The 401(k) plan, an employer-sponsored retirement plan, has transformed the way businesses and employees approach retirement savings. This plan, named after the section of the tax code that establishes it, allows employees to save and invest a portion of their paychecks before taxes are taken out. The funds are then tax-deferred, meaning taxes are not paid until the money is withdrawn during retirement. Beyond being an avenue for employees' savings, the 401(k) plan carries immense significance for businesses. Offering a 401(k) plan enhances a company's benefits package, making it more appealing to prospective and existing employees. In essence, this plan serves as a valuable tool in recruitment and retention strategies. Furthermore, employers also receive tax benefits, as contributions are tax-deductible, increasing the overall financial health of the business.

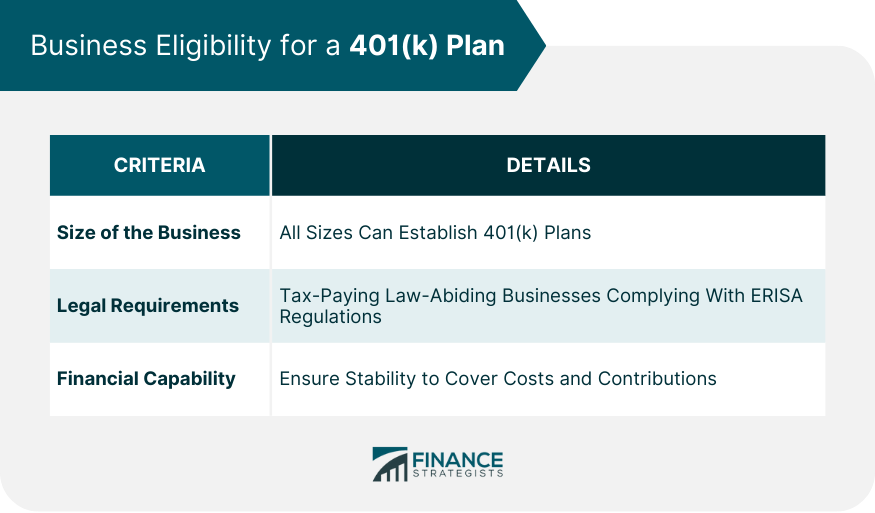

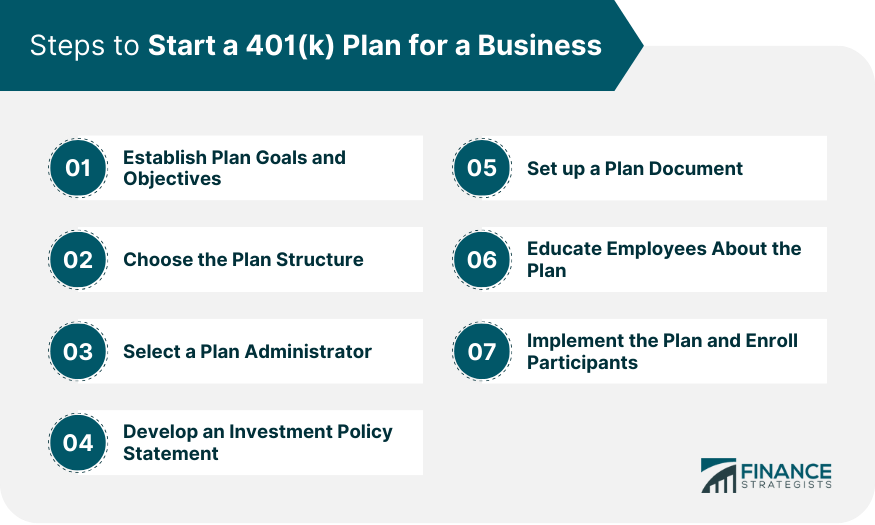

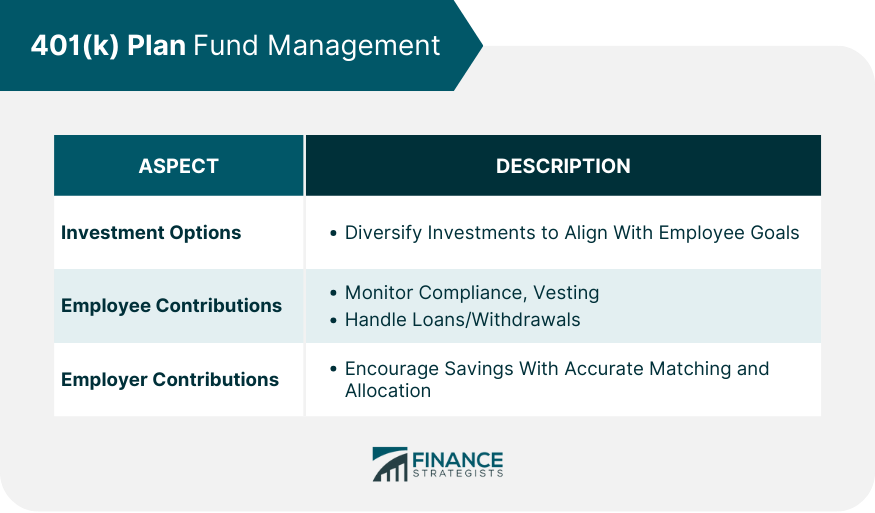

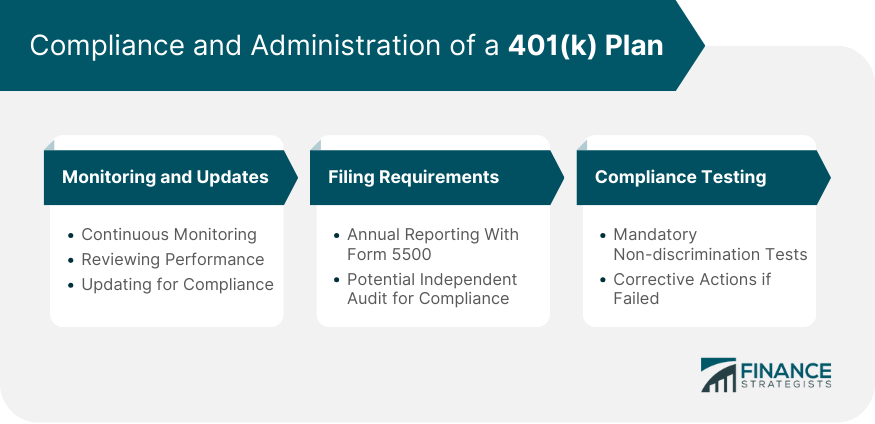

Most people associate the 401(k) plan with large corporations, but that's not entirely accurate. Companies of all sizes, whether small, medium, or large, can establish these retirement plans. Small businesses may consider SIMPLE 401(k) plans, specifically designed with their needs in mind, while larger entities may opt for traditional 401(k) plans. It's worth noting that no minimum number of employees is needed to establish a 401(k) plan. To set up a 401(k) plan, a business must meet certain legal criteria. The business must be a tax-paying entity operating in the United States, and it should not be involved in any illegal activities. Moreover, the plan must be established for the exclusive benefit of the employees and their beneficiaries. The employers must also ensure that the 401(k) plan complies with the Employee Retirement Income Security Act (ERISA) regulations, which set minimum standards for these plans. Financial capability is a significant consideration for businesses aiming to start a 401(k) plan. These plans require administrative costs and possibly employer contributions. Although tax advantages help offset these expenses, businesses should ensure they have the financial stability to maintain the plan without jeopardizing their operational funds. Establishing a 401(k) plan begins with setting clear objectives and goals. Companies must evaluate what they hope to achieve through the plan. These goals could range from attracting top-tier talent, and encouraging employees to save for retirement to gaining tax benefits. The company's goals and objectives will influence the structure and features of the 401(k) plan. The next step involves selecting a plan structure. There are several types of 401(k) plans available, including traditional, safe harbor, and SIMPLE 401(k) plans, each offering different features and benefits. Businesses must consider factors such as their size, financial capability, and objectives to choose the most suitable structure. Choosing a plan administrator is an essential step in starting a 401(k) plan. The administrator could be an individual within the company or an outside entity. They will handle tasks like plan recordkeeping, employee education, compliance testing, and filing necessary reports. The business must ensure the chosen administrator is reliable and well-versed in ERISA and IRS regulations. A 401(k) plan requires an investment policy statement (IPS). The IPS outlines the investment strategies, objectives, and philosophy of the plan. It also includes details about the risk tolerance, diversification, and selection and monitoring of the investment options. Developing a clear IPS is crucial to guide investment decisions and provide transparency to participants. Setting up a plan document is the blueprint for the operation of the 401(k) plan. This document includes all the features, rules, and procedures related to the plan, such as eligibility requirements, contribution limits, vesting schedules, and distribution rules. A well-drafted plan document is essential for smooth operation and compliance. Once the 401(k) plan is established, it's crucial to educate employees about its benefits, rules, and responsibilities as participants. Employers should communicate how the plan works, how to make contributions and the range of investment options available. This step encourages employee participation and promotes a savings culture within the business. Finally, the 401(k) plan is ready to be rolled out. Implementation includes setting up payroll deductions, coordinating with the plan provider, and opening accounts for participating employees. Employees who wish to participate are then enrolled in the plan, marking the beginning of their retirement savings journey. Managing 401(k) plan funds requires a careful selection of investment options and diversification strategies. Typically, a 401(k) plan offers a variety of investment choices, including mutual funds, stocks, bonds, and money market funds. These should be diversified to spread risk and cater to the varying risk tolerances and retirement goals of employees. This involves setting up payroll deductions for employees' pre-tax contributions and ensuring they don't exceed the annual contribution limits set by the IRS. Additionally, the plan administrator must track vesting schedules and manage loan requests or hardship withdrawals if the plan allows these features. Some 401(k) plans include employer contributions, often in the form of matching. This implies that the employer contributes an equivalent amount to what the employee contributes up to a certain limit. This encourages employees to contribute more to their retirement savings. Management of these contributions requires the administrator to accurately match and allocate these funds to the respective employees' accounts. Continuous monitoring and timely updates are critical to maintaining a compliant 401(k) plan. This includes regularly reviewing the plan's investment performance, auditing financial statements, and updating the plan to reflect changes in tax laws or company policies. Routine monitoring ensures the plan's continued compliance and effectiveness in meeting the retirement goals of its participants. Each year, the employer is required to file Form 5500 with the Department of Labor to report the plan's financial conditions, investments, and operations. In certain cases, an independent audit of the plan's financial statements may be required. Keeping up with these filing requirements is essential to avoid penalties and ensure the plan's compliance with ERISA regulations. 401(k) plans must undergo annual compliance tests to ensure they do not overly favor highly compensated employees or owners. These tests are known as non-discrimination tests and are mandated by the IRS. If a plan fails these tests, corrective actions need to be taken. These may include refunding contributions to highly compensated employees or increasing contributions to non-highly compensated employees. Starting a 401(k) plan for a business is a strategic move that benefits both employers and employees. The plan offers a tax-advantaged way for employees to save for retirement and enhances a company's benefits package, aiding in talent acquisition and retention. To determine business eligibility, factors such as size, legal requirements, and financial capability must be considered. The process of establishing a 401(k) plan involves setting goals, choosing a plan structure, selecting a plan administrator, developing an investment policy statement, and setting up a plan document. Employee education and enrollment are essential for participation. Post-implementation, managing plan funds includes diverse investments, employee contributions, and employer matching. Compliance and administration require continuous monitoring, meeting filing requirements, and conducting compliance testing. By following these steps and effectively managing the plan, businesses can provide a valuable retirement savings tool for their employees and reap the benefits of a well-structured 401(k) plan.Overview of 401(k) Plan for Businesses

Business Eligibility for a 401(k) Plan

Size of the Business

Legal Requirements

Financial Capability

Steps to Start a 401(k) Plan for a Business

Step 1: Establish Plan Goals and Objectives

Step 2: Choose the Plan Structure

Step 3: Select a Plan Administrator

Step 4: Develop an Investment Policy Statement

Step 5: Set up a Plan Document

Step 6: Educate Employees About the Plan

Step 7: Implement the Plan and Enroll Participants

Management of 401(k) Plan Funds

Investment Options and Diversification

Employee Contribution Management

Employer Contributions and Matching

Compliance and Administration of a 401(k) Plan

Monitoring and Updates

Filing Requirements

Compliance Testing

Conclusion

How to Start a 401(k) Plan for a Business FAQs

Most types of businesses, including corporations, sole proprietorships, partnerships, non-profits, and even government entities, are eligible to offer a 401(k) plan. The business must be a tax-paying entity operating within the United States and should not be involved in any illegal activities. The size of the business doesn't matter - small, medium, and large companies can all establish 401(k) plans.

A 401(k) plan should ideally be reviewed at least annually. However, it's also necessary to update the plan when there are significant changes like alterations in the tax laws, company policies, or the financial situation of the company. This helps to ensure that the plan remains compliant with current regulations and continues to serve the best interests of the participants.

While it is legally possible for a business to plan, the process is not as simple as just ceasing operations. The employer must follow a specific termination process as outlined by the IRS. This includes notifying employees, distributing all assets, filing a final Form 5500, and possibly undergoing a termination audit. It's crucial to remember that any decision to terminate a 401(k) plan should be made considering the potential impact on employees.

Non-discrimination tests ensure that a 401(k) plan does not disproportionately favor highly compensated employees or company owners. If a plan fails these tests, the employer is required to take corrective actions. These can include refunding excess contributions to highly compensated employees or making additional contributions on behalf of the non-highly compensated employees to balance the contributions.

No, employer contributions are not mandatory. They are a discretionary feature that businesses can choose to offer. Some companies may decide to offer a match, where they contribute an equivalent amount to what an employee contributes up to a certain limit. This serves as an incentive for employees to contribute more towards their retirement savings. However, it's important to remember that once an employer commits to a matching contribution, it becomes obligatory for that specific plan year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.