Often, when individuals transition between jobs or careers, they leave behind 401(k) retirement accounts with previous employers. These accounts, sometimes forgotten or not actively managed, are referred to as old 401(k) plans. The assets within them remain invested, and depending on the plan's terms and the investments chosen, they can continue to grow tax-deferred. While the term "old" suggests abandonment, these accounts often contain substantial savings which can be crucial for retirement planning.

Starting with personal records can be the most straightforward approach. If you've maintained a file of financial documents, scour through them to find any old 401(k) statements. These statements not only confirm the existence of an account but also provide crucial details like the plan administrator's contact information, which can be instrumental in reclaiming the account. Getting in touch with the HR department of your former employers is a pragmatic step. They usually have records of your employment and any associated benefits, including the 401(k) plan. By connecting with them, you can gather information about your old account and the necessary steps to access or manage it. Several online platforms and tools can help trace old 401(k) plans. The National Registry of Unclaimed Retirement Benefits is a secure search website designed to help both employers and former employees. By entering your Social Security number, you can search for any unclaimed retirement account balances left in your name. Popular retirement plan providers often administer multiple 401(k) plans across different employers. If you remember the name of the provider (like Fidelity, Vanguard, or T. Rowe Price), contacting them directly can yield results. They can search their systems for any accounts associated with your name and Social Security number. One of the most common reasons people lose track of their 401(k) plans is the frequency with which they change jobs. In the hustle of shifting roles and responsibilities, the details about retirement plans often take a backseat. Over time, as one switches multiple jobs, it becomes a challenge to remember each employer-sponsored retirement plan. Additionally, without periodic reminders or statements, these plans can be easily overlooked. Another common cause for the disconnect between individuals and their old 401(k) plans is relocation. When you move, especially across states or countries, there's a multitude of tasks to handle. Amidst the chaos, updating address details with past employers or retirement plan providers might be missed. As a result, essential communications about the account, including statements or updates, may not reach the individual, leading to unawareness about the account's status. Corporate mergers and acquisitions can further complicate the landscape of tracking old 401(k) plans. If a former employer gets acquired or merges with another company, the original retirement plan might undergo changes or be integrated into a new plan. Without clear communication about these changes, former employees might find it challenging to identify or access their accounts. Once you've located your old 401(k) plans, it's crucial to assess their performance. Review the historical returns, compare them with relevant benchmarks, and determine if the investments align with your current financial goals and risk tolerance. Old 401(k) plans might have limited investment options compared to what's available in the market today. Reevaluate these options and see if they still resonate with your investment philosophy. If not, consider changing the investment mix or even the account type, which leads to the next consideration. Before making any changes to your old 401(k) plans, it's vital to understand the tax implications. Any premature withdrawals might be subject to taxes and penalties. Also, shifting funds between accounts could be a taxable event unless done correctly. Consolidating several 401(k) plans into a single account can simplify management and oversight. It's easier to monitor one account's performance, make informed asset allocation decisions, and reduce the paperwork involved with multiple accounts. Additionally, it might open up a broader range of investment options depending on the chosen platform. One popular choice among individuals is rolling over old 401(k) funds into an Individual Retirement Account (IRA). IRAs often offer a wider range of investment options than employer-sponsored plans. They also provide flexibility in terms of withdrawal rules and estate planning considerations. When considering a rollover, there are two main types: direct and indirect. A direct rollover involves funds being transferred from the old 401(k) provider directly to the new plan or IRA provider, ensuring no tax implications. In contrast, an indirect rollover means the funds are first distributed to the individual, who then has 60 days to deposit them into another qualified retirement account. Missing this deadline can result in taxes and penalties. Locating old 401(k) plans allows individuals to tap into previously accumulated retirement savings, bolstering their overall retirement nest egg. This can contribute significantly to financial security during the retirement years, as the additional funds can complement ongoing contributions and potential investment growth. Finding and consolidating old 401(k) plans simplifies financial management by centralizing retirement assets. This streamlines investment tracking and facilitates more informed decision-making regarding asset allocation and portfolio diversification, potentially optimizing returns and risk management. Old 401(k) plans might offer access to investment options and employer matches that are no longer available in current plans. By locating these plans, individuals could leverage diverse investment opportunities and employer contributions, maximizing their retirement savings potential. Transferring funds from old 401(k) plans to new ones or to IRAs can be intricate and time-consuming. Negotiating the paperwork, adhering to specific rollover procedures, and coordinating with various financial institutions can lead to confusion and potential errors. Some financial institutions charge administrative fees for maintaining dormant or small 401(k) accounts. Locating and consolidating old plans may subject individuals to such fees, which could erode a portion of their retirement savings, especially if the benefits of consolidation are outweighed by the costs. Rollover or withdrawal of funds from old 401(k) plans can have tax implications, potentially affecting an individual's current tax situation. Depending on the chosen approach, individuals might face tax withholding, early withdrawal penalties, or changes in their tax bracket, necessitating careful consideration and planning before taking action. To locate an old 401(k) plan, start by tracking down old account statements and reaching out to previous employers' HR departments. Utilize online tools like the National Registry of Unclaimed Retirement Benefits or directly engage with retirement plan providers for assistance. Losing track of old 401(k) plans can happen due to changing jobs, relocating, or corporate mergers. Once located, evaluate the plan's performance and investment options, considering tax implications before making changes. Consider consolidating multiple plans for streamlined management, or opt for a rollover to an Individual Retirement Account (IRA) for increased flexibility. Carefully choose between direct and indirect rollovers to avoid unintended tax consequences.What Are Old 401(k) Plans?

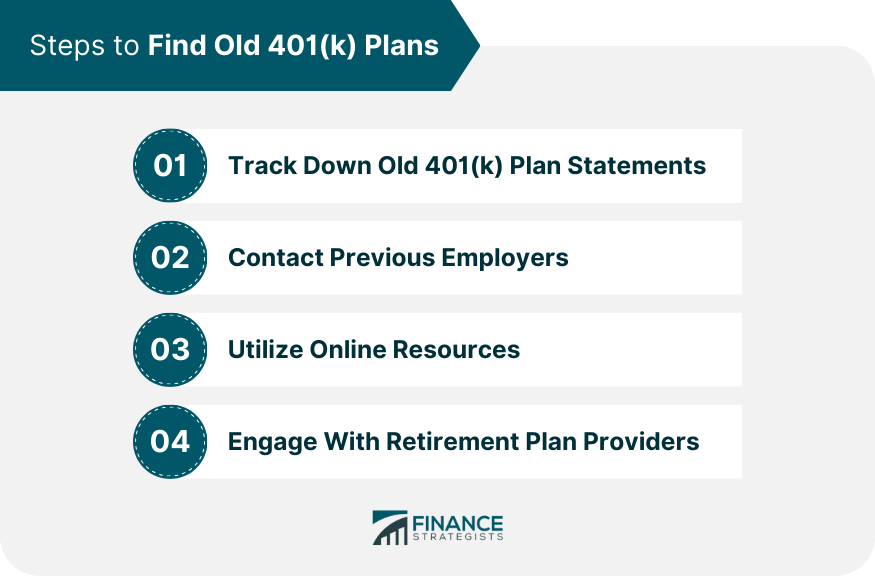

Steps on How to Find Old 401(k) Plans

Track Down Old 401(k) Plan Statements

Contact Previous Employers

Utilize Online Resources

Engage With Retirement Plan Providers

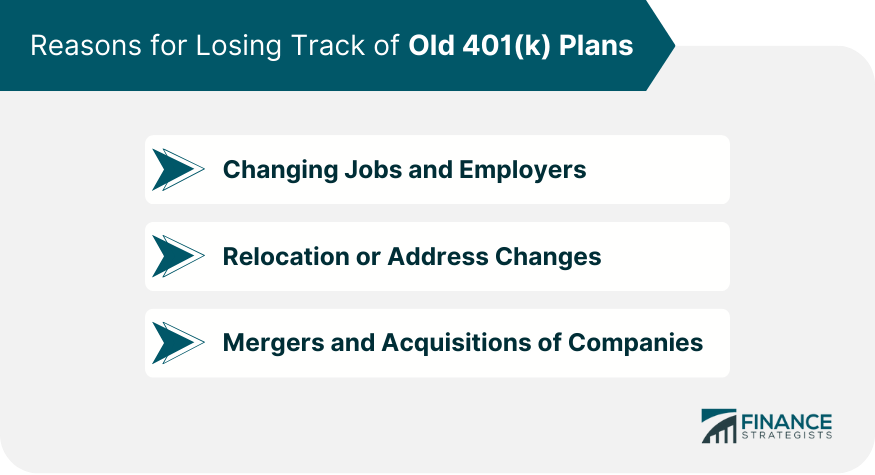

Reasons for Losing Track of Old 401(k) Plans

Changing Jobs and Employers

Relocation or Address Changes

Mergers and Acquisitions of Companies

What to Do After Locating Old 401(k) Plans

Evaluate Plan Performance

Assess Investment Options

Understand Tax Implications

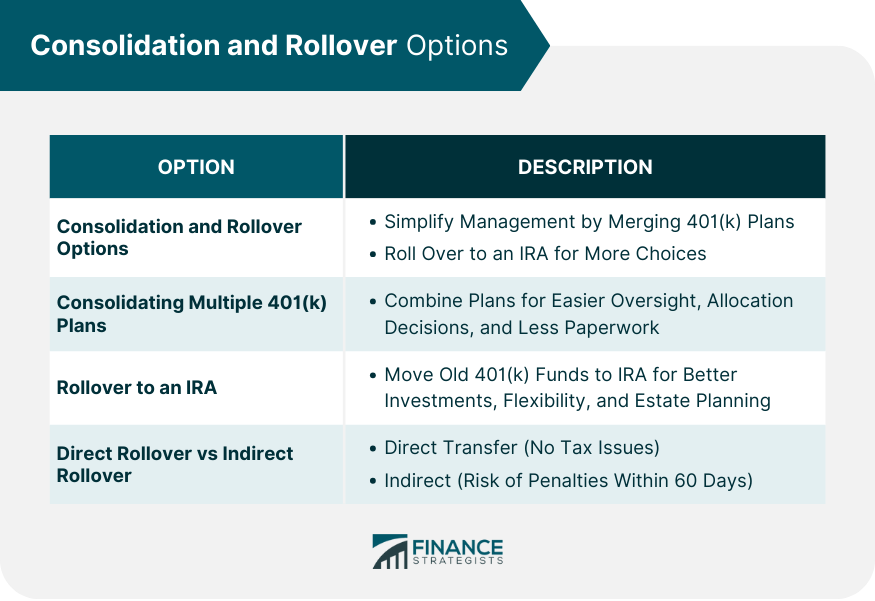

Consolidation and Rollover Options

Consolidating Multiple 401(k) Plans

Rollover to an IRA

Direct Rollover vs Indirect Rollover

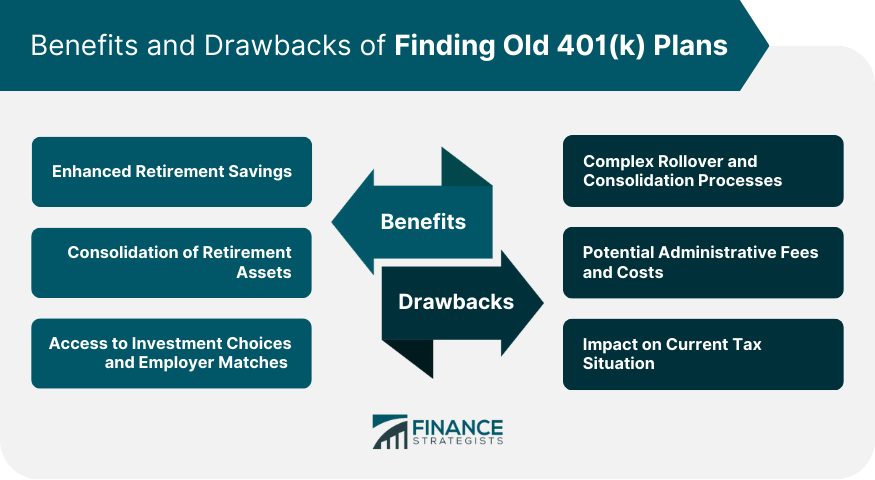

Benefits of Finding Old 401(k) Plans

Enhanced Retirement Savings

Consolidation of Retirement Assets

Access to Investment Choices and Employer Matches

Drawbacks of Finding Old 401(k) Plans

Complex Rollover and Consolidation Processes

Potential Administrative Fees and Costs

Impact on Current Tax Situation

Conclusion

How to Find Old 401(k) Plans FAQs

An old 401(k) plan refers to a retirement account left with a previous employer, which might not be actively managed or sometimes even forgotten.

Begin by checking personal records for any old statements, contact previous employers, utilize online resources like the National Registry of Unclaimed Retirement Benefits, or reach out to known retirement plan providers.

Yes, consolidating can simplify account management, potentially offer a broader range of investment options, and reduce paperwork.

A direct rollover transfers funds directly from one retirement account to another, avoiding tax implications. An indirect rollover first gives the funds to the individual, who then has 60 days to deposit them into another retirement account to avoid taxes and penalties.

Yes, premature withdrawals before the age of 59½ typically incur a 10% penalty and are subject to income tax. Always consult with a financial advisor before making any decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.