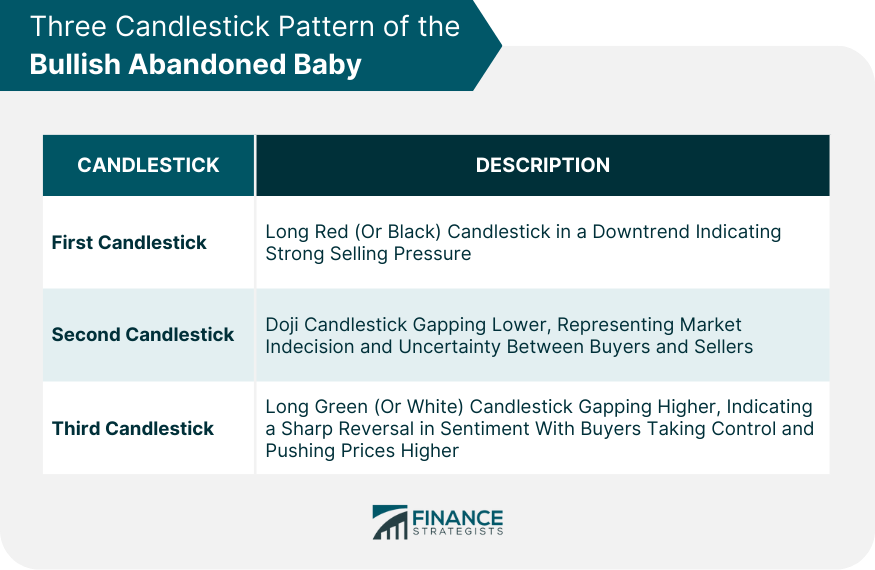

The Bullish Abandoned Baby is a unique and highly significant candlestick pattern within the realm of technical analysis. Recognized for its strong predictive power, this pattern typically signifies a potential reversal in a downtrend, often indicating that bulls are regaining control of the market after a period of dominance by the bears. The Bullish Abandoned Baby pattern comprises three distinct candlesticks. The first, a long red (or black) candlestick, signifies a continuation of the existing downward trend. The second candlestick, known as a Doji, is characterized by its narrow or non-existent body, signifying indecision in the market. Lastly, a third long green (or white) candlestick, gapping above the Doji, suggests a powerful upward reversal. The Bullish Abandoned Baby, like many candlestick patterns, originated from Japanese rice traders over centuries ago, who used these patterns to predict future price movements. The effectiveness of these patterns has been time-tested and, over time, they've been adopted into the larger financial trading world. While there are many types of candlestick patterns, the Bullish Abandoned Baby is one that traders pay particular attention to due to its reliability. The Bullish Abandoned Baby pattern begins with a long red (or black) candlestick. This candlestick represents a continuation of the prevailing downtrend and signifies strong selling pressure. The second candlestick is a Doji that gaps below the first candlestick. The Doji, with its small or non-existent body, signifies market indecision. It's as if the market is taking a breather, reflecting uncertainty between buyers and sellers. The pattern concludes with a third candlestick, a long green (or white) one, that gaps above the Doji. This candlestick signifies a sharp reversal in sentiment, with buyers now taking control, pushing prices higher. Gaps play a pivotal role in the formation of the Bullish Abandoned Baby pattern. The 'abandoned baby' (Doji) should be gapped away from the other two candlesticks. The presence of gaps helps to confirm the strength of the pattern and indicates a strong shift in market sentiment. The Doji is a unique type of candlestick, characterized by its small or non-existent body and long shadows. Dojis are often seen as signs of indecision in the market, where neither the buyers nor sellers have managed to gain a decisive upper hand. In the context of the Bullish Abandoned Baby pattern, the Doji plays a crucial role, marking the turning point of market sentiment. As a bullish reversal signal, the Bullish Abandoned Baby pattern indicates the possibility of a trend reversal from bearish to bullish. This signal is of significant importance to traders as it suggests that it might be time to consider taking long positions or exiting short positions. However, traders should also consider other market indicators and factors to avoid false signals. Certain conditions can strengthen the bullish reversal signal of the Bullish Abandoned Baby pattern. One such condition is the presence of higher trading volume on the third day, which can confirm the bullish reversal. Another condition is if the pattern occurs at a known support level or a significant Fibonacci retracement level. Trading volume is an important factor that can confirm the signal of the Bullish Abandoned Baby. A significant increase in trading volume on the third day, when the bullish candlestick appears, can confirm the change in market sentiment. If the volume is relatively low, it could suggest a weaker signal. The reliability of the Bullish Abandoned Baby signal can also depend on the timeframe of the chart. The pattern is generally considered more reliable on longer timeframes, such as the daily, weekly, or monthly charts. On shorter timeframes, the pattern might still be valid, but it could be more prone to false signals due to increased market noise. One of the primary benefits of trading the Bullish Abandoned Baby is the potential to catch the early stages of a new uptrend. This pattern often occurs after a downtrend, indicating a possible reversal and the beginning of an upward price movement. By identifying this pattern early on, traders can position themselves to take advantage of the subsequent price increase. Successfully trading the Bullish Abandoned Baby pattern can lead to significant profits. If the expected reversal materializes and the price starts to move upward, traders who entered at the right time may experience substantial gains as the uptrend continues. This potential for profit is what attracts many traders to this pattern. One of the main risks of trading the Bullish Abandoned Baby pattern is the possibility of receiving a false signal. Although this pattern suggests a potential reversal, it does not guarantee that the price will indeed start moving upward. Traders need to be cautious and not solely rely on this pattern without considering other factors and confirming indicators. If the expected reversal indicated by the Bullish Abandoned Baby pattern fails to materialize, traders may face potential losses. It is important to recognize that not all patterns lead to the desired outcome, and there is always a degree of uncertainty in trading. Traders should have proper risk management strategies in place to mitigate potential losses. One common mistake that traders make when encountering the Bullish Abandoned Baby pattern is acting on the signal without confirming it with other indicators or high trading volume. Relying solely on this pattern may increase the chances of falling victim to a false signal. It is advisable to seek confirmation from additional technical indicators or market factors before entering a trade. Not setting a stop-loss order is another mistake that traders should avoid when trading the Bullish Abandoned Baby pattern. A stop-loss order helps limit potential losses by automatically closing a trade if the price moves against the expected direction. Failing to implement a stop-loss order can expose traders to higher risks, as the price may continue to decline, resulting in significant losses. Trading the Bullish Abandoned Baby pattern should not be done in isolation from the broader market context. Traders should consider the overall market conditions, trends, and other relevant factors before making trading decisions based solely on this pattern. Ignoring the market context can lead to misguided trades and missed opportunities. The Bullish Abandoned Baby pattern is a potent reversal signal in the stock market. Traders and investors often monitor this pattern to anticipate potential bullish reversals and adjust their strategies accordingly. This pattern is also effective in the forex market, known for its high liquidity and 24-hour trading. The Bullish Abandoned Baby can signal potential reversals in currency price trends, offering valuable insights for forex traders. In the relatively new and highly volatile field of cryptocurrency trading, the Bullish Abandoned Baby pattern can provide a reliable signal of a potential bullish reversal. However, due to the higher volatility, traders should be particularly mindful of false signals. While the Bullish Abandoned Baby pattern can be useful in various markets, its reliability may vary depending on market conditions and volatility. It's generally considered highly reliable in the stock and forex markets, but caution should be exercised in the crypto market due to its increased volatility. Both the Bullish Abandoned Baby and the Morning Star are bullish reversal patterns consisting of three candlesticks. However, the presence of gaps differentiates the Bullish Abandoned Baby, making it a stronger signal. The Hammer is a bullish reversal pattern that consists of a single candlestick, unlike the three-candlestick Bullish Abandoned Baby. The Hammer is considered less reliable than the Bullish Abandoned Baby due to its single-candlestick nature. The Bullish Engulfing pattern is a two-candlestick pattern that also signifies a bullish reversal. While powerful, it lacks the confirmation provided by the gaps in the Bullish Abandoned Baby pattern. The Bullish Abandoned Baby is a potent pattern in technical analysis, signifying a bullish reversal. It is defined by three distinct candlesticks: a long red candlestick, followed by a Doji that gaps down from the first candlestick, and finally a long green candlestick that gaps up from the Doji. This pattern's two gaps add to its reliability, signaling a strong shift in market sentiment from bearish to bullish. When it comes to trading this pattern, it is crucial to validate it with additional indicators and confirm it with an increase in trading volume. A stop-loss order should always be placed to limit potential losses, typically below the low of the Doji candlestick. However, trading the Bullish Abandoned Baby, like all trading strategies, involves certain risks, including the risk of false signals. Therefore, it's recommended to seek advice from financial advisors or wealth management services. Such services can provide a comprehensive understanding of market dynamics, assist in making informed decisions, and help design a balanced investment portfolio aligned with individual financial goals. What Is a Bullish Abandoned Baby?

Components of the Bullish Abandoned Baby

Detailed Analysis of the Three Candlestick Pattern

First Candlestick: A Long Red (Or Black) Candlestick in a Downtrend

Second Candlestick: A Doji Candlestick Gapping Lower (The ‘Abandoned Baby’)

Third Candlestick: A Long Green (Or White) Candlestick Gapping Higher

Importance of Gaps in the Pattern

Concept of Doji in Candlestick Patterns

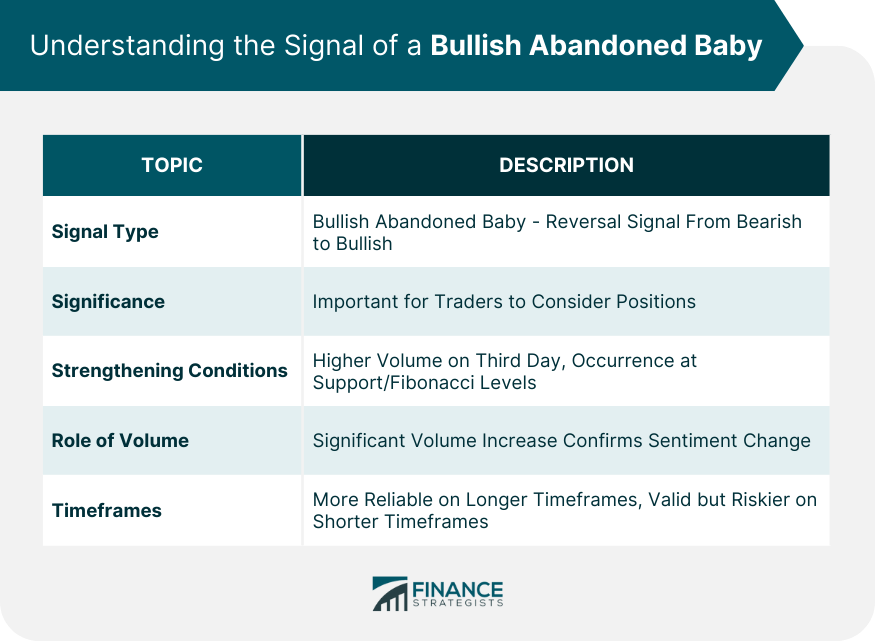

Understanding the Signal of Bullish Abandoned Baby

Bullish Reversal Signal: Explanation and Significance

Conditions That Strengthen the Signal

Role of Volume in the Signal’s Confirmation

Timeframes and Their Importance When Considering the Signal

Benefits of Trading the Bullish Abandoned Baby

Early Stage of a New Uptrend

Profit Potential

Risks Associated With Trading the Bullish Abandoned Baby

False Signals

Potential Losses

Common Mistakes to Avoid When Trading Bullish Abandoned Baby Patterns

Lack of Confirmation

Absence of Stop-Loss Orders

Ignoring Market Context

Bullish Abandoned Baby in Various Markets

Efficacy in the Stock Market

Utility in the Forex Market

Use in Cryptocurrency Trading

Comparison Across Different Markets

Comparison of the Bullish Abandoned Baby With Other Reversal Patterns

Morning Star

Hammer

Bullish Engulfing

Final Thoughts

Bullish Abandoned Baby FAQs

The Bullish Abandoned Baby is a three-candlestick pattern that signals a possible bullish reversal in the market.

The Bullish Abandoned Baby is considered reliable due to the presence of gaps on either side of the Doji, indicating a strong shift in market sentiment.

The Bullish Abandoned Baby pattern is typically traded by entering a long position once the pattern is confirmed, with a stop-loss placed below the low of the Doji.

Yes, the Bullish Abandoned Baby pattern can be used in various markets, including stocks, forex, and cryptocurrencies. However, its reliability may vary depending on market conditions.

The Bullish Abandoned Baby is unique due to its rare occurrence and the presence of gaps on either side of the Doji, making it a highly reliable bullish reversal signal.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.