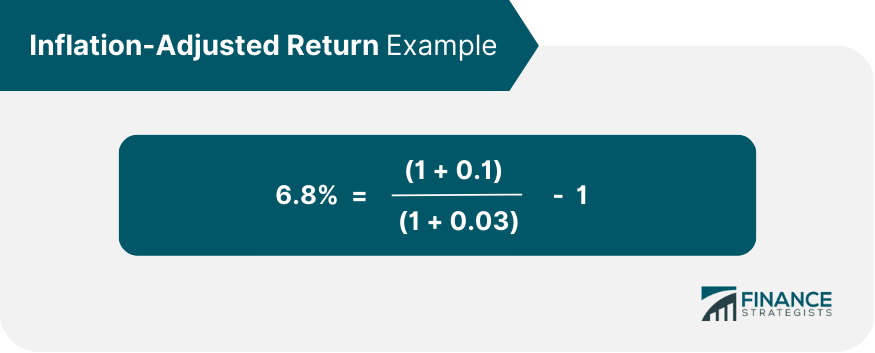

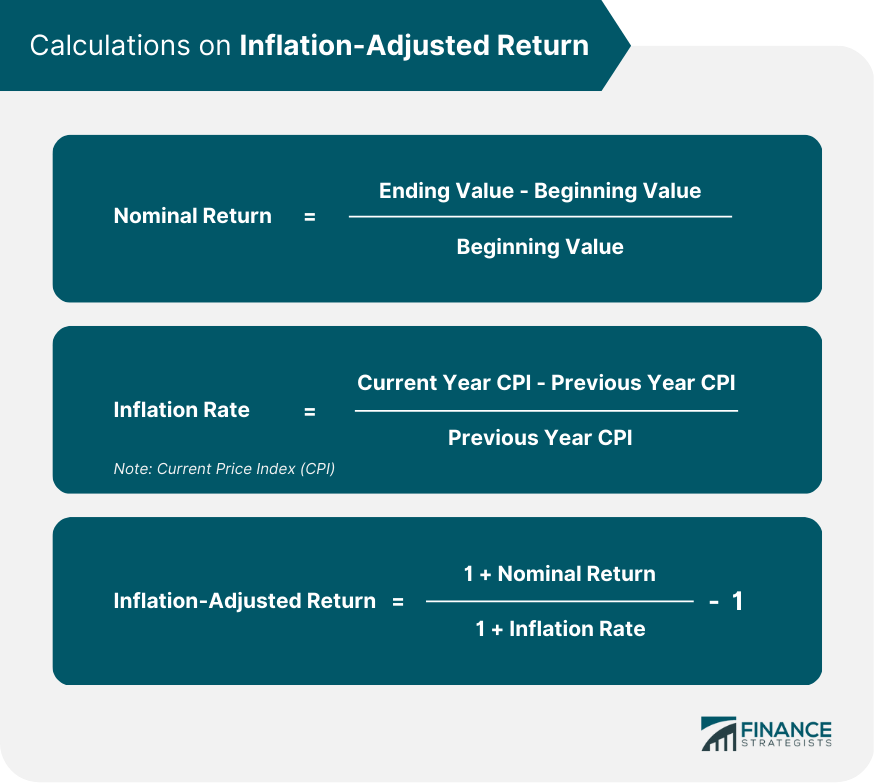

Inflation-adjusted return, also known as real return, is the return on an investment after accounting for inflation. Inflation refers to the general increase in prices of goods and services over time, which reduces the purchasing power of money. Therefore, inflation-adjusted return provides a more accurate measure of the true value of an investment. Nominal return refers to the percentage increase in the value of an investment over a period without considering the effects of inflation. It is the raw return on investment, usually expressed as a percentage. Inflation is the rate at which the general level of prices for goods and services increases over time, resulting in a decrease in the purchasing power of money. Inflation data can be obtained from various sources, such as government agencies, international organizations, and financial institutions. There are several ways to measure inflation, including the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index. These indices provide a comprehensive view of the changes in the price levels of a basket of goods and services over time. Calculating inflation-adjusted return is a method of measuring the return on an investment after adjusting for inflation. Inflation is the rate at which the general level of prices for goods and services is rising, and it erodes the purchasing power of currency over time. Inflation-adjusted returns are important because they provide a more accurate picture of the true return on an investment, taking into account the effects of inflation. To calculate the inflation-adjusted return, you first need to determine the nominal return, which is the actual return on the investment. This is calculated by subtracting the initial investment from the final value of the investment, and then dividing the result by the initial investment. For example, if you invest $1,000 and after one year the investment is worth $1,100, the nominal return is 10% ($100 / $1,000). Next, you need to determine the rate of inflation over the same period. This can be done by subtracting the previous year's consumer price index (CPI) from the current year's CPI, and then dividing the result by the previous year's CPI. The CPI is a measure of the average change in prices over time for a fixed basket of goods and services. Finally, you can calculate the inflation-adjusted return by subtracting the inflation rate from the nominal return, and then adding 1. This gives you the real rate of return, which reflects the actual increase in purchasing power of the investment. For example, if the inflation rate over the same period was 3%, the inflation-adjusted return would be 6.8%. Inflation-adjusted returns can be a valuable tool for comparing the performance of different investments over time, as they provide a more accurate picture of the actual return on investment. Here is a summary table of the calculation: Inflation erodes the purchasing power of money over time. By considering inflation-adjusted returns, investors can better understand the real value of their investments and make decisions to preserve their purchasing power. Inflation-adjusted returns allow investors to compare different investment opportunities on an equal footing by accounting for the impact of inflation on their potential returns. Inflation-adjusted returns play a vital role in asset allocation and portfolio management, as they help investors identify assets that are more likely to outperform inflation and maintain their purchasing power. Inflation-adjusted returns are crucial for retirement planning and income projections, as they help individuals estimate the real value of their future income and expenses, ensuring a more accurate assessment of their financial needs in retirement. Inflation rates have fluctuated throughout history, with periods of high inflation, such as the 1970s, and periods of low inflation, such as the early 2000s. Understanding these trends can help investors make better-informed decisions about their investments and prepare for potential changes in the inflation environment. Inflation affects different asset classes in various ways, and understanding this relationship can help investors build a more resilient portfolio. Historically, stocks have provided long-term returns that outpace inflation. However, individual stocks and market sectors may perform differently during inflationary periods, with some industries benefiting from rising prices, while others may struggle. Bonds, particularly long-term bonds, tend to perform poorly during periods of high inflation as their fixed interest payments become less valuable in real terms. However, inflation-protected bonds, such as Treasury Inflation-Protected Securities (TIPS), can help investors hedge against inflation risk. Real estate has generally been considered a good hedge against inflation because property values and rental income often increase with inflation. However, real estate investments can be subject to market and location-specific risks that can impact their inflation-hedging capabilities. Commodities, such as gold and other precious metals, have been used as a hedge against inflation historically. However, the performance of individual commodities can vary significantly, and they may not always provide an effective hedge against inflation. Diversifying investments across various asset classes and sectors can help protect a portfolio from the effects of inflation by spreading risk and taking advantage of different assets' inflation-hedging capabilities. Inflation-protected securities, such as TIPS and I-Bonds, are designed to provide returns that adjust for inflation, helping investors preserve their purchasing power. Investing in real assets, such as real estate and commodities, can provide a hedge against inflation as these assets often appreciate in value during inflationary periods. Dividend-paying stocks can offer a hedge against inflation, as companies that generate stable and growing cash flows can increase their dividend payments over time, helping investors maintain their purchasing power. Diversifying investments across different countries and regions can help investors mitigate the impact of inflation in their home country, as inflation rates and economic conditions can vary significantly across the globe. Understanding inflation-adjusted return is crucial for making informed investment decisions. Nominal returns alone do not provide an accurate picture of an investment's true value, as they do not account for the effects of inflation. By calculating inflation-adjusted returns, investors can better understand the real return on their investments and make decisions to preserve their purchasing power. Inflation-adjusted returns also allow investors to compare different investment opportunities on an equal footing and identify assets that are more likely to outperform inflation. Additionally, historical trends in inflation rates and their impact on different asset classes can inform investors' portfolio management strategies. By diversifying investments across various asset classes and sectors, investing in inflation-protected securities and real assets, and considering international investments, investors can mitigate the impact of inflation on their portfolios and protect their investments' purchasing power.What Is Inflation-Adjusted Return?

Components of Inflation-Adjusted Return

Nominal Return

Inflation Rate

Sources of Inflation Data

Measurement Methods

Calculating Inflation-Adjusted Return

Importance of Inflation-Adjusted Return in Investment Decisions

Preservation of Purchasing Power

Comparison of Investment Opportunities

Asset Allocation and Portfolio Management

Retirement Planning and Income Projections

Historical Perspective on Inflation and Returns

Trends in Inflation Rates Over Time

Impact of Inflation on Various Asset Classes

Stocks

Bonds

Real Estate

Commodities

Strategies for Protecting Investments From Inflation

Diversification

Inflation-Protected Securities

Real Assets

Dividend-Paying Stocks

International Investments

The Bottom Line

Inflation-Adjusted Return FAQs

Inflation-adjusted returns, also known as real returns, account for the impact of inflation on investment returns, providing a more accurate representation of an investment's true value. They are important because they help investors preserve purchasing power, compare investment opportunities, make informed asset allocation decisions, and plan for retirement more accurately.

Inflation-adjusted returns can be calculated using the following formula: Real Return = [(1 + Nominal Return) / (1 + Inflation Rate)] - 1. This formula adjusts the nominal return for the impact of inflation, providing a more accurate representation of the investment's real value.

Yes, inflation-adjusted returns allow investors to compare different investment opportunities on an equal footing by accounting for the impact of inflation on their potential returns. This comparison helps investors make more informed decisions and select investments that are more likely to maintain or increase their purchasing power.

Some strategies to protect investments from inflation using inflation-adjusted returns include diversification across various asset classes and sectors, investing in inflation-protected securities (TIPS, I-Bonds), allocating funds to real assets (real estate, commodities), focusing on dividend-paying stocks, and diversifying investments across different countries and regions.

Historical trends in inflation, such as periods of high inflation or low inflation, have highlighted the importance of considering inflation-adjusted returns in investment decisions. These trends help investors understand the impact of inflation on different asset classes and inform their strategies for building a more resilient portfolio that can withstand varying inflationary environments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.