A 401(k) is not a defined benefit plan. Instead, it is classified as a defined contribution plan. It is an employer-sponsored retirement savings that allows employees to contribute a portion of their pre-tax salary. The plan offers individuals more control over their investments and retirement savings, but the ultimate retirement benefits depend on the contributions made and the investment performance. It is different from defined benefit plans which provide retirees with a fixed and guaranteed income. A defined benefit plan, commonly referred to as a pension, promises employees a specific monthly benefit at retirement. The benefit amount is predetermined and is based on factors like age, years of service, and salary. Unlike defined contribution plans, where the retirement payout depends on the individual's contributions and investment returns, defined benefit plans provide a set amount regardless of market conditions. The responsibility of funding and managing the investment of a defined benefit plan largely rests with the employer. The employer commits to providing the agreed-upon benefit and bears the investment risks associated with ensuring the necessary funds are available when the employee retires. For employees enrolled in a defined benefit plan, the process is relatively straightforward. Upon retirement, they receive a guaranteed amount, usually monthly, for the rest of their life or for a specified period. How much they receive is calculated using a formula that often factors in their final salary, years of service, and a predetermined percentage. On the employer side, it's more intricate. Employers must contribute to the plan and ensure it's adequately funded. They usually work with actuaries to determine contribution amounts and ensure they can meet future obligations. This involves assessing the current value of the fund, projecting future liabilities, and making investment decisions to grow the fund's assets. One of the main attractions of defined benefit plans is the promise of a stable income during retirement. Employees can have peace of mind knowing they'll receive a specific amount every month, regardless of market conditions. This predictability is invaluable for retirees, allowing them to plan their post-retirement life with a degree of certainty. For many, knowing that they can count on a regular income stream, just like when they were working, provides a sense of security. They don't have to worry about outliving their savings or constantly monitoring the stock market. "While defined contribution plans often allow or even encourage employees to contribute a portion of their salary, sometimes with employer matching, defined benefit plans promise a specific pension amount based on a set formula. Although these defined benefit plans are primarily funded by employers, there are instances where employees are also required to contribute." This means employees can accrue retirement benefits without having to set aside a portion of their paycheck. For employees, this can be seen as an added benefit on top of their regular salary. They're effectively getting "free money" for their retirement, making these plans attractive for recruitment and retention purposes. The use of a predetermined formula to calculate retirement benefits provides clarity to employees. They can, with relative accuracy, project their retirement income based on their career trajectory and years of service. Such transparency is beneficial for future planning. Employees can assess their expected pension alongside other retirement savings and strategize accordingly, ensuring they're on track to meet their post-retirement financial goals. It requires the expertise of actuaries to determine funding levels, investment professionals to manage the portfolio, and administrators to handle the day-to-day operations. These complexities can make defined benefit plans expensive to administer. For smaller companies, the costs and intricacies associated with these plans can be prohibitive, pushing them to explore alternative retirement solutions. If an employee changes jobs, they might face challenges in transferring their defined benefit plan to a new employer. While certain provisions allow for the transfer of benefits, it's not always straightforward, and employees might end up with reduced benefits. Furthermore, employees may feel tied to their job if they're nearing a milestone that would significantly increase their pension, limiting their career flexibility. Employers bear the risks associated with defined benefit plans. If investments underperform, the employer is responsible for making up the difference. Similarly, if retirees live longer than projected, employers might face funding shortages. Such risks can lead to financial instability for the company, especially if they have a large number of retirees and the market conditions are unfavorable. Under a 401(k) plan, the retirement income is not guaranteed and is based on the total contributions made and the investment performance over time. The final benefit amount depends on factors such as individual contributions, employer matches, and the returns on the chosen investments. The benefit amount is calculated using a formula that considers factors like years of service and average salary at retirement, providing participants with a guaranteed income stream for life. Employees are primarily responsible in a 401(k) plan for contributing to their retirement savings, often with the option of employer matching contributions. The investment risk and responsibility for generating adequate retirement income rest on the employee. While, in a defined benefit plan, the employer bears the responsibility of funding the plan and assumes the investment and longevity risks. The employer must ensure there are sufficient funds to fulfill the promised retirement benefits to employees. 401(k) plans offer more portability and flexibility for employees who change jobs. Participants can typically roll over their 401(k) funds into a new employer's retirement plan or an Individual Retirement Account (IRA). Defined benefit plans are generally less portable and offer limited flexibility when employees change jobs. They are often tied to a specific employer, and in some cases, employees may not be able to transfer their benefits to a new plan when switching jobs. A 401(k) is not a defined benefit plan. A defined benefit plan, also known as a pension, guarantees retirees a specific monthly benefit for life based on factors like age, years of service, and salary. In contrast, a 401(k) is a defined contribution plan where employees contribute a portion of their pre-tax salary to their retirement savings, and the ultimate benefits depend on individual contributions and investment performance. Defined benefit plans provide retirees with a stable and predictable income regardless of market conditions, offering security and peace of mind. However, they come with complexities and higher administration costs for employers. Additionally, the employer bears the investment and longevity risks. On the other hand, a 401(k) offers employees more control over their investments and greater portability when changing jobs. While it lacks guaranteed income, participants can benefit from employer-matching contributions and enjoy the potential for higher returns based on investment choices.Overview of 401(k) and Defined Benefit Plans

What Are Defined Benefit Plans?

How Defined Benefit Plans Work

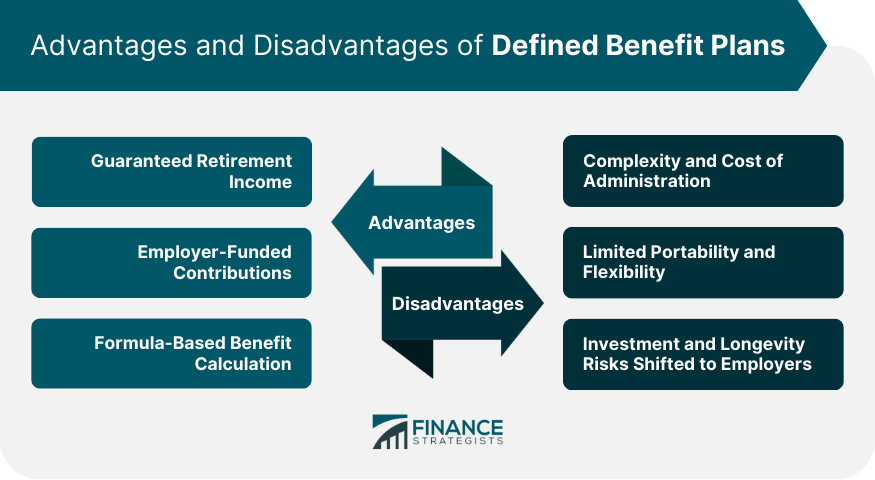

Advantages of Defined Benefit Plans

Guaranteed Retirement Income

Employer-Funded Contributions

Formula-Based Benefit Calculation

Disadvantages of Defined Benefit Plans

Complexity and Cost of Administration

Limited Portability and Flexibility

Investment and Longevity Risks Shifted to Employers

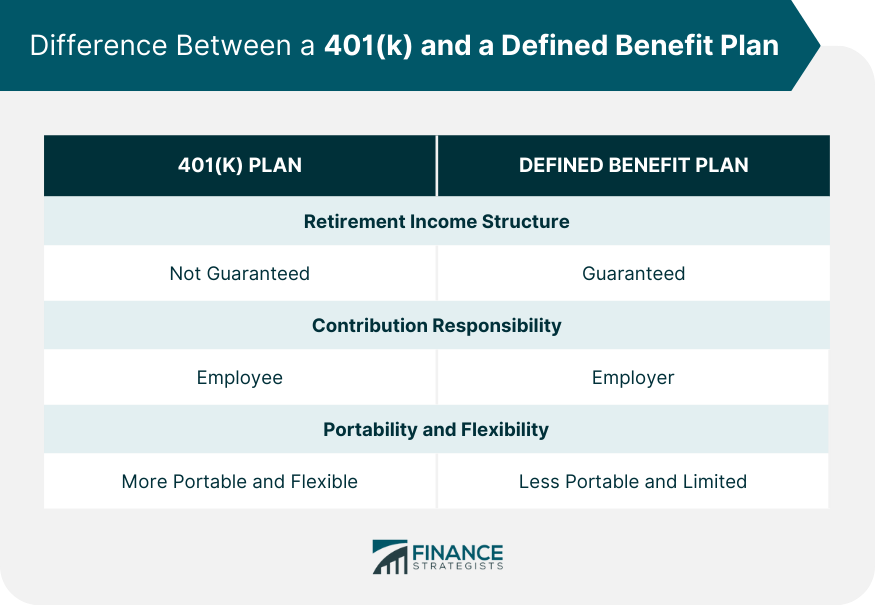

Difference Between a 401(k) and a Defined Benefit Plan

Retirement Income Structure

In a defined benefit plan, retirees receive a fixed and predetermined income during retirement. Contribution Responsibility and Risk

Portability and Flexibility

Conclusion

Is a 401(k) a Defined Benefit Plan? FAQs

No, a 401(k) is a defined contribution plan, while a pension is a defined benefit plan. In a 401(k), the retirement benefit depends on contributions and investment performance, whereas a pension promises a predetermined benefit.

The employer typically bears the investment risk in a defined benefit plan, ensuring the agreed-upon benefits are provided regardless of market performance.

Defined benefit plans have become less common, especially in the private sector, due to their cost and complexity. Many employers now favor defined contribution plans, like 401(k)s.

It depends on the plan's provisions and vesting schedule. You may be able to transfer benefits, but it could come with reduced benefits or specific requirements.

Typically, employers fund defined benefit plans. However, some plans may allow or require employee contributions. It's essential to check the specific terms of your plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.