An investment manager is a financial professional who specializes in managing investment portfolios on behalf of clients, including individuals, institutions, and organizations. They are responsible for making investment decisions, conducting research and analysis, and managing risks to achieve their clients' financial objectives. Investment managers play a vital role in the financial landscape, as they help clients navigate the complexities of the financial markets, make informed investment decisions, and grow their wealth. By leveraging their expertise and experience, investment managers provide valuable insights and guidance to clients, enabling them to achieve their financial goals and objectives. Investment managers construct and manage investment portfolios tailored to their clients' needs, risk tolerance, and financial goals. They are responsible for selecting appropriate investments, monitoring portfolio performance, and making adjustments as needed to ensure optimal returns and risk management. Investment managers conduct in-depth research and analysis on various investment products and opportunities, such as stocks, bonds, and mutual funds. They use their findings to identify suitable investment opportunities for their clients and make recommendations based on their analysis. Investment managers assist clients in determining the appropriate allocation of their assets across various investment categories, such as equities, fixed income, and cash. This process, known as asset allocation, is crucial for managing investment risk and achieving long-term financial goals. Investment managers actively manage risk within their clients' portfolios, ensuring that the level of risk remains consistent with the clients' objectives and risk tolerance. They employ various risk management techniques, such as diversification and hedging, to minimize potential losses and protect clients' investments. Institutional investment managers primarily work with institutional clients, such as pension funds, endowments, and insurance companies. They manage large-scale investment portfolios and typically focus on long-term investment strategies to meet their clients' financial objectives. Retail investment managers cater to individual investors and typically manage smaller-scale investment portfolios. They provide personalized investment advice and portfolio management services tailored to the specific needs and financial goals of individual clients. Private wealth managers specialize in managing the investments of high-net-worth individuals and families. They offer a wide range of financial services, including investment management, tax planning, and estate planning, and often take a holistic approach to wealth management. Robo-advisors are digital platforms that provide automated investment management services using algorithms and data analysis. They typically offer lower fees than traditional investment managers and are suitable for investors who prefer a hands-off approach to investment management. While investment managers and investment advisors both provide financial advice and guidance, their roles and responsibilities differ. Investment managers focus primarily on managing clients' investment portfolios and making investment decisions on their behalf. In contrast, investment advisors provide broader financial advice, encompassing investments, financial planning, and other financial matters. Investment managers possess expertise in portfolio management, investment research, and risk management, while investment advisors have a more comprehensive understanding of various financial topics, including financial planning, tax planning, and retirement planning. Depending on your specific financial needs and goals, you may require the services of an investment manager, an investment advisor, or both. If your primary focus is portfolio management and investment decision-making, an investment manager may be the best choice. However, if you need assistance with broader financial planning and advice, an investment advisor may be more suitable. Investment managers may hold various certifications and designations that demonstrate their expertise and commitment to professional standards. Some common credentials include the Chartered Financial Analyst (CFA) designation, the Chartered Investment Manager (CIM) designation, and the Certified Financial Planner (CFP) certification. Investment managers typically have a strong educational background in finance, economics, or a related field. Many investment managers hold a bachelor's degree or higher in these areas. Additionally, investment managers gain valuable experience through years of working in the financial industry, managing portfolios, and navigating the complexities of the financial markets. Investment managers are subject to regulatory oversight and must adhere to various rules and regulations governing their industry. In the United States, for example, investment managers may be required to register with the Securities and Exchange Commission (SEC) or state securities regulators, depending on the size of their assets under management. When choosing an investment manager, it is essential to evaluate their investment philosophy and strategy to ensure that they align with your financial goals and objectives. Consider their approach to asset allocation, risk management, and investment selection, and make sure their methods are consistent with your preferences and expectations. While past performance is not necessarily indicative of future results, reviewing an investment manager's track record can provide valuable insights into their capabilities and investment strategies. Look for a consistent history of strong performance and a demonstrated ability to manage risk effectively. Investment managers may be compensated through various fee structures, such as a percentage of assets under management, fixed fees, or performance-based fees. Compare the fees charged by different investment managers and consider how their compensation structure aligns with your financial goals and objectives. Effective communication and exceptional client service are crucial components of a successful investment manager-client relationship. When selecting an investment manager, consider their communication style, frequency of communication, and responsiveness to your needs and concerns. Investment managers play a crucial role in helping clients achieve their financial goals by providing expert portfolio management, investment research, and risk management services. By leveraging their expertise and experience, investment managers enable clients to navigate the complexities of the financial markets and make informed investment decisions to grow their wealth. Choosing the right investment manager is essential for maximizing your investment success and achieving your financial goals. By carefully evaluating an investment manager's credentials, investment philosophy, fee structure, and communication style, you can select a professional who aligns with your needs and preferences and provides the guidance and expertise necessary to secure your financial future.What Is an Investment Manager?

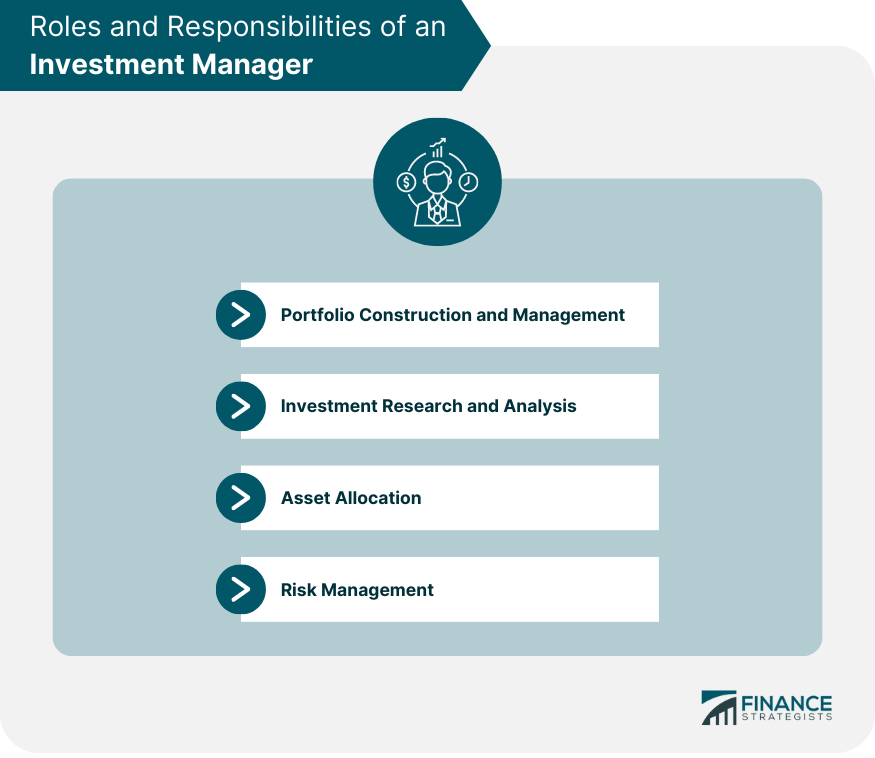

Roles and Responsibilities of an Investment Manager

Portfolio Construction and Management

Investment Research and Analysis

Asset Allocation

Risk Management

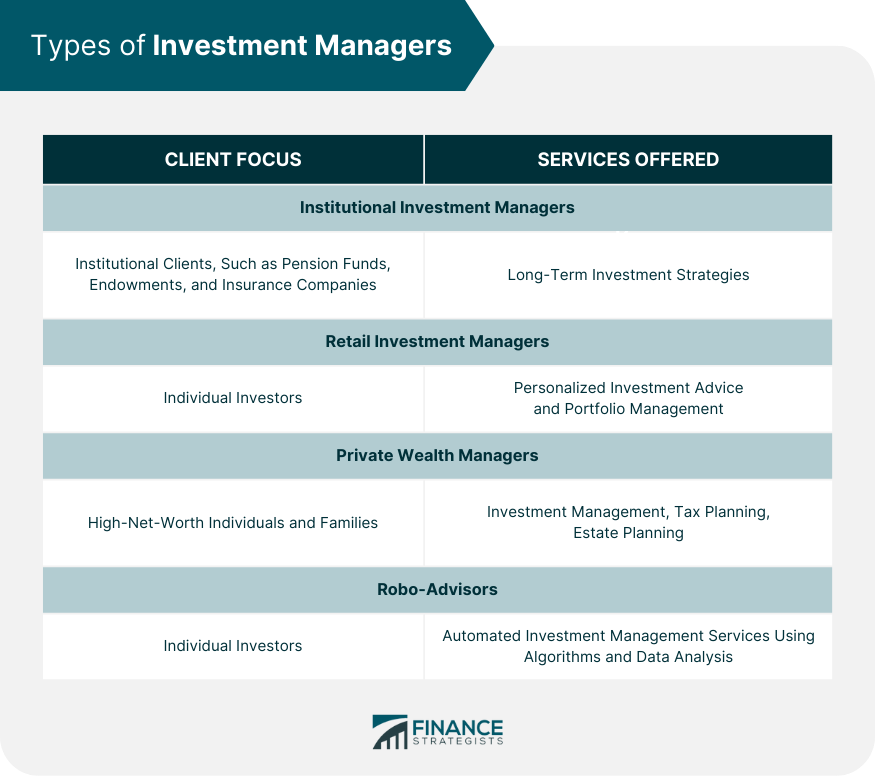

Types of Investment Managers

Institutional Investment Managers

Retail Investment Managers

Private Wealth Managers

Robo-Advisors

Investment Manager vs Investment Advisor

Differences in Roles and Responsibilities

Areas of Expertise

Which Professional to Choose

Qualifications and Credentials of Investment Managers

Relevant Certifications and Designations

Education and Experience

Regulatory Compliance

Selecting an Investment Manager

Assessing Investment Philosophy and Strategy

Evaluating Past Performance and Track Record

Comparing Fees and Compensation Structures

Examining Client Service and Communication

Conclusion

Investment Manager FAQs

An investment manager is a professional who manages investment portfolios on behalf of clients, such as institutional investors, high net worth individuals, and pension funds. Investment managers make investment decisions based on a client's objectives, risk tolerance, and investment preferences.

An investment manager provides a range of services, including portfolio management, investment research, risk management, and performance reporting. They work closely with clients to develop and implement investment strategies that align with their goals and objectives.

Investment managers can be compensated in several ways, including through management fees, performance-based fees, or a combination of both. Management fees are based on a percentage of assets under management, while performance-based fees are based on investment performance relative to a benchmark.

An investment advisor provides advice and guidance to clients about investing in securities, while an investment manager actively manages investment portfolios on behalf of clients. Investment advisors may provide a broader range of financial planning services, while investment managers focus on investment management.

When choosing an investment manager, consider their investment philosophy, track record, and experience. Look for an investment manager with a proven track record of success and a clear investment strategy that aligns with your objectives and risk tolerance. It's also important to understand their fees and compensation structure and ensure that their services align with your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.