A SIMPLE 401(k) is a type of defined-contribution plan that employers can offer to their employees. The SIMPLE in SIMPLE 401(k) is short for Savings Incentive Match Plan for Employees of Small Employers. This type of 401(k) has very specific rules about what kind of contributions and vesting schedule the employer must use. SIMPLE 401(k) can also be known as a safe-harbor plan, because the employer doesn't have to worry about constructing a plan that complies with many rules and restrictions. Have questions about SIMPLE 401(k) Plans? Click here. A SIMPLE 401(k) is much like the traditional 401(k), except that it has fewer rules than the latter. It gives the employer more freedom to design a plan for his or her employees' retirement needs. For example, an employer could offer SIMPLE 401(k)s to his entire staff or just some employees; traditional 401(k)s, on the other hand, must be offered to all full-time employees. The SIMPLE 401(k), like the traditional 401(k), is funded by both employee and employer contributions. It can have a salary-deferral arrangement where the employee defers a portion of their wages to be withheld and placed in the SIMPLE 401(k). The SIMPLE 401(k) must be made available to all employees who work at the company, regardless of their age or employment status. Employers also have the option of excluding employees from SIMPLE 401(k). Here are some possible alternatives to the SIMPLE 401(k): Although SIMPLE 401(k)s are simple to administer, they may not be simple for employees, especially when it comes to paying taxes on SIMPLE 401(k) contributions. Employers must also comply with SIMPLE 401(k) plan rules in order to maintain their qualified status and avoid taxes on the SIMPLE 401(k). If you are not sure how SIMPLE 401(k)s work, do not have the time or resources to research SIMPLE 401(k) requirements, or are looking for an easier way to administer SIMPLE 401(k) contributions, consider using another employer-sponsored retirement plan.How Does It Work?

Who Can Participate in a SIMPLE 401(k)

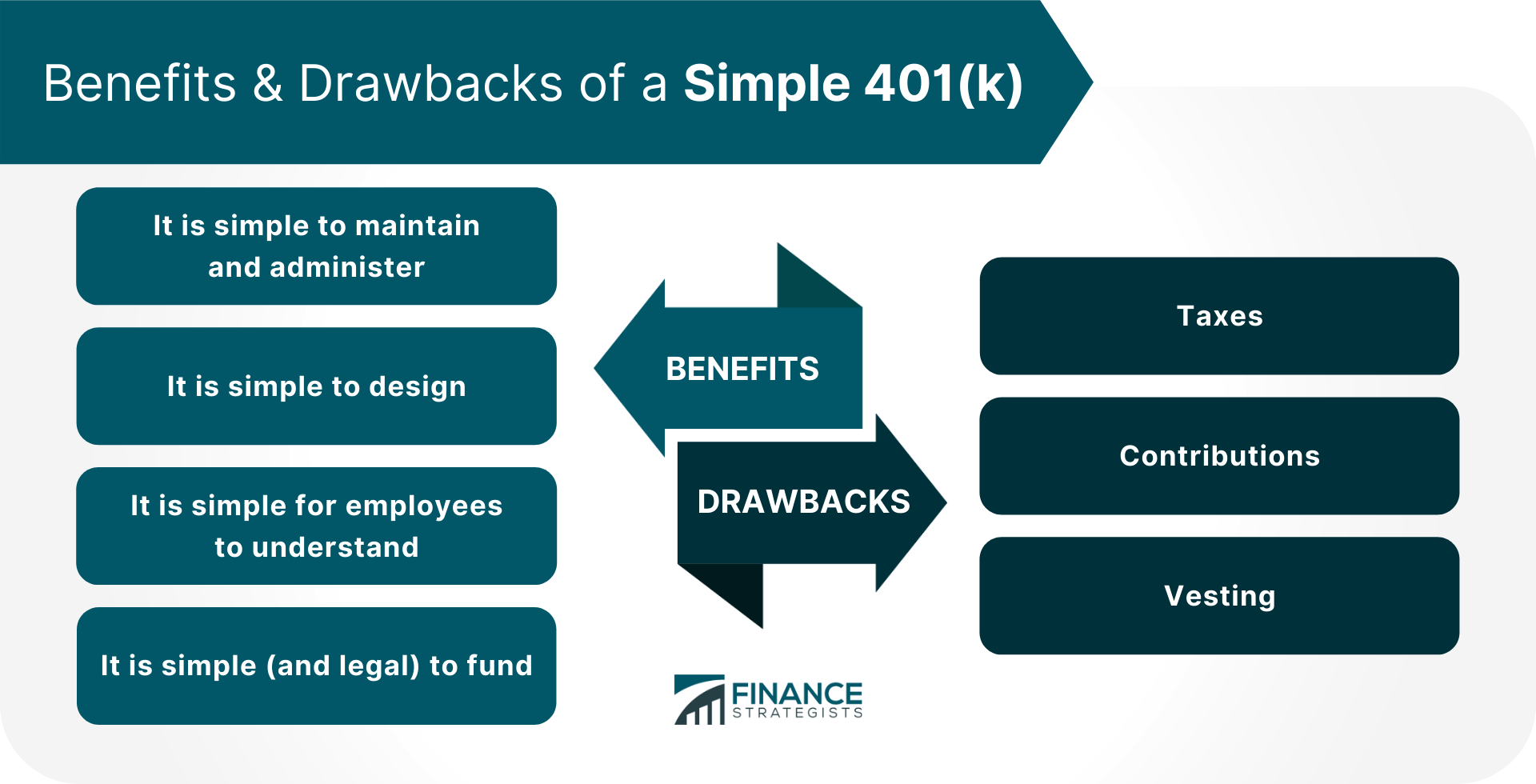

Benefits of a SIMPLE 401(k)

Drawbacks of a SIMPLE 401(k)

Alternative For a SIMPLE 401(k)

The Bottom Line

SIMPLE 401(k) FAQs

A SIMPLE 401(k) is a simple, tax-deferred retirement plan designed to make it simple for small business owners & employees to save for retirement.

A SIMPLE 401(k) is much like the traditional 401(k), except that SIMPLE 401(k)s have fewer rules than traditional 401(k)s. The simple 401(k) gives the employer more freedom to design a plan for his or her employees' retirement needs.

Employers can contribute simple pretax dollars to your simple 401(k), which reduces their taxable income & employees can grow their simple retirement account with compound interest, tax-free until they withdraw the simple 401(k).

SIMPLE 401(k)s are simple for simple employers to adopt, but employees must wait until they are 59 ½ years old to withdraw money without a 10% early withdrawal penalty. In addition, simple 401(k) contributions are subject to income tax when withdrawn from the simple retirement account.

A SIMPLE IRA is an alternative to a SIMPLE 401(k), with lower contribution limits, less investment flexibility, and more complicated transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.