An indirect rollover transfers funds from one retirement account to another by temporarily taking possession of the funds before depositing them into the new account. In an indirect rollover, the account holder withdraws funds from their original retirement account (e.g., a 401(k) or traditional IRA) and receives a distribution as a check or direct deposit. The account holder then has 60 days to deposit the funds into another eligible retirement account (e.g., a new 401(k) or IRA) to complete the rollover. If the account holder fails to complete the rollover within the 60-day window, the distribution may be treated as a taxable event, subject to income taxes and possibly an early withdrawal penalty if the account holder is under the age of 59½.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. A few years back, a client faced a tight spot after switching jobs, with their retirement funds tied up in an old employer's plan. Advising an indirect rollover, we navigated the 60-day rule meticulously, avoiding taxes and penalties by ensuring the funds landed in their new IRA within the timeframe. It's a nuanced process, but with the right guidance, it can be a smooth and beneficial transition. Let's discuss how you can protect and grow your retirement funds. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth PreservationWhat Is an Indirect Rollover?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Eligibility and Requirements for Indirect Rollover

Eligible Retirement Plans for Indirect Rollover

Indirect rollovers can be performed with various types of retirement accounts, including:

Requirements for a Valid Indirect Rollover

To perform a valid indirect rollover, account holders must adhere to the following rules:

60-Day Rule: The distributed funds must be deposited into the new retirement account within 60 days of receiving the distribution.

One-Per-Year Rule: Account holders can only perform one indirect rollover per 12-month period for each IRA they own.

Rollover Amount Limits: There are no specific dollar limits for an indirect rollover, but certain limitations may apply depending on the retirement account type.

Rollover Frequency Limitations: Some plans may impose limitations on the frequency of indirect rollovers.

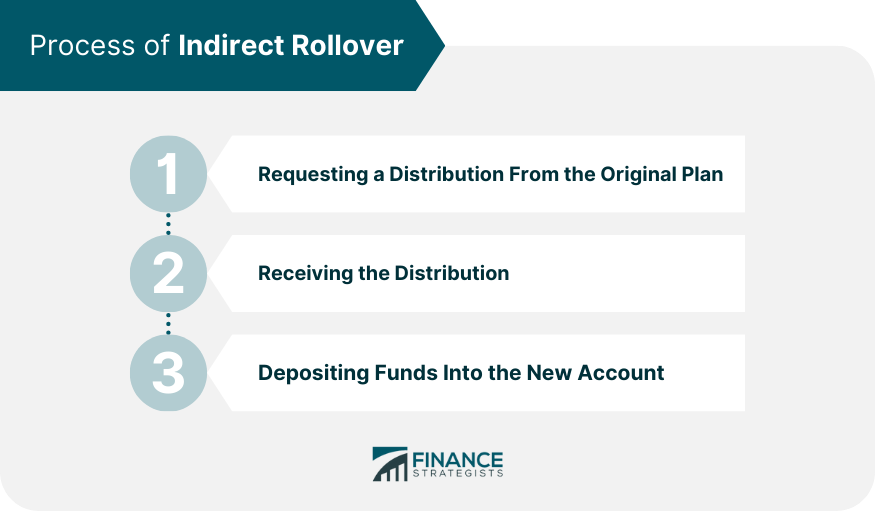

Process of Indirect Rollover

Requesting a Distribution From the Original Plan

To initiate an indirect rollover, account holders must first request a distribution from their current retirement plan.

This typically requires completing and submitting the necessary documentation to the plan administrator. At this stage, account holders should be aware of any withholding taxes and potential penalties that may apply.

Receiving the Distribution

After the distribution has been processed, the account holder will receive the funds. Payment options may vary, and it is important to understand the tax implications associated with the distribution, including mandatory withholding taxes and potential penalties.

Depositing Funds Into the New Account

Once the account holder has received the distribution, they must open a new retirement account if they do not already have one.

The funds must be deposited into the new account within the 60-day deadline. Account holders may need to complete additional documentation and forms to ensure a successful rollover.

Account holders must report the indirect rollover to the Internal Revenue Service (IRS) using the appropriate tax forms. Failing to report the rollover can result in tax implications and potential penalties.

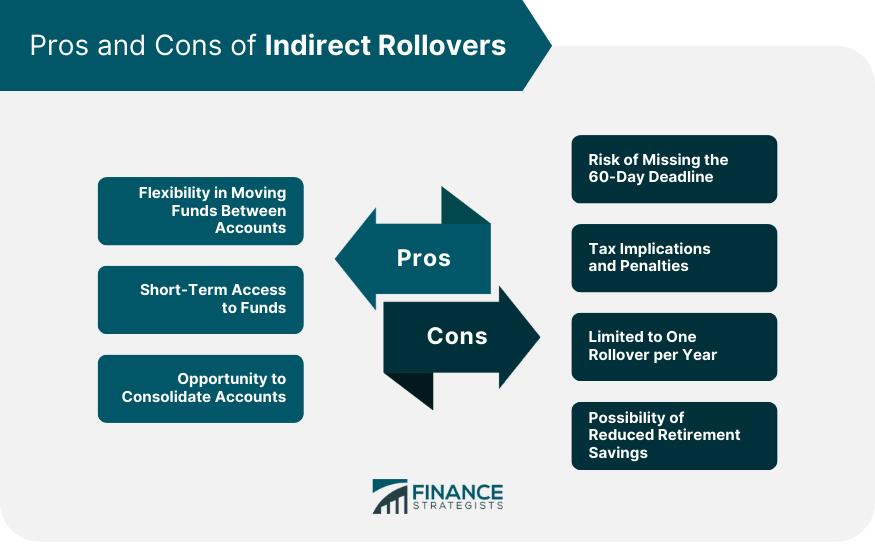

Pros and Cons of Indirect Rollovers

Pros

Flexibility in Moving Funds Between Accounts: Indirect rollovers allow the account holder to move funds between various retirement accounts.

Short-Term Access to Funds: Indirect rollovers allow account holders temporary access to their retirement funds before depositing them into the new account.

Opportunity to Consolidate Accounts: Indirect rollovers can be used to consolidate multiple retirement accounts, simplifying the account holder's retirement planning.

Cons

Risk of Missing the 60-Day Deadline: Failing to deposit the funds within the 60-day window may result in taxes and penalties.

Tax Implications and Penalties: Indirect rollovers can trigger withholding taxes and potential penalties if not executed correctly.

Limited to One Rollover per Year: Account holders can only perform one indirect rollover per 12-month period for each IRA they own, limiting their ability to move funds between accounts.

Possibility of Reduced Retirement Savings: If the account holder does not deposit the entire distributed amount into the new account, their overall retirement savings may be reduced, potentially impacting their long-term financial goals.

Direct Rollover as an Alternative to Indirect Rollover

Definition of Direct Rollover

A direct rollover, also known as a trustee-to-trustee transfer, is an alternative method of transferring retirement assets.

In a direct rollover, the funds are directly transferred from the original retirement account to the new account, bypassing the account holder.

Differences Between Direct and Indirect Rollover

Transfer Process: In a direct rollover, the funds are transferred directly between the two retirement accounts, while in an indirect rollover, the account holder receives the funds before depositing them into the new account.

Tax Implications: Direct rollovers typically have fewer tax implications than indirect rollovers, as there is no mandatory withholding tax, and the funds are not temporarily in the account holder's possession.

Frequency Limitations: Direct rollovers are not subject to the one-per-year limitation that applies to indirect rollovers.

Advantages of Direct Rollover

Easier Process: Direct rollovers generally involve a simpler process, as the funds are moved directly between the retirement accounts.

Reduced Tax Risks: Direct rollovers have fewer tax implications, making them a more attractive option for account holders who wish to avoid potential taxes and penalties.

No Access to Funds During the Transfer: While this might be seen as a disadvantage, it helps account holders avoid the temptation to spend the funds during the rollover process, thus preserving their retirement savings.

Conclusion

An indirect rollover is a method of transferring funds from one retirement account to another by temporarily taking possession of the funds before depositing them into the new account.

While it provides flexibility and temporary access to retirement funds, there are potential risks and limitations.

Account holders must adhere to the 60-day rule, the one-per-year rule, and be mindful of rollover amount limits and frequency limitations.

Failure to meet the 60-day deadline or execute the rollover correctly can result in tax implications and penalties, potentially reducing retirement savings.

Considering the pros and cons of an indirect rollover, there are benefits such as the flexibility to move funds between accounts, short-term access to funds, and the opportunity to consolidate accounts.

However, the risks include missing the 60-day deadline, tax implications, limited rollover frequency, and the possibility of reduced retirement savings.

Ultimately, individuals should carefully consider their specific circumstances, consult with financial advisors, and evaluate the advantages and disadvantages of indirect rollovers to determine the most suitable approach for transferring their retirement assets.

Indirect Rollover FAQs

An indirect rollover is when you take a retirement account distribution and deposit the funds into another account within 60 days.

Yes, you are only allowed one indirect rollover per year per IRA account.

Generally, any retirement account that is eligible for rollover can participate in an indirect rollover, including 401(k)s, 403(b)s, and traditional IRAs.

Yes, you can withdraw money from your retirement account during an indirect rollover, but it must be redeposited within 60 days to avoid penalties and taxes.

Yes, there are two alternatives: a direct rollover, which involves transferring funds directly between retirement accounts without taking possession of the money, or a trustee-to-trustee transfer, which is a direct transfer between two different retirement account trustees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.