Asset transfer is a process by which ownership or control of an asset is transferred from one person or entity to another. The asset in question could be a tangible asset such as real estate or inventory, or an intangible asset such as a patent or a contractual right. Asset transfer can occur for a variety of reasons, such as inheritance, business acquisition, divorce settlement, or restructuring. The process of asset transfer involves a series of steps, which typically include an assessment of the asset's value, negotiation of the terms of the transfer, and the execution of a legal agreement to document the transfer. There may also be tax implications associated with asset transfer, and it is important to consider these implications and ensure compliance with all relevant regulations. In some cases, asset transfer may also involve due diligence, which is a process of assessing the asset's condition, value, and legal status. Asset transfer is an important process in many industries and can have a significant impact on the financial health and growth of a business. . Asset transfers are subject to various laws and regulations depending on the jurisdiction and the type of asset involved. These may include property laws, corporate laws, intellectual property laws, and tax laws. It is essential for the parties involved to understand the legal requirements and ensure compliance to avoid disputes and penalties. Proper documentation is crucial to the success of any asset transfer. The documentation process may include drafting contracts or agreements, registering the transfer with relevant authorities, and obtaining necessary permits or licenses. Legal professionals can provide guidance and assistance in navigating these requirements. Tax consequences often accompany asset transfers. Parties involved must carefully assess the tax implications of the transfer, such as capital gains tax, gift tax, inheritance tax, and value-added tax. Tax planning and professional advice can help minimize potential tax liabilities. Real estate, including residential, commercial, and industrial properties, is a common type of asset transferred. Property transfers may involve sales, donations, or inheritances, and often require registration with a land registry or similar authority. Vehicles, such as cars, boats, and aircraft, can also be transferred between owners. Proper documentation and registration with relevant authorities are essential for a successful transfer. Machinery and equipment used in various industries can be transferred as part of business transactions, mergers, or acquisitions. These transfers may involve negotiations, contracts, and proper valuation of the assets. Intangible assets, such as patents, trademarks, and copyrights, can be transferred through licensing agreements, sales, or donations. Proper documentation and registration with relevant authorities are crucial for safeguarding the rights of the new owner. Goodwill, representing the reputation and customer relationships of a business, can be transferred as part of a business sale or merger. Proper valuation and accounting for goodwill are necessary to ensure a fair transaction. Brand names and trademarks can be transferred through licensing agreements or as part of business transactions. Proper registration and documentation with relevant authorities are essential for protecting the new owner's rights. A common method of asset transfer is through sale or purchase agreements. These agreements outline the terms and conditions of the transfer, including the purchase price, payment terms, and warranties. Gifts or donations are another way to transfer assets without a monetary exchange. Tax implications and documentation requirements must be considered in such transfers. Assets can be transferred through inheritance upon the death of the owner. Estate planning tools, such as wills and trusts, can help ensure a smooth transfer of assets to beneficiaries. In mergers and acquisitions, businesses combine or transfer assets to create a new entity or expand operations. Due diligence, negotiation, and proper documentation are vital in such transactions. When a business or individual is insolvent, assets may be transferred to pay off creditors. This process is usually governed by bankruptcy or insolvency laws and may involve court supervision and the appointment of a trustee or administrator. Valuation is a critical aspect of asset transfers, as it determines the fair market value of the asset. The market value approach considers the price at which similar assets have recently been bought or sold in the open market. The income approach values an asset based on the income it is expected to generate in the future. This method is particularly useful for income-producing assets, such as rental properties and businesses. The cost approach estimates the value of an asset based on the cost of creating a similar asset from scratch. This method is often used for assets with no established market value, such as unique machinery or equipment. Due diligence is an essential part of the asset transfer process, as it helps identify potential risks, liabilities, and issues that may affect the transaction. This process includes reviewing financial records, legal documents, and conducting inspections of the assets involved. Negotiating the terms and structuring the asset transfer are essential to ensure a successful transaction. Factors to consider include the purchase price, payment terms, warranties, and contingencies. Legal and financial professionals can provide valuable guidance during this process. Asset transfers can lead to legal disputes if the parties involved do not adhere to the governing laws and regulations or if there is a breach of contract. Such disputes can result in costly litigation and delays in the transfer process. Fraud and misrepresentation are potential risks in asset transfers, as unscrupulous parties may provide false information or conceal material facts about the assets. Due diligence is essential in mitigating these risks. Assets may be encumbered by liens, mortgages, or other claims, which can complicate the transfer process. It is essential to identify and address any encumbrances before completing the transaction. Unresolved tax liabilities and disputes can pose risks in asset transfers. Proper tax planning and advice from professionals can help minimize these risks and ensure compliance with tax laws. Failure to comply with relevant regulations and requirements can lead to penalties, fines, or even the nullification of the asset transfer. Seeking professional advice and ensuring strict compliance with laws and regulations can help avoid these issues. Trusts and foundations are legal entities that can be used to transfer assets for wealth management and succession planning purposes. They can provide tax benefits, protect assets from creditors, and ensure a smooth transfer of assets to beneficiaries. Family limited partnerships (FLPs) are a popular tool for transferring assets within a family while maintaining control and providing tax benefits. FLPs can help minimize estate taxes and facilitate the transfer of business interests to the next generation. Gifting strategies, such as annual exclusion gifts and lifetime exemption gifts, can help reduce the taxable value of an estate and facilitate the transfer of assets to beneficiaries. Proper planning and advice from professionals are crucial to ensure compliance with tax laws. Estate planning and the creation of a will can help ensure the orderly transfer of assets upon the death of the owner. Proper planning can help minimize estate taxes, avoid probate, and provide clear instructions for the distribution of assets. Asset transfers are a complex yet essential aspect of financial management and planning. Understanding the legal and regulatory framework, types of assets, methods of transfer, key considerations, risks, and strategies for wealth management and succession planning is crucial for a successful transaction. Proper planning, due diligence, and the guidance of professional advisors can help navigate the process and mitigate potential risks, ensuring a smooth and efficient asset transfer. By considering the various factors involved in asset transfers, individuals and businesses can better manage their wealth and plan for the future.What Is an Asset Transfer?

Legal and Regulatory Framework for Asset Transfers

Governing Laws and Regulations

Required Documentation and Compliance

Tax Implications and Considerations

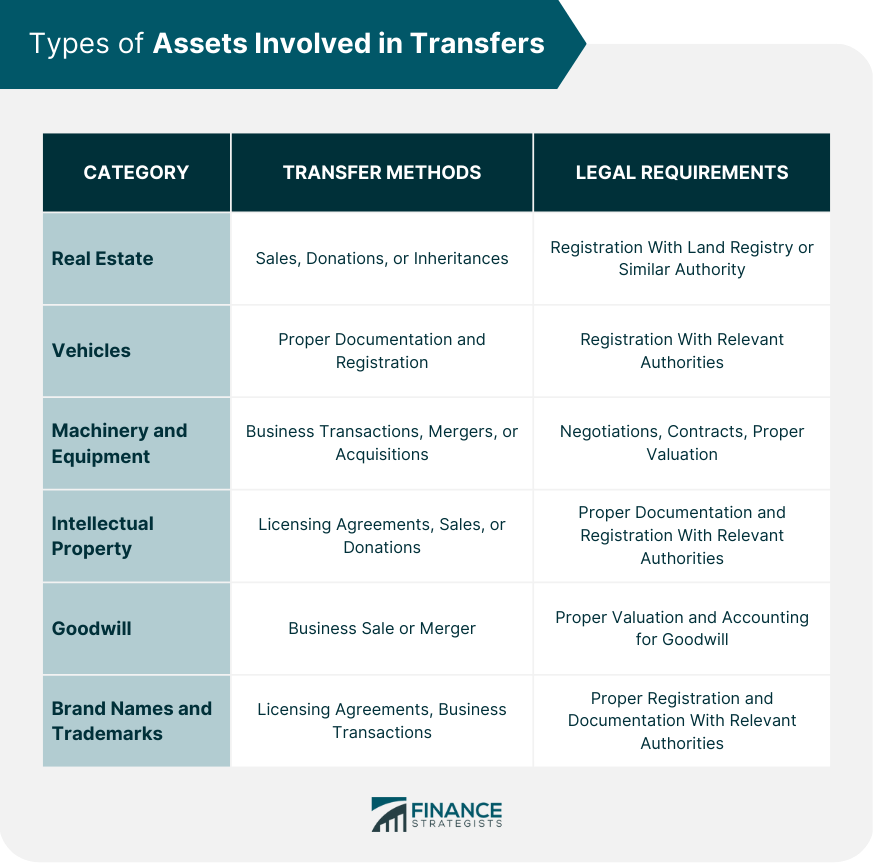

Types of Assets Involved in Transfers

Tangible Assets

Real Estate

Vehicles

Machinery and Equipment

Intangible Assets

Intellectual Property

Goodwill

Brand Names and Trademarks

Methods of Asset Transfer

Sale or Purchase Agreements

Gift or Donation

Inheritance and Estate Planning

Mergers and Acquisitions

Asset Transfer in Bankruptcy or Insolvency

Key Considerations in Asset Transfers

Valuation of Assets

Market Value Approach

Income Approach

Cost Approach

Due Diligence Process

Negotiation and Structuring of the Transfer

Risks and Challenges in Asset Transfers

Legal Disputes and Litigation

Fraud and Misrepresentation

Asset Encumbrances and Liens

Tax Liabilities and Disputes

Regulatory Compliance and Penalties

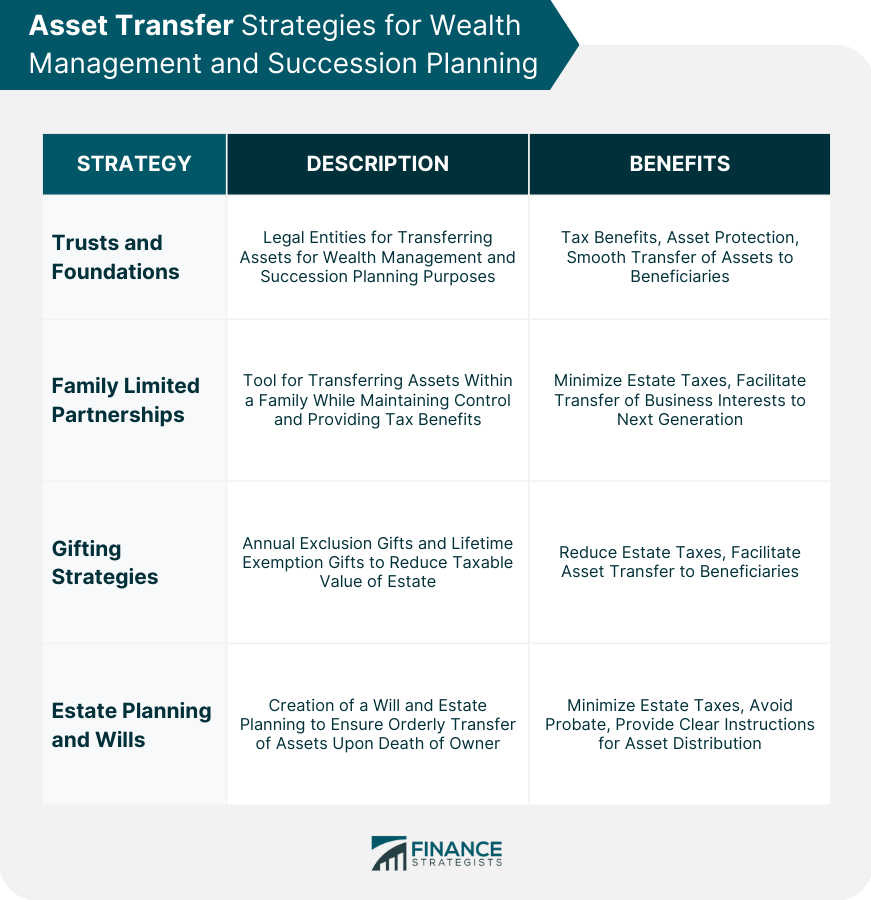

Asset Transfer Strategies for Wealth Management and Succession Planning

Trusts and Foundations

Family Limited Partnerships

Gifting Strategies

Estate Planning and Wills

Conclusion

Asset Transfer FAQs

An asset transfer refers to the process of transferring ownership or control of an asset from one person or entity to another. The asset could be tangible, such as property or inventory, or intangible, such as intellectual property or a contractual right.

Asset transfers can occur for a variety of reasons, such as in the case of an inheritance, a gift, a business acquisition, or a divorce settlement. Additionally, companies may transfer assets as part of a restructuring or to merge with another company.

When transferring assets, it is important to consider factors such as the value of the asset, any potential tax implications, and any legal or regulatory requirements that may apply. Additionally, it is important to ensure that the transfer is properly documented and recorded to avoid any disputes or misunderstandings in the future.

Asset transfer refers specifically to the act of transferring ownership or control of an asset, while asset management refers to the ongoing process of managing and optimizing the value of assets over time. Asset management may involve tasks such as maintenance, repair, and replacement of assets, as well as strategic planning to ensure that assets are being used effectively.

Lawyers can play a critical role in asset transfers by helping to ensure that the transfer is conducted legally and in compliance with all relevant regulations. They can also provide advice on the best approach to take in terms of structuring the transfer, as well as on any potential risks or liabilities that may arise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.