A performance fee is a type of compensation that wealth managers receive based on the returns they generate for their clients. This fee is typically calculated as a percentage of the profits earned on a client's investment portfolio. In contrast to other fee structures, such as management fees or fixed fees, performance fees create a direct link between a wealth manager's compensation and the success of their investment strategies. Performance fees have grown in popularity, as they can lead to better alignment between client and advisor interests. This type of fee structure incentivizes wealth managers to actively manage portfolios and seek higher returns. Additionally, performance fees can help clients better assess the value they receive from their wealth managers by directly tying compensation to results. Performance fees differ from other common fee structures, such as management fees, which are typically a fixed percentage of Assets Under Management (AUM). With performance fees, wealth managers earn more when they generate higher returns, while management fees remain the same regardless of investment performance. There are several key components that determine how a performance fee is calculated and paid: A high-water mark ensures that a wealth manager only receives performance fees on new profits. This means that if a client's portfolio suffers losses, the wealth manager will not receive a performance fee until the portfolio's value has recovered and surpassed its previous high point. A hurdle rate is a minimum return that a portfolio must achieve before a performance fee is charged. This rate can be a fixed percentage or tied to a benchmark, such as an index. The fee calculation period is the time frame over which the performance fee is assessed. This can be monthly, quarterly, or annually, depending on the specific agreement between the wealth manager and the client. The fee percentage is the portion of profits that the wealth manager receives as a performance fee. This can be a fixed rate or vary depending on the level of returns achieved. There are several different performance fee models commonly used in wealth management: Under this model, the wealth manager receives a fixed percentage of the profits generated by the client's investment portfolio. This percentage remains the same regardless of the level of returns. In a sliding scale fee structure, the performance fee percentage changes based on the level of returns generated. For example, the fee percentage might increase as the portfolio's return surpasses certain thresholds. A tiered fee structure combines elements of both fixed and sliding-scale fee structures. In this model, different fee percentages apply to different tiers of returns, allowing for a more customized fee arrangement. There are several regulatory considerations that wealth managers must take into account when implementing performance fee structures: Wealth managers are required to provide clear and transparent disclosure of their fee structures, including performance fees, to clients. This ensures that clients fully understand the potential costs associated with their investments. Wealth managers must ensure that their performance fee arrangements comply with the requirements of the Investment Advisers Act of 1940, which sets forth rules governing the advisory industry. Certain jurisdictions may impose restrictions or limitations on the use of performance fees, such as caps on the maximum fee percentage or requirements for the use of high-water marks or hurdle rates. When considering performance fee structures, clients should take the following steps: Clients should compare the performance fee structures of various wealth managers to determine which arrangement best suits their needs and preferences. This may involve assessing fixed fees, sliding scale fees, and tiered fee structures. Clients should evaluate the overall value proposition offered by their wealth manager, including the investment strategy, performance history, and services provided. This can help clients determine if the potential benefits of a performance fee structure outweigh any potential drawbacks. When evaluating performance fees, clients should consider not only the level of returns generated but also the level of risk taken to achieve those returns. By considering risk-adjusted returns, clients can better assess the true value of a wealth manager's services. There are several benefits of performance fees for clients in wealth management: Performance fees align the interests of clients and wealth managers, incentivizing the latter to generate higher returns. This can lead to more active portfolio management and a focus on maximizing returns for clients. As wealth managers have a direct financial incentive to generate higher returns, clients may benefit from better investment performance. Performance fees can encourage wealth managers to actively manage client portfolios and seek out investment opportunities that generate higher returns. This can lead to a more proactive approach to portfolio management, resulting in better long-term performance for clients. Despite their benefits, performance fees also come with some potential drawbacks: During periods of strong investment performance, clients may end up paying higher fees under a performance fee structure than they would under a fixed fee arrangement. This can be a concern for some investors who may prefer a more predictable fee structure. Performance fees can sometimes encourage wealth managers to take on excessive risk in an attempt to generate higher returns. While this may result in higher fees for the wealth manager, it can also lead to greater portfolio volatility and potential losses for clients. The variable nature of performance fees can make it difficult for clients to budget for wealth management costs. Depending on market conditions and investment performance, clients may pay significantly different fees from one period to the next. Performance fees have become an increasingly popular fee structure in the wealth management industry due to the benefits they offer clients and the alignment of interests between clients and wealth managers. By incentivizing active portfolio management and higher returns, performance fees can potentially generate greater value for clients. However, they also come with potential risks such as higher fees during profitable periods, excessive risk-taking, and lack of consistency in fees. It is important for clients to carefully evaluate the value proposition offered by wealth managers and compare different fee structures before deciding on a performance fee arrangement. Wealth managers must also ensure compliance with regulatory requirements and provide transparent disclosure of their fee structures to clients. Overall, performance fees can be a valuable tool for both clients and wealth managers, but careful consideration and management are necessary to maximize their benefits and minimize their risks.Definition of Performance Fee

Importance of Performance Fees

Performance Fee vs Other Fee Structures

Key Components of Performance Fee

High-Water Mark

Hurdle Rate

Fee Calculation Period

Fee Percentage

Performance Fee Models

Fixed Percentage of Profits

Sliding Scale Fee Structure

Tiered Fee Structure

Regulatory Considerations for Performance Fee

Disclosure Requirements

Compliance With the Investment Advisers Act

Restrictions and Limitations

Evaluating Performance Fee Structures

Comparing Fee Structures of Different Wealth Managers

Assessing the Value Proposition

Considering Risk-Adjusted Returns

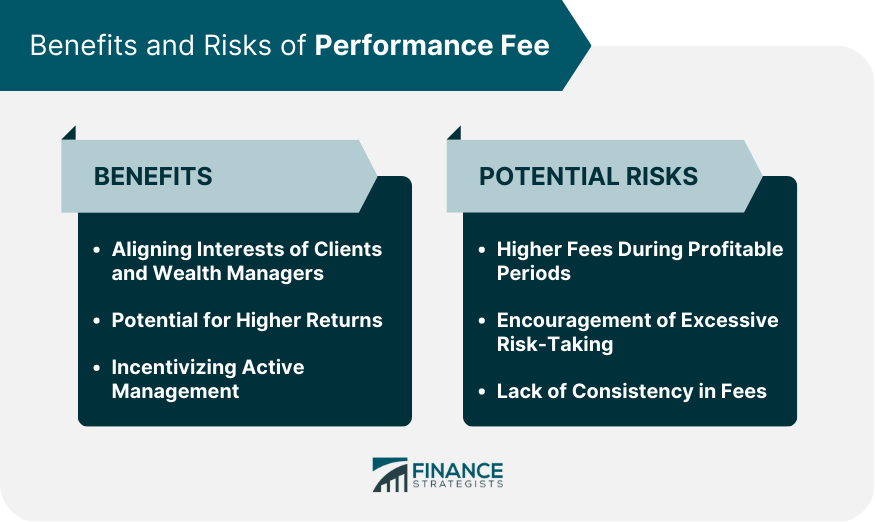

Benefits of Performance Fees for Clients

Aligning Interests of Clients and Wealth Managers

Potential for Higher Returns

Incentivizing Active Management

Potential Risks of Performance Fees

Higher Fees During Profitable Periods

Encouragement of Excessive Risk-Taking

Lack of Consistency in Fees

Conclusion

Performance Fee FAQs

Performance fees are a type of compensation paid to wealth managers based on the investment returns they generate for their clients. These fees are usually calculated as a percentage of the profits earned on a client's portfolio, directly linking a wealth manager's compensation to the success of their investment strategies.

Unlike fixed management fees, which are based on a percentage of assets under management (AUM), performance fees are directly tied to the investment returns generated by a wealth manager. This creates an incentive for wealth managers to actively manage portfolios and seek higher returns, potentially leading to better investment performance for clients.

The key components of performance fees include the high-water mark, hurdle rate, fee calculation period, and fee percentage. These factors determine how a performance fee is calculated and paid to a wealth manager, ensuring that fees are only earned on new profits and in line with agreed-upon terms.

Benefits of performance fees include aligning the interests of clients and wealth managers, incentivizing active portfolio management, and the potential for higher returns. Drawbacks include higher fees during profitable periods, the encouragement of excessive risk-taking, and a lack of consistency in fees.

Clients can evaluate performance fees by comparing fee structures of different wealth managers, assessing the overall value proposition offered by each provider, and considering risk-adjusted returns. This helps clients determine if the potential benefits of a performance fee structure outweigh any potential drawbacks and select a wealth manager that best suits their needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.