In the context of a job change, a 401(k) transfer refers to moving your retirement savings from your current employer's 401(k) plan to a new plan offered by your future employer. A 401(k) transfer, often known as a "rollover", involves moving your retirement savings from one account to another without suffering tax penalties. A 401(k) is an employer-sponsored retirement savings plan that allows employees to contribute a portion of their pre-tax salary to a retirement account. The funds in this account are then invested in various assets to grow over time. Your 401(k) is an essential tool in your retirement planning toolkit, and it's crucial to manage it wisely, especially when you're switching jobs. One of the key advantages of transferring your 401(k) is the convenience of having all your retirement savings consolidated into one account. This makes it much easier to track your investments, assess your overall retirement savings, and devise an investment strategy that aligns with your retirement goals. The ability to streamline your finances can also eliminate the stress and confusion of handling multiple retirement accounts, particularly if you have switched jobs several times. The investment options available in your new employer's 401(k) plan might be more diverse and potentially better than those in your old plan. This means you could gain access to a wider variety of asset classes, including different types of stocks, bonds, and mutual funds, which can help diversify your portfolio and potentially boost your returns. Transferring your 401(k) allows you to take advantage of these options, aligning with your risk tolerance and investment objectives. Fees can significantly eat into your retirement savings over time. Transferring your 401(k) to your new employer's plan might afford you lower administrative and management fees, which can result in substantial savings in the long run. These savings can be reinvested, further compounding your retirement nest egg. Always compare the fee structures of the old and new plans before making a decision. If you leave your 401(k) with your old employer and you switch jobs multiple times, you run the risk of losing track of your retirement accounts. This can create a significant administrative burden, as you'll need to manage multiple accounts with different investment options, fees, and account statements. Moreover, if you forget about an old 401(k), you could potentially miss out on the growth of those funds and make it harder to reach your retirement goals. When you maintain multiple 401(k) plans, you'll have to stay abreast of the different investment options and fees associated with each plan. Not only can this be a complex and time-consuming task, but it could also lead to less-than-optimal investment decisions due to a lack of oversight or understanding. High fees in one plan can erode your savings, while less desirable investment options in another could stunt the growth of your retirement nest egg. Therefore, ignoring a 401(k) transfer might potentially undermine your retirement savings strategy. If an old 401(k) plan has high fees, ignoring a transfer could result in a significant erosion of your savings over time. This could potentially undercut the growth of your retirement nest egg, making it more challenging to reach your financial goals for retirement. The best time to consider a 401(k) transfer is typically when you're changing jobs. However, other situations may prompt a transfer. When you leave a job, you have several options for your 401(k). One of them is to roll it over into your new employer's plan, keeping your retirement savings consolidated and continuing to grow. If your new employer offers a 401(k) with a wider range of investment options, lower fees, or better overall terms, it may be a good idea to transfer your old 401(k) to this new plan. If you've changed jobs a few times and have multiple 401(k) accounts, it might be beneficial to consolidate them by transferring them all into your current employer's plan. This makes your retirement savings easier to manage. First, confirm with your new employer that their 401(k) plan accepts rollovers. Not all plans do, so it's essential to verify this before starting the process. Next, get in touch with your current 401(k) plan provider. They can guide you through their specific rollover process and let you know what information you'll need to provide. The direct rollover is an efficient and streamlined process that allows for seamless transitions between retirement plans. In this process, your current plan administrator transfers your 401(k) funds directly into your new retirement plan. This method provides an added layer of safety as it avoids the possible mishandling of funds. It essentially takes the onus off of you and entrusts it to the professionals. Additionally, the direct rollover can protect your savings from unexpected tax liabilities and penalties. This is because, in a direct rollover, no distribution of funds occurs to trigger tax events. Therefore, it remains a non-taxable event and safeguards the entire amount of your retirement savings. This hands-off approach simplifies the process, eliminates the risk of human error, and allows your money to continue to grow tax-deferred, making the direct rollover a popular choice among retirement savers. On the other hand, the indirect rollover is a method that offers more flexibility but also carries a higher degree of risk. In an indirect rollover, the 401(k) funds are distributed to you directly, and you are then given a 60-day period to deposit them into your new retirement plan. This approach can provide an opportunity to have access to your funds for a short period, which can sometimes be beneficial in case of urgent financial needs. However, this route is not without potential pitfalls. If you fail to deposit the distributed amount into a new plan within the stipulated 60-day period, the amount could be considered a taxable distribution, thus incurring income tax, and possibly a 10% early withdrawal penalty if you're under 59.5 years old. Additionally, during an indirect rollover, your plan administrator is required to withhold 20% of the rollover amount for potential taxes, which you'll have to make up out of pocket if you want the full balance rolled over. This can result in unplanned financial burdens and complications. Therefore, while the indirect rollover offers flexibility, it demands careful planning and timely execution to avoid unnecessary penalties and taxes. While the transfer process is usually straightforward, obstacles can arise. These might include waiting periods, paperwork, and restrictions on certain types of investments. It's crucial to understand these potential challenges and how to navigate them to ensure a smooth transfer. One option is to leave your 401(k) where it is. If you're happy with your old employer's plan, and they allow it, you can leave your savings in the existing account. Another option is to roll over your 401(k) into an Individual Retirement Account (IRA). IRAs often offer more investment options than 401(k) plans and can be a good choice if you're seeking more control over your investments. While it's generally not recommended due to potential tax implications and penalties, in some cases, you may choose to cash out your 401(k). If you withdraw funds from your 401(k) before you're 59.5 years old, you may be subject to a 10% early withdrawal penalty. Transferring your 401(k) to a new employer's plan or rolling it over to an IRA allows you to avoid this penalty. With a direct rollover, there are usually no immediate tax consequences. However, with an indirect rollover, if you fail to deposit the funds into your new plan within 60 days, the amount may be considered a taxable distribution. When starting a new job, it's important to ask about the company's 401(k) plan. You'll want to know if the plan accepts rollovers, what the investment options are, and what fees are associated with the plan. Take the time to understand the new plan's details, including the investment options, the fees and costs, and any potential matching contributions from your employer. This information will help you determine whether it's beneficial to transfer your old 401(k) to the new plan. Every 401(k) plan has its advantages and disadvantages. Compare the new plan with your old one or other options like an IRA. Consider factors like investment options, fees, and employer match to make an informed decision. Navigating a job transition entails an important decision regarding the disposition of an existing 401(k) plan. Transferring, often referred to as "rolling over," the 401(k) to a new employer's plan presents multiple advantages, including streamlined retirement savings management, potential access to superior investment options, and possible reduction in fees. However, careful assessment of the new plan's attributes, a clear understanding of the transfer process, and awareness of potential challenges are essential for a smooth transition. It is equally important to evaluate alternatives such as retaining the old 401(k) or opting for a rollover into an IRA, each with unique benefits and potential pitfalls. Given the significant impact of these decisions on retirement savings strategy, consultation with a financial advisor is a step that can greatly enhance the decision-making process and contribute to optimal financial outcomes.What Are 401(k) Transfers?

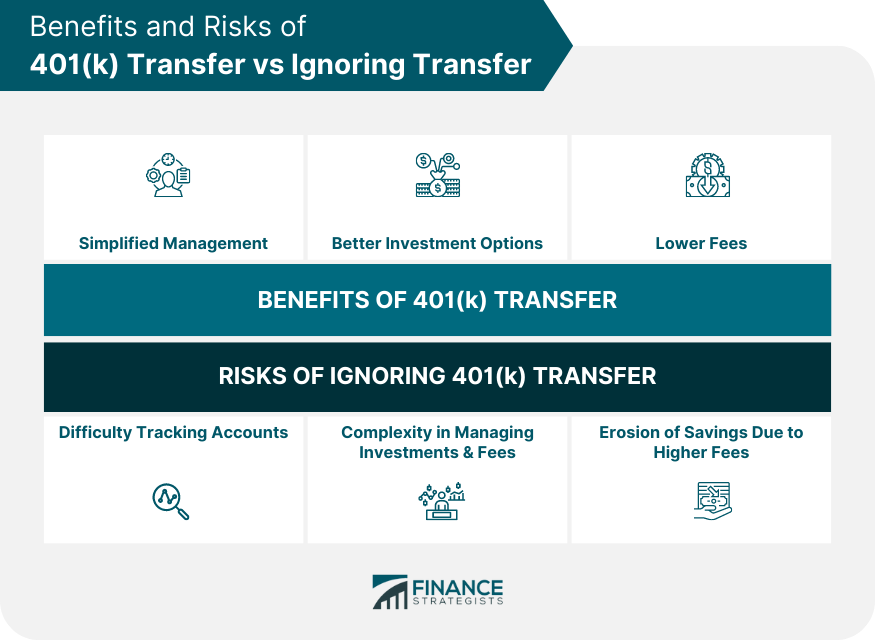

Benefits of a 401(k) Transfer

Simplified Management of Retirement Savings

Access to Better Investment Options

Potential for Lower Fees

Risks Associated With Ignoring a 401(k) Transfer

Difficulty in Keeping Track of Multiple Accounts

Complexity in Managing Multiple Investment Options and Fees

Erosion of Savings Due to Higher Fees

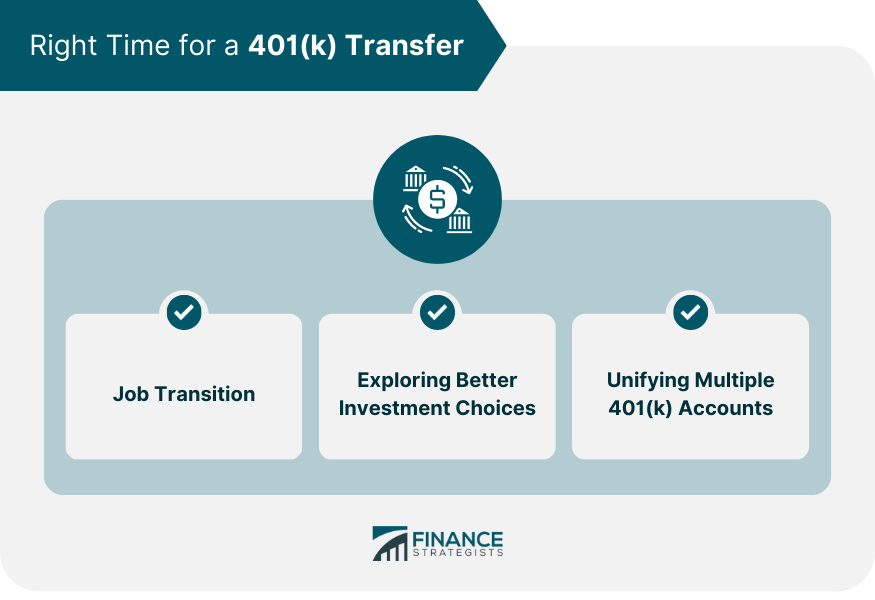

Right Time for a 401(k) Transfer

Job Transition

Exploring Better Investment Choices

Unifying Multiple 401(k) Accounts

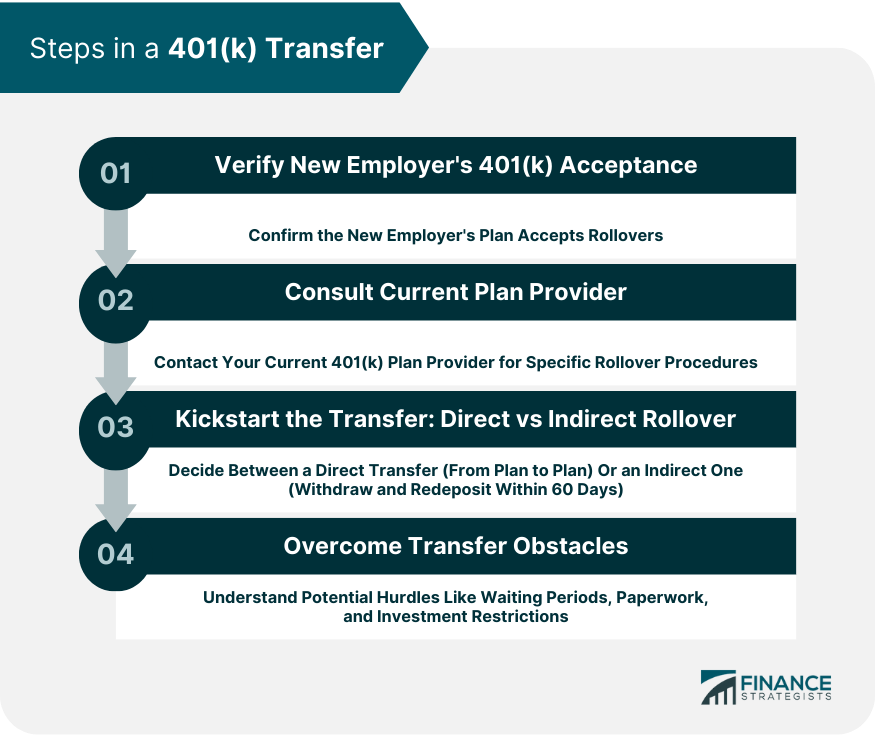

Steps to Transfer Your 401(k)

Verify New Employer's 401(k) Acceptance

Consult Current Plan Provider

Kickstart the Transfer: Direct vs Indirect Rollover

Direct Rollover

Indirect Rollover

Overcome Transfer Obstacles

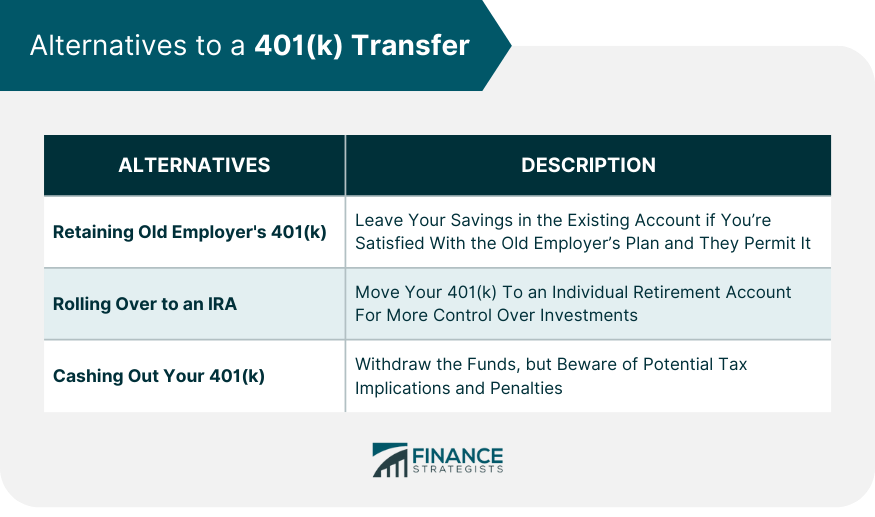

Alternatives to a 401(k) Transfer

Retaining Old Employer's 401(k)

Rolling Over to an IRA

Cashing Out Your 401(k)

Tax and Penalty Implications

Avoiding Early Withdrawal Penalties

Understanding Tax Consequences

New Employer's Role in Transfer

Key Questions for Your New Employer

Decoding Your New Employer's 401(k) Plan

Weighing the Pros and Cons of the New Plan

The Bottom Line

How to Transfer 401(k) To a New Employer FAQs

A 401(k) transfer, often referred to as a "rollover," means moving your retirement savings from your old employer's 401(k) plan to your new employer's plan.

The best time to consider a 401(k) transfer is usually when you're changing jobs. However, better investment options or consolidating multiple accounts can also prompt a transfer.

Verify if your new employer's 401(k) plan accepts transfers, consult your current plan provider, initiate the transfer either through direct or indirect rollover, and navigate any potential obstacles.

Alternatives include leaving your 401(k) with your old employer (if allowed), rolling it over into an Individual Retirement Account (IRA), or cashing it out, although this last option usually has tax penalties.

Generally, a direct rollover has no immediate tax consequences. However, with an indirect rollover, if you don't deposit the funds into the new plan within 60 days, it may be considered a taxable distribution.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.