Stocks and bonds are two primary investment vehicles in the financial market, each offering unique features and opportunities. Stocks represent ownership in a company and entitle shareholders to a proportionate share of the company's assets and earnings. Bonds, on the other hand, are debt instruments issued by governments, corporations, or municipalities to raise capital. Investors who purchase bonds essentially lend money to the issuer in exchange for regular interest payments and the return of the principal upon maturity. Investing in stocks and bonds plays a pivotal role in achieving long-term financial goals such as retirement planning, wealth preservation, and capital growth. These investment vehicles offer the potential for higher returns compared to traditional savings accounts or fixed deposits. This involves setting clear financial goals, determining risk tolerance, and creating a well-balanced asset allocation plan. Setting financial goals allows individuals to identify their investment objectives. Determining risk tolerance helps investors assess their comfort level with potential fluctuations in investment values. Allocating assets between stocks and bonds depends on factors such as age, financial situation, and risk tolerance. Additionally, diversification strategies involving a mix of stocks and bonds can reduce portfolio volatility and minimize risk. To make informed investment decisions in the stock market, investors need to conduct thorough research and analysis. Fundamental analysis involves evaluating a company's financial statements, analyzing its competitive position, and assessing its management team. By examining key financial metrics, understanding industry trends, and investigating a company's growth prospects, investors can gauge its intrinsic value and make better investment choices. Technical analysis, on the other hand, focuses on studying historical price patterns, chart trends, and using indicators and oscillators to predict future stock price movements. Investing in bonds requires a different set of research and analysis techniques compared to stocks. Evaluating bond issuers involves assessing their creditworthiness and credit ratings, which reflect their ability to fulfill interest and principal payment obligations. Investors need to analyze a bond issuer's financial health, debt levels, profitability, and cash flow. Understanding bond yields and prices is essential to grasp the income potential and risk associated with bond investments. Yield-to-maturity provides a measure of the expected return from holding a bond until maturity, while yield curve analysis helps investors gauge market expectations of future interest rates. When it comes to investing in stocks, selecting the right brokerage account is crucial. A brokerage account serves as a platform that allows individuals to buy and sell stocks. Factors to consider when choosing a brokerage account include the account fees, commission charges, trading platform usability, research tools and resources provided, customer service quality, and account security measures. Once you have chosen a brokerage account, you can start placing stock orders. Stock orders specify the instructions for buying or selling stocks. A market order is a type of order where you buy or sell stocks at the prevailing market price. It ensures that the trade is executed promptly, but the exact price at which the order gets filled may vary. Market orders are suitable for investors looking for quick execution and are less concerned about the specific price. Limit orders allow you to set a specific price at which you are willing to buy or sell a stock. With a buy limit order, you specify the maximum price you are willing to pay, while with a sell limit order, you set the minimum price you are willing to accept. Limit orders provide more control over the price at which your trade gets executed but may not be immediately filled if the stock price doesn't reach your specified limit. Stop orders, also known as stop-loss orders, are used to limit potential losses or protect profits. A sell stop order is placed below the current market price, and if the stock price falls to or below the specified stop price, the order gets triggered and becomes a market order. Similarly, a buy stop order is placed above the current market price, and if the stock price reaches or exceeds the stop price, the order becomes a market order. Stop orders help investors implement risk management strategies and automate the execution of trades. Once you have invested in stocks, it's important to regularly monitor the performance of your investments. Keeping track of how your stocks are performing allows you to make informed decisions about whether to hold, sell, or buy additional shares. Monitoring stock performance involves reviewing financial news, analyzing company updates and announcements, and staying aware of market trends. It's also important to periodically assess your investment portfolio and make any necessary adjustments based on changes in your financial goals or risk tolerance. Bonds can be purchased in either the primary market or the secondary market. In the primary market, bonds are issued directly by the issuer and sold to investors. This is typically done through an initial public offering (IPO) or a private placement. Investing in bonds in the primary market allows investors to buy newly issued bonds at their face value. In the secondary market, investors buy and sell bonds among themselves. Bond prices in the secondary market may differ from their face value due to changes in interest rates, credit ratings, and market demand. Another option for investing in bonds is through bond funds. Bond funds are mutual funds or exchange-traded funds (ETFs) that pool together investors' money to invest in a diversified portfolio of bonds. Investing in bond funds provides several advantages, including professional management, diversification across a range of bonds, and ease of buying and selling shares. Bond funds come in various types, such as government bond funds, corporate bond funds, and municipal bond funds, allowing investors to choose the fund that aligns with their investment goals and risk tolerance. When investing in bonds, it's important to consider the various yields associated with bond investments. Yields indicate the income potential of a bond and help investors assess the attractiveness of a particular bond. The coupon rate of a bond is the fixed annual interest rate that the issuer pays to bondholders. It is usually expressed as a percentage of the bond's face value. The coupon rate determines the regular income that investors receive from owning the bond. The yield of a bond, on the other hand, takes into account the current market price of the bond and reflects the total return an investor can expect to earn. As bond prices fluctuate in the secondary market, the yield may differ from the coupon rate. Two commonly used yield measures are the current yield and the yield to maturity. The current yield is calculated by dividing the annual interest payment by the current market price of the bond. It provides a snapshot of the bond's yield at a specific point in time. On the other hand, the yield to maturity represents the total return an investor can expect if the bond is held until its maturity date, assuming all interest payments are reinvested at the same yield. The yield to maturity takes into account not only the coupon payments but also any capital gains or losses that may arise if the bond is bought at a premium or discount to its face value. Investing in bonds comes with certain risks that investors should be aware of and manage effectively. Interest rate risk is the most significant risk faced by bond investors. It refers to the potential for changes in interest rates to affect the value of existing bonds. When interest rates rise, the prices of existing bonds typically decrease, as newly issued bonds offer higher coupon rates. Conversely, when interest rates fall, the prices of existing bonds tend to increase. Investors need to consider their investment horizon and the potential impact of interest rate fluctuations on their bond investments. Credit risk pertains to the possibility that the issuer of a bond may default on its interest payments or fail to repay the principal amount at maturity. Bond issuers with lower credit ratings are considered to have a higher credit risk. Investors should carefully assess the creditworthiness of bond issuers by reviewing credit ratings from rating agencies and analyzing the financial health and stability of the issuing entity. Diversification across different issuers and bond types can help mitigate credit risk. To ensure the effectiveness of your investment strategy, it's important to conduct regular portfolio reviews. This involves assessing the performance of your investments, comparing them against your financial goals, and making any necessary adjustments. Regular portfolio reviews help investors stay on track, identify underperforming assets, and capitalize on new opportunities. As market conditions change and investment values fluctuate, the asset allocation of your portfolio may deviate from your original plan. Rebalancing involves realigning your portfolio by buying or selling assets to restore the desired asset allocation. Rebalancing ensures that your portfolio remains aligned with your risk tolerance and long-term investment objectives. Managing your portfolio also involves considering the tax implications of your investment decisions. Different types of investments are subject to varying tax treatments. For example, dividends received from stocks are typically taxable, while interest income from municipal bonds may be tax-exempt. It's important to understand the tax implications of your investments and consider tax-efficient strategies such as holding certain investments in tax-advantaged accounts like individual retirement accounts (IRAs) or utilizing tax-loss harvesting techniques to offset capital gains. Investing in stocks and bonds can be complex, and seeking professional advice can be beneficial, especially for individuals who are new to investing or have substantial assets to manage. Financial advisors can provide personalized guidance based on your financial goals, risk tolerance, and investment horizon. They can help you develop a comprehensive investment plan, select suitable stocks and bonds, and navigate market fluctuations. Investing in stocks and bonds is a fundamental aspect of achieving long-term financial goals and building wealth. Stocks represent ownership in a company, while bonds are debt instruments issued by governments, corporations, or municipalities. To invest in stocks and bonds effectively, it is crucial to develop an investment strategy. This involves setting clear financial goals, determining risk tolerance, and allocating assets between stocks and bonds. Diversification strategies further enhance portfolio stability and reduce risk. When investing in bonds, it is important to evaluate bond issuers, understand bond yields and prices, and manage bond market risks. Assessing creditworthiness, analyzing financial health, and understanding yield measures such as coupon rates and yields to maturity are critical. Investing in stocks requires selecting the right brokerage account, understanding different types of stock orders, and monitoring stock performance. On the other hand, investing in bonds involves considering primary and secondary markets, bond funds, and yield considerations. Managing and reviewing your investment portfolio is crucial for long-term success. Regular portfolio reviews, rebalancing, tax considerations, and seeking professional advice can optimize your investment strategy and help achieve your financial goals.Overview of Stocks and Bonds

How to Invest in Stocks and Bonds

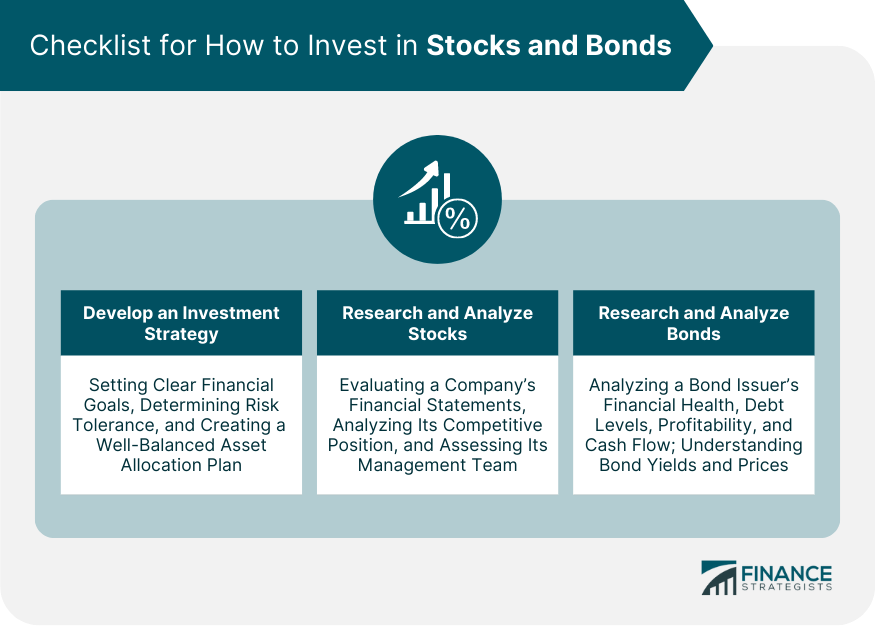

Developing an Investment Strategy

Researching and Analyzing Stocks

Researching and Analyzing Bonds

Investing in Stocks

Choosing a Brokerage Account

Placing Stock Orders

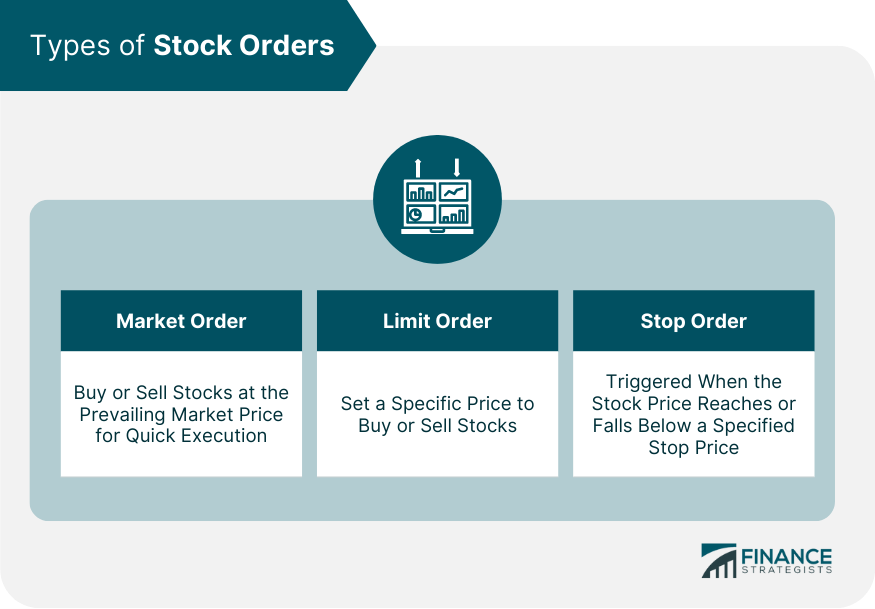

Market Orders

Limit Orders

Stop Orders

Monitoring Stock Performance

Investing in Bonds

Buying Bonds

Primary Market vs Secondary Market

Investing in Bond Funds

Considering Yield

Coupon Rates and Yields

Current Yield vs Yield To Maturity

Managing Bond Market Risks

Interest Rate Risk

Credit Risk

Reviewing Your Portfolio

Reviewing Portfolio Regulary

Rebalancing Your Portfolio

Considering Tax Implications

Seeking Professional Advice

Conclusion

How to Invest in Stocks and Bonds FAQs

Begin by learning the basics of what stocks and bonds are. Then, determine your risk tolerance and financial goals. You can start investing in stocks and bonds through brokerage accounts, retirement accounts, or directly from the issuer. Remember, diversification is key when building your investment portfolio.

Investing in stocks carries the risk of market volatility and the potential loss of your investment if a company underperforms. Bonds, while generally considered safer, have risks related to interest rate changes, creditworthiness of the issuer, and inflation. It's crucial to assess these risks before investing.

You can start investing with relatively small amounts of money. Many online brokerages allow you to purchase fractional shares of stocks, and some bonds can be bought for as little as $100. However, diversification and the size of your portfolio is important for managing risk.

The best strategy will depend on your individual goals, risk tolerance, and investment timeline. However, diversification and a balance between stocks and bonds is generally recommended. Also, consider whether short-term or long-term investing aligns with your financial objectives.

Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. This might involve rebalancing your portfolio occasionally, adjusting your strategy in response to personal or market changes, and deciding when to sell certain investments. You might also consider getting help from a financial advisor.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.