The Hulbert Rating is a quantitative tool developed by Mark Hulbert to measure the performance of investment advisory newsletters. It assesses the risk-adjusted returns of different investment strategies, taking into account both overall returns and portfolio volatility. The rating system provides investors with a benchmark for comparing and evaluating different newsletter recommendations. It helps investors make more informed decisions by considering the historical performance of newsletter recommendations and their associated risks. The Hulbert Rating is widely recognized for its impartiality, transparency, and reliability in the financial industry, making it a trusted tool among investors and financial advisors. The Hulbert Rating is calculated based on a newsletter's recommended portfolio's risk-adjusted returns. It evaluates the performance of a portfolio by taking into account both its return and its risk. This is done by comparing the portfolio's return with the risk-free rate, usually the return on a 3-month U.S. Treasury bill, and then adjusting this by the portfolio's standard deviation, a measure of volatility. The higher the risk-adjusted return, the better the portfolio's performance. The total return represents the cumulative gain or loss that an investment has generated over a specified time frame. This parameter includes both the capital appreciation and any income received from the investment, such as dividends or interest. The total return provides a comprehensive picture of the profitability of an investment strategy. The risk-adjusted return is a measure that takes into account both the return and the risk associated with an investment strategy. It is calculated by dividing the total return by the risk measure, typically the standard deviation of the investment's returns. This measure helps investors understand the level of risk they are taking for the potential return they are expecting. It shows how effectively the investment strategy manages risk while achieving returns. The maximum drawdown represents the largest single drop from peak to bottom in the value of a portfolio before a new peak is achieved. It measures the worst-case scenario for an investment strategy, providing investors with an idea of the potential losses they might face. The lower the maximum drawdown, the better the investment strategy is at protecting investors' capital during downturns. The consistency of the performance reflects how regularly the investment strategy achieves its expected returns. It measures the reliability of an investment strategy over time. This component is important for investors because it provides an indication of the investment's dependability. A high level of consistency indicates that the strategy regularly meets or surpasses its targets, providing investors with a more predictable return on their investments. The period of the performance record refers to the length of time over which the investment strategy has been tracked and evaluated. A longer record can provide more confidence in the reliability of the rating, as it includes a larger number of different market conditions. The period of the performance record can also give insights into the investment strategy's ability to adapt to different economic and market environments. For investors, the Hulbert Rating is an invaluable tool. It provides a reliable and unbiased assessment of different investment strategies, helping investors to navigate the complex world of investing. It allows them to compare different strategies and make informed decisions based on their risk tolerance and investment goals. Moreover, it helps investors to avoid strategies that might promise high returns but are associated with high risks. Financial advisors use Hulbert Ratings to provide their clients with informed and personalized investment advice. They use the ratings to compare different strategies, to identify those that align with their client's risk tolerance and investment goals, and to monitor the performance of the strategies over time. They also use the ratings to educate their clients about the importance of considering risk-adjusted returns rather than simply focusing on the total return. The Hulbert Rating also has a significant influence on the stock market. It shapes investment trends and behaviors, as it helps investors identify profitable and stable investment strategies. Furthermore, the rating system indirectly influences the allocation of capital in the market, as highly rated strategies tend to attract more investors. The Hulbert Rating system is highly regarded for its accuracy and reliability. Focusing on risk-adjusted returns, it provides a more realistic measure of performance than other rating systems. Moreover, its methodology is transparent and consistent, which increases its credibility among investors. However, like any rating system, it is not infallible and should be used in conjunction with other investment tools and considerations. Despite its popularity, the Hulbert Rating system has faced criticism. Some critics argue that it overemphasizes past performance, which is not always a reliable indicator of future results. Others believe that it does not sufficiently account for the specific risk preferences and investment goals of individual investors. Nevertheless, many investors and financial advisors continue to find value in the system and consider it a useful tool in their investment decisions. Compared to other financial rating systems, the Hulbert Rating is unique in its focus on risk-adjusted returns and its application to investment newsletters. While other ratings, such as Morningstar Ratings for mutual funds, also consider risk-adjusted returns, they do not cover the same breadth of investment strategies. Therefore, the Hulbert Rating fills an important gap in the investment landscape. The Hulbert Rating is a valuable tool for investors and financial advisors in the financial world. It provides reliable and unbiased assessments of investment strategies, helping investors make informed decisions based on their risk tolerance and goals. Financial advisors utilize Hulbert Ratings to offer personalized advice, compare strategies, monitor performance, and educate clients about the importance of risk-adjusted returns. Additionally, the Hulbert Rating system influences the stock market by shaping investment trends and indirectly affecting capital allocation. While the system is highly regarded for its accuracy and transparency, it is not without criticism. Some argue that it overemphasizes past performance and does not fully consider individual risk preferences. However, many investors and advisors still find value in the Hulbert Rating as a useful tool for evaluating investment strategies. Compared to other financial ratings, the Hulbert Rating stands out for its focus on risk-adjusted returns and its application to investment newsletters, filling an important gap in the investment landscape.What Is Hulbert Rating?

Detailed Explanation of Hulbert Rating

Understanding How Hulbert Rating Is Calculated

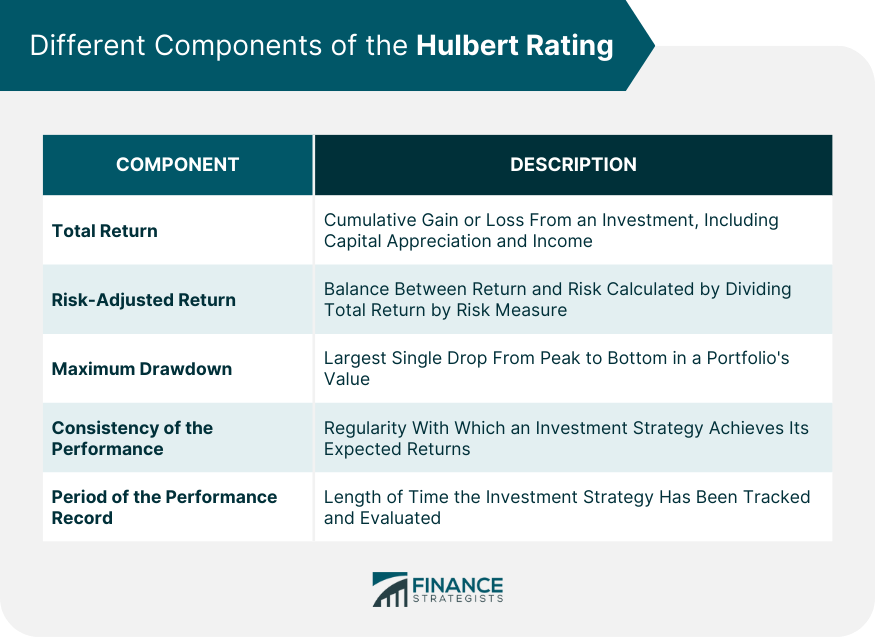

Different Components of the Hulbert Rating

Total Return

Risk-Adjusted Return

Maximum Drawdown

Consistency of the Performance

Period of the Performance Record

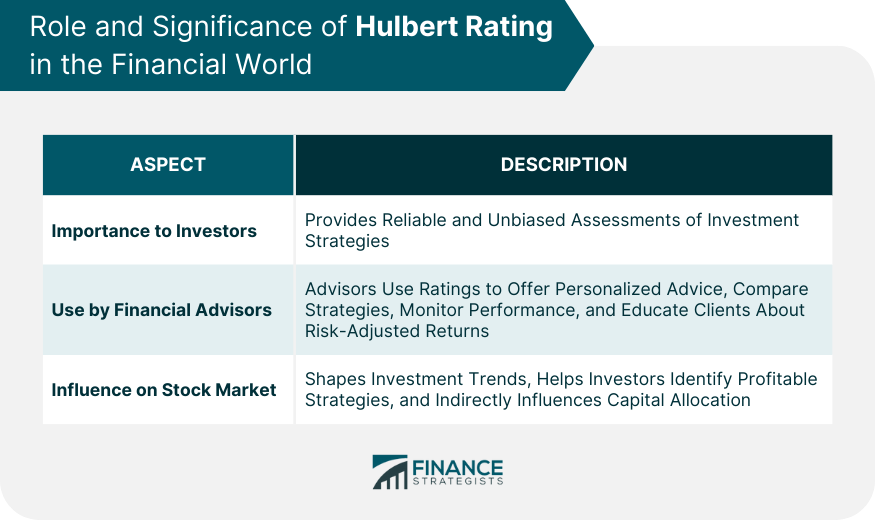

Role and Significance of Hulbert Rating in the Financial World

Importance of Hulbert Rating to Investors

How Financial Advisors Use Hulbert Ratings

Hulbert Rating's Influence on the Stock Market

Evaluation of Hulbert Rating

Accuracy and Reliability of Hulbert Ratings

Criticisms and Controversies of the Rating

Comparisons With Other Financial Ratings

Final Thoughts

Hulbert Rating FAQs

The Hulbert Rating is a system that measures the performance of investment advisory newsletters. It focuses on risk-adjusted returns, providing a holistic view of an investment strategy's potential.

The Hulbert Rating is calculated based on the risk-adjusted returns of a newsletter's recommended portfolio. It compares the portfolio's return with the risk-free rate and adjusts it by the portfolio's standard deviation.

The Hulbert Rating provides investors with a benchmark to compare different investment strategies. By considering risk-adjusted returns, investors can identify strategies that align with their risk tolerance and investment goals.

Some critics argue that the Hulbert Rating overemphasizes past performance, which may not be a reliable indicator of future results. Others believe it does not account sufficiently for individual investors' specific risk preferences and investment goals.

Future improvements to the Hulbert Rating could include incorporating more data points, such as investor sentiment or macroeconomic indicators, and leveraging advanced technologies like AI for more accurate, real-time ratings.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.