A direct rollover is a financial process that allows individuals to transfer their retirement savings from one qualified retirement account to another without incurring taxes or penalties. This transfer is done directly between the account providers, ensuring a smooth and tax-free transition. The process is straightforward, and individuals do not receive the funds directly; they go directly from one retirement account to another. This method differs from an indirect rollover, where an individual receives the distribution and then deposits it into a new account within 60 days, which can incur taxes or penalties if not done correctly. Direct Rollovers can consolidate multiple retirement accounts, provide access to a broader range of investment options, lower fees, and simplify estate planning.

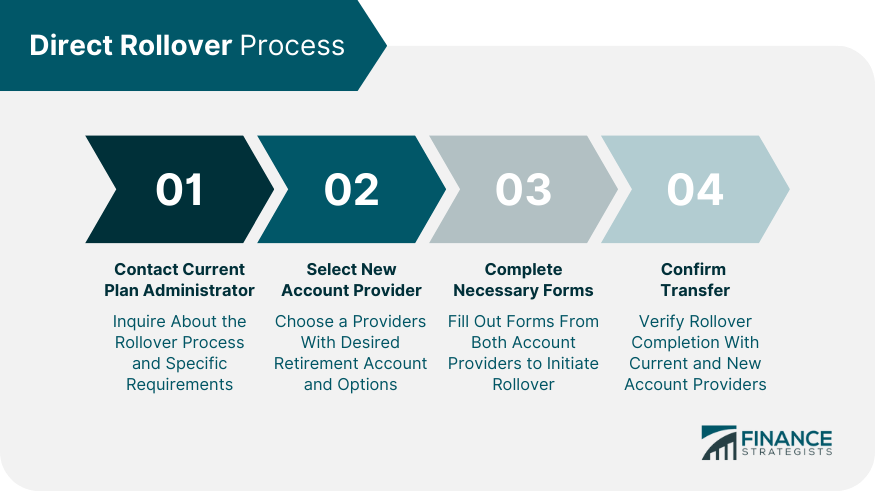

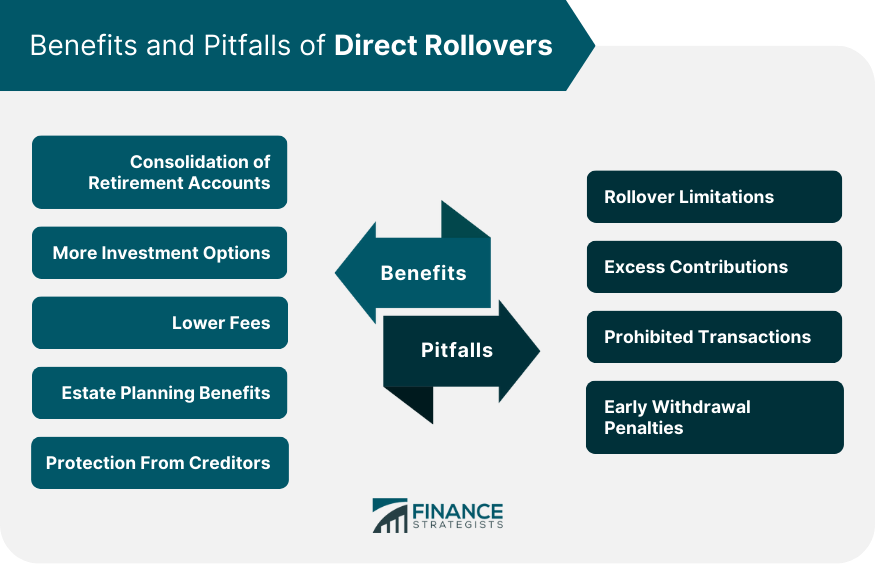

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Direct Rollover involves moving funds from an employer-sponsored retirement plan directly into an IRA or another employer's plan without incurring taxes or penalties. To maximize benefits, ensure the receiving account is appropriately designated for rollovers and confirm the transfer type with both financial institutions. This strategy preserves tax-deferred status and avoids unnecessary fees.Don't miss out on an opportunity to maintain the tax-advantaged status of your retirement funds. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation To be eligible for a direct rollover, an individual must have a qualified retirement account and be allowed by the plan provider to make a rollover. Common reasons for rollover eligibility include changing jobs, retiring, or reaching the required minimum distributions (RMDs) age. Contacting the Current Plan Administrator: Reach out to your current plan administrator to inquire about the rollover process and any specific requirements. Selecting the New Account Provider: Choose a new account provider that offers the desired retirement account type and investment options. Completing Necessary Forms: Complete the required forms provided by the current and new account providers to initiate the rollover. Confirming the Transfer: Once the funds have been transferred, confirm the rollover completion with the current and new account providers. The direct rollover process can take anywhere from a few days to several weeks, depending on the providers and the complexity of the transfer. When done correctly, a direct rollover is tax-free, allowing individuals to transfer their retirement savings without incurring taxes or penalties. Traditional IRA vs Roth IRA: When rolling over a traditional IRA to a Roth IRA, the individual must pay taxes on the pre-tax contributions and earnings. Pre-tax 401(k) to Roth IRA: Rolling over a pre-tax 401(k) to a Roth IRA also results in the individual paying taxes on the pre-tax contributions and earnings. If a rollover is not done correctly, it may be treated as a taxable distribution, resulting in taxes and potential penalties for early withdrawal. RMDs are mandatory withdrawals from certain retirement accounts once the individual reaches a specific age. RMDs cannot be rolled over, and failure to take RMDs can result in significant penalties. A direct rollover can help consolidate multiple retirement accounts, making managing and monitoring investments easier. A direct rollover may provide access to a broader range of investment options, helping to diversify and optimize the retirement portfolio. Consolidating retirement accounts through a direct rollover can reduce account management and investment fees. A direct rollover can simplify estate planning by reducing the number of accounts and beneficiaries to manage. Some retirement accounts offer better protection from creditors than others. A direct rollover can help individuals secure their retirement savings from potential creditors. An individual can only perform one indirect rollover between IRAs in a 12-month period. This limitation does not apply to direct rollovers or rollovers from a 401(k) to an IRA. Contributing more than the annual limit to a retirement account can result in taxes and penalties. Ensure that the rollover does not cause excess contributions in the new account. Certain transactions between retirement accounts and disqualified persons can result in taxes and penalties. Be aware of prohibited transactions when initiating a rollover. Withdrawing funds from a retirement account before reaching the specified age can result in taxes and penalties. Ensure that the rollover does not trigger early withdrawal penalties. Rolling over employer stock from a qualified plan to an IRA can have unique tax implications. Consult with a financial advisor to understand the best course of action. Outstanding loans from a retirement plan may need to be repaid or treated as a taxable distribution when initiating a rollover. Some retirement plans require spousal consent for certain transactions, including rollovers. Ensure that all necessary consents are obtained before initiating the rollover. Special rules apply to the rollover of retirement accounts after a divorce or the account holder's death. Consult with a financial advisor to navigate these situations. A direct rollover is a financial process that enables individuals to transfer their retirement savings from one qualified retirement account to another without incurring taxes or penalties. This tax-free transfer is conducted directly between account providers. It offers several advantages, including consolidating retirement accounts, access to a broader range of investment options, lower fees, simplified estate planning, and enhanced protection from creditors. The direct rollover process involves meeting eligibility criteria, initiating the transfer, and confirming its completion, with the timeline varying based on the providers and complexity of the transfer. It's important to understand the tax implications of direct rollovers, especially when rolling over between different account types, such as from a traditional IRA to a Roth IRA. Additionally, individuals should be aware of potential pitfalls and common mistakes, including the differences between direct and indirect rollovers, rollover limitations, excess contributions, prohibited transactions, and early withdrawal penalties. Special considerations may apply in cases involving employer stock, outstanding loans, spousal consent, and rollovers after divorce or death. What Is a Direct Rollover?

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Direct Rollover Process

Eligibility Criteria

Initiating the Process

Timeline for Completion

Tax Implications of Direct Rollover

Tax-Free Nature of Direct Rollover

Rollover Between Different Account Types

Tax Consequences of Incorrect Rollover

Required Minimum Distributions (RMDs)

Benefits of Direct Rollover

Consolidation of Retirement Accounts

More Investment Options

Lower Fees

Estate Planning Benefits

Protection From Creditors

Potential Pitfalls and Common Mistakes of Direct Rollover

Rollover Limitations

Excess Contributions

Prohibited Transactions

Early Withdrawal Penalties

Special Considerations for Direct Rollover

Direct Rollover of Employer Stock

Direct Rollover and Loans

Spousal Consent Requirements

Rollover After Divorce or Death

Conclusion

Direct Rollover FAQs

A Direct Rollover is a financial process that allows individuals to transfer their retirement savings from one qualified retirement account to another without incurring taxes or penalties. It involves transferring funds directly between account providers, ensuring a smooth and tax-free transition.

You should consider a Direct Rollover when changing jobs, retiring, or reaching the age for required minimum distributions (RMDs). It can consolidate multiple retirement accounts, provide access to a broader range of investment options, lower fees, and simplify estate planning.

A Direct Rollover, when done correctly, is a tax-free event. However, rolling over from a pre-tax account (like a Traditional IRA or 401(k) to a Roth IRA will require you to pay pre-tax contributions and earnings taxes. Always consult a financial advisor to understand the tax implications specific to your situation.

Common mistakes to avoid during a Direct Rollover include confusing it with an indirect rollover, not adhering to rollover limitations, causing excess contributions in the new account, engaging in prohibited transactions, and triggering early withdrawal penalties.

The timeline for completing a Direct Rollover can vary, typically ranging from a few days to several weeks, depending on the account providers and the complexity of the transfer. It's essential to stay in touch with both the current and new account providers to ensure a smooth process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.