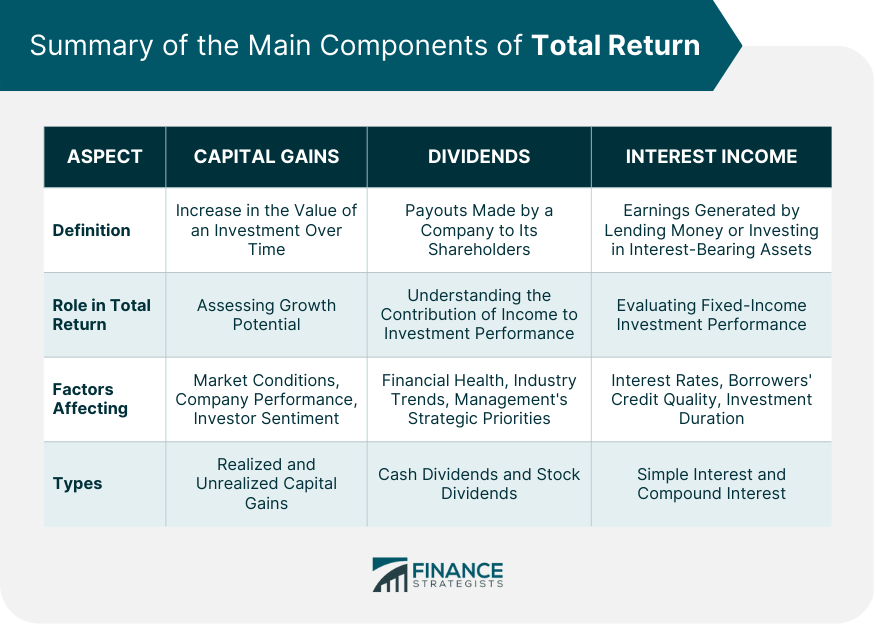

Total return is a comprehensive measure of investment performance that includes capital gains and income generated through dividends or interest. It is an important tool for comparing investment options and assessing their profitability and risk. Total return provides a holistic view of an investment's performance, allowing investors to evaluate the true growth of their portfolios and make strategic choices based on their goals and risk tolerance. The main components of total return are capital gains, dividends, and interest income. By understanding these components, investors can better understand how their investments are performing and how different factors contribute to their overall returns. Capital gains refer to the increase in the value of an investment, such as stocks or real estate, over time. A capital gain is realized when an asset is sold at a higher price than its original purchase price. Capital gains are an essential component of total return, as they represent the appreciation of an investment's value. Realized capital gains occur when an investor sells an asset at a profit, while unrealized capital gains represent the increase in value of an asset that has not yet been sold. Both realized and unrealized capital gains contribute to total return. However, realized gains have tax implications, whereas unrealized gains do not. Investors should consider the impact of taxes when calculating their total returns. Capital gains play a significant role in determining total return, as they represent the appreciation of an investment's value over time. To calculate total return, investors need to account for both realized and unrealized capital gains, as well as any income generated by the investment. By including capital gains in the total return calculation, investors can better assess the growth potential of their assets. Several factors can influence capital gains, including market conditions, company performance, and investor sentiment. Market trends can drive asset prices up or down, while a company's financial health and growth prospects can impact its stock price. Additionally, investor sentiment can cause fluctuations in asset prices, as positive or negative news can lead to changes in demand for a particular investment. Dividends are payouts made by a company to its shareholders, typically in the form of cash or additional shares of stock. They represent a portion of a company's earnings that is distributed to investors as a reward for their ownership in the company. Dividends are an important component of total return, as they provide investors with a consistent income stream. Cash dividends are the most common type of dividend and involve a company distributing a portion of its earnings to shareholders in the form of cash. Cash dividends provide investors with a steady income stream and can be used to reinvest in additional shares or for other purposes. They are typically paid on a quarterly basis, although some companies may pay them monthly or annually. Stock dividends involve a company issuing additional shares of its stock to shareholders instead of cash. This type of dividend allows investors to increase their ownership in the company without requiring an additional cash outlay. Stock dividends can also be advantageous for companies that want to conserve cash while still rewarding their shareholders. Dividends play an important role in total return, as they provide investors with an income stream that can enhance their overall returns. When calculating total return, investors need to account for both cash and stock dividends and any reinvested dividends. By including dividends in the total return calculation, investors can better understand the contribution of income to their overall investment performance. Several factors can influence a company's ability and willingness to pay dividends, including its financial health, industry trends, and management's strategic priorities. A company's profitability and cash flow can directly impact its ability to pay dividends, while industry trends and competitive pressures may influence management's decisions regarding dividend policies. Additionally, a company's dividend history and investor expectations can play a role in shaping its dividend strategy. Interest income refers to the earnings generated by lending money or investing in interest-bearing assets, such as bonds or savings accounts. It represents a return on the principal amount invested, typically paid out periodically. Interest income is an important component of total return, as it provides investors a steady income stream. Simple interest is calculated by multiplying the principal amount, the interest rate, and the length of time the money is invested or borrowed. It is a straightforward method of calculating interest income and is commonly used for short-term investments or loans. Simple interest does not take into account the compounding effect, which can significantly impact the overall return on investment. Compound interest is calculated by taking into account not only the principal amount and interest rate but also the interest earned on the previously accumulated interest. This compounding effect can significantly enhance an investment's total return, especially over longer periods. Compound interest is commonly used for long-term investments, such as retirement accounts or bond investments. Interest income contributes to total return by providing a consistent stream of income for investors. When calculating total return, investors should account for both simple and compound interest and any reinvested interest income. By incorporating interest income into the total return calculation, investors can better evaluate the performance of their fixed-income investments and compare them with other asset classes. Several factors can influence interest income, including interest rates, borrowers' credit quality, and investment duration. Changes in interest rates can impact the income generated by fixed-income investments, while the credit quality of borrowers can affect the likelihood of receiving interest payments as scheduled. Additionally, the duration of the investment can influence the overall return, as longer-term investments are typically more sensitive to interest rate fluctuations. Reinvesting dividends and interest income can significantly enhance an investment's total return due to the compounding effect. When investors reinvest their earnings, they effectively increase the principal amount invested, leading to higher future income. Over time, this compounding effect can lead to exponential growth in the value of an investment, especially when reinvestments are made consistently. DRIPs are programs offered by companies or brokerage firms that allow investors to automatically reinvest their cash dividends into additional shares of the company's stock. DRIPs can effectively increase an investor's ownership in a company and take advantage of the compounding effect. By participating in a DRIP, investors can benefit from the potential growth of their investments without incurring additional transaction costs. Automatic reinvestment of interest income involves using the interest earned on an investment to purchase additional assets or to increase the principal amount invested in the same asset. This strategy enables investors to benefit from the compounding effect, as their interest income is continually reinvested, generating higher future returns. Automatic reinvestment of interest income can be particularly advantageous for long-term investors seeking to maximize their total return. The impact of reinvestment on long-term investment performance can be substantial, as the compounding effect allows for exponential growth in the value of an investment. By consistently reinvesting dividends and interest income, investors can increase their principal amount invested, which in turn generates higher future returns. Over time, reinvestment strategies can significantly contribute to an investor's overall total return and help them achieve their financial goals. Total return indices are financial indices that track the performance of a specific group of assets, accounting for both price appreciation and income generation. They provide a comprehensive view of the market or asset class performance, making them an essential tool for benchmarking and performance evaluation. Total return indices help investors understand the true growth of their investments and compare their performance against a relevant benchmark. The S&P 500 Total Return Index is a widely followed benchmark that tracks the performance of the 500 largest U.S. companies, accounting for both capital gains and dividend income. It serves as a popular indicator of the overall health of the U.S. stock market and is commonly used by investors to compare their investment performance with the broader market. The MSCI World Total Return Index is a global equity index that captures the performance of large and mid-cap companies across 23 developed market countries. By accounting for both capital gains and dividend income, the index provides a comprehensive view of the global equity market's performance. Investors can use the MSCI World Total Return Index as a benchmark for their international investments. The Bloomberg Barclays Global Aggregate Bond Total Return Index is a benchmark that tracks the performance of investment-grade fixed-income securities from around the world. By accounting for both capital gains and interest income, the index provides a comprehensive measure of the global bond market's performance. Investors can use this index to evaluate the performance of their fixed-income investments and compare them with the broader market. Total return indices serve as valuable tools for investors to evaluate their investment performance against relevant benchmarks. By comparing their total returns with those of a specific index, investors can gauge the effectiveness of their investment strategies and make informed decisions about their portfolios. Using total return indices can help investors identify areas of strength and weakness in their portfolios and potential opportunities for improvement and growth. Capital gains are subject to taxation, with the tax rate depending on the investor's income level and the holding period of the investment. Short-term capital gains resulting from the sale of investments held for one year or less are generally taxed at the investor's ordinary income tax rate. Long-term capital gains arising from the sale of investments held for more than one year typically receive preferential tax treatment and are subject to lower tax rates. Dividends are also subject to taxation, with specific tax treatment depending on the type of dividend received. Qualified dividends, which are typically paid by U.S. corporations and some foreign corporations, are taxed at a lower rate, similar to long-term capital gains. Non-qualified dividends, such as those paid by real estate investment trusts (REITs) or certain foreign corporations, are taxed at the investor's ordinary income tax rate. Interest income is generally subject to federal and, in some cases, state and local income taxes. The tax treatment of interest income depends on the type of investment and the investor's tax bracket. For example, interest earned on U.S. Treasury securities is subject to federal income tax but is exempt from state and local taxes. Conversely, interest earned on municipal bonds is generally exempt from federal income tax and, in some cases, state and local taxes as well. Investors can implement various tax-efficient strategies to help minimize the impact of taxes on their total return. Some potential strategies include investing in tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k) plans, which allow for tax-deferred or tax-free growth. Additionally, investors can consider investing in tax-exempt securities, such as municipal bonds, or strategically managing their capital gains and losses to minimize their tax liability. Understanding total return is essential for making informed investment decisions, as it offers a comprehensive measure of investment performance that accounts for both capital gains and income generation. By considering all the components of total return – capital gains, dividends, and interest income – investors can better assess the profitability and risk of various assets. Balancing risk and reward in pursuit of optimal total return can help investors achieve their financial goals while navigating the complexities of market fluctuations and tax implications. To optimize your total return and build a tailored investment strategy, consider seeking the guidance of professional wealth management services. Wealth managers can provide valuable insights, assist in tax-efficient investing, and help you create a diversified portfolio aligned with your financial goals and risk tolerance. Don't leave your financial future to chance – contact a wealth management professional today to get started on the path to long-term financial success.What Is Total Return?

Capital Gains in Total Return

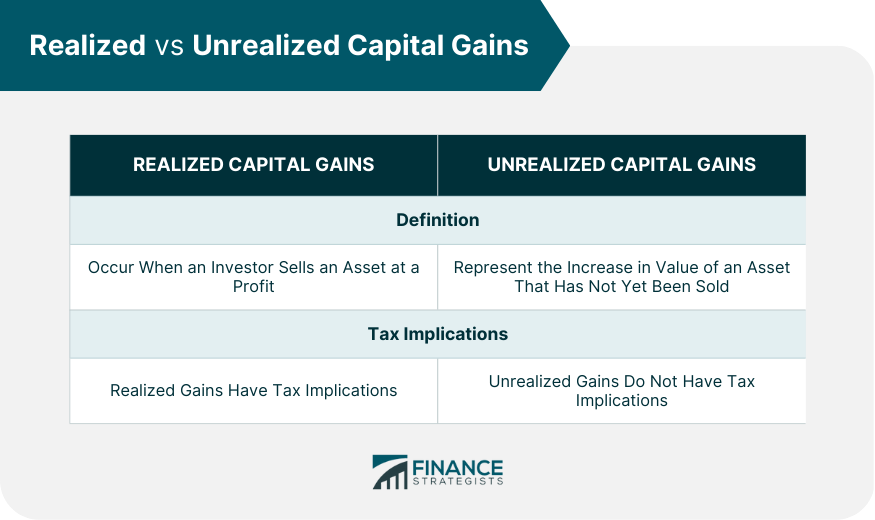

Realized vs Unrealized Capital Gains

Role of Capital Gains in Total Return Calculation

Factors Affecting Capital Gains

Dividends in Total Return

Types of Dividends

Cash Dividends

Stock Dividends

Role of Dividends in Total Return Calculation

Factors Affecting Dividends

Interest Income in Total Return

Types of Interest Income

Simple Interest

Compound Interest

Role of Interest Income in Total Return Calculation

Factors Affecting Interest Income

Reinvestment of Dividends and Interest Income

Compounding Effect on Total Return

Dividend Reinvestment Plans (DRIPs)

Automatic Reinvestment of Interest Income

Impact of Reinvestment on Long-Term Performance

Total Return Indices

Popular Total Return Indices

S&P 500 Total Return Index

MSCI World Total Return Index

Bloomberg Barclays Global Aggregate Bond Total Return Index

Using Total Return Indices for Benchmarking and Performance Evaluation

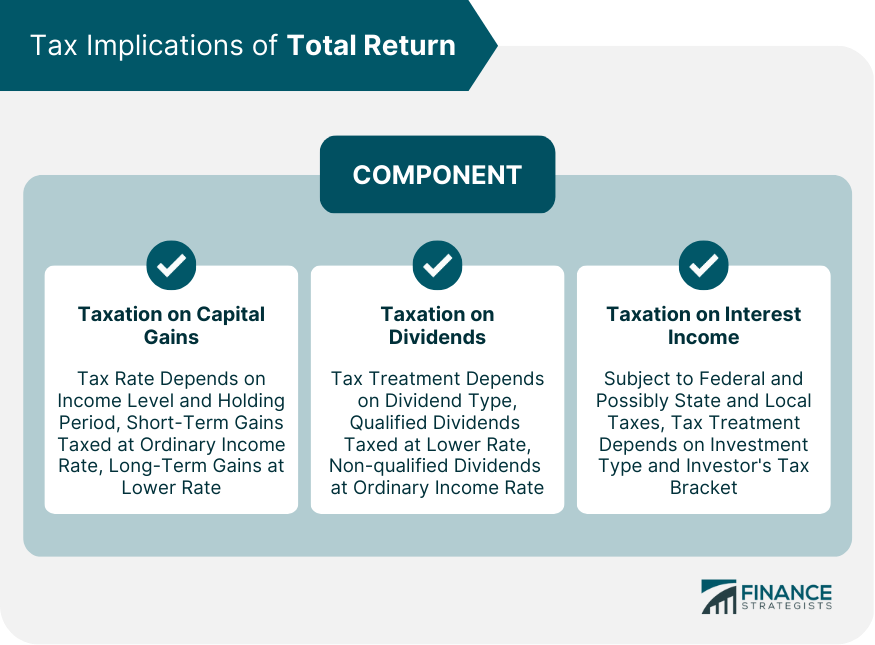

Tax Implications of Total Return

Taxation on Capital Gains

Taxation on Dividends

Taxation on Interest Income

Tax-Efficient Investment Strategies

Final Thoughts

Total Return FAQs

Total return is a comprehensive measure of investment performance that accounts for both capital gains and income generation, such as dividends and interest income. By considering total return, investors can better assess the profitability and risk of various assets, allowing them to make informed decisions and achieve their financial goals.

Capital gains represent the increase in the value of an investment over time, such as stocks or real estate. They are an essential component of total return, as they showcase the appreciation of an investment's value. Both realized and unrealized capital gains are considered when calculating total return, providing a more accurate reflection of investment performance.

Dividends are payouts made by a company to its shareholders, typically in the form of cash or additional shares of stock. They contribute to total return by providing investors with a consistent income stream. When calculating total return, investors need to account for both cash and stock dividends, as well as any reinvested dividends, to better understand the contribution of income to their overall investment performance.

Interest income is generated by lending money or investing in interest-bearing assets, such as bonds or savings accounts. It contributes to total return by providing a steady stream of income for investors. When calculating total return, investors should account for both simple and compound interest, as well as any reinvested interest income, to better evaluate the performance of their fixed-income investments.

Taxes can impact total return by reducing the net gains and income generated by an investment. Capital gains, dividends, and interest income are subject to varying tax rates depending on factors such as holding period, income level, and type of investment. Implementing tax-efficient strategies, such as investing in tax-advantaged accounts or tax-exempt securities, can help minimize the impact of taxes on total return and enhance overall investment performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.