Large-cap funds are investment vehicles that primarily invest in companies with large market capitalizations. These funds provide investors with exposure to well-established, financially stable companies that typically have a track record of success and a strong presence in their respective industries. Incorporating large-cap funds in an investment portfolio can help investors achieve long-term growth and reduce portfolio volatility. These funds offer diversification, lower risk, and potential for capital appreciation and dividends, making them an attractive option for investors seeking a balance between risk and reward. Large-cap companies typically have a market capitalization of $10 billion or more. Investing in large-cap funds allows investors to gain exposure to some of the largest and most successful companies in the global market, which can be beneficial for long-term growth and stability. Large-cap funds can be categorized into three main types: growth, value, and blend funds. Growth funds focus on companies with high growth potential, value funds invest in undervalued companies with strong fundamentals, and blend funds combine both growth and value strategies. Large-cap funds tend to exhibit lower volatility and more stability compared to small and mid-cap funds. This is because large-cap companies often have more stable revenues, established market positions, and greater financial resources, making them less susceptible to market fluctuations. Large-cap funds can provide investors with both dividend income and capital appreciation. Many well-established companies distribute dividends to their shareholders, providing a steady income stream, while capital appreciation occurs when the share price of the invested companies increases over time. Investing in large-cap funds offers diversification benefits, as these funds hold a variety of companies across different industries. This can help reduce the impact of poor performance in any single sector, spreading risk and improving overall portfolio stability. Large-cap funds generally pose a lower risk compared to small- and mid-cap funds. The companies they invest in are well-established, have strong financial positions, and are less likely to be affected by economic downturns, making large-cap funds a more conservative investment option. Large-cap funds offer investors the potential for long-term capital growth. These funds invest in companies with a proven track record of success, which can lead to consistent growth and positive returns over time. Investing in large-cap funds provides exposure to well-established, industry-leading companies. These companies often possess strong competitive advantages, extensive resources, and global reach, which can contribute to their continued growth and success. Despite their lower risk profile, large-cap funds are still subject to market risk. Economic conditions, political events, and other factors can cause stock prices to fluctuate, potentially leading to losses for investors. Some large-cap funds may be heavily concentrated in specific sectors or industries, exposing investors to concentration risk. If the fund's performance is heavily tied to a particular sector, any downturn in that sector can negatively impact the fund's overall performance. Large-cap funds can be sensitive to changes in interest rates. When interest rates rise, the cost of borrowing increases for companies, which can negatively affect their profitability and stock prices, leading to potential losses for investors. For large-cap funds that invest in international companies, currency risk is a concern. Fluctuations in exchange rates can impact the value of investments, resulting in gains or losses for investors when converting returns back to their local currency. When evaluating large-cap funds, it's crucial to consider their past performance and historical returns. Although past performance does not guarantee future results, examining a fund's track record can provide insights into its consistency and potential for future growth. The expertise and experience of the fund manager play a significant role in a fund's performance. Assessing the manager's investment philosophy, strategy, and tenure can help investors determine if the fund aligns with their investment goals and risk tolerance. The expense ratio and fees associated with large-cap funds can impact an investor's returns. Lower fees and expense ratios generally translate to higher net returns, making it essential to compare costs among similar funds before making an investment decision. Examining a large-cap fund's portfolio holdings and sector allocation can provide valuable information about its diversification and investment approach. Investors should ensure the fund's holdings align with their investment objectives and preferences. The core-satellite approach involves building a portfolio with a core of diversified, low-cost investments, such as large-cap funds, and adding satellite investments for additional growth potential. This strategy can help investors achieve long-term growth while managing risk effectively. Large-cap funds can be either passively or actively managed. Passive funds, such as index funds or exchange-traded funds (ETFs), track a market index and typically have lower fees, while actively managed funds seek to outperform the market through active stock selection and typically charge higher fees. Regularly rebalancing and optimizing a portfolio can help investors maintain their desired risk level and ensure their investments remain aligned with their objectives. Incorporating large-cap funds into this process can provide stability and long-term growth potential while mitigating risk. Large-cap funds can play an essential role in a diversified investment portfolio, providing exposure to well-established companies, lower risk, and potential for long-term growth. Incorporating these funds can help investors achieve a balance between risk and reward, improving their overall investment strategy. In summary, large-cap funds offer investors the potential for long-term growth and lower volatility compared to small- and mid-cap funds. By considering factors such as fund performance, investment strategy, fees, and portfolio holdings, investors can make informed decisions about incorporating large-cap funds into their investment portfolios.Definition of Large-Cap Funds

Characteristics of Large-Cap Funds

Market Capitalization Range

Types of Large-Cap Funds

Stability and Low Volatility

Dividend Payments and Capital Appreciation

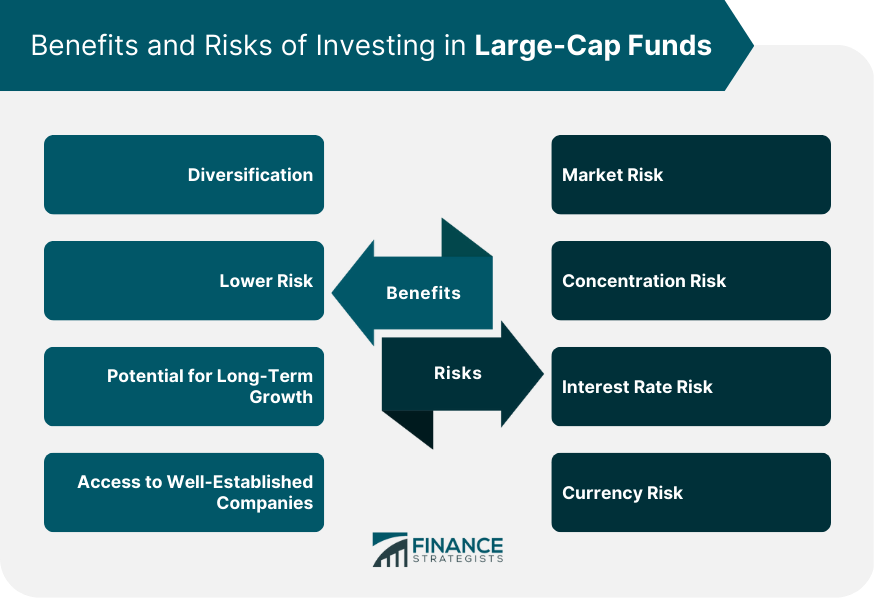

Benefits of Investing in Large-Cap Funds

Diversification

Lower Risk

Potential for Long-Term Growth

Access to Well-Established Companies

Risks Associated With Large-Cap Funds

Market Risk

Concentration Risk

Interest Rate Risk

Currency Risk

Evaluating and Selecting Large-Cap Funds

Fund Performance and Historical Returns

Fund Manager and Investment Strategy

Expense Ratio and Fees

Portfolio Holdings and Sector Allocation

Incorporating Large-Cap Funds in Investment Strategies

Core-Satellite Approach

Passive vs. Active Management

Rebalancing and Portfolio Optimization

Conclusion

Large-Cap Funds FAQs

Large-Cap Funds are mutual funds that invest in large-cap stocks, which are stocks of companies with a market capitalization of over $10 billion.

Investing in Large-Cap Funds can provide investors with diversification, stability, and potentially higher long-term returns compared to other types of investments.

Large-Cap Funds can be subject to market fluctuations, interest rate risk, and geopolitical events that can impact the performance of the fund.

You can invest in Large-Cap Funds through a financial advisor, a brokerage firm, or an online investment platform.

Large-Cap Funds invest in large-cap stocks, while Small-Cap Funds invest in small-cap stocks, which are stocks of companies with a market capitalization of less than $2 billion. Small-Cap Funds can offer higher potential returns but also come with higher risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.