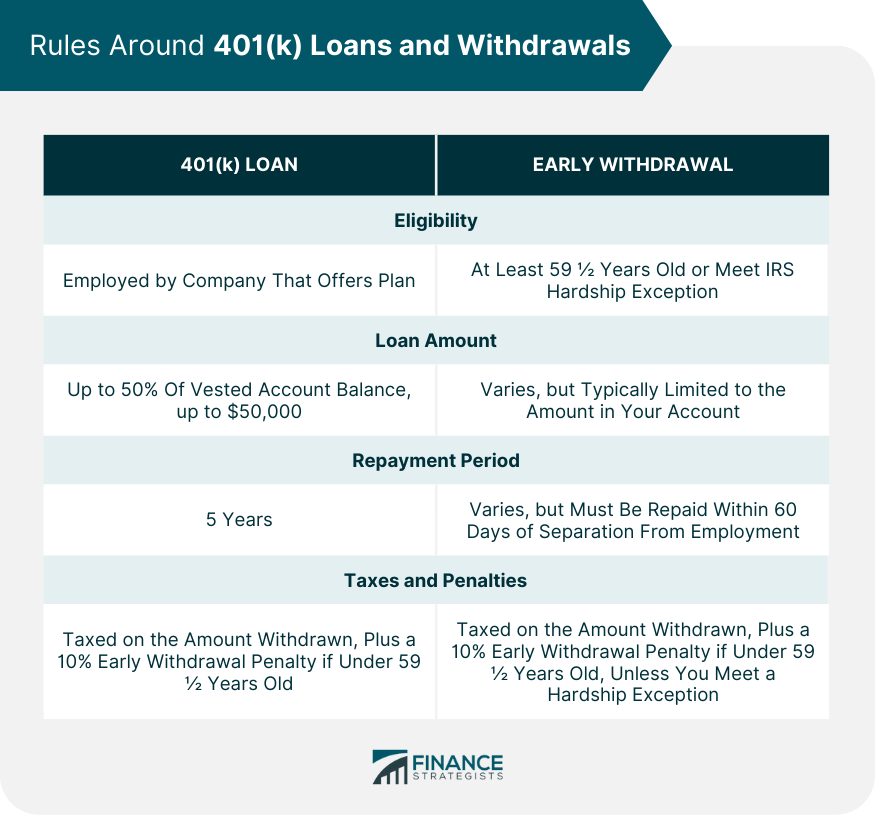

When facing financial challenges, individuals may consider taking a 401(k) loan or withdrawal as a potential solution. A 401(k) loan refers to borrowing money from one's own 401(k) retirement savings, while a withdrawal involves permanently taking funds out of the 401(k) account before reaching the retirement age of 59 ½. The purpose of offering these options is to provide individuals with access to funds during times of financial hardship or urgent need. A 401(k) loan allows borrowers to access a portion of their retirement savings, which must be repaid with interest over a specified period. On the other hand, a withdrawal provides immediate access to funds but incurs penalties and taxes, which can significantly impact the overall retirement savings. It is important to weigh the benefits and drawbacks of taking a 401(k) loan or withdrawal, considering the potential long-term impact on retirement savings When you take out a 401(k) loan, you're essentially borrowing from your own retirement savings. The amount you can borrow is generally up to 50% of your vested account balance, with a maximum limit of $50,000. Once the loan is taken, you're required to pay it back with interest over a specified period of time, typically five years. An early 401(k) withdrawal, on the other hand, involves taking money out of your account before reaching retirement age. Unlike a loan, this money doesn't have to be paid back, but it does come with a hefty 10% penalty tax, in addition to being subject to regular income tax. Before considering a 401(k) loan or withdrawal, it's important to understand the eligibility criteria. For a loan, you must still be employed by the company that offers your 401(k) plan. For a withdrawal, while the money is technically yours, the IRS imposes restrictions to discourage early distribution. If you opt for a loan, you'll need to adhere to a strict repayment schedule set by your 401(k) plan provider. Failing to repay a loan on time results in a default, which turns your loan into a deemed distribution that's subject to income tax and possibly an early withdrawal penalty. Early withdrawals are subject to a 10% early withdrawal penalty plus income tax. However, certain situations, known as hardship withdrawals, might qualify for an exemption from the penalty. The most apparent advantage of a 401(k) loan or withdrawal is the immediate access to a sizable amount of money. This can be a lifeline in case of a financial emergency or large, unforeseen expenses. Another pro is that 401(k) loans do not require a credit check. So, even if your credit history is less than stellar, you can still have access to funds. Certain qualifying circumstances, such as disability, certain medical expenses, or a court order after a divorce, can exempt you from the 10% early withdrawal penalty. The most significant drawback is the potential long-term impact on your retirement savings. The money you withdraw or borrow isn't growing with the market, which could leave you with less money when you retire. Both loans and withdrawals can have tax implications. If you default on a loan, the entire balance becomes taxable. Withdrawals are treated as taxable income and can bump you into a higher tax bracket. There's also the risk of defaulting on the loan if you lose your job or change employers. Also, the penalties associated with early withdrawal can significantly reduce the amount of money you receive. Before taking a loan or withdrawal from your 401(k), consider alternatives like: IRA Rollovers: You might be able to roll over your 401(k) funds to an Individual Retirement Account (IRA) which might offer more flexible withdrawal options. Personal Loans: Personal loans may offer lower interest rates than credit cards and can be a better alternative to borrowing from your 401(k), especially if you have a good credit score. Home Equity Line of Credit: If you're a homeowner, a Home Equity Line of Credit (HELOC) allows you to borrow against the equity in your home, often at a lower interest rate. Assess Financial Situation: Before making any financial decisions, take a comprehensive look at your finances. A 401(k) loan or withdrawal should be considered only after other options have been exhausted. Understand the Long-Term Impact of Retirement: Consider the long-term effects on your retirement savings. Remember, the money you take out today could mean less for your future. Seek Professional Advice: Always consult with a financial advisor before making significant decisions regarding your retirement savings. They can help you understand the potential ramifications and guide you toward a decision that best suits your situation. Taking a 401(k) loan or withdrawal can be a tempting solution during times of financial need, but it's important to carefully consider the implications and alternatives. Both options provide access to funds, but they come with significant drawbacks. A 401(k) loan allows for repayment with interest, but defaulting can lead to taxes and penalties. On the other hand, a withdrawal provides immediate funds but incurs a 10% penalty and taxes. In either case, the long-term impact on retirement savings should be carefully evaluated, as reducing your nest egg today could hinder your future financial security. Exploring alternatives like IRA rollovers, personal loans, or home equity lines of credit may offer more favorable terms and protect your retirement savings. Ultimately, seeking guidance from a financial advisor is crucial to understand the specific implications and make an informed decision aligned with your financial goals.Overview of Taking a 401(k) Loan or Withdrawal

How a 401(k) Loan or Withdrawal Works

Mechanics to Take Out a Loan

Process of Early Withdrawal

Rules Around 401(k) Loans and Withdrawals

Eligibility Criteria

Loan Repayment and Default

Tax and Penalties on Early Withdrawal

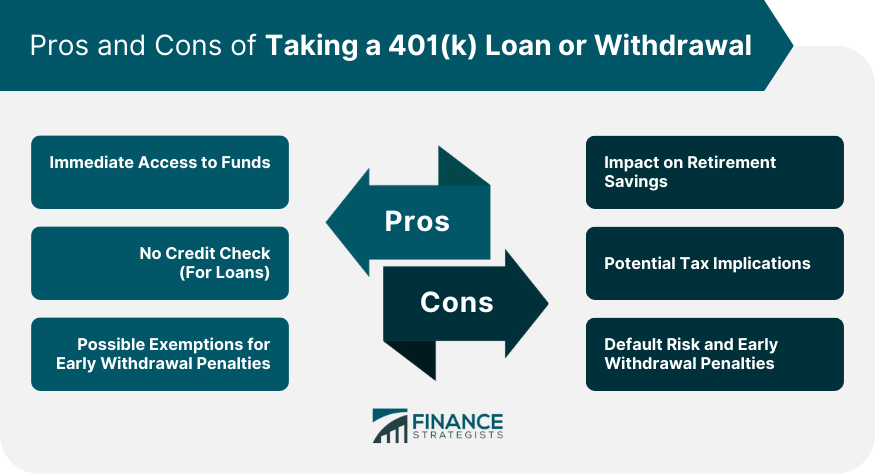

Pros of Taking a 401(k) Loan or Withdrawal

Immediate Access to Funds

No Credit Check (For Loans)

Possible Exemptions for Early Withdrawal Penalties

Cons of Taking a 401(k) Loan or Withdrawal

Impact on Retirement Savings

Potential Tax Implications

Default Risk and Early Withdrawal Penalties

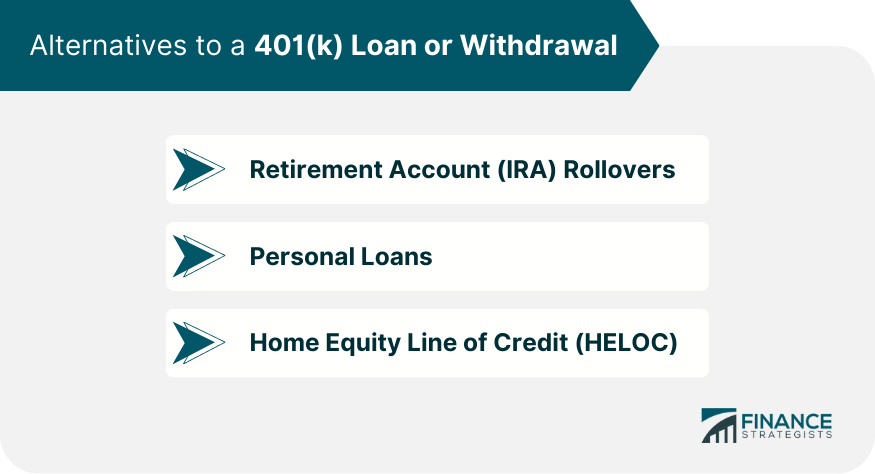

Alternatives to a 401(k) Loan or Withdrawal

Key Considerations Before Taking a 401(k) Loan or Withdrawal

Bottom Line

Taking a 401(k) Loan or Withdrawal FAQs

The maximum amount you can borrow from your 401(k) is usually up to 50% of your vested account balance or $50,000, whichever is less.

Yes, early withdrawals from a 401(k) before the age of 59 ½ are generally subject to a 10% penalty tax in addition to regular income tax. Certain exceptions exist in cases of hardship withdrawals.

If you fail to repay your 401(k) loan according to the set schedule, the unpaid amount is considered a default. The defaulted amount is then treated as a deemed distribution and is subject to income tax and potentially an early withdrawal penalty.

Yes, alternatives to a 401(k) loan or withdrawal include IRA rollovers, personal loans, and home equity lines of credit. These alternatives should be considered first before resorting to a 401(k) loan or withdrawal.

Yes, consulting with a financial advisor is highly recommended before making a significant decision, like taking a 401(k) loan or withdrawing. They can provide personalized advice based on your financial situation and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.