At its most basic level, a waiting period—also known as an elimination period or a qualifying period—is a stipulated amount of time that a policyholder or investor must wait before their coverage or benefits kick in. During this period, the insured party typically does not receive benefits for any claims made. Waiting periods serve various purposes, primarily related to risk management and ensuring fairness in financial transactions. Waiting periods are integral components of many financial products, with their implementation intending to balance the interests of providers and consumers. For insurance providers, they act as protective measures against adverse selection, ensuring that policyholders do not abuse the coverage. In investments, waiting periods discourage short-term speculation and incentivize long-term holding, stabilizing the market and promoting healthy investment behavior. Insurance providers use waiting periods as a tool for managing risk. By delaying the time when the coverage begins, insurers protect themselves against high-risk individuals who might purchase insurance knowing they will soon need expensive care. In essence, waiting periods help insurers control costs and maintain affordable premiums for all policyholders. Investment firms employ waiting periods to deter short-term trading and speculation. This approach discourages investors from making hasty decisions based on short-term market movements, reducing market volatility. The waiting period allows for more informed decision-making, promoting stability and healthier investor behavior. Waiting periods are not only about risk management and market stabilization; they also serve to promote long-term investment and policy holding. For example, certain life insurance policies reward policyholders who maintain their policies over a long period by reducing the waiting period for specific conditions. Similarly, investment funds often provide incentives for long-term holdings, fostering investor loyalty and stable fund growth. In the realm of health insurance, waiting periods are often used to discourage individuals from purchasing coverage only when they foresee a need for medical care. The waiting period can vary significantly, ranging from a few months to a year, depending on the specific condition and the type of coverage. For example, most health insurance policies have a waiting period for pre-existing conditions, often ranging between 10 months to 2 years. Life insurance policies typically incorporate a waiting period known as the "contestability period." Usually two years long, this period allows the insurer to investigate and deny claims if the policyholder misrepresented or omitted relevant health information in their application. If the insured party passes away during this period, the insurer may scrutinize the claim and, in extreme cases, nullify the policy. Disability insurance employs waiting periods known as "elimination periods" between the onset of a disability and when the benefit payments begin. These periods can range from a few days to several months, with longer waiting periods resulting in lower premiums. In investments, mutual funds often have a waiting period, also known as the "cooling-off period." This timeframe gives investors a chance to reconsider their investment decision, which is particularly crucial in closed-end funds or initial public offerings where information asymmetry is a concern. The IPO (Initial Public Offering) waiting period, often referred to as the "quiet period," is another example. During this time, the issuing company and associated parties must limit what they say publicly about the company to prevent hype from affecting the stock price. For policyholders and investors, one of the main advantages of waiting periods is that they help mitigate the risk of adverse selection. Adverse selection occurs when high-risk individuals are more likely to purchase insurance or make risky investments. By incorporating waiting periods, financial providers can discourage such behavior, ensuring a fairer system for all participants. Waiting periods help ensure fair pricing and the financial viability of insurance providers and investment funds. By managing their risk effectively, these organizations can keep premiums and fees at reasonable levels, promoting overall profitability. This benefit is ultimately passed on to the consumer in the form of lower costs and higher returns. The most apparent disadvantage of waiting periods for consumers is the delay in accessing benefits or returns. This delay can be particularly challenging in the case of health insurance, where the individual may need immediate care but is unable to get coverage due to the waiting period. Another significant concern is the financial strain during the waiting period. Without access to insurance benefits or investment returns, individuals may find themselves under financial stress. This stress is especially acute in cases of disability insurance, where the insured party may be unable to work and have no income during the elimination period. The length of a waiting period can be influenced significantly by the type of policy or investment. For instance, disability insurance usually has a longer waiting period than health insurance, primarily due to the long-term nature of disability benefits. Similarly, investments like mutual funds and IPOs can have different waiting periods based on the market conditions and the nature of the investment. In insurance policies, the individual's health status can also influence the length of the waiting period. Individuals with chronic or pre-existing conditions might be subjected to longer waiting periods, ensuring that they don't abuse the insurance system. Regulatory guidelines and rules play a crucial role in determining the length of waiting periods. Regulatory bodies often stipulate minimum and maximum waiting periods to ensure fairness and prevent the exploitation of consumers. Any changes in these regulations can significantly impact waiting periods across the industry. In the insurance industry, regulations often dictate the terms and conditions of waiting periods. For example, the Affordable Care Act in the United States prohibits health insurance companies from imposing waiting periods of more than 90 days. Other countries have similar regulations, each with its nuances and complexities. The investment sector is also subject to regulatory oversight. In the United States, for instance, the Securities and Exchange Commission (SEC) oversees regulations concerning waiting periods for new security issues. These regulations aim to protect investors and maintain the integrity of the market. Several strategies can help minimize the impact of waiting periods. One way is to plan ahead and apply for insurance coverage before you expect to need it. Similarly, for investments, understanding the terms and conditions related to the waiting period can help you strategize your investments better. Some insurers offer policies with shorter waiting periods, although these might come with higher premiums. If immediate coverage is a priority, such policies can be a suitable option. It is important to compare different policies and make an informed decision. For investments, a long-term view can help manage the impact of waiting periods. A well-diversified portfolio that includes both short-term and long-term investments can also be beneficial. Furthermore, keeping abreast of regulatory changes can help you adjust your investment strategies accordingly. Waiting periods serve a crucial role in balancing risk and promoting fair pricing within insurance policies and investment vehicles. The length and specifics of these periods can differ greatly, influenced by several factors, including the type of policy or investment, individual health conditions, and regulatory guidelines. While they are designed to manage risk for providers, deter short-term speculation, and incentivize long-term investments, waiting periods also have their disadvantages. These may include delayed access to benefits and potential financial strain for consumers. Despite these challenges, consumers can navigate waiting periods effectively through careful planning and a deep understanding of their terms and conditions. As financial landscapes evolve, so will the rules surrounding waiting periods, making it essential for consumers to stay informed. Consulting a trusted insurance broker or financial advisor can provide valuable guidance through the complexities of waiting periods in various financial products.What Are Waiting Periods?

Understanding the Rationale Behind Waiting Periods

Risk Management for Insurance Providers

Prevention of Short-Term Trading and Speculation

Encouraging Long-Term Investment and Policy Holding

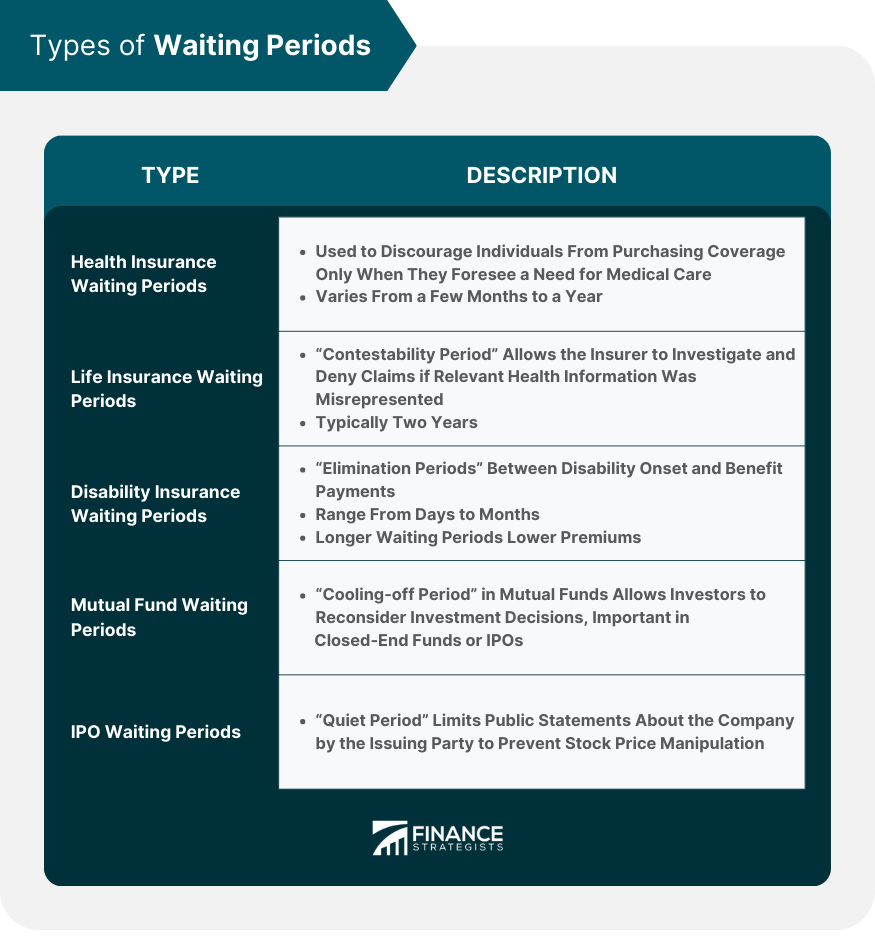

Types of Waiting Periods

Insurance Waiting Periods

Health Insurance Waiting Periods

Life Insurance Waiting Periods

Disability Insurance Waiting Periods

Investment Waiting Periods

Mutual Fund Waiting Periods

IPO Waiting Periods

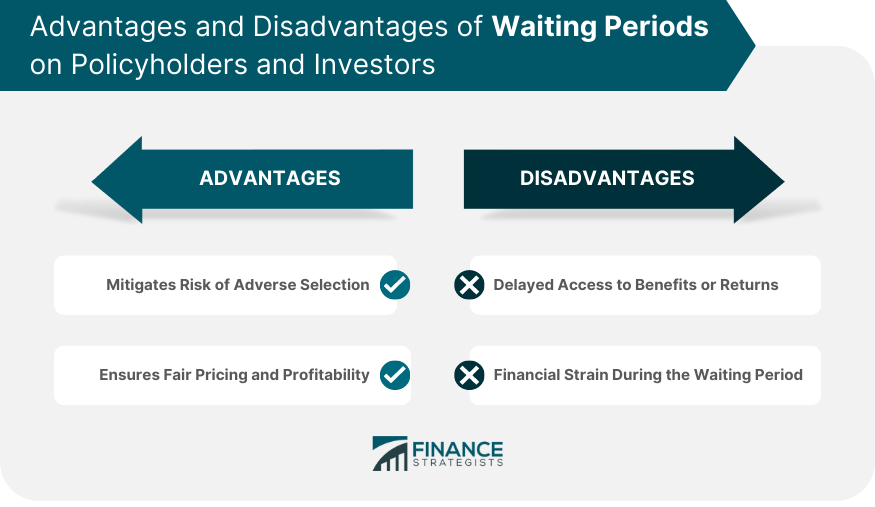

Advantages of Waiting Periods on Policyholders and Investors

Mitigates Risk of Adverse Selection

Ensures Fair Pricing and Profitability

Disadvantages of Waiting Periods on Policyholders and Investors

Delayed Access to Benefits or Returns

Financial Strain During the Waiting Period

Factors Influencing the Length of Waiting Periods

Type of Policy or Investment

Individual’s Health Status (For Insurance Policies)

Regulatory Guidelines and Rules

Regulatory Framework Surrounding Waiting Periods

Regulations in the Insurance Industry

Regulations in the Investment Sector

How to Navigate Waiting Periods

Strategies to Minimize the Impact of Waiting Periods

Opting for Policies With Shorter Waiting Periods

Strategies for Handling Investment Waiting Periods

Final Thoughts

Waiting Periods FAQs

Waiting periods in insurance policies are a stipulated amount of time that a policyholder must wait before their coverage begins. During this period, the insured party typically does not receive benefits for any claims made.

Waiting periods are integral to financial instruments as they help manage risk, prevent short-term speculation, and encourage long-term investment and policy holding.

Waiting periods can have both advantages and disadvantages for policyholders and investors. They help mitigate the risk of adverse selection and ensure fair pricing, but they also mean delayed access to benefits or returns and potential financial strain during the waiting period.

Several factors can influence the length of waiting periods, including the type of policy or investment, the individual's health status (for insurance policies), and regulatory guidelines and rules.

Strategies to navigate the impact of waiting periods include planning ahead, opting for policies with shorter waiting periods if immediate coverage is necessary, and handling investment waiting periods with a long-term view and a diversified portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.