Auto-escalation, also known as automatic increase or automatic contribution escalation, is a feature in retirement savings plans that systematically increases the percentage of an employee's salary being contributed to the plan. The main purpose of auto-escalation is to boost retirement savings over time, helping individuals to accumulate a larger nest egg for their retirement years. In the realm of retirement planning, auto-escalation plays a crucial role in helping individuals achieve their retirement goals. This feature ensures that the employee's contribution rate increases gradually, encouraging disciplined saving habits and taking advantage of compound interest to grow the retirement account. Auto-escalation is a feature in some 401(k) retirement plans that automatically increases the percentage of an employee's salary that is contributed to their retirement account over time. Here's how it typically works: The goal of auto-escalation is to help employees gradually increase their retirement savings without having to remember to manually increase their contribution percentage each year. This can be especially helpful for employees who may not have a lot of experience with investing or retirement planning, or who might not think to increase their contribution percentage on their own. 401(k) plans are a common employer-sponsored retirement plan that allows employees to save and invest part of their paychecks before taxes are taken out. Many 401(k) plans offer auto-escalation features to help employees increase their savings rate over time. 403(b) plans are a retirement plan for specific employees of public schools, tax-exempt organizations, and certain ministers. Similar to 401(k) plans, 403(b) plans may also include auto-escalation features. IRAs are a personal retirement savings account that allows individuals to contribute pre-tax or after-tax dollars, depending on the type of IRA. Many employers offer auto-escalation as a feature in their retirement plans, either as an opt-in or opt-out option. Employers may also choose to match employee contributions up to a certain percentage, encouraging employees to save more and take advantage of the full employer match. The Pension Protection Act of 2006 (PPA) encourages employers to include auto-escalation features in their retirement plans. The Act provides safe harbor provisions for employers that adopt certain automatic enrollment and escalation features, protecting them from potential liability. By automatically increasing contributions, auto-escalation helps individuals save more money over time, ultimately leading to a larger retirement nest egg. Auto-escalation promotes disciplined saving habits by gradually increasing the savings rate, making it easier for individuals to adjust their spending and adapt to higher contribution levels. With auto-escalation, employees can ensure they are contributing enough to take full advantage of any employer-matching contributions, further boosting their retirement savings. As auto-escalation increases the amount contributed to retirement accounts, it also increases the potential for investment growth through compound interest, potentially leading to a larger retirement nest egg. Some individuals may struggle with the idea of saving more for retirement, fearing a decrease in their current quality of life. It's essential to strike a balance between current spending and future financial security and to emphasize the importance of long-term financial goals. Individuals must balance various financial priorities, such as paying off debt, saving for emergencies, and investing in retirement. A well-structured financial plan can help manage these priorities and allocate resources effectively. Income fluctuations may affect an individual's ability to maintain or increase their retirement savings rate. In such cases, it's essential to adjust auto-escalation schedules accordingly, ensuring contributions remain feasible and sustainable. Unexpected financial events, such as job loss or medical emergencies, can disrupt retirement savings plans. It's crucial to maintain an emergency fund and adjust auto-escalation schedules as needed to navigate through such challenging situations. Auto-escalation is a powerful tool in retirement planning, helping individuals save more over time and ultimately achieve their retirement goals. By promoting disciplined saving habits and maximizing employer match opportunities, auto-escalation can lead to a more secure financial future. Auto-escalation provides customization and flexibility, allowing individuals to create a savings plan tailored to their unique financial goals and circumstances. With various auto-escalation schedules and escalation rates available, individuals can find a strategy that best suits their needs. Finally, auto-escalation serves as a reminder for individuals to regularly review and adjust their retirement planning strategy. As financial goals, personal circumstances, and market conditions change, it's crucial to adapt the retirement plan accordingly, ensuring long-term financial security and success.Definition and Purpose of Auto-Escalation

Importance of Auto-Escalation

How Auto-Escalation Works

1. The employee selects a starting contribution percentage when they enroll in the plan. This is usually a percentage of their salary, such as 3% or 5%.

2. The auto-escalation feature is enabled in the plan, with a predetermined increase in amount and frequency. For example, the plan might automatically increase the contribution percentage by 1% each year, or every other year.

3. Once the predetermined time period has passed, the contribution percentage is automatically increased without any action required from the employee.

Common Types of Retirement Plans With Auto-Escalation Features

401(k) Plans

403(b) Plans

Individual Retirement Accounts (IRAs)

Although IRAs don't inherently have auto-escalation features, individuals can set up automatic contributions and increase them periodically to mimic auto-escalation.Employer-Sponsored Auto-Escalation Options

Government Regulations and Guidelines

Implementing Auto-Escalation

Steps to Set up Auto-Escalation

1. Assess Current Savings Rate: Determine your current retirement savings rate to establish a baseline.

2. Determine Desired Escalation Rate: Set a target savings rate and decide on the percentage increase for each escalation period.

3. Review Employer-Provided Options: Check if your employer's retirement plan offers auto-escalation features and enroll in the program.

4. Utilize Investment Platforms With Auto-Escalation Features: If your employer does not offer auto-escalation, consider using an investment platform that allows for automated increases in contributions.

Auto-Escalation Schedules

1. Annual Increases: Auto-escalation may be set to increase contributions once per year.

2. Bi-annual Increases: Some individuals may choose to escalate contributions twice per year for a more gradual increase.

3. Custom Schedules: Depending on personal preferences and financial goals, individuals can create a custom auto-escalation schedule that suits their needs.

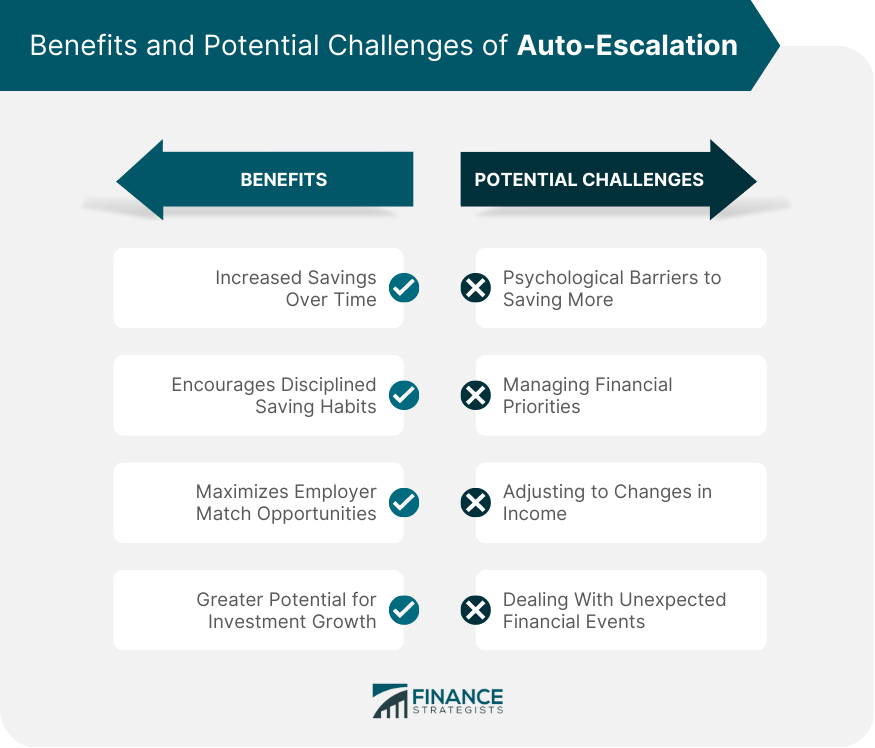

Benefits of Auto-Escalation

Increased Savings Over Time

Encouragement of Disciplined Saving Habits

Maximizing Employer Match Opportunities

Greater Potential for Investment Growth

Potential Challenges and Solutions of Auto-Escalation

Psychological Barriers to Saving More

Managing Financial Priorities

Adjusting to Changes in Income

Dealing With Unexpected Financial Events

Final Thoughts

Auto-Escalation FAQs

Auto-escalation is a feature in retirement savings plans that automatically increases the percentage of an employee's salary being contributed to the plan over time. It is important in retirement planning because it helps individuals accumulate a larger nest egg, encourages disciplined saving habits, and maximizes employer match opportunities.

Auto-escalation features are commonly found in employer-sponsored retirement plans, such as 401(k) and 403(b) plans. Although Individual Retirement Accounts (IRAs) do not inherently have auto-escalation features, individuals can set up automatic contributions and periodically increase them to mimic auto-escalation.

To implement auto-escalation, assess your current savings rate, determine your desired escalation rate, review your employer-provided options, and utilize investment platforms with auto-escalation features if needed. Choose an auto-escalation schedule, such as annual or bi-annual increases, that best suits your financial goals and circumstances.

Auto-escalation offers several benefits in retirement planning, including increased savings over time, improved saving habits, maximized employer match opportunities, and a greater potential for investment growth through compound interest.

Some challenges associated with auto-escalation include psychological barriers to saving more, managing financial priorities, adjusting to changes in income, and dealing with unexpected financial events. Addressing these challenges may involve striking a balance between current spending and future financial security, creating a well-structured financial plan, maintaining an emergency fund, and adjusting auto-escalation schedules as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.