Government bonds are debt securities issued by a government to support its spending and obligations. Investors who buy these bonds are, in essence, lending money to the government. In return, the government promises to pay the investor a specific rate of interest over a specified period until the bond reaches its maturity date, at which point the initial investment (or principal) is returned. The main components of government bonds are the principal amount, the coupon rate, and the maturity date. The principal amount is the money that the investor lends to the government, the coupon rate is the interest that the government pays to the investor, and the maturity date is the date when the government has to repay the principal amount to the investor. There are several types of government bonds, including Treasury bonds (T-bonds), Treasury notes (T-notes), Treasury bills (T-bills), and Treasury Inflation-Protected Securities (TIPS) in the United States. Each of these types of bonds varies in terms of their maturity periods, interest rates, and method of interest payments. The most straightforward method to buy government bonds is to purchase them directly from the issuing government. In the United States, for example, you can buy bonds directly from the government through a platform called TreasuryDirect. The first step in buying government bonds directly from the U.S. government is to open an account with TreasuryDirect. The account setup process involves providing some basic information, including your Social Security Number (or Employer Identification Number), email address, U.S. address of record, and bank account information for purchases and redemptions. Once your account is set up, you can use it to buy, manage, and redeem various types of U.S. Treasury securities. U.S. Treasury securities are sold through regular public auctions. As a TreasuryDirect account holder, you can participate in these auctions to purchase Treasury securities at competitive market rates. The U.S. Treasury announces the dates of these auctions in advance, so you can prepare and ensure you have sufficient funds in your account for any purchases. Non-Competitive bidding is simpler and guarantees that you'll receive the security you want, but at the high yield determined by the auction process. This method is typically suitable for individual investors. In contrast, competitive bidding allows you to specify the yield you're willing to accept. However, you risk not receiving the bond if your specified yield is higher than the auction's high yield. This method is more common among institutional investors. Alternatively, investors can purchase government bonds through financial institutions or brokerage firms. This approach offers the flexibility to buy bonds when it suits the investor, not just when the government is issuing new bonds. Brokerages provide access to a wide range of investments, including government bonds. They also offer tools and resources to help you make informed investment decisions. However, keep in mind that brokerages typically charge a fee for their services. Mutual funds pool money from many investors to invest in a diversified portfolio of assets, which often include government bonds. When you invest in a bond mutual fund, you're buying shares of the mutual fund rather than individual bonds. This approach offers diversification and professional management but may come with higher fees. Similar to mutual funds, bond ETFs pool investor money to invest in a portfolio of bonds. However, ETFs are traded on an exchange like individual stocks. This provides intra-day liquidity, meaning you can buy or sell ETF shares at any time during the trading day. The secondary market is where investors buy and sell securities they already own. It's called the secondary market because it's one step removed from the primary market, where securities are created. Buying government bonds in the secondary market provides the flexibility to buy bonds at any time, not just when a new issue is being released. However, the prices of bonds in the secondary market can be affected by various factors, including interest rates, so the price you pay may be more or less than the bond's face value. Government bonds are considered among the most secure investments because they're backed by the full faith and credit of the government issuing them. For instance, U.S. Treasury securities are backed by the U.S. government, which has never defaulted on its debt obligations. This assurance of payment even in uncertain economic times makes government bonds a haven for conservative investors seeking to preserve their capital. While the default risk with corporate bonds can vary significantly depending on the financial health of the issuing company, government bonds, particularly those issued by stable governments, have virtually zero default risk. This reliability can bring peace of mind to investors, knowing that their initial investment is safe. Government bonds typically pay interest semi-annually, providing a steady and predictable income stream for bondholders. This regular income is particularly appealing to retirees and other income-focused investors who rely on their investments to cover living expenses. The interest rate or the coupon rate is fixed over the life of the bond. This fixed rate provides certainty in terms of investment returns, regardless of market fluctuations, making government bonds an excellent option for investors seeking a stable income. Government bonds are highly liquid investments. A liquid market ensures that investors can buy or sell bonds relatively quickly and without significantly affecting the bond's price. The secondary market for government bonds, especially U.S. Treasuries, is highly active and has many participants, ensuring that there are always potential buyers when an investor wants to sell. Moreover, this liquidity can provide financial flexibility to investors, allowing them to convert their investments into cash quickly if needed. For instance, in the U.S., the interest income earned from Treasury securities is exempt from state and local income taxes, which can lead to significant tax savings, particularly for investors in high-tax states. This tax advantage effectively increases the after-tax yield of these bonds, making them more attractive compared to other taxable fixed-income investments. However, the tax implications of investing in government bonds can be complex and can vary from one jurisdiction to another, so it's essential for investors to seek tax advice relevant to their particular circumstances. When you invest in government bonds, you're lending money to the government that can be used for various public services and infrastructure projects such as education, healthcare, and transportation. In this sense, investing in government bonds not only potentially provides financial benefits but also allows investors to contribute to societal development. Investing in government bonds, therefore, can offer a sense of pride and fulfillment, knowing that your money is being used to fund projects that benefit the community and the nation as a whole. Interest rates and bond prices have an inverse relationship - when interest rates rise, bond prices fall, and vice versa. Therefore, if you need to sell your bond before maturity during a period of rising interest rates, you may have to sell it at a price lower than its face value. This situation could lead to a capital loss. Furthermore, bonds with longer maturities are more sensitive to changes in interest rates. Therefore, if you're investing in long-term government bonds, you could be exposed to a significant level of interest rate risk. The importance of understanding interest rate risk cannot be overstated, especially in an environment where interest rates are expected to rise. In such situations, it's essential to balance the security offered by government bonds with the potential for decreased returns or even losses. This is the risk that when a bond's interest payments or principal is returned to the investor, they will not be able to reinvest this money at a rate that provides the same return. For instance, if you're holding a bond paying a 5% coupon and interest rates fall to 3% by the time you receive your coupon payment, you'll have to reinvest at the lower rate. This reinvestment risk can potentially impact the overall yield of your investment and is particularly important for those relying on their bond investments for a steady stream of income. Bonds pay a fixed interest rate, but inflation can erode the purchasing power of these fixed payments. If inflation outpaces the bond's interest rate, it could reduce the real return of your investment. For example, if a bond pays a 2% annual return, but inflation is at 3%, the real, inflation-adjusted return is actually negative. This effect can be particularly damaging for long-term bonds, where the purchasing power of the fixed interest payments can be significantly eroded over time. While it's true that government bonds are generally considered liquid investments, liquidity can vary depending on the specific bond and market conditions. For example, bonds from smaller or less stable governments may be harder to sell, especially during periods of market stress. Furthermore, in volatile market conditions, you might have to sell the bond at a discount to its face value, leading to potential losses. Therefore, while liquidity risk with government bonds is typically lower than with other types of bonds, it is not completely eliminated. This allows you to know when to expect interest payments and when your principal will be returned. Investors can create a calendar or use investment tracking software to keep tabs on these critical dates. This type of organization can also help in tax planning, as interest income from bonds is taxable at the federal level. In addition, knowing when your bonds mature can help you plan for reinvestment opportunities or potential cash needs. By choosing to reinvest rather than spending the interest, you can take advantage of the power of compounding. This strategy allows your interest to generate its own interest, leading to exponential growth over time. Platforms like TreasuryDirect in the U.S. even offer an automatic reinvestment option, enabling you to easily compound your returns without the need for regular manual reinvestment. However, it's crucial to remember that reinvesting interest might not always be the best option, depending on individual financial goals and needs. For instance, retirees might prefer to use the interest as a source of regular income. Sometimes, financial circumstances may require you to sell your bonds before their maturity date. This could be because you need cash or because you want to realize capital gains due to favorable market conditions. However, selling bonds before maturity could also result in a capital loss if the market price is lower than your purchase price. Being prepared for these situations is an essential part of portfolio management. Knowing the market conditions and understanding the impact of interest rates on bond prices can help you make informed decisions about when it might be beneficial to sell your bonds early. Over time, changes in bond prices and interest payments can cause the actual allocation of your portfolio to drift away from your original asset allocation. Rebalancing involves selling or buying assets to restore your portfolio to its target allocation. For example, if the value of your government bonds has significantly increased due to a drop in interest rates, you might consider selling some of your bonds and reallocating the proceeds to other investments to maintain your desired risk level. Regular portfolio rebalancing can help manage risks and potentially enhance investment returns. However, it's important to consider transaction costs and potential tax implications when rebalancing your portfolio. Government bonds are a secure and reliable investment option issued by governments to raise funds. These debt securities provide investors with the assurance of capital preservation and a steady income stream through fixed-interest payments. Government bonds can be purchased directly from the government through platforms like TreasuryDirect or acquired through financial institutions, brokerages, or participation in the secondary market. They offer benefits such as safety and security, liquidity, favorable tax treatment, and the opportunity to contribute to public projects. However, investors should be aware of potential drawbacks, including interest rate risk, reinvestment risk, inflation risk, and liquidity risk. Effective portfolio management strategies, such as tracking interest payments and maturity dates, considering reinvestment options, and understanding when to sell bonds before maturity, can help investors optimize their government bond investments and balance risk and returns.Overview of Government Bonds

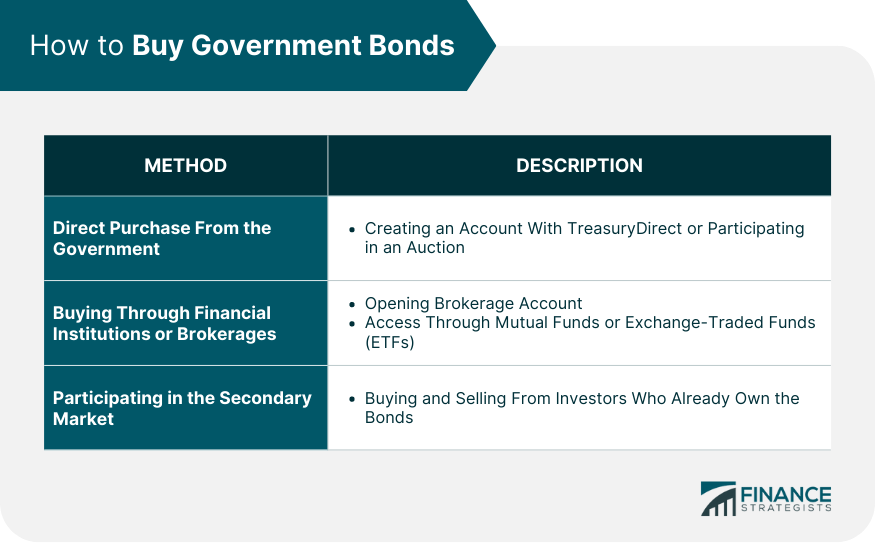

How to Buy Government Bonds

Direct Purchase From the Government

Creating an Account With TreasuryDirect

Participating in an Auction

Understanding Non-Competitive and Competitive Bidding

Buying Through Financial Institutions or Brokerages

Brokerage Accounts

Mutual Funds

Exchange-Traded Funds (ETFs)

Participating in the Secondary Market

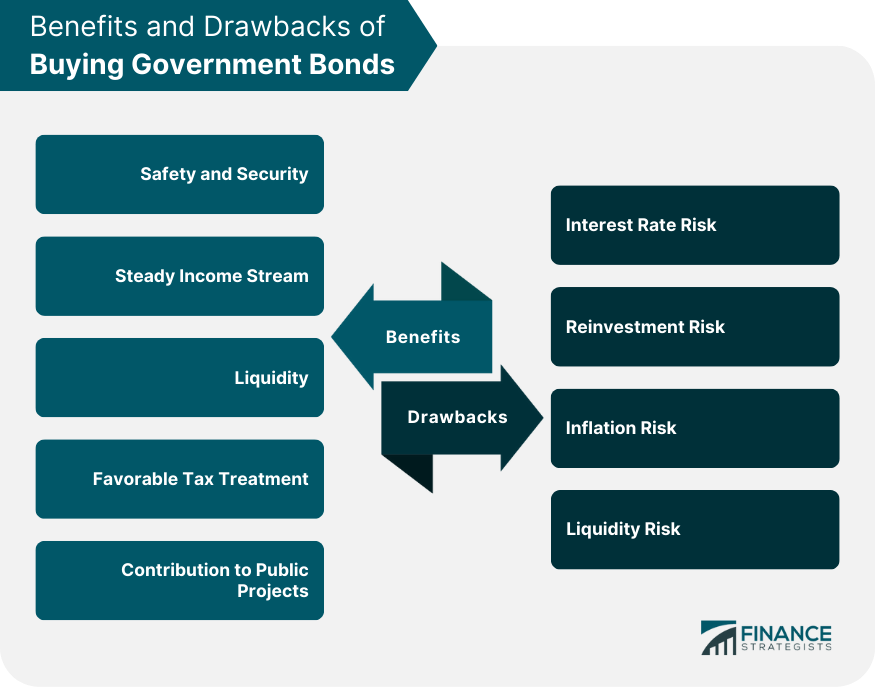

Benefits of Buying Government Bonds

Safety and Security

Steady Income Stream

Liquidity

Favorable Tax Treatment

Contribution to Public Projects

Drawbacks of Buying Government Bonds

Interest Rate Risk

Reinvestment Risk

Inflation Risk

Liquidity Risk

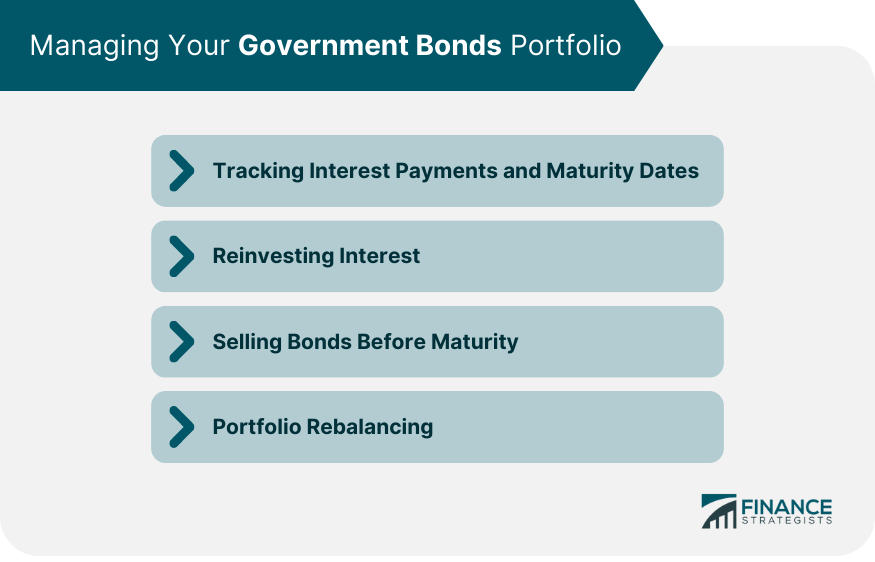

Managing Your Government Bonds Portfolio

Tracking Interest Payments and Maturity Dates

Reinvesting Interest

Selling Bonds Before Maturity

Portfolio Rebalancing

Final Thoughts

How to Buy Government Bonds FAQs

Yes, you can purchase government bonds directly from the government through platforms like TreasuryDirect in the United States.

To open an account with TreasuryDirect or a similar platform, you will typically need to provide basic information such as your Social Security Number (or Employer Identification Number), email address, U.S. address of record, and bank account information for purchases and redemptions.

Yes, you can purchase government bonds through financial institutions or brokerages. They provide access to a wide range of investments, including government bonds, and offer tools and resources to help you make informed investment decisions.

Buying government bonds lets you take advantage of safety and security, steady income, liquidity, favorable tax treatment, and indirectly contributing to public projects.

The various types of government bonds include Treasury bonds (T-bonds), Treasury notes (T-notes), Treasury bills (T-bills), and Treasury Inflation-Protected Securities (TIPS) in the United States. Each type has different characteristics, such as varying maturity periods, interest rates, and methods of interest payment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.