An agency bond is a type of debt security issued by a government-sponsored enterprise (GSE) or by a federal agency. The purpose of the bond is to raise funds for the issuing entity, which then uses the money to fulfill its mission and objectives. Generally, these entities are backed by the U.S. government, so they generally have a lower risk of default than corporate bonds. Additionally, the issuing agency or GSE is typically engaged in a specific activity or set of activities that are considered to be in the public interest. Agency bonds offer fixed and higher interest rates than treasury bonds, but they are also typically more volatile. Certain agency bonds can be called back by the bond issuer before their maturity date, enabling them to reap certain benefits. Agency bonds are issued and traded in the primary market like any other type of bond. The issuing federal agency or government-sponsored enterprise raises capital by issuing debt securities in the form of bonds to investors. The investors, in turn, provide the issuing entity with the capital it needs to achieve its goals. In exchange for this capital, the issuer promises to pay the investors interest on the bonds and return the principal at maturity. Agency bonds can also be traded in the secondary market, where investors can buy and sell securities from each other, using a broker as an intermediary. The price of these bonds fluctuate based on supply and demand and the interest rate at which they are trading. The interest rate, also known as the coupon rate, is the amount of money that must be paid to bondholders on a specific frequency, such as semi-annually. Agency bonds usually have a fixed coupon rate, but some may have a floating rate linked to a benchmark like the Treasury bill rate. Although fixed coupon rates can guarantee returns for a certain period of time, this may not last until the bond’s maturity. Some issuing agencies can call back certain bonds before maturity, which can affect a bondholder’s returns from the investment. Agency bonds are classified into two main types: These are debt securities issued by federal government agencies to raise funds for their operations. They are typically backed by the full faith and credit of the U.S. government. Examples include bonds issued by the Small Business Administration (SBA), Federal Housing Administration (FHA), and Government National Mortgage Association (GNMA). A bondholder will gain the privilege of collecting regular interest payments. At the end of the investment term, they can earn back the principal amount. Agency bonds issued by the federal government typically offer a slightly higher interest rate than Treasury bonds due to the lower liquidity of these bonds. Additionally, these bonds may have a call-back option, allowing the issuing agency to redeem them earlier than their scheduled maturity date. These are bonds issued by government-sponsored enterprises, such as Federal National Mortgage Association (Fannie Mae) and Freddie Mac (Federal Home Loan Mortgage). GSEs were created to provide liquidity in particular markets, such as the housing market. Fannie Mae, Freddie Mac, the Federal Farm Credit Banks Funding Corporation, and the Federal Home Loan Bank all provide GSE bonds. These are private companies that provide a crucial public service. They are monitored by and can receive financial help from the government. However, bonds issued by GSEs do not have the same level of assurance provided by the U.S. government that federal government agency bonds do. This can mean there is a greater risk that investors will not get back their principal. Agency bonds have different characteristics, depending on their make-up and structure: Fixed coupon bonds are agency bonds that pay a fixed interest rate to the bondholder. These bonds typically have a set maturity date, and the bond issuer must pay the bondholder a fixed coupon rate until maturity. With these types of bonds, investors receive interest at regular intervals, such as quarterly, annually, or semi-annually. However, bondholders are not protected against inflation, as the interest received may not keep pace with the rising cost of living. Unlike traditional fixed coupon rate bonds, the coupon rate on these bonds adjusts periodically based on a benchmark rate with a preset formula, such as the U.S. Treasury bonds or the London Interbank Offered Rate (LIBOR). This means that the interest payments received by bondholders will fluctuate as the benchmark rate changes over time. Fluctuation of the coupon rate also means that this type of bond's market price will be subject to more volatility compared to fixed coupon rate bonds. Short-term notes are another type of agency bond. These bonds typically have a maturity period of less than one year. They are generally are used to finance short-term borrowing needs. Due to their short maturity, they offer fewer interest payments than longer-term bonds but also carry less risk. Medium-term notes are agency bonds with maturities of one to ten years. These bonds offer higher interest rates than short-term notes, but there is a greater risk associated with them. Both government-sponsored agencies and federal agencies issue them for more substantial financing needs. A callable bond is a type of agency bond that allows the issuer the option to redeem the bond before its maturity date at a predetermined price, known as the call price. This is usually lower than the current market price. This feature is typically exercised when interest rates are declining. The issuer can borrow at a lower interest rate, use the proceeds to repay investors, and withdraw the higher-yielding, callable bonds. This can result in the bond being redeemed early and investors receiving their principal back before the maturity date. There are no interest payments with zero-coupon bonds during their term, but they are sold at a discount to their face value. The bondholder acquires the face value of the bond at maturity but does not receive any periodic interest payments. Instead, the bond's return is generated by the difference between the purchase price and the face value at maturity. Zero-coupon bonds are also known as accrual bonds and are often issued for short-term funding needs. Consider, as an example, the bond described in the table below: The bond was issued on January 25, 2022, with a maturity of 6 years. This means the bond will mature on January 25, 2028. The bond has a face value of $25,000 and offers a fixed coupon rate of 3.5% per year. Investors in this bond will receive annual interest payments of $875 (3.5% of $25,000). The bond is callable and has a redemption date on January 25, 2025. This means that the issuer can repay the investor earlier than intended, using the principal amount plus any accumulated interest. Because of the call option, bondholders run the risk that the issuer may pay back the bond earlier than intended, effectively ending all future interest payments and lessening the overall return on this investment. Agency bonds have the following advantages: One of the significant advantages of investing in agency bonds is that they are considered low-risk investments. Even if the issuing agency defaults on its debt, the government would step in to ensure that bondholders are repaid. As a result, agency bonds are believed to be less risky than other types of bonds, such as corporate bonds. Another advantage of investing in agency bonds is that they can offer a higher return than other types of bonds. This is because agency bonds typically offer a higher coupon rate than Treasury bonds, considered the safest type of bond. Additionally, agency bonds are often used as a benchmark for other types of bonds, which can help to increase their value. Agency bonds are also highly liquid, so they can easily be bought and sold in the secondary market. This makes them a good choice for investors who need to raise cash quickly or want to take advantage of changes in interest rates. Lastly, because agency bonds are widely traded, finding a buyer or seller is relatively easy, which helps minimize price fluctuations. Investing in agency bonds also have the following disadvantages: Investing in agency bonds is subject to the risk of inflation. Inflation can reduce the purchasing power of the interest and principal payments received from the bond. This makes the investment less valuable over time. If inflation rises, interest rates may also increase, leading to a decrease in the value of a previously issued bond in the secondary market. In this case, newer bonds will offer higher yields, so bondholders who wish to resell previously issued bonds might find it challenging. Agency bonds can be complex and may require significant research and analysis before investors can fully understand the risks and potential returns. This complexity can make them less accessible to individual investors, who may be better served by other types of investments. Agency bonds may be subject to local and state income taxes, though there may be exceptions depending on the type of bond. For instance, agency bonds issued by Federal Home Loan Banks, Tennessee Valley Authority (TVA), and Federal Farm Credit Banks are exempt from local and state taxes. On the other hand, agency bonds issued by Farmer Mac, Freddie Mac, and Fannie Mae are fully taxable. In addition, when agency bonds are acquired at a discounted price, investors may be subjected to capital gains tax when they resell these bonds or redeem the principal at maturity. Given all of these, investors need to consider their options before investing in agency bonds. Agency bonds are financial instruments issued by government-sponsored organizations or federal agencies to obtain the funding needed to carry out their operations and achieve their goals. The federal agency or GSE involved raises capital by issuing bonds to investors. The investors, in turn, provide the money the agency needs to achieve its goals. In exchange for these funds, issuers promise to pay interest and return the principal at maturity. Agency bonds can be offered as fixed coupon bonds, short-term notes, medium-term notes, callable bonds, or zero-coupon bonds. These structures vary based on their purchase price, coupon rates, and the length of time before maturity. Investors can enjoy lower risk, higher returns, and relatively high liquidity with agency bonds. However, they also have to deal with drawbacks, such as inflation risk, possible interest rate changes, and complexity. There are also tax implications to consider when investing in agency bonds, such as income tax treatment and taxes for capital gains or losses. If you wish to use agency bonds to diversify your portfolio, you may consult a financial professional specializing in wealth management services to help you through the process. What Is an Agency Bond?

How Agency Bonds Work

Types of Agency Bonds

Federal Government Agency Bonds

Government-Sponsored Enterprise Bonds

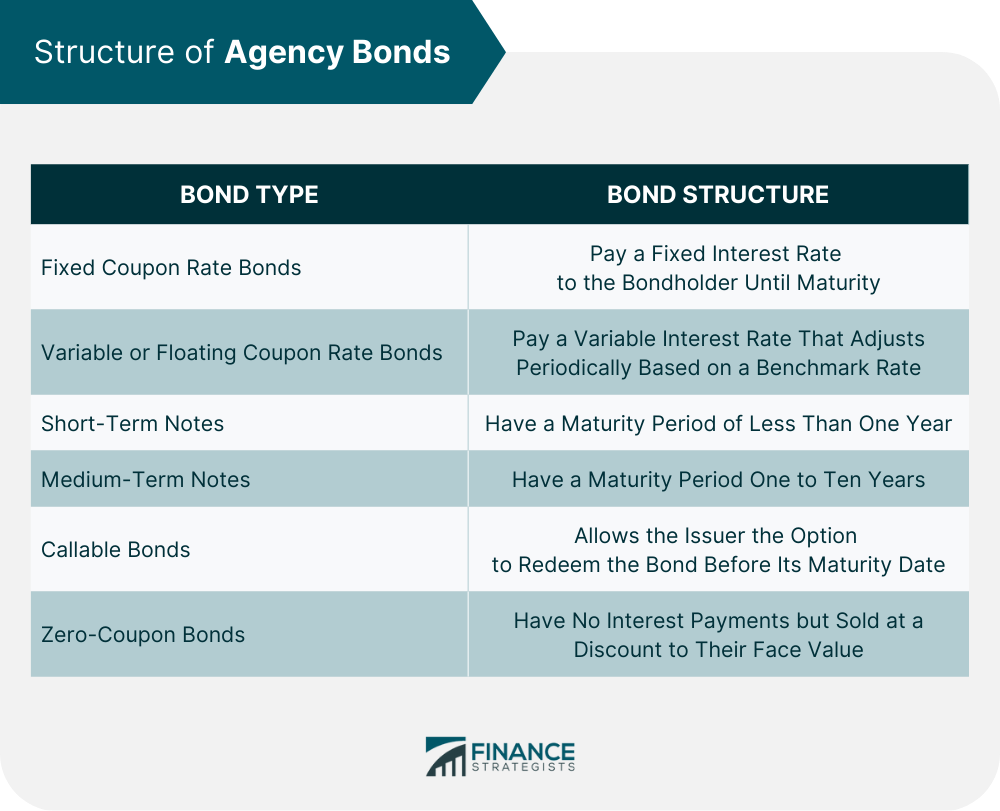

Structure of Agency Bonds

Fixed Coupon Rate Bonds

Variable or Floating Coupon Rate Bonds

Short-Term Notes

Medium-Term Notes

Callable Bonds

Zero-Coupon Bonds

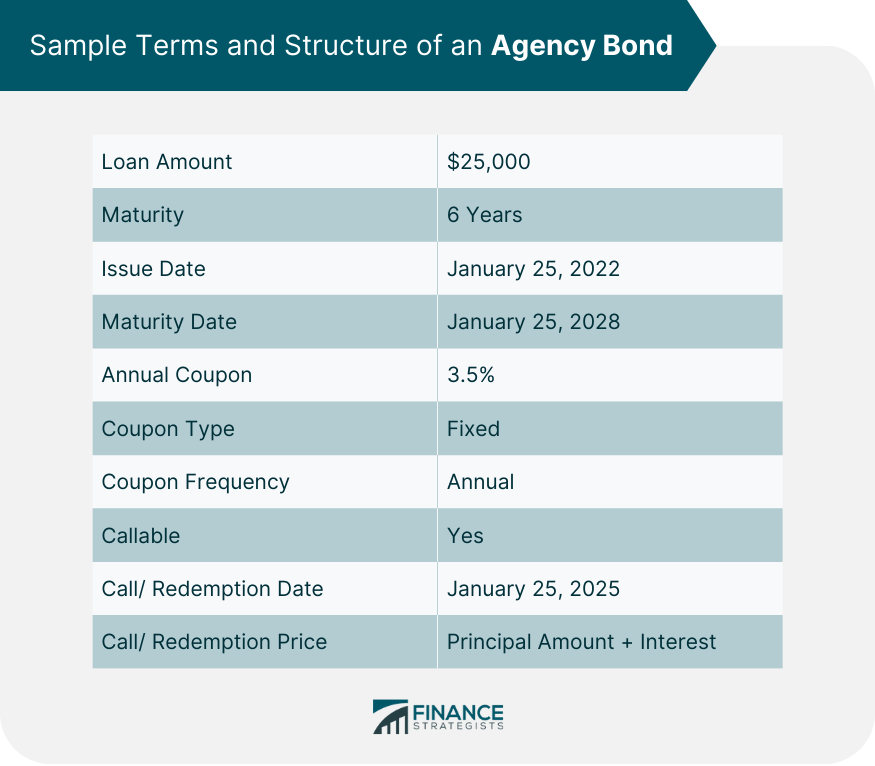

Example of an Agency Bond

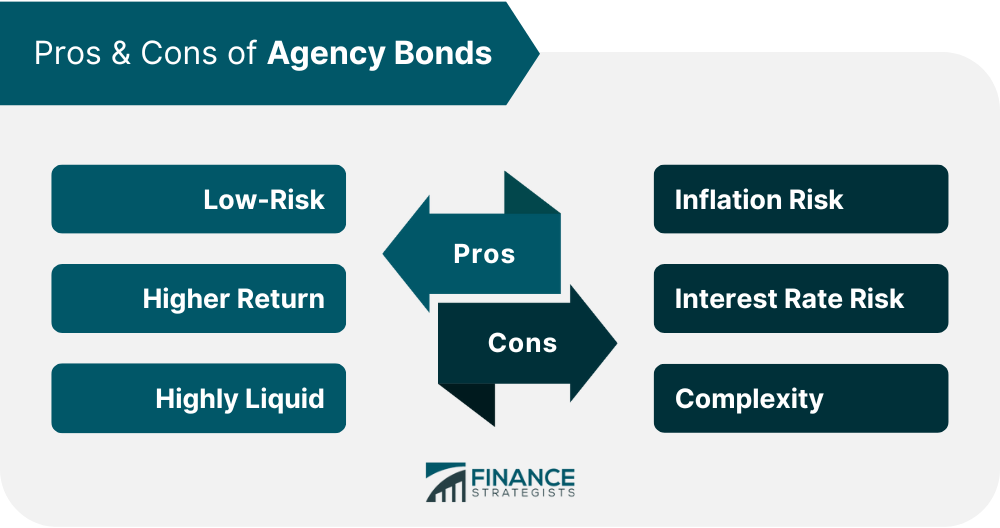

Advantages of Agency Bonds

Low-Risk

Higher Return

Highly Liquid

Disadvantages of Agency Bonds

Inflation Risk

Interest Rate Risk

Complexity

Tax Considerations for Agency Bonds

Final Thoughts

Agency Bond FAQs

Agency bonds are typically issued and sold by government-sponsored enterprises (GSEs) or federal agencies to raise funds for their operations and objectives.

Agency bonds are generally considered safe investments since they are issued by organizations with a solid ability to repay their debt and a lower default risk than many other types of bonds. However, the level of risk can still vary depending on the specific issuer and the underlying conditions of the bond market.

Treasury bonds are issued by the U.S. Department of Treasury to finance the national debt and are considered to be risk-free investments with the full faith and credit of the U.S. government behind them. Agency bonds may also be backed by the U.S. government, but they carry a slightly higher level of risk with the potential for a higher yield.

An agency bond is a type of debt security issued by a GSE or by a federal agency. The purpose of the bond is to raise funds for the issuing entity, which then uses the money to fulfill its mission and objectives. Agency bonds are considered less risky than corporate bonds.

To purchase government agency bonds, an investor must go through a broker or bank participating in the bond market. The investor would need to open a brokerage account and place an order to buy the desired agency bond. The bond can be purchased at its face value or a price reflecting its current market value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.