A 401(k) plan is an employer-sponsored retirement savings account that allows employees to contribute a portion of their wages before taxes are taken out. This deferred income is then invested, providing employees with the opportunity to grow their savings over time. The allure of a 401(k) comes not just from its tax advantages but also from the potential for employers to match contributions. This employer match feature, where employers contribute additional funds often proportional to the employee's own contributions, makes 401(k) plans an attractive option for retirement savings. Each time an employee receives a paycheck, a predetermined amount or percentage is automatically deducted and deposited into their 401(k) account. These funds are then invested in a variety of investment options, such as stocks, bonds, and mutual funds, selected by the employee. The 401(k) plan has the potential to grow significantly over time as earnings from investments are reinvested, leading to further earnings. Furthermore, since contributions are made with pre-tax dollars, and the earnings in the account are not taxed until they are withdrawn, a 401(k) plan provides significant tax advantages. The first step in contributing to your 401(k) is determining the amount you wish to contribute from each paycheck. This amount, often represented as a percentage of your salary, should ideally be high enough to maximize your employer's match (if available) but still affordable enough to maintain your current lifestyle. One common strategy is to start with a modest contribution, such as 3% or 5% of your salary, and gradually increase it each year until you're maximizing your allowable contributions. This approach allows you to gradually adjust your budget to accommodate higher savings rates. One of the keys to accumulating significant savings in your 401(k) is to maximize your contributions. The Internal Revenue Service (IRS) sets a limit on the amount you can contribute to your 401(k) each year. As of 2023, the maximum employee contribution limit is $23,000 for individuals under 50 and $30,500 for individuals 50 or older. It is beneficial to aim to contribute at least enough to receive the full match from your employer, as this is essentially "free money" that will significantly boost your retirement savings. If it's financially feasible, you should consider maxing out your contributions to take full advantage of the tax benefits and compound interest that a 401(k) offers. Once you've decided how much to contribute, the next step is to choose your investment options. Most 401(k) plans offer a range of investment options, typically including mutual funds, index funds, and target-date funds. Your investment selection should align with your risk tolerance, financial goals, and investment horizon. Keep in mind that diversification—spreading your investments across various asset classes—can help manage risk and potentially enhance returns over the long term. A well-diversified portfolio could include a mix of stocks (for growth), bonds (for income), and cash or cash equivalents (for stability). With your contribution amount determined and your investment options chosen, the next step is to start contributing. Contributions to your 401(k) are typically deducted automatically from your paycheck, which makes saving for retirement relatively effortless. It's also important to note that contributing to a 401(k) is a long-term commitment. While the funds in your 401(k) are technically accessible before retirement, early withdrawals come with penalties and tax implications. Therefore, it's crucial to consider your 401(k) as untouchable until retirement. Just as you would with any other investment, it's important to regularly monitor your 401(k) and make adjustments as necessary. This might involve increasing your contributions as your salary grows, rebalancing your portfolio to maintain your desired asset allocation, or adjusting your investment selections as you approach retirement. The goal is not to time the market or chase short-term returns but to ensure your 401(k) continues to align with your long-term financial goals and risk tolerance. Regular reviews—say, once a year or whenever you have a significant life change—are generally sufficient. While contributing to a 401(k) can offer significant tax advantages, it's also important to ensure compliance with IRS regulations. This includes not exceeding the annual contribution limit and understanding the rules around 401(k) loans and early withdrawals. For example, taking an early distribution from your 401(k)—before you reach age 59½—typically results in a 10% early withdrawal penalty in addition to regular income taxes. There are some exceptions to this rule, such as in cases of financial hardship, but in general, it's best to avoid early withdrawals to preserve the tax advantages of your 401(k). Contributing too little to your 401(k) can mean missing out on the employer match, losing the tax advantages, and potentially not having enough savings for retirement. One guideline often suggested by financial planners is to aim to save at least 10-15% of your income for retirement. While this might not be feasible for everyone, especially early in their careers, it's a good goal to work toward. Even small increases in your contribution rate can have a significant impact on your retirement savings over time. While it's true that investing involves risk, avoiding risk entirely by investing too conservatively can also jeopardize your retirement savings. For example, if you're young and have a long time horizon until retirement, investing too heavily in low-risk, low-return investments like money market funds or bonds might not provide the growth needed to build substantial retirement savings. On the other hand, if you're close to retirement, investing too heavily in high-risk assets like stocks can expose you to potential market downturns. The key is to strike a balance between risk and return that aligns with your financial goals, risk tolerance, and investment horizon. This often involves maintaining a diversified portfolio and regularly reviewing and adjusting your investments as needed. Cashing out your 401(k) prematurely—either through an early withdrawal or when changing jobs—is another common mistake. Early withdrawals from a 401(k) come with hefty penalties and tax implications. Furthermore, cashing out your 401(k) means missing out on potential future growth and the power of compound interest. If you change jobs, consider rolling over your 401(k) into an IRA or your new employer's 401(k) plan rather than cashing it out. This allows your savings to continue growing tax-deferred and helps preserve your retirement nest egg. Contributions to a traditional 401(k) are made with pre-tax dollars, which means they lower your taxable income for the year. Additionally, the money in your 401(k) grows tax-deferred, meaning you don't pay taxes on the investment earnings until you withdraw the funds in retirement. This tax deferral can make a significant difference in the amount of money you accumulate over time. It effectively allows you to earn returns on money that would have otherwise gone to taxes. Compound interest is the concept that your earnings generate their own earnings. In other words, you earn interest not only on your contributions but also on the earnings those contributions have generated. Over time, this compounding effect can lead to exponential growth in your savings. The longer your money is invested, the more significant the compounding effect becomes, which is why starting to save for retirement early is so beneficial. With Social Security providing only a base level of income and traditional pensions becoming increasingly rare, having a substantial 401(k) nest egg can be critical to maintaining your lifestyle in retirement. Moreover, having a 401(k) can provide peace of mind knowing that you're actively preparing for your future. This peace of mind can be invaluable in reducing financial stress and achieving overall well-being. Determining the optimal contribution rate to your 401(k) depends on a variety of factors, including your income, age, retirement goals, and other financial obligations. As a starting point, aim to contribute at least enough to receive the full employer match, if available. From there, try to gradually increase your contributions each year or each time you receive a raise. The goal should be to eventually max out your contributions if possible or at least to contribute a substantial portion of your income (e.g., 15%). Diversification helps to spread risk across different types of investments (e.g., stocks, bonds, cash), different industry sectors, and even different geographical regions. The right diversification strategy for you depends on your individual risk tolerance, investment goals, and time horizon. A financial advisor or retirement plan representative can help you determine the most appropriate asset allocation for your circumstances. Rebalancing involves adjusting your portfolio back to its original asset allocation as market performance causes it to drift over time. This can help ensure your portfolio continues to reflect your investment strategy and risk tolerance. How often you should rebalance your 401(k) depends on various factors, but a common guideline is to do it at least once a year or whenever your asset allocation shifts by a certain percentage (e.g., 5%). Lastly, remember that contributing to a 401(k) is part of a long-term retirement planning strategy. This means not being swayed by short-term market fluctuations and not making impulsive decisions based on fear or greed. Instead, stay focused on your long-term financial goals, maintain a disciplined investment strategy, and regularly review and adjust your plan as needed. With patience and persistence, your 401(k) can be a powerful tool in achieving a secure and comfortable retirement. A 401(k) plan is a valuable retirement savings account that allows employees to contribute a portion of their wages before taxes, providing an opportunity for long-term investment growth. The first step is to determine an optimal contribution rate, aiming to receive the full employer match and gradually increasing contributions over time. Diversifying the investment portfolio is crucial to managing risk and enhancing returns, while regular portfolio rebalancing ensures alignment with long-term goals. It is essential to remember that contributing to a 401(k) is a long-term commitment, requiring patience and adherence to a well-thought-out retirement plan. By adhering to these practices and avoiding common pitfalls, individuals can build a substantial retirement nest egg, ensuring financial security and peace of mind in their post-employment years.What Is a 401(k)?

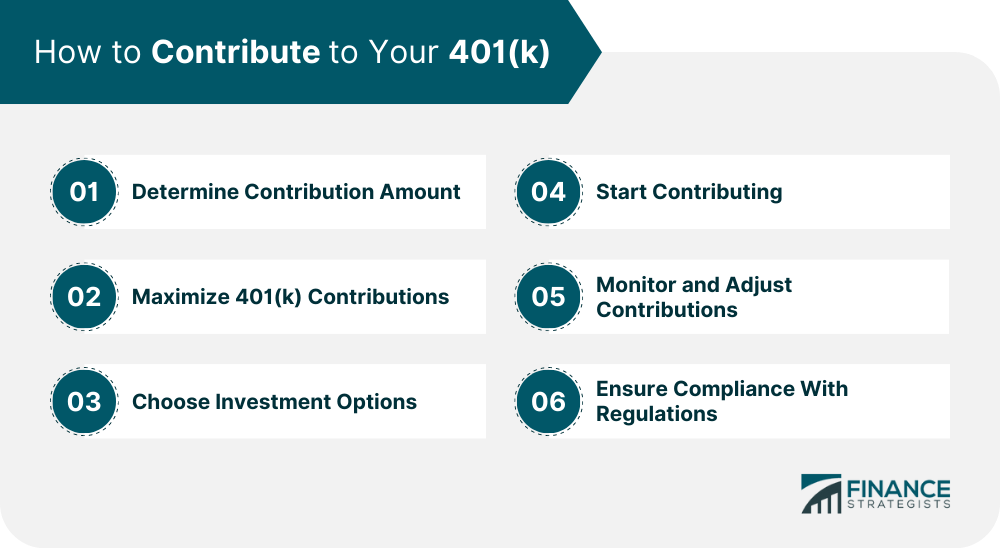

Contributing to Your 401(k)

Step 1: Determine Contribution Amount

Step 2: Maximize 401(k) Contributions

Step 3: Choose Investment Options

Step 4: Start Contributing

Step 5: Monitor and Adjust Contributions

Step 6: Ensure Compliance With Regulations

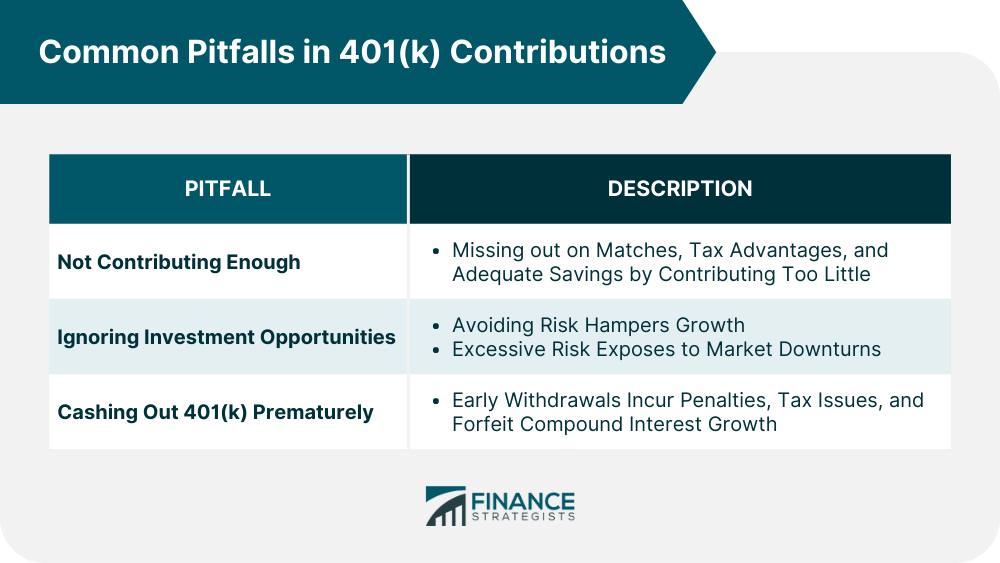

Common Pitfalls in 401(k) Contributions

Not Contributing Enough

Ignoring Investment Opportunities

Cashing Out 401(k) Prematurely

Benefits of Contributing to 401(k)

Tax Advantages

Compound Interest and Investment Growth

Retirement Savings and Financial Security

Best Practices in Contributing to 401(k)

Optimal Contribution Rate

Diversified Investment Portfolio

Regular Portfolio Rebalancing

Long-Term Retirement Planning

Conclusion

How to Contribute to Your 401(k) FAQs

When you change jobs, you generally have four options for your 401(k): leave it with your old employer, roll it over into your new employer's plan, roll it into an individual retirement account (IRA), or cash it out. Cashing out is typically the least favorable option due to potential taxes and penalties.

Yes, you can contribute to both a 401(k) and an individual retirement account (IRA) in the same year, providing you with a way to boost your retirement savings. However, if you or your spouse are covered by a retirement plan at work, such as a 401(k), your deduction for contributions to a traditional IRA may be reduced or eliminated depending on your income.

A Roth 401(k) is a type of 401(k) plan where contributions are made after taxes rather than before. This means that withdrawals in retirement (both contributions and earnings) are tax-free, assuming certain conditions are met. This can be a good option if you expect to be in a higher tax bracket in retirement than you are now.

Even if you can only afford to contribute a small amount, it's still worth starting. Even small contributions can add up over time, especially when you consider the power of compound interest and potential employer matching. As your financial situation improves, aim to increase your contributions gradually.

If you have an old 401(k) from a previous employer, consider rolling it over into an IRA or your current employer's 401(k) plan. This can make managing your retirement savings easier and could provide more investment options or lower fees. However, always compare the investment options, fees, and services before making a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.