Employee contributions refer to the portion of an employee's income voluntarily allocated towards a retirement plan. These contributions form the foundation of an individual's retirement savings, helping to ensure financial security in their post-career years. Employee contributions are critical in retirement planning, enabling individuals to build a nest egg to support their financial needs after leaving the workforce. The more an individual contributes to their retirement plan, the more they can benefit from tax advantages, employer match, and compound interest. These employer-sponsored retirement plans allow employees to contribute a portion of their salary on a pre- or after-tax (Roth) basis. Employers may also offer matching contributions up to a certain percentage of the employee's income. Like 401(k) plans, 403(b) plans are designed for employees of non-profit organizations, public schools, and certain religious institutions. They offer pre-tax contributions, tax-deferred growth, and potential employer match. 457(b) and 457(f) plans cater to state and local government employees, as well as certain non-governmental organizations. Contributions are made pre-tax, with tax-deferred growth and the possibility of employer matching. The TSP is a defined contribution plan for federal employees and members of the uniformed services. It offers pre-tax contributions, tax-deferred growth, and low-cost investment options. A traditional IRA is an individual retirement account that allows pre-tax contributions, tax-deferred growth, and potential tax deductions depending on the individual's income and participation in an employer-sponsored plan. A Roth IRA allows for after-tax contributions with tax-free growth and withdrawals in retirement, subject to certain conditions. SEP plans enable self-employed individuals and small business owners to make tax-deductible contributions towards their employees' retirement accounts, with the potential for higher contribution limits than traditional IRAs. SIMPLE 401(k) and SIMPLE IRA plans are designed for small businesses with 100 or fewer employees, allowing both employee and employer contributions with reduced administrative requirements compared to traditional 401(k) plans. Employers may offer matching contributions to employees' retirement plans, with varying formulas such as dollar-for-dollar or a percentage match up to a certain limit. Employer match may be subject to a vesting schedule, determining when employees gain full ownership of these contributions. The schedule can be immediate, graded, or cliff-based. The Internal Revenue Service (IRS) sets annual limits on employee contributions to retirement plans, which may change yearly due to inflation adjustments. Employees aged 50 and above can make additional catch-up contributions to their retirement plans, allowing them to save more as they approach retirement. Pre-tax contributions lower an individual's taxable income for the year, reducing their current tax liability. After-tax contributions, such as those made to a Roth IRA, do not provide immediate tax benefits. However, they enable tax-free growth and withdrawals in retirement. Investments within retirement accounts grow tax-deferred, meaning taxes are paid upon withdrawal rather than on annual gains. Withdrawals from pre-tax retirement accounts are generally taxed as ordinary income, whereas qualified withdrawals from Roth accounts are tax-free, subject to certain conditions. Regular employee contributions to retirement plans help build a nest egg that can support individuals during their retirement years, providing financial security and independence. Employee contributions to retirement plans can lower an individual's current and future tax liability through pre-tax contributions, tax-deferred growth, and tax-free withdrawals. Contributing consistently to a retirement plan allows individuals to take advantage of compound interest and investment growth, leading to a larger retirement fund over time. By contributing enough to receive the maximum employer match, employees can effectively increase their retirement savings without additional effort or cost. Retirement plans often provide various investment options, allowing employees to tailor their investment strategy based on their risk tolerance, time horizon, and financial goals. Many employees may face financial constraints or competing priorities, such as student loans or home savings, limiting their ability to contribute to a retirement plan. A lack of financial knowledge can hinder employees from fully understanding the benefits and options available within their retirement plan, potentially leading to suboptimal contribution levels and investment choices. Some employees may delay contributing to their retirement plan due to inertia or procrastination, missing valuable time for their investments to grow. Navigating the intricacies of various retirement plans and investment options can overwhelm employees, leading to confusion and hesitation in making informed decisions. Creating a budget that prioritizes retirement savings can help employees maximize their contributions and reach their long-term financial goals. As employees receive salary increases, they can allocate a portion of their additional income towards their retirement plan, helping to grow their savings more quickly. Investing in a mix of asset classes and investment types can help reduce risk and optimize returns in a retirement portfolio. Regularly reviewing and adjusting the allocation of assets within a retirement portfolio can help maintain an appropriate risk level and investment strategy over time. Working with a financial advisor can help employees make informed decisions about their retirement plan contributions and investment strategies, tailored to their unique financial circumstances and goals. Employee contributions are vital to an individual's financial security in retirement. By consistently contributing to a retirement plan, employees can take advantage of tax benefits, employer match, and compound interest, building a solid foundation for their post-career years. Potential challenges faced by employees in making contributions to their retirement accounts revolve around competing priorities, lack of financial literacy, procrastination, and the complexity of plan structures and investment options. It is crucial for employees to actively participate in their retirement plans and make informed decisions about their contributions and investment strategies. Employers can support this by providing ongoing education, resources, and guidance. Continued education and support can empower employees to make the most of their retirement plans and achieve their long-term financial goals. By fostering a culture of financial wellness, employers can help ensure the financial security of their workforce well into the future. Employees must consult a qualified financial advisor for further guidance regarding contributions and retirement plans available to them. It will allow employees to maximize the benefits and navigate the challenges mentioned for a more secure retirement.What Are Employee Contributions?

Types of Retirement Plans With Employee Contributions

Defined Contribution Plans

401(k) Plans

403(b) Plans

457 Plans

Thrift Savings Plan (TSP)

Individual Retirement Accounts (IRAs)

Traditional IRA

Roth IRA

Simplified Employee Pension (SEP) Plans

Savings Incentive Match Plan for Employees (SIMPLE) Plans

Factors Affecting Employee Contributions

Employer Match

Matching Formulas

Vesting Schedules

Contribution Limits

Annual Limits

Catch-up Contributions for Older Employees

Tax Implications

Pre-tax Contributions

After-Tax Contributions

Tax-Deferred Growth

Taxation Upon Withdrawal

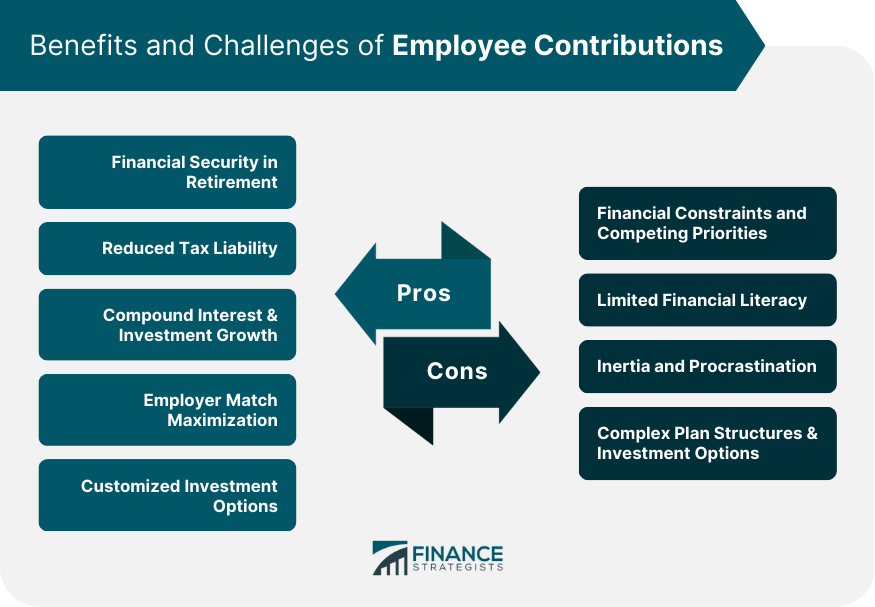

Benefits of Employee Contributions

Financial Security in Retirement

Reduced Tax Liability

Compound Interest and Investment Growth

Employer Match Maximization

Customized Investment Options

Challenges and Barriers to Employee Contributions

Financial Constraints and Competing Priorities

Limited Financial Literacy

Inertia and Procrastination

Complex Plan Structures and Investment Options

Strategies for Maximizing Employee Contributions

Budgeting and Saving for Retirement

Increasing Contributions With Salary Increases

Diversifying Investment Options

Rebalancing Investment Portfolios Periodically

Seeking Professional Financial Advice

Conclusion

Employee Contributions FAQs

Employee contributions are payments made by employees towards their retirement plans, such as 401(k)s, IRAs, or pension plans. These contributions are deducted from the employee's salary and are invested to help build their retirement savings.

The amount you should contribute to your retirement plan as an employee depends on your financial situation, retirement goals, and employer's plan. A general rule of thumb is to contribute at least enough to take advantage of any employer match, and to aim for a total contribution of 10-15% of your salary if possible.

Many retirement plans allow for employee contributions, including 401(k)s, 403(b)s, IRAs, and Roth IRAs. Some employers also offer pension plans that allow for employee contributions.

The advantages of making employee contributions to a retirement plan include building a nest egg for retirement, taking advantage of any employer matching contributions, reducing taxable income, and potentially receiving tax benefits.

Yes, you can change your employee contributions to a retirement plan. Many plans allow you to adjust your contribution amount at any time, and some plans may also allow you to change your investment options or asset allocation. It's important to review your plan regularly and adjust as needed to ensure you are on track to meet your retirement goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.