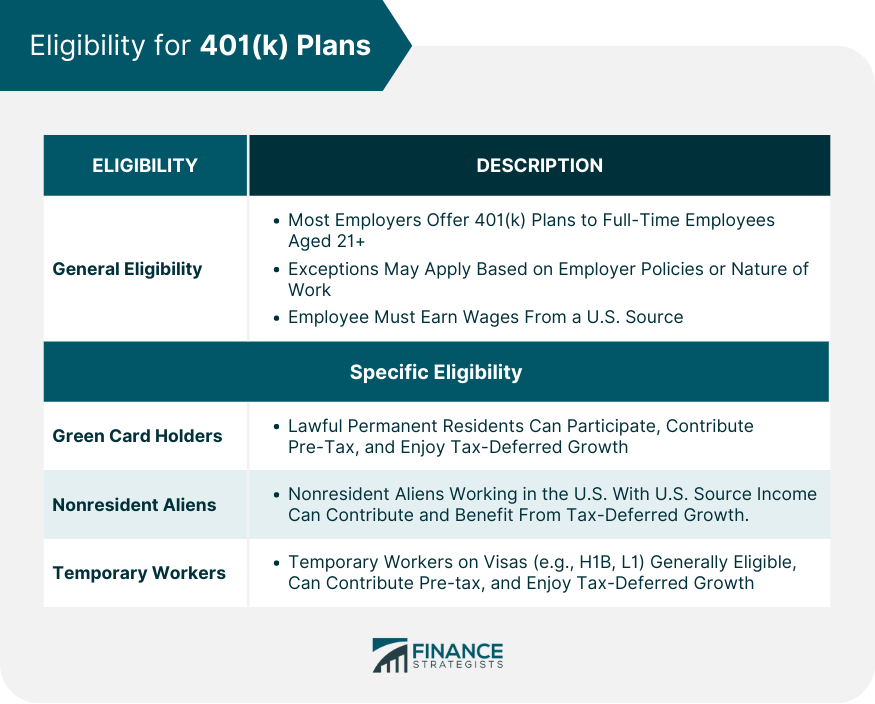

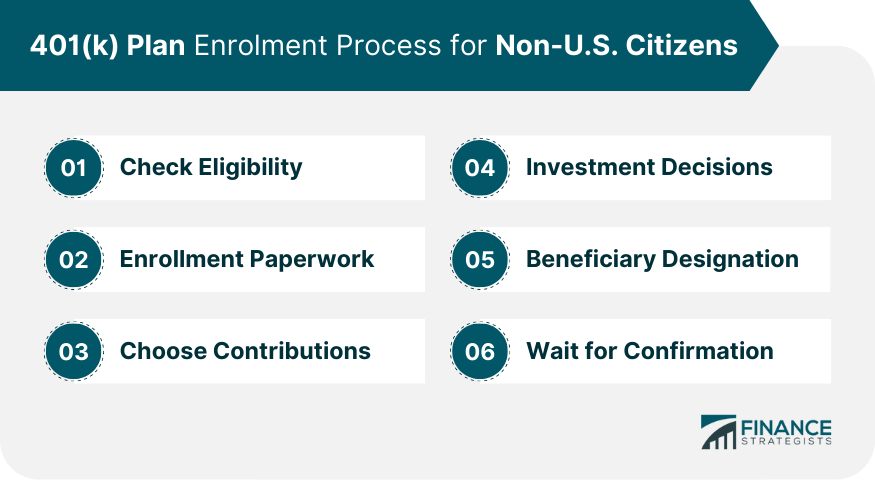

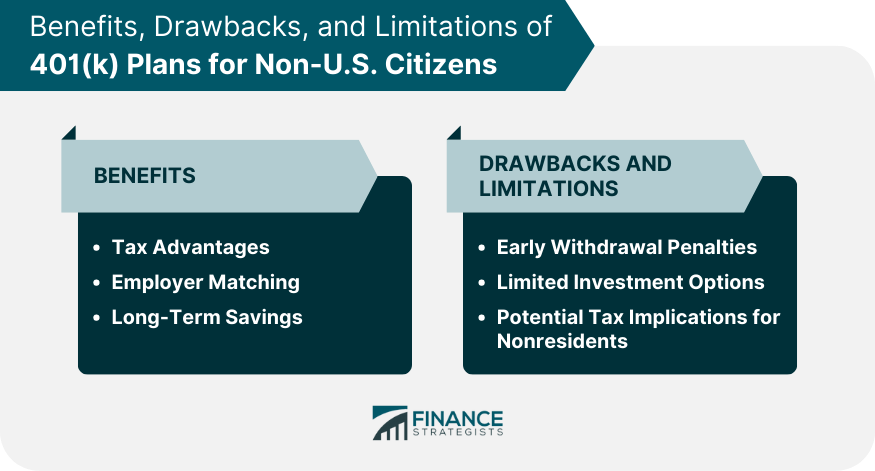

A 401(k) plan is an employer-sponsored retirement savings program that offers significant tax benefits to participants. As one of the most common retirement plans in the United States, it allows employees to save and invest a portion of their paychecks before taxes are taken out. Funds in a 401(k) grow tax-free until withdrawal, typically during retirement when many people find themselves in a lower tax bracket. An additional advantage is that many employers offer to match contributions up to a certain percentage, effectively increasing the employee's earnings. Many non-U.S. citizens working in the country may wonder whether they can benefit from such plans. The answer is a resounding yes. Whether you're a permanent resident, a nonresident alien, or a temporary worker, participating in a 401(k) plan can provide substantial benefits. However, understanding the complexities and potential implications of these plans is crucial for strategic planning. In general, eligibility for a 401(k) plan depends on the company's specific plan document. While most U.S. employers extend their 401(k) plans to all full-time employees aged 21 and older, some exceptions may apply, depending on the employer's policies or the nature of the employee's work. The most important factor is that the employee earns wages from a U.S. source. Green Card holders, also known as lawful permanent residents, are generally eligible to participate in their employer's 401(k) plan, assuming they meet all other standard eligibility criteria. As long-term residents, they are taxed on their worldwide income, just like U.S. citizens. Hence, they can make pre-tax contributions to a 401(k) plan, enjoy tax-deferred growth of their investments, and take taxable distributions during retirement. Nonresident aliens working in the United States and earning U.S. source income are typically eligible to participate in 401(k) plans. They can contribute a portion of their U.S.-source income to the plan and benefit from tax-deferred growth. Temporary workers on visas such as H1B or L1 are also generally eligible to participate in a 401(k) plan if their employer offers one. They can contribute pre-tax dollars from their U.S. source income and enjoy tax-deferred growth. However, it's important for temporary workers to understand the potential tax implications and penalties if they decide to return to their home country before retirement age. The process of enrolling in a 401(k) plan is typically straightforward. 1. Check Eligibility: Confirm with your HR department that you meet the eligibility requirements for the 401(k) plan. 2. Enrollment Paperwork: Complete the necessary enrollment forms provided by your employer. This might be a paper-based process or an online process. 3. Choose Contributions: Decide how much of your salary you wish to contribute. The IRS sets a limit on how much you can contribute each year. As of 2024, the limit is $23,000 per year or $30,500 for those aged 50 or older. 4. Investment Decisions: Choose your investments from the options provided in your company's plan. This usually includes a range of mutual funds. 5. Beneficiary Designation: Choose who would inherit your 401(k) should something happen to you. This can be a spouse, child, or anyone else you wish. 6. Wait for Confirmation: Once you've submitted all the necessary paperwork, you should receive confirmation of your enrollment and a summary plan description that provides details about how the plan operates. In terms of documentation, non-U.S. citizens will typically need to provide their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), in addition to proof of employment and wage information. The process is largely the same as for U.S. citizens, with the primary difference being the potential need to complete a W-8BEN form, which is used by nonresident aliens to claim tax treaty benefits, if applicable. One of the main benefits of 401(k) plans, including for non-U.S. citizens, is the tax advantage they provide. Contributions to the plan are made pre-tax, meaning that they lower your current taxable income. Additionally, your contributions and any earnings from the investments grow tax-deferred until you withdraw them in retirement. Many employers offer to match a portion of the contributions their employees make to a 401(k) plan, often up to a certain percentage of their salary. This essentially represents free money and can significantly boost your retirement savings. Non-U.S. citizens are also typically eligible for this benefit if they participate in a 401(k) plan. A 401(k) plan encourages long-term savings habits, as the money you contribute is meant to serve you in retirement. Over time, thanks to compound interest, your savings can grow significantly. Withdrawals from a 401(k) plan before the age of 59.5 are subject to a 10% early withdrawal penalty, in addition to being taxed as ordinary income. Non-U.S. citizens who leave the U.S. permanently before reaching this age might need to withdraw their savings and could thus face these penalties. 401(k) plans typically offer a select list of investment options, and you cannot invest in anything outside of this list. This could be a limitation if you prefer to have more control over your investment choices. Nonresident aliens could face additional tax implications when participating in a 401(k) plan. While they can enjoy tax-deferred growth, distributions might be subject to U.S. withholding taxes. The details could vary depending on the tax treaty between the U.S. and their home country. U.S. tax laws can be complex, particularly for non-U.S. citizens who might not be familiar with the system. It's crucial to understand the tax implications of contributing to a 401(k), including how your contributions will affect your taxable income, how your investments will grow tax-free, and what taxes you'll pay upon distribution. Changing immigration status, such as moving from a temporary worker status to being a green card holder, can affect how you handle your 401(k) plan. For instance, while a temporary worker might plan to take a lump-sum distribution upon leaving the U.S., a new green card holder might decide to keep their savings in the plan for a longer-term retirement strategy. If you leave the U.S. permanently, you'll need to decide what to do with your 401(k) plan. You might choose to keep it in the U.S., roll it over into an IRA, or take a distribution. Each option has different tax implications, and the right choice will depend on your personal situation and potentially the tax treaty between the U.S. and your home country. Individual Retirement Accounts (IRAs) are another type of tax-advantaged retirement account that might be available to non-U.S. citizens, depending on their income and tax status. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs offer tax-free growth and tax-free withdrawals in retirement. A standard brokerage account doesn't offer the same tax advantages as a 401(k) or an IRA, but it provides greater flexibility. You can invest in a wide range of stocks, bonds, mutual funds, and other securities, and there are no restrictions on withdrawals. Depending on their status and situation, non-U.S. citizens might also consider other savings options. These might include high-yield savings accounts, certificates of deposit (CDs), or even real estate investments. The right choice will depend on factors such as risk tolerance, time horizon, financial goals, and more. Navigating the world of U.S. retirement savings plans as a non-U.S. citizen can be complex, but it can also provide significant advantages. Eligibility for 401(k) plans extends to green card holders, nonresident aliens, and temporary workers who earn U.S.-sourced income. With the appropriate planning and understanding, these plans can be a critical part of your financial future. The benefits of 401(k) plans, such as tax advantages, potential employer matching, and long-term savings growth, often outweigh the potential drawbacks. However, limitations do exist, including early withdrawal penalties, limited investment options, and potential tax implications for non-residents. It's essential to understand these aspects and plan accordingly. If you're a non-U.S. citizen considering a 401(k) plan, it may be beneficial to consult with a financial advisor or a retirement planning service.Overview of 401(k) Plans for Non-U.S. Citizens

Eligibility for 401(k) Plans

General Eligibility Requirements

Specific Eligibility for Non-U.S. Citizens

Green Card Holders

Nonresident Aliens

Temporary Workers

Enrollment Process for Non-U.S. Citizens

Step-By-Step Guide

Necessary Documentation

Benefits of 401(k) Plans for Non-U.S. Citizens

Tax Advantages

Employer Matching

Long-Term Savings

Drawbacks and Limitations of 401(k) Plans for Non-U.S. Citizens

Early Withdrawal Penalties

Limited Investment Options

Potential Tax Implications for Nonresidents

Navigating 401(k) Plans as a Non-U.S. Citizen

Understanding U.S. Tax Laws

Impact of Changing Immigration Status

Handling 401(k) When Leaving the U.S.

Alternatives to 401(k) for Non-U.S. Citizens

Individual Retirement Accounts (IRAs)

Brokerage Accounts

Other Savings Plans

Bottom Line

401(k) Plans for Non-U.S. Citizens FAQs

Yes, non-U.S. citizens who earn U.S.-source income, including green card holders, nonresident aliens, and temporary workers, are generally eligible to contribute to a 401(k) plan if their employer offers one.

The benefits include tax advantages, potential employer matching, and long-term savings growth. These benefits can significantly boost your retirement savings.

Potential drawbacks include early withdrawal penalties, limited investment options, and potential tax implications for non-residents. It's important to understand these aspects before participating in a 401(k) plan.

Non-U.S. citizens who leave the U.S. have several options, including leaving the money in the 401(k), rolling it over into an IRA, or taking a distribution. Each option has different tax implications, and the right choice will depend on your personal situation.

Yes, alternatives might include Individual Retirement Accounts (IRAs), brokerage accounts, or other savings options like high-yield savings accounts or real estate investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.