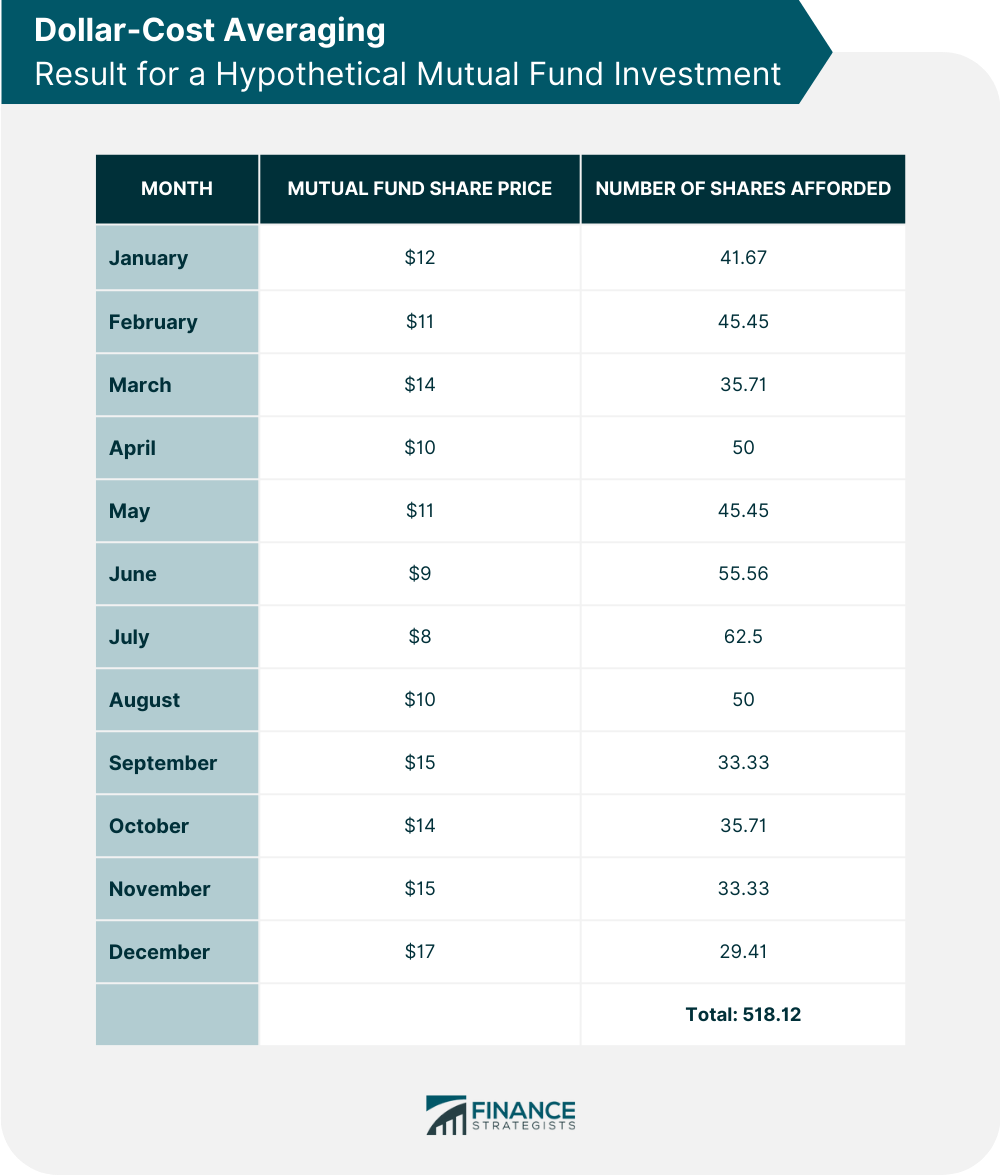

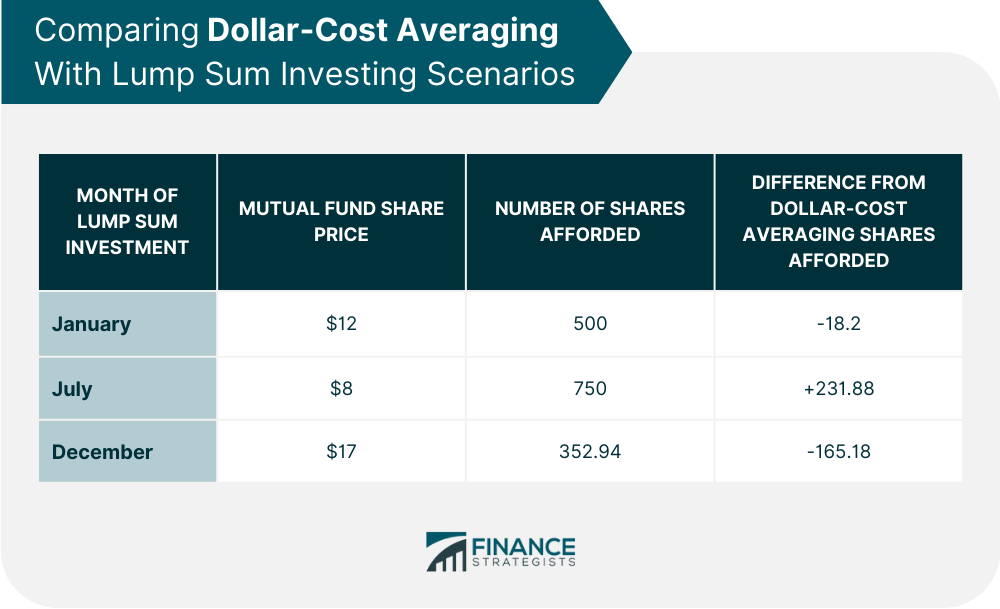

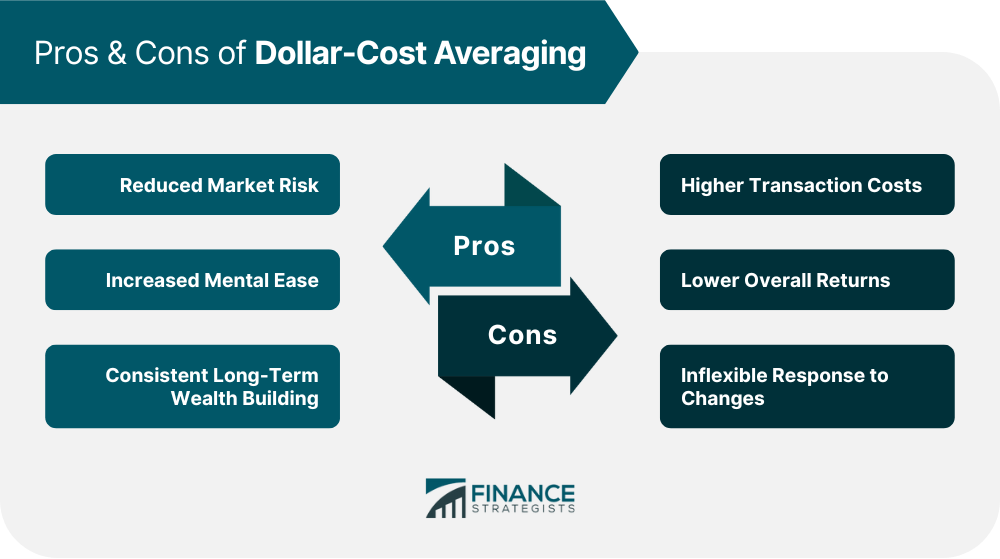

Dollar-cost averaging is an investment strategy that divides the total amount to be invested across regular purchases of a target asset at consistent intervals, regardless of fluctuations in the asset's price. It allows investors to spread out investments instead of buying a large sum upfront. It helps reduce the risk of investing in stocks, mutual funds, and other securities by pouring a steady stream of capital into the market over several months or years. Dollar-cost averaging also protects investors from buying into overvalued markets and enables them to buy more shares when the prices are lower and fewer when they are higher. In effect, it levels out risk by averaging the effects of market volatility. It is an alternative to lump-sum investing and timing the market, which can be hit or miss and carries more risk. The premise behind dollar-cost averaging is simple: Instead of investing all your money during a single day in one security or asset type, you invest smaller amounts consistently over multiple periods. This strategy involves two essential elements: fixed amount and consistent timing. Price movement is of lesser importance. You invest the same amount of money into an asset at regular intervals, regardless of its price. Suppose you want to invest in a mutual fund. You set aside $500 and buy shares every 15th of the month. The amount of shares you gain fluctuates depending on the share price at the time of purchase. Your $500 affords you fewer shares when the price is high. The same amount buys you more shares when prices are low. Over time, your average cost per share will be lower than the market price. To further illustrate the effects of dollar-cost averaging, consider the following examples. Suppose you want to invest $6,000 in a mutual fund. You cannot decide whether to invest it all at the beginning or end of the year because you do not know the best time to buy, so you elect to use dollar-cost averaging and invest $500 monthly instead. Examine this hypothetical investment result: In this example, you were able to buy a total of 518.12 shares of the mutual fund with dollar-cost averaging. Your average cost per share is $11.58 ($6,000/ 518.12 shares). Consider this scenario where you made a lump sum investment of $6,000 in January: You would be able to buy 500 mutual fund shares at the January price of $12, which is 18.2 shares less than the total you acquired from dollar-cost averaging. Suppose you invested all your money at the end of the year instead. You would be able to buy 352.94 mutual fund shares at the December price of $17, which is 165.18 less than what you earned with the dollar-cost averaging method. What if, instead of at the beginning or end of the year, you made a lump sum investment mid-year, say, in July? You would have purchased 750 shares, 231.88 more than what you acquired with dollar-cost averaging for the whole year. The above examples show the benefits and potential drawbacks of dollar-cost averaging. Since you do not know when prices will rise or fall, you are able to continually invest in small increments over time and earn a total of 518.12 shares. It is a simpler process since you do not need to consider market fluctuations. It requires little effort and guesswork on your part when to actually invest your money. You reduced the risk of lump sum investing in January or December and realized gains of 18.2 and 165.18 mutual fund shares, respectively. However, you also missed the opportunity to capitalize on the low July prices and lost a potential gain of 231.88 shares. Below are discussed further the pros and cons of dollar cost averaging. The strategy of dollar-cost averaging comes with several advantages: Dollar-cost averaging reduces market risk because you invest at various prices rather than at one specific price. It helps protect your investments against sharp market movements while allowing you to earn long-term profits over time. You take advantage of the varying prices to purchase more asset shares. It reduces the risk of buying an asset at its peak price and losing significant amounts if the value decreases shortly after purchase. Since you afford fewer shares when prices are high and more when prices are low, you will likely pay a lower cost per share over time than if you invested all your money at once. It can result in a greater return on investment over the long term. Dollar-cost averaging provides less stress because you are not investing your entire savings at once. It removes the pressure of constantly worrying about prices and market conditions when investing a large sum. You can still benefit from rising prices by making smaller investments over time without feeling overwhelmed. The slow, steady approach of dollar-cost averaging can also help prevent investors from distressed selling during volatile periods. Since each periodic contribution has already been set aside for investment purposes, investors are less likely to be concerned with short-term market movements. Dollar-cost averaging is an effective way to build a portfolio since it involves continuous investments over time. It allows investors to adjust their contributions according to available funds and can be customized around any budget. It creates a disciplined method for accumulating wealth that can help lead to greater returns in the long run. It encourages you to save regularly, even in modest amounts, which leads to compounding your investments. You benefit from modest gains over long periods when assets increase steadily. It can help you reach your financial goals at a consistent and manageable pace. The dollar-cost averaging method also comes with several disadvantages: Dollar-cost averaging requires investors to buy multiple times, which could mean higher accumulated transaction costs. A fee will be charged each time you purchase assets. These fees can quickly eat into potential returns and reduce overall portfolio growth. It can be costly if an investor purchases stock in small denominations, such as buying four or five company shares at a time. You need to be aware of the fees associated with the transactions and factor such into your calculations when determining whether dollar-cost averaging is a viable investment strategy for you. The assurance of lower risk comes with the tradeoff of lower potential returns. Dollar-cost averaging can lead to reduced overall returns when compared to the performance gains that could be achieved through lump sum investment. Indeed, dollar-cost averaging helps lessen potential losses in bear markets, but it also might limit your potential gains in bull markets. On the other hand, lump sum investing allows investors to capitalize on bull markets and reap the highest returns possible during those periods, which is not necessarily true with dollar-cost averaging. Since dollar-cost averaging requires investors to split up their purchases over time, it can be difficult for you to respond quickly to market changes or news. There is some lag between purchases and the actual impact on your portfolio. Once you commit to dollar-cost averaging, you are set on making regular investments regardless of what happens in the markets, which could mean missing out on important investment opportunities. By contrast, a lump sum investment allows you to use the entire amount straight away, meaning that if there are any opportunities in the market, you will be able to take advantage of them. Dollar-cost averaging is a great investment strategy for individuals who want to minimize the risks of investing. It is useful if you have limited capital but want to invest regularly and systematically. For example, it may be suitable for a new investor who is only starting to learn the intricacies of the market. With the reduced risk, you can be confident that your money is safe and that any losses are minimized. Dollar-cost averaging can also be beneficial if you are not interested in researching market fluctuations and how to time trading. You may opt for this method if you do not see yourself capable of risking more money in down markets. People with a long-term investment horizon can also benefit from this strategy as they have time to recoup any losses and benefit from market growth over time. Finally, individuals who already make regular investments through a 401(k) plan or an individual retirement account (IRA) are well-equipped to employ dollar-cost averaging. If you have an IRA, you are essentially practicing this strategy already. Dollar-cost averaging is an investment strategy in which investors purchase a fixed dollar amount of their chosen asset at regular intervals. It disregards asset price changes and secures a steady stream of investments over time. The key premise of this strategy is that it helps spread out the risk associated with market movements. It lessens the mental stress associated with monitoring and timing investments and creates consistency in building wealth over time. However, dollar-cost averaging can have lower overall returns compared to lump-sum investing. It may lead to higher accumulated transaction costs due to the buying frequency. Dollar-cost averaging also tends to be inflexible when it comes to market changes. This strategy is best for new investors with limited capital and market knowledge and people with a long-term investment horizon. It is also suitable for investors who regularly invest through 401(k) plans or IRA accounts. Before choosing dollar-cost averaging or other investment strategies, consider your financial situation and risk tolerance. Consult a qualified financial advisor to help you determine the best fit for your situation.What Is Dollar-Cost Averaging?

How Dollar-Cost Averaging Works

Examples of Dollar-Cost Averaging

Benefits of Dollar-Cost Averaging

Reduced Market Risk

Increased Mental Ease

Consistent Long-Term Wealth Building

Downsides of Dollar-Cost Averaging

Higher Transaction Costs

Lower Overall Returns

Inflexible Response to Changes

Who Should Use Dollar-Cost Averaging?

Final Thoughts

Dollar-Cost Averaging FAQs

Dollar-cost averaging allows you to consistently invest in an asset at regular intervals, thereby minimizing the risk of buying at the wrong time. By making regular investments, an investor may be able to purchase more shares when prices are lower and fewer when prices increase. Over time, the average cost per share is lower than lump-sum investments, which can lead to profits.

Dollar-cost averaging is a useful strategy for reducing the risk of investing. It may be especially beneficial to new investors who lack market experience and are hesitant to invest large sums at once. It can also be advantageous for those with limited capital who cannot afford to make hefty investments or want to evenly spread out their capital over time.

An alternative approach to dollar-cost averaging is known as lump-sum investing. It is a high-risk, high-reward strategy that entails investing a large sum of money at once to capitalize on market conditions and any discounts or gains due to the size of the investment. This approach is suitable for experienced investors with significant market knowledge and access to a large sum of money.

It depends. Dollar-cost averaging is a good idea for those who do not have the confidence or expertise to time their investments. It is also a good tool for those who want to reduce volatility, as they will buy more units at lower prices and less when prices are higher. Ultimately, whether or not to use dollar-cost averaging comes down to an individual's risk appetite, financial situation, and investment goals.

It can lead to higher transaction costs due to the frequency of investing. Dollar-cost averaging can also have lower overall returns and may be inflexible to market changes compared to lump-sum investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.