A pension plan rollover is a process that enables individuals to transfer the assets from their traditional pension plan into another qualified retirement account, such as a 401(k). It's a legal and financial mechanism that offers more flexibility in managing retirement savings. Notably, this transfer isn't a cash-out of pension assets; instead, it moves the money directly between the financial institutions, thereby preserving its tax-deferred status. The 401(k) plan, named after its section in the U.S. tax code, is a popular retirement plan where both employees and employers can contribute. It offers more control over investments, tax advantages, and the potential for employer matching contributions, which can significantly boost retirement savings. The ideal way to rollover a pension plan into a 401(k) is through a direct transfer. By doing this, to avoid paying the withdrawal tax on your pension and can defer your taxable income. You can also take the pension as a payout, but it will be taxed.

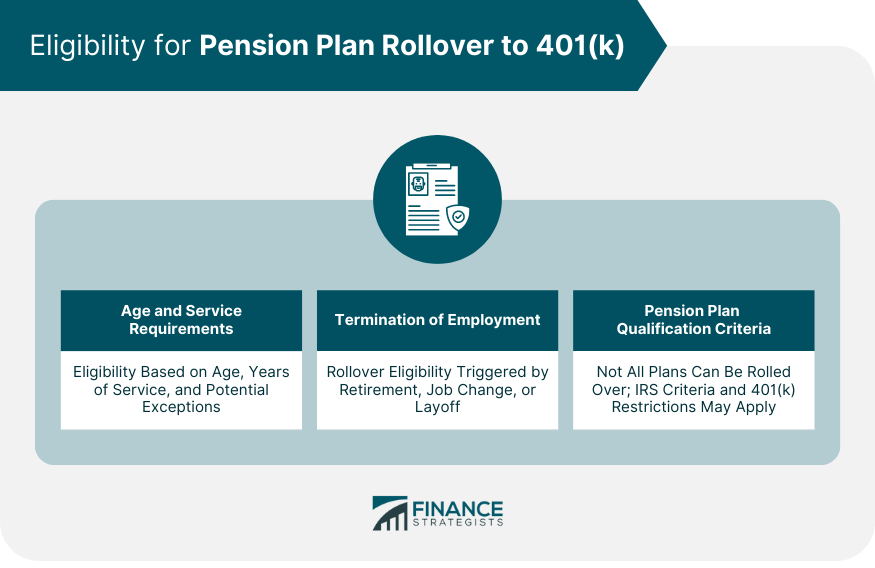

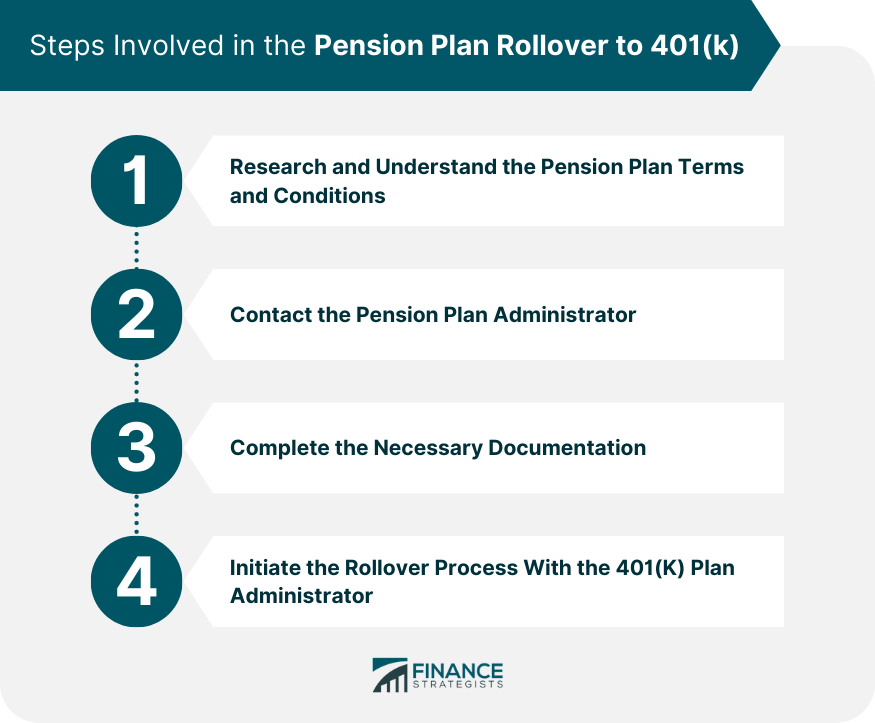

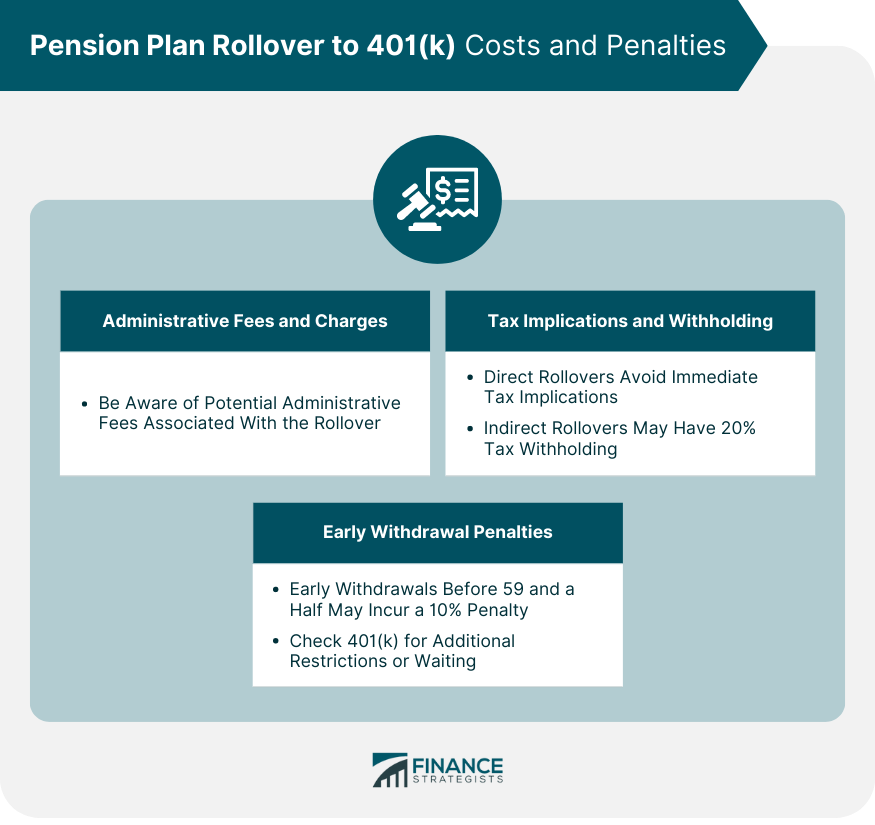

Eligibility for a pension plan rollover into a 401(k) is typically governed by age and years of service. Usually, participants can begin withdrawals from their retirement accounts without penalty after they reach the age of 59 and a half. Furthermore, some pension plans require individuals to have a minimum number of years of service before they can rollover their funds. However, certain circumstances, such as severe financial hardship or disability, may permit earlier withdrawals. Given these variables, it's essential for individuals to understand their specific pension plan rules and any potential limitations before proceeding with a rollover. Generally, one of the triggers for a pension plan rollover to a 401(k) is the termination of employment. Whether an individual is retiring, changing jobs, or has been laid off, these circumstances usually make them eligible for a rollover. However, the exact conditions can vary depending on the terms of the pension plan and the receiving 401(k) plan. It's crucial to consult with a plan administrator or a financial advisor to comprehend the precise terms of the rollover. Not all pension plans can be rolled over into a 401(k). The pension plan must meet specific IRS qualification criteria to ensure the tax-advantaged status of the funds being transferred. The 401(k) plan must also allow for rollovers. In some cases, the 401(k) may impose restrictions on the types of assets they can accept. For instance, certain company stocks or real estate investments may not be eligible for rollover. To prevent any surprises, individuals should verify the qualification criteria of both their pension and 401(k) plans prior to initiating a rollover. Before undertaking a pension plan rollover to a 401(k), it's crucial to conduct thorough research and understand the terms and conditions of the pension plan. Some plans may have stipulations that could affect the rollover process, such as fees for early withdrawal or limitations on the type of assets that can be transferred. The specifics of each pension plan can differ, so understanding these nuances is a crucial step in the rollover process. Likewise, understanding the 401(k) plan's terms is equally important, as this will impact how the transferred assets are managed and potentially withdrawn in the future. The next step in the rollover process is to contact the pension plan administrator. The administrator will provide the necessary forms and instructions to initiate the rollover. This is an ideal time to ask any questions or clarify any uncertainties regarding the rollover process. It's important to carefully follow the administrator's instructions to avoid any potential issues or delays. The administrator will also be able to provide specific timelines for the rollover, helping individuals plan accordingly. Following the instructions provided by the pension plan administrator, individuals must then complete the necessary documentation to initiate the rollover. This documentation typically includes a request for a direct rollover, in which the funds are transferred directly from the pension plan to the 401(k), maintaining the funds' tax-advantaged status. It's essential to review all forms and documentation thoroughly and ensure accuracy in every detail. Any errors or omissions can cause complications, delays, or even potential tax implications. Once the necessary documentation is completed and returned to the pension plan administrator, the next step is to initiate the rollover process with the 401(k) plan administrator. This generally involves notifying them of the upcoming transfer and providing any necessary documentation they require. The 401(k) plan administrator will guide individuals through their part of the process. Just like with the pension plan administrator, it's important to follow these instructions carefully to ensure a smooth transition. While a pension plan rollover to a 401(k) can offer many benefits, it's important to be aware of potential costs. There may be administrative fees associated with the transfer. These fees can vary based on the financial institutions involved and the complexity of the rollover. In some cases, these fees can be significant, especially for larger or more complicated pension plans. Therefore, it's essential to understand these costs upfront and factor them into the overall financial planning. Generally, if the rollover is performed correctly as a direct rollover (where funds move directly from the pension plan to the 401(k) without the individual taking possession of the funds), there should be no immediate tax implications. However, indirect rollovers, where the individual receives the funds before depositing them into the 401(k), can trigger mandatory tax withholding of 20%. Moreover, the full amount must be deposited into the 401(k) within 60 days to avoid further taxation and potential penalties. Another potential cost of a pension plan rollover to a 401(k) is the early withdrawal penalty. If funds are withdrawn before the individual reaches the age of 59 and a half, a 10% early withdrawal penalty may apply, unless specific exceptions are met. Furthermore, the receiving 401(k) plan may have its own set of restrictions on withdrawals. This can include penalties for early withdrawal or a waiting period before funds can be accessed. These restrictions should be considered carefully before initiating a rollover. One of the key considerations when contemplating a pension plan rollover to a 401(k) is the financial impact. This includes potential fees, tax implications, and changes in investment strategies. It's also important to consider how the rollover fits into one's overall financial plan. For example, a rollover might provide an opportunity to diversify investments and potentially achieve higher returns. However, it could also expose individuals to greater risk if the market underperforms. Hence, it's vital to understand these potential scenarios and consult with a financial advisor before making a decision. Tax considerations also play a critical role in deciding whether to proceed with a rollover. As discussed earlier, direct rollovers, where the funds move directly from the pension plan to the 401(k), typically avoid immediate tax implications. However, the tax treatment of future withdrawals may vary depending on the type of 401(k) plan the funds are rolled into. For instance, traditional 401(k) plans offer tax-deferred growth, while Roth 401(k) plans provide tax-free growth and withdrawals, provided certain conditions are met. Understanding these differences is crucial in making an informed decision. Lastly, one's retirement goals and time horizon should be taken into account. If an individual plans to retire soon and values a guaranteed income, retaining the pension plan may be advantageous. However, if retirement is many years away, rolling over to a 401(k) could provide more time for potential investment growth. Moreover, individuals with specific retirement goals, such as leaving a legacy to heirs, might find a 401(k) to be a better fit due to its more flexible distribution options. You cannot rollover a 401(k) into a 529 plan. Any withdrawals you make from your 401(k) will be taxed, and be subject to an early withdrawal fee if applicable. This is also the case for individual retirement accounts. The decision to rollover a pension plan to a 401(k) is highly personal and depends on several factors, including financial circumstances, tax situation, retirement goals, and risk tolerance. It's a decision that can significantly impact an individual's retirement planning and future financial security. As such, it's important to carefully consider all aspects, including potential benefits, costs, and implications. Consulting with a financial advisor can also provide valuable insight and guidance in making this critical decision. A pension plan rollover to a 401(k) involves transferring assets from a traditional pension plan to a 401(k) retirement plan. This process offers benefits such as more control over investments, potentially broader investment options, and flexibility in distributions. Eligibility for a rollover is typically based on age, years of service, termination of employment, and the qualification criteria of the pension and 401(k) plans. There are also potential costs and penalties to consider, including administrative fees, tax implications, and early withdrawal penalties. The decision to rollover should take into account financial and tax considerations, as well as retirement goals and time horizon. It's essential to research and understand the terms and conditions of both plans, consult with the plan administrators, and complete all necessary documentation correctly. A pension plan rollover is not a decision to be taken lightly, and careful planning and consideration are required.What Is a Pension Plan Rollover to 401(k)?

Have questions about Pension Plan rollovers? Click here.Eligibility for Pension Plan Rollover to 401(k)

Age and Service Requirements

Termination of Employment

Pension Plan Qualification Criteria

Steps Involved in the Pension Plan Rollover to 401(k)

Step 1: Research and Understand the Pension Plan Terms and Conditions

Step 2: Contact the Pension Plan Administrator

Step 3: Complete the Necessary Documentation

Step 4: Initiate the Rollover Process with the 401(k) Plan Administrator

Pension Plan Rollover to 401(k) Costs and Penalties

Administrative Fees and Charges

Tax Implications and Withholding

Early Withdrawal Penalties and Restrictions

Considerations for Pension Plan Rollover to 401(k)

Financial

Tax

Retirement Goals and Time Horizon

Can I Rollover a 401(k) into a 529 Plan?

Is a Pension Plan Rollover to 401(k) Right for You

Conclusion

Pension Plan Rollover to 401(k) FAQs

A pension plan rollover to 401(k)is when an individual transfers funds from a traditional pension plan account into a 401(k) retirement account.

Yes, moving your funds into a 401(k) account can have many advantages, such as greater investment options and tax savings benefits.

Yes, depending on the type of account you are rolling over your funds from, you may incur taxes and/or penalties for early withdrawal. It is important to speak with a financial advisor before making this decision.

You will need to provide bank account information and other relevant documents, such as proof of identity and evidence of your current pension plan status.

The length of time varies depending on the type of accounts involved, but typically takes no more than 5 business days for the transfer to be completed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.