Disposition in finance refers to the act of selling or otherwise disposing of an asset or security. The concept of disposition is central to investment strategy, portfolio management, and tax planning. Key factors influencing financial disposition include market trends, investor behavior, and broader economic conditions. For instance, market trends can signal optimal times for disposition, while investor behavior, often driven by emotions, can sway disposition decisions, sometimes detrimentally. Economic factors such as interest rates and inflation also play a role, affecting the attractiveness of certain assets. The process of financial disposition involves planning, executing, and post-disposition considerations. Investors need to strategize based on their financial goals and risk tolerance, execute the sale or transfer effectively, and consider post-disposition implications, such as the need for portfolio rebalancing and tax consequences. Understanding these elements can lead to more informed and strategic asset management. Disposition, in essence, refers to the act of getting rid of an asset, most commonly through a sale. An investor disposes of stocks, bonds, real estate, or other assets for various reasons, including changing market conditions, rebalancing a portfolio, or realizing capital gains. Financial dispositions can take several forms, such as outright sales, asset swaps, gifts, or transfers upon death. Each form of disposition comes with its unique set of financial implications, and understanding them can be key to effective portfolio management. Market trends significantly influence the disposition of assets. For instance, during a bull market, investors might be more inclined to dispose of underperforming assets to take advantage of rising prices. Conversely, a bear market might compel investors to dispose of assets to prevent further losses. Investor behavior is a critical factor in financial disposition. Some investors might dispose of assets based on emotional decisions rather than rational investment strategy, which can lead to suboptimal outcomes. Economic factors such as interest rates, inflation, and unemployment rates can also influence disposition decisions. For instance, rising interest rates might make bond investments less attractive, leading to a higher disposition of bonds. Effective disposition requires careful planning. Investors should consider their financial goals, risk tolerance, and market conditions before disposing of an asset. A well-planned disposition can help to maximize returns and minimize potential losses. Executing a disposition involves selling the asset, usually through a broker or exchange. It's crucial to understand the mechanics of the sale, including fees and commissions, to ensure a smooth transaction. After a disposition, investors should reassess their portfolio to ensure it remains aligned with their investment goals. They should also consider the tax implications of the disposition, as capital gains or losses can significantly impact their overall financial situation. Disposition plays a critical role in asset management. By disposing of underperforming or unnecessary assets, investors can optimize their portfolio's performance and align it more closely with their investment objectives. Disposition strategies can vary widely based on an investor's goals and risk tolerance. Some might adopt a "buy and hold" strategy, disposing of assets infrequently, while others might engage in active trading, resulting in more frequent dispositions. Stocks is frequently subject to disposition as investors rebalance their portfolios or take profits. However, frequent stock dispositions can result in high trading costs and tax implications. Bonds might be disposed of if interest rates rise, making existing bonds less valuable. Investors might also dispose of bonds if they need to liquidate assets or if the issuer's creditworthiness declines. Real estate disposition can occur through sales or exchanges. Real estate investors might dispose of properties to realize capital gains or to shift their investment focus. Mutual fund shares can be disposed of by selling them back to the fund or on the secondary market. Investors might dispose of mutual funds to adjust their asset allocation or to respond to changes in the fund's performance. Capital gains or losses resulting from the disposition of an asset. If the asset was sold for more than its purchase price, the result is a capital gain. Conversely, if the asset was sold for less than its purchase price, the result is a capital loss. These gains and losses have significant tax implications. The tax rate applied to a disposition depends on the type of asset and the length of time it was held. Long-term capital gains, from assets held for more than a year, typically have a lower tax rate than short-term gains. Understanding these rates is crucial when planning dispositions. Tax-efficient disposition strategies can help to minimize tax liability. For example, investors can offset capital gains with capital losses through a strategy known as tax-loss harvesting. Another strategy is to hold assets for longer periods to qualify for lower long-term capital gains rates. The disposition effect is a behavioral finance phenomenon where investors are more likely to sell assets that have increased in value and hold onto assets that have decreased in value. This behavior runs contrary to the conventional financial wisdom of "buy low, sell high." The disposition effect can lead to suboptimal investment outcomes. By holding onto losing assets, investors may incur greater losses. Conversely, by selling winning assets too soon, they may miss out on potential gains. Managing the disposition effect involves understanding its psychological roots, such as loss aversion and mental accounting. By being aware of these biases and adopting a disciplined investment approach, investors can mitigate the impact of the disposition effect. The concept of disposition is fundamental to finance, involving the act of selling or disposing' of an asset. It is central to investment strategy, portfolio management, and tax considerations. Key factors influencing disposition include market trends, investor behavior, and economic conditions. Market trends can create opportunities or pressures to sell, investor behavior can drive emotional selling decisions, and economic factors like interest rates and inflation can dictate the attractiveness of holding certain assets. The process of financial disposition involves careful planning, effective execution, and thoughtful post-disposition considerations. It requires an understanding of one's financial goals, risk tolerance, and the broader market context. In essence, mastering the concept and process of financial disposition is crucial for any investor seeking to optimize their financial outcomes and navigate the investment world with confidence.Definition of Disposition

Understanding the Concept of Disposition

Different Types of Financial Disposition

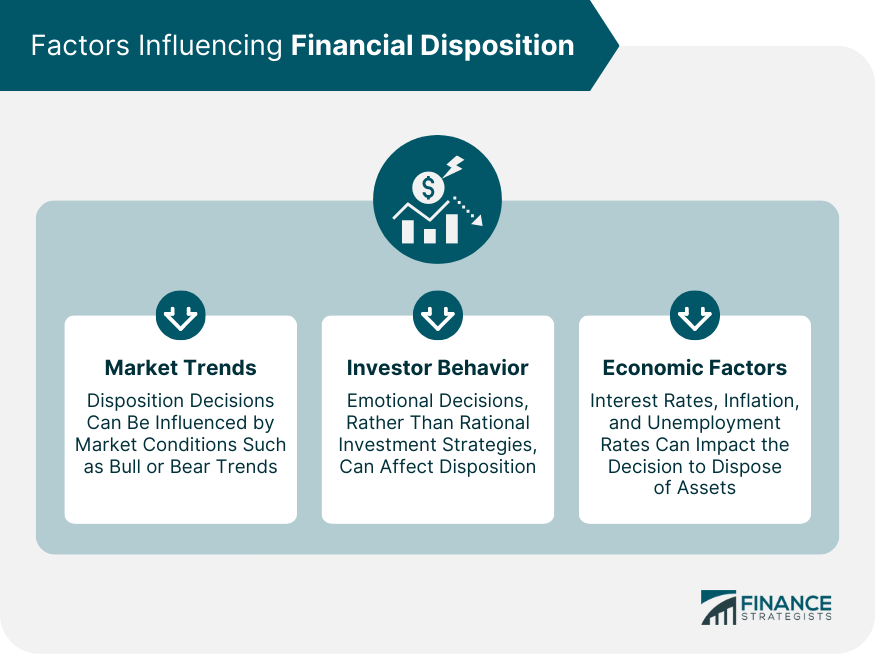

Factors Influencing Financial Disposition

Market Trends and Disposition

Investor Behavior and Disposition

Economic Factors and Disposition

The Process of Financial Disposition

Planning for Disposition

Executing the Disposition

Post-disposition Considerations

Disposition and Asset Management

Role of Disposition in Asset Management

Disposition Strategies in Asset Management

Disposition in Different Financial Instruments

Disposition in Stocks

Disposition in Bonds

Disposition in Real Estate

Disposition in Mutual Funds

Tax Implications of Disposition

Understanding Capital Gains and Losses

Tax Rates and Disposition

Strategies for Minimizing Tax Liability Through Disposition

The Disposition Effect and Behavioral Finance

Explanation of the Disposition Effect

Impact of the Disposition Effect on Investors

How to Manage the Disposition Effect

Conclusion

Disposition FAQs

Disposition in finance refers to the act of selling or otherwise 'disposing' of an asset or security. It is an integral part of investment strategy and portfolio management.

Factors influencing financial disposition include market trends, investor behavior, and economic conditions. These factors can impact the decision to sell or hold onto an asset.

The process of financial disposition involves planning, executing the sale or disposal of the asset, and post-disposition considerations such as reassessing the portfolio and understanding the tax implications.

Disposition plays a crucial role in asset management. It helps investors optimize their portfolio performance, align with their investment objectives, and manage their risk exposure.

The disposition effect is a phenomenon where investors are more likely to sell assets that have increased in value and hold onto assets that have decreased in value. It can lead to suboptimal investment outcomes and is a key concept in behavioral finance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.