An Inside Day is a concept used in technical analysis within the financial markets. It refers to a day in which the range of prices, from high to low, falls within the range of the previous day. This means that the highest price of the current day is lower than the highest price of the previous day, and the lowest price of the current day is higher than the lowest price of the previous day. Inside Days can occur in any market, including stocks, commodities, and forex. Inside Days reflect a moment of market equilibrium where bullish and bearish sentiments are balanced. They represent a pause in the prevailing trend and can often be a harbinger of a potential reversal. Traders and investors pay keen attention to Inside Days as they offer an opportunity for strategic decision-making aimed at either optimizing profits or minimizing losses. The fundamental architecture of an Inside Day rests upon the high and low prices recorded during a trading day. To classify a trading day as an Inside Day, both the highest and lowest recorded prices must fit neatly within the range established by the preceding day's prices. This unique position of the day's price range, neatly encapsulated within the confines of the previous day's range, lends the Inside Day its descriptive moniker and anchors its relevance in the realm of trading analysis. Assessing the Inside Day involves a crucial juxtaposition of the price range of the current day against that of the previous day. This comparison serves as the bedrock of Inside Day analysis, helping traders not only spot the occurrence of an Inside Day but also infer its potential repercussions on market direction. By studying these nuances, investors can extract invaluable insights into upcoming market movements. An Inside Day often manifests during periods of market indecision. It represents a temporary truce in the tug-of-war between the bullish and bearish forces that drive market fluctuations, culminating in a consolidation phase marked by a tightening price range. This stasis can provide traders with a window of opportunity to reassess their strategies as they wait for the next significant market move. Inside Days can serve as potential compasses, indicating the direction of forthcoming market trends. When an Inside Day is succeeded by a breakout day — a day with a price range that eclipses that of the Inside Day — it often heralds the onset of a new trend. The direction of this breakout can provide traders with an indication of the impending trend, enabling them to strategize their trades accordingly. A Bullish Inside Day denotes an Inside Day that gives way to a breakout ascending beyond the high point of the Inside Day. This event typically signals a victorious stride by the bulls, wresting control from the bears. As a result, it could be an indicator that prices are poised to continue their upward trajectory, potentially unlocking profitable long positions for traders. Conversely, a Bearish Inside Day unfolds when an Inside Day is followed by a breakout that plunges below the Inside Day's lowest point. Such a scenario marks a victory for the bears, suggesting they've wrested control from the bulls. It could imply that prices are likely to embark on a downward course, presenting potentially lucrative opportunities for short selling. In the arena of trading, bullish breakouts following an Inside Day are frequently perceived as potent buy signals. This trend often signifies a ripe opportunity to initiate a long position, leveraging the momentum of the market as it tips in favor of the bulls. Conversely, a bearish breakout stemming from an Inside Day is typically seen as a strong sell signal. Such a trend points towards an opportune window to establish a short position, capitalizing on a potential downturn as the market sentiment swings towards the bears. The validation of a breakout following an Inside Day significantly benefits from volume analysis. A breakout that coincides with heightened trading volume typically denotes a more substantial commitment from market participants, thus serving as a more dependable signal. In addition to volume analysis, momentum oscillators such as the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) can furnish valuable insights. When employed synergistically with Inside Day patterns, these tools can provide a more holistic view of market dynamics. As with all trading strategies, Inside Day techniques come with inherent risks and limitations. Traders must be aware of the potential for false breakouts, which can lead to unwelcome losses. Moreover, it is essential to recognize that Inside Days do not always presage a shift in market trend. Thus, incorporating them as one element within a broader, diversified trading strategy is key to mitigating these potential risks and optimizing trading success. An Inside Day in the context of the stock market can serve as a reliable barometer, reflecting potential reversals or continuations of trends. It carries notable significance during the earnings season, when stocks may be more prone to volatility, and market trends may not be as predictable. In the build-up to an earnings announcement, Inside Days could be indicative of investor indecision, representing a standoff between bullish and bearish investors. It portrays a market narrative where neither the buyers nor the sellers are able to gain the upper hand, leading to the current day's price remaining 'inside' the previous day's range. When it comes to forex trading, an Inside Day can be a valuable tool for identifying consolidation periods and potential breakout points. The foreign exchange market, with its round-the-clock operation, can exhibit significant price changes over short periods due to the influence of various global factors. Inside Days can offer crucial insights into the dynamics of supply and demand. They can help traders decipher potential price direction in markets that might be influenced by a host of factors, from weather patterns affecting agricultural commodities to geopolitical issues impacting oil prices. Particularly in volatile commodities, Inside Days might represent a breather in price movement, indicating a pause after significant price changes. This pause often embodies a period of market agreement or uncertainty about a commodity's future direction. Inside Day is a crucial concept in technical analysis, reflecting a state of market equilibrium when the day's price range falls within the previous day's range. This phenomenon, indicative of potential market trend reversals, is prevalent across various markets, including stocks, forex, and commodities. Key variations include Bullish Inside Days and Bearish Inside Days, which suggest potential upward and downward trends, respectively. Traders harness these patterns to identify strategic entry points, utilizing bullish breakouts as buy signals and bearish breakouts as sell signals. When used alongside volume analysis and momentum oscillators, Inside Day patterns can provide a comprehensive market overview. Despite its utility, traders must approach Inside Day strategies cautiously, considering the risks of false breakouts and acknowledging that Inside Days don't always signal trend shifts. Overall, recognizing Inside Days enhances decision-making, optimizing profits, and minimizing losses in trading.What Is an Inside Day?

Structure of Inside Day

Role of High and Low Prices

Comparison With the Previous Day's Range

Evaluating the Significance of Inside Day

Reflection of Market Indecision

Serving as Harbingers of Market Trends

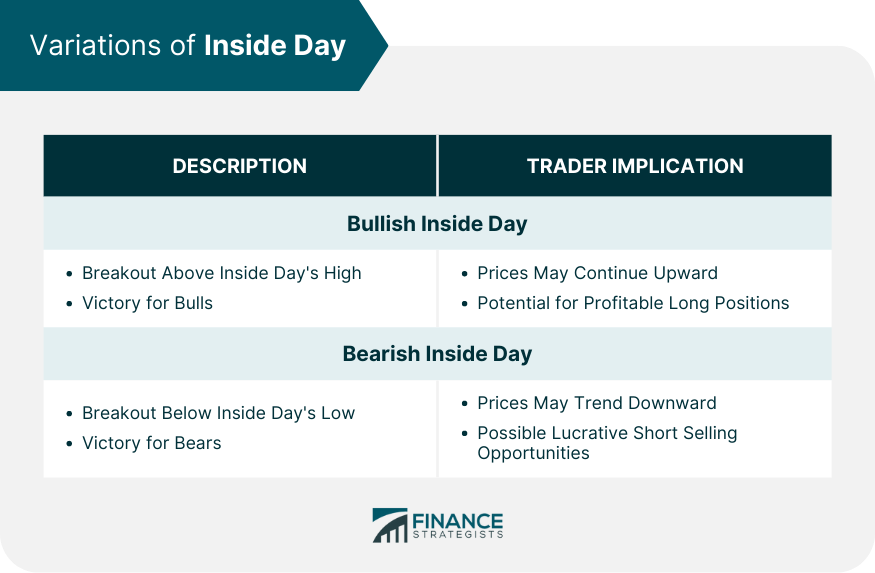

Variations of Inside Day

Ascendance of the Bull: Bullish Inside Day

Roar of the Bear: Bearish Inside Day

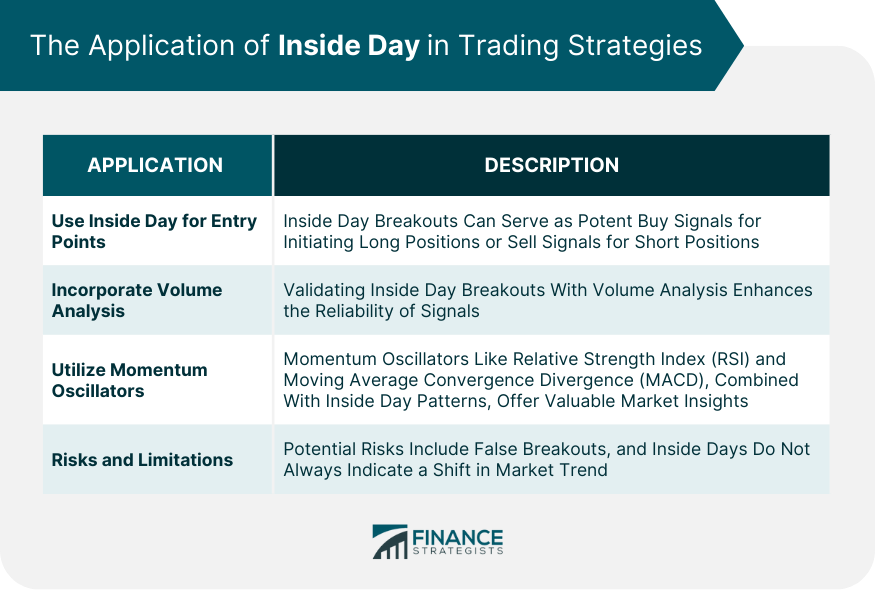

Application of Inside Day in Trading Strategies

Using Inside Day for Entry Points

Capitalizing on Buy Signals

Identifying Sell Signals

Using Inside Day in Combination With Other Indicators

Incorporating Volume Analysis

Utilizing Momentum Oscillators

Risks and Limitations of Inside Day Strategies

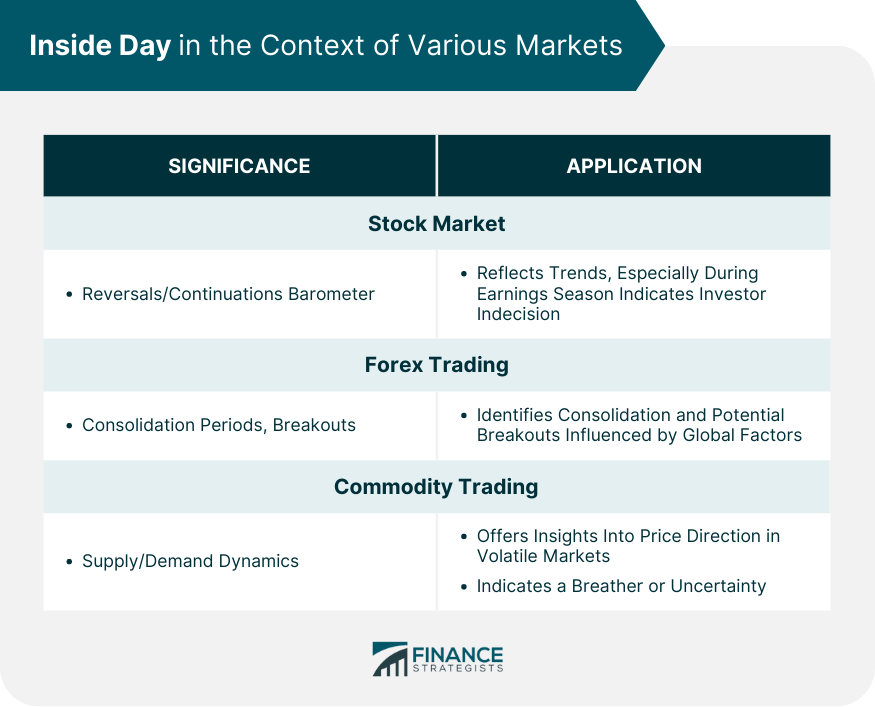

Inside Day in the Context of Various Markets

Stock Market

Inside Day in Forex Trading

Inside Day in Commodity Trading

Bottom Line

Inside Day FAQs

An Inside Day occurs in financial trading when the entire price range of a given day falls within the price range of the previous day. This means both the day's highest and lowest prices are lower and higher, respectively than those of the prior day. Inside Days often highlight a moment of market equilibrium and can serve as a potential signal of a shift in the market trend.

Inside Days can act as possible predictors of market trends. If an Inside Day is followed by a price breakout, it could signify the onset of a new trend. A breakout above the Inside Day's high suggests a potential bullish (upward) trend, while a breakout below its low could hint at a bearish (downward) trend.

Yes, Inside Day strategies can be employed across diverse markets, including the stock market, forex trading, and commodity trading. These strategies can help identify potential trend reversals or continuations and spotlight periods of consolidation and potential breakout points.

Like all trading strategies, Inside Day approaches come with inherent risks and limitations. One of these is the possibility of false breakouts, which can result in potential losses. Also, Inside Days might not always signal a trend change, occasionally representing market noise instead. Therefore, it's crucial to incorporate Inside Day strategies within a larger, more comprehensive trading approach.

A Bullish Inside Day transpires when an Inside Day is followed by a breakout above its high, indicating a potential upward trend as the bulls gain control. Conversely, a Bearish Inside Day occurs when a breakout is seen below the Inside Day's low, suggesting a potential downward trend as the bears take the reins. These concepts are critical when applying Inside Days as part of a trading strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.