means investors are expecting prices to rise, and vice versa. Traders can use these insights from tape reading to align their strategies with the prevailing sentiment and potentially profit from it. Level II quotes provide more detailed information than typical stock quotes, including the range of bid and ask prices offered by various market makers. This data offers a view of the depth of market, which refers to the liquidity and depth of buy and sell orders at different prices. Having access to this information allows traders to understand the supply and demand dynamics of a security at a granular level. For instance, if there are more pending sell orders than buy orders at a particular price level, it might indicate a potential downward pressure on the price. The time and sales window, also known as the tape, displays the real-time price, volume, and time stamp of every transaction executed. By tracking this data, traders can identify patterns of large trades, sudden changes in volume, or unusual price movement. This information can help traders identify trends and potentially profitable trading opportunities. For example, if a trader observes a large volume of trades executed at progressively higher prices, it could indicate the beginning of an upward trend. Volume analysis is a crucial aspect of tape reading. By comparing the volume of trades at different price levels, traders can identify key levels of support or resistance. The cumulative delta, which measures the cumulative difference between the buying and selling volume, is another important tool. A positive cumulative delta suggests more aggressive buying, while a negative one indicates more aggressive selling. Traders use this information to anticipate potential price movements. For instance, if the cumulative delta is rising while the price is falling, it might be a sign of an impending upward price movement. Market profile charts present price action in a statistical bell curve format, which helps traders identify price levels where trading activity is most concentrated. On the other hand, footprint charts provide a detailed view of market activity, including the number of contracts traded at each price level and the direction of the trades. These charts can help traders understand the balance between supply and demand and identify potential turning points in the market. For example, if a market profile chart shows a high volume of trades at a particular price level, it may indicate a strong support or resistance level. Scalping is a popular strategy among tape readers. It involves making numerous trades within a day, aiming to profit from small price changes. The key to scalping is quick decision-making based on real-time data. For instance, if a scalper observes an influx of large buy orders, they might anticipate a short-term price increase and quickly buy the security. Once the price increases, even slightly, they would sell it for a small profit. While the profit from each trade may be small, the cumulative profit from numerous such trades can be significant. Momentum trading involves buying or selling securities based on recent price trends. If a stock's price has been rising, momentum traders assume it will continue to rise, and vice versa. Tape reading plays a crucial role in identifying these trends. A sudden surge in volume accompanied by a steady price increase could indicate a strong upward momentum. A momentum trader would buy the stock with the expectation that the price will continue to rise. The key to this strategy is timing - entering and exiting the trade at the right time to capture the momentum. Trend following is a strategy that attempts to capture gains by analyzing a security's momentum in a particular direction. Tape reading aids in identifying these trends by observing price and volume data. A tape reader may notice a pattern of increasing trade volume and rising prices. They might interpret this as a positive trend and decide to buy the security with the expectation that the price will continue to rise. Trend followers typically hold onto their positions until they believe the trend has reversed. Breakout trading is a strategy used when the price of a security moves above a defined resistance level or below a defined support level on high volume. Traders expect the price to continue in the breakout direction and make their trades accordingly. If a trader observes a sudden increase in volume as the price approaches a known resistance level, it could signal an imminent breakout. The trader can then enter a long position, anticipating a price surge. Reversal trading involves identifying when a trend is about to reverse and making trades based on that anticipation. This strategy is riskier as it goes against the prevailing trend.Tape reading can be beneficial in spotting early signs of reversals. For example, if a tape reader observes a decline in volume and slower price increases during an uptrend, it could indicate that the trend is losing steam and a reversal might be imminent. The trader can then prepare to short the stock, anticipating a price drop. Unlike other analytical methods that rely on historical data, tape reading focuses on live data. This enables traders to understand the market dynamics as they unfold, and adjust their trading strategies accordingly. Furthermore, by providing a glimpse into the actions of other market participants, tape reading allows traders to anticipate market movements. This can be especially valuable in volatile markets, where prices can change rapidly and without warning. Tape reading can significantly enhance trade timing and execution. By understanding the immediate supply and demand dynamics of a security, traders can identify the most advantageous times to enter or exit trades. For instance, if a tape reader notices a large sell order at a particular price level, they might anticipate a temporary drop in price and time their buy order accordingly. Similarly, noticing a high volume of buy orders could indicate an imminent price increase, signaling a good time to sell. Tape reading can help traders identify hidden trading opportunities that might not be evident through other forms of analysis. By closely observing order flow and volume, a tape reader might spot patterns or anomalies that could signal a trading opportunity. For example, a sudden increase in volume at a specific price level could suggest a large hidden order. Recognizing this, a tape reader could position their trade to profit from the potential price movement caused by the execution of the hidden order. Tape reading is highly dependent on interpretation and subjectivity, which can be a significant limitation. The ability to accurately read the tape requires considerable experience and skill, and even seasoned tape readers may interpret the same data differently. Furthermore, because it involves making rapid decisions based on real-time data, tape reading can be stressful and mentally taxing. It requires constant focus and attention, which might not be feasible for all traders. Tape reading can be vulnerable to market manipulation. Sophisticated market participants can use techniques like "spoofing" or "layering" to create a false impression of supply and demand, potentially misleading tape readers. For instance, a manipulator might place a large order to create the impression of high demand or supply, only to cancel the order once the market reacts. Traders relying on tape reading may be deceived by such tactics and make trades based on inaccurate information. Tape reading can lead to emotional and psychological stress due to its high-speed and high-stakes nature. Making rapid trading decisions based on constantly changing real-time data can be stressful, and mistakes can be costly. Additionally, tape reading requires a high level of focus and attention, which can be mentally exhausting over extended periods. Traders need to manage their emotions effectively to prevent stress from affecting their trading decisions. Tape reading is a time-honored method in financial trading. Although its techniques have evolved with technology, the fundamental principle remains the same - analyzing real-time price and volume information to predict future market movements. The principles of tape reading involve interpreting market data, such as price, volume, order flow, and market sentiment. Various strategies can be applied in tape reading, including scalping, momentum trading, trend following, breakout trading, and reversal trading. These strategies aim to capitalize on short-term price movements based on real-time market data. While tape reading offers many advantages, such as real-time market insight, enhanced trade timing, and the ability to identify hidden opportunities, it also has its limitations. These include reliance on interpretation and subjectivity, vulnerability to market manipulation, and the potential for emotional and psychological stress. With sufficient practice and experience, it can provide a unique perspective on market dynamics and create lucrative trading opportunities.What Is Tape Reading?

Principles of Tape Reading

Market Analysis Through Price and Volume

Interpreting Tape Reading Signals

Identifying Order Flow and Market Sentiment

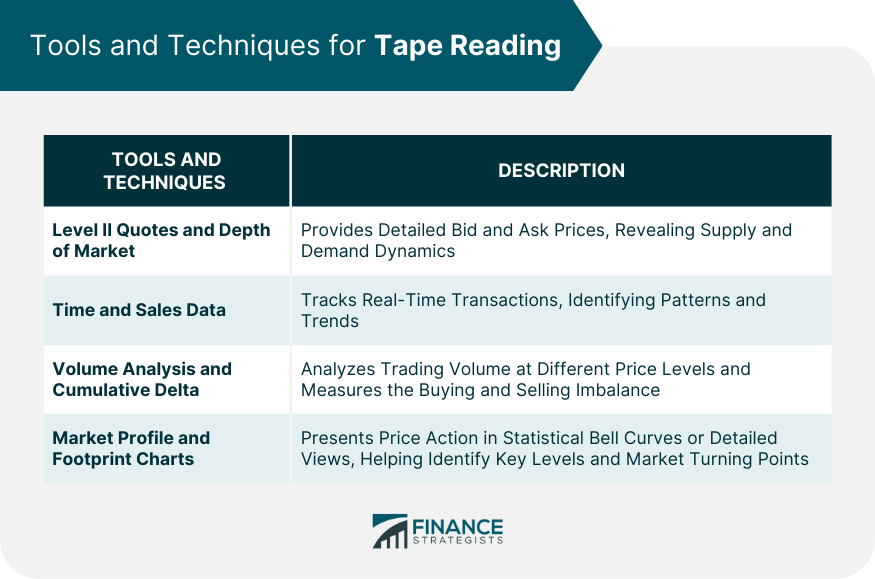

Tools and Techniques for Tape Reading

Level II Quotes and Depth of Market

Time and Sales Data

Volume Analysis and Cumulative Delta

Market Profile and Footprint Charts

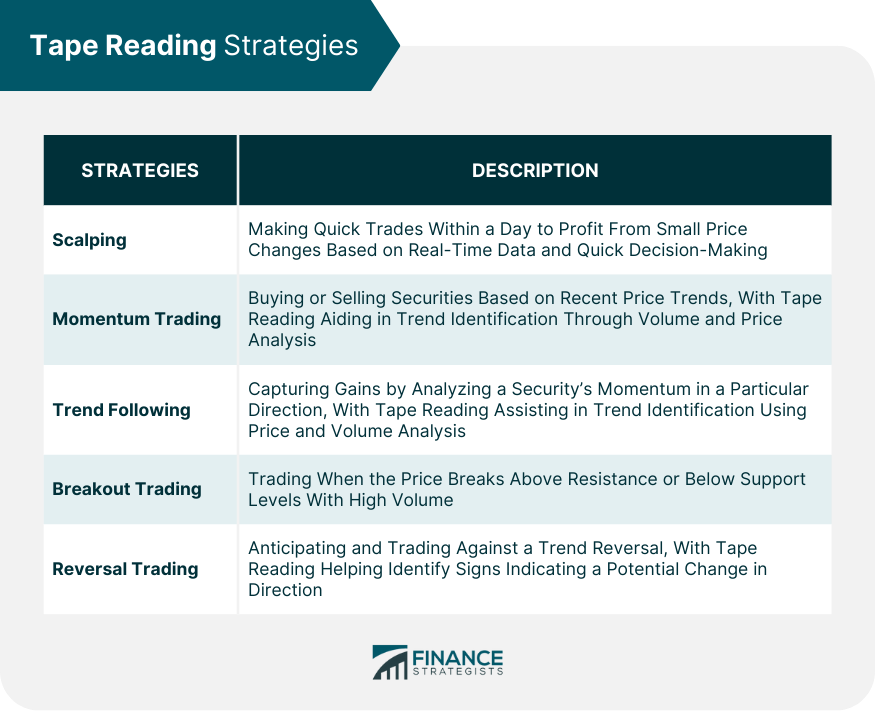

Tape Reading Strategies

Scalping

Momentum Trading

Trend Following

Breakout Trading

Reversal Trading

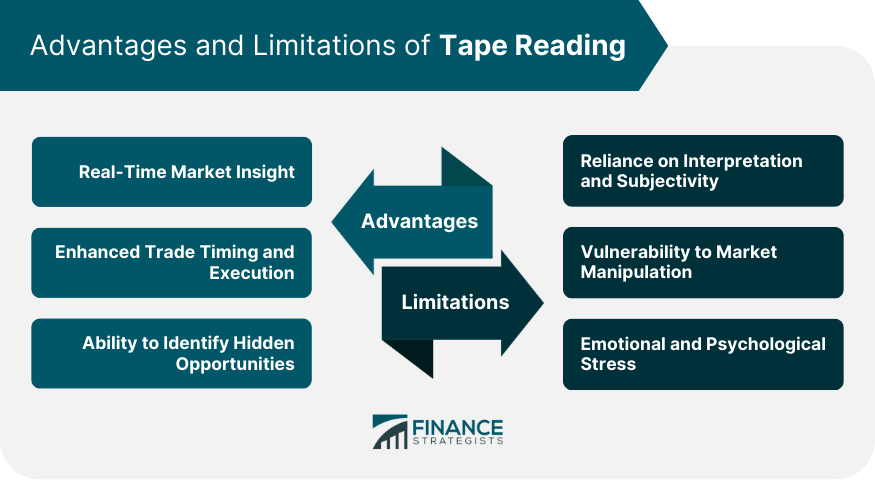

Advantages of Tape Reading

Real-Time Market Insight

Enhanced Trade Timing and Execution

Ability to Identify Hidden Opportunities

Limitations of Tape Reading

Reliance on Interpretation and Subjectivity

Vulnerability to Market Manipulation

Emotional and Psychological Stress

Conclusion

Tape Reading FAQs

Tape reading is a trading technique that involves analyzing real-time price and volume information of a security to predict its future movements.

Tape reading is important because it provides real-time insights into market activity, allowing traders to anticipate price movements and time their trades more effectively.

Some common tape reading strategies include scalping, momentum trading, trend following, breakout trading, and reversal trading.

Advantages of tape reading include real-time market insight, enhanced trade timing and execution, and the ability to identify hidden trading opportunities.

Limitations of tape reading include its reliance on interpretation and subjectivity, vulnerability to market manipulation, and potential for emotional and psychological stress.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.